Valuable Papers Insurance refers to a specific type of insurance policy designed to protect important documents, such as deeds, wills, contracts, and other critical papers. These insurance policies cover the costs associated with the loss, damage, or destruction of such valuable papers, as well as the expenses related to recreating or restoring them. This form of insurance is particularly important for businesses and individuals who possess critical documents that hold significant value. In the event of an unexpected disaster or accident, having Valuable Papers Insurance can help to minimize the financial burden and ensure that essential records can be restored or replaced as needed. The importance of Valuable Papers Insurance cannot be overstated, as it safeguards crucial documents that may hold substantial monetary or sentimental value. For businesses, this can include essential contracts, client records, and financial data. For individuals, valuable papers may comprise legal documents, such as wills, property deeds, or certificates of ownership. The loss or damage of such documents can have significant consequences, including financial losses, legal disputes, or even the loss of essential information needed to run a business or manage personal affairs. As such, Valuable Papers Insurance provides peace of mind and protection in the face of potential disasters. Valuable Papers Insurance typically covers a wide range of important documents, including but not limited to legal papers, financial records, and even certain types of artwork or collectibles. Coverage extends to the costs of restoring or recreating these valuable papers in the event of loss or damage, as well as any additional expenses incurred due to the disruption of business operations or personal affairs. Some policies also provide coverage for the costs of temporarily relocating a business or individual in the event that their location becomes uninhabitable due to the loss or damage of valuable papers. This ensures continuity and minimizes the financial impact of such a disruption. While Valuable Papers Insurance policies cover a wide range of documents and scenarios, there are certain exclusions to be aware of. Typical policy exclusions may include wear and tear, gradual deterioration, or damage caused by rodents, insects, or other pests. Additionally, coverage may not extend to losses resulting from intentional acts, such as fraud or intentional destruction. It's essential to carefully review your Valuable Papers Insurance policy to understand the specific coverages and exclusions that apply. This will help ensure that you have the appropriate level of protection for your valuable papers and documents. Valuable Papers Insurance policies generally come with predetermined limits, which represent the maximum amount the insurance provider will pay in the event of a covered loss. These limits are typically established based on the estimated value of the insured documents, as well as the potential costs associated with restoring or recreating them. Policyholders should work closely with their insurance provider to establish appropriate coverage limits, taking into account the value of their documents and the potential financial impact of their loss or damage. It's also important to review and update these limits periodically, as the value of your documents may change over time. Manuscript insurance is a specialized form of Valuable Papers Insurance that specifically covers manuscripts, such as unpublished books, plays, screenplays, or research papers. This type of insurance protects authors, researchers, and other professionals whose work is represented in written form and could be difficult or impossible to recreate if lost or damaged. In addition to providing coverage for the restoration or recreation of manuscripts, this insurance may also cover any potential lost income or royalties resulting from the loss or damage of the insured documents. This can be particularly valuable for authors and researchers who rely on their written work as a source of income or professional advancement. Blueprint insurance is another specialized form of Valuable Papers Insurance designed to protect architectural drawings, engineering plans, and other technical documents. These blueprints and plans are crucial to construction projects, infrastructure development, and various industries that rely on detailed design documents. Like other types of Valuable Papers Insurance, blueprint insurance covers the costs of restoring or recreating lost or damaged blueprints, as well as any associated expenses resulting from project delays or disruptions. This type of coverage is essential for architects, engineers, and other professionals whose work relies on accurate and detailed design plans. Securities insurance is a type of Valuable Papers Insurance that specifically covers financial instruments, such as stocks, bonds, and other investment documents. This coverage is important for investors, financial institutions, and other organizations that manage significant financial assets and rely on physical documentation to represent their investments. This form of insurance provides coverage for the costs associated with replacing lost, damaged, or stolen securities, as well as any legal or administrative expenses that may arise in the process. In some cases, securities insurance may also offer protection against losses resulting from changes in market value during the time it takes to replace the missing or damaged documents. In addition to the specific types of Valuable Papers Insurance mentioned above, there are various other policies available that cater to different needs and circumstances. For instance, some policies may cover important historical documents, collectible items, or even artwork. The key is to work closely with your insurance provider to identify the most suitable coverage for your unique situation and the valuable documents you possess. One of the most significant benefits of Valuable Papers Insurance is the protection it provides against the loss or damage of crucial documents. Whether these papers hold financial, legal, or sentimental value, having insurance coverage in place ensures that you have the financial means to restore or recreate them in the event of an unforeseen disaster. This peace of mind is invaluable, as it allows individuals and businesses to focus on their core activities without the constant worry of potential document loss or damage. Another major benefit of Valuable Papers Insurance is the reimbursement it provides for the costs associated with recreating or restoring lost or damaged documents. This can include expenses related to hiring experts, obtaining copies of original documents, or even reproducing artwork or other unique items. Without insurance coverage, these costs can quickly become overwhelming, particularly for small businesses or individuals with limited financial resources. Valuable Papers Insurance ensures that you have the financial support necessary to recover from such a loss and move forward. Valuable Papers Insurance policies generally provide coverage for a wide range of perils, including fire, theft, vandalism, water damage, and other common risks. This comprehensive protection ensures that you are covered regardless of the specific circumstances surrounding the loss or damage of your valuable papers. By having this broad coverage in place, you can be confident that your important documents are protected from a diverse range of potential threats. One potential drawback of Valuable Papers Insurance is the cost associated with premiums and deductibles. Like any insurance policy, the cost of coverage will vary depending on a variety of factors, such as the value of the documents being insured, the specific coverage limits, and the risks associated with the location or storage of the papers. While the cost of insurance may be a deterrent for some individuals or businesses, it's essential to weigh these expenses against the potential financial impact of losing or damaging your valuable papers without coverage. In many cases, the cost of insurance premiums and deductibles may be significantly less than the expenses associated with restoring or recreating important documents. Another potential drawback of Valuable Papers Insurance is the limitations on coverage that may apply. As mentioned earlier, policies typically include exclusions for certain perils, such as wear and tear or damage caused by pests. Additionally, coverage limits may not fully encompass the total value of your documents or the expenses required for their restoration or recreation. To mitigate these limitations, it's crucial to carefully review your policy, ensure that you have adequate coverage, and update your coverage limits as necessary. Regular communication with your insurance provider can help you maintain the appropriate level of protection for your valuable papers. In the event of a loss or damage, policyholders will need to document and prove the value of their valuable papers in order to receive reimbursement from their insurance provider. This process can be time-consuming and may require additional effort to gather the necessary documentation, such as appraisals, receipts, or expert evaluations. While this process can be challenging, it's important to recognize that proper documentation is essential for ensuring that you receive the appropriate reimbursement for your lost or damaged documents. Keeping thorough records and maintaining an up-to-date inventory of your valuable papers can help simplify this process in the event of a claim. The first step in obtaining Valuable Papers Insurance is to evaluate your need for coverage. Consider the types of valuable papers you possess, their estimated value, and the potential financial impact of losing or damaging these documents. This assessment will help you determine whether Valuable Papers Insurance is a worthwhile investment for your specific situation. If you determine that coverage is necessary, begin researching insurance providers and policies that cater to your unique needs. This may include exploring specialized policies, such as manuscript insurance or securities insurance, depending on the nature of your valuable papers. Once you have identified your need for Valuable Papers Insurance, the next step is to choose the right insurance provider. This will involve researching and comparing different providers based on factors such as their reputation, customer service, and policy offerings. When selecting an insurance provider, it's important to choose a company that understands the unique risks associated with valuable papers and can offer tailored coverage options to address these risks. Additionally, look for providers that offer flexible policy limits and comprehensive coverage for a wide range of perils. After choosing an insurance provider, work closely with them to assess your policy needs and develop a customized Valuable Papers Insurance policy. This will involve determining appropriate coverage limits, identifying any specific coverage exclusions, and selecting any optional policy endorsements that may be necessary for your unique situation. By taking the time to thoroughly assess your policy needs and work closely with your insurance provider, you can ensure that you have the appropriate level of protection for your valuable papers and documents. Valuable Papers Insurance is a crucial form of coverage that protects important documents from loss, damage, or destruction. This type of insurance is essential for individuals and businesses that possess valuable papers, such as legal documents, financial records, or other critical papers, and can provide peace of mind in the face of potential disasters. There are various types of Valuable Papers Insurance policies available to cater to different needs and circumstances, including manuscript insurance, blueprint insurance, securities insurance, and other specialized coverages. By working closely with your insurance provider, you can identify the most suitable policy for your unique situation and the valuable documents you possess. While Valuable Papers Insurance offers numerous benefits, such as protection against loss or damage, reimbursement for restoration or recreation costs, and coverage for various perils, there are also some drawbacks to consider. These include the cost of premiums and deductibles, limitations on coverage, and the time and effort required to document and prove the value of lost or damaged papers. Despite these drawbacks, for many individuals and businesses, the benefits of Valuable Papers Insurance outweigh the potential downsides. By carefully assessing your need for coverage, choosing the right insurance provider, and working closely with them to develop a customized policy, you can ensure that your valuable papers are well-protected and you have the financial resources to recover from a loss or damage.What Is Valuable Papers Insurance?

Coverage of Valuable Papers Insurance

Exclusions of Valuable Papers Insurance

Policy Limits

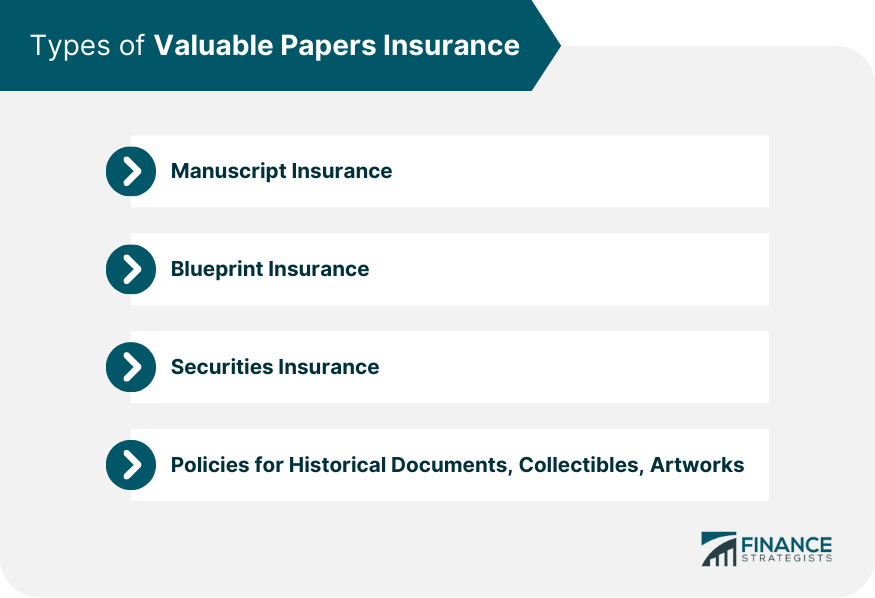

Types of Valuable Papers Insurance

Manuscript Insurance

Blueprint Insurance

Securities Insurance

Other Types of Valuable Papers

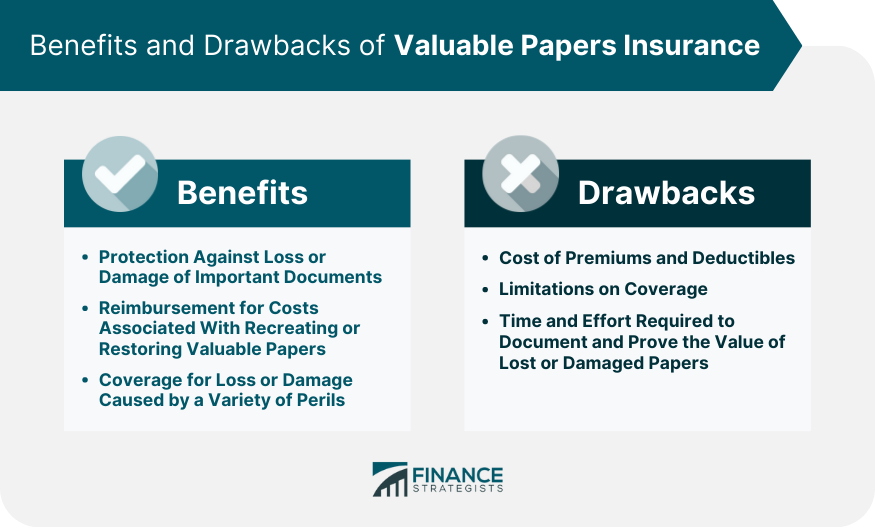

Benefits of Valuable Papers Insurance

Protection Against Loss or Damage

Reimbursement for Costs

Coverage for Loss or Damage Caused by a Variety of Perils

Drawbacks of Valuable Papers Insurance

Cost of Premiums and Deductibles

Limitations on Coverage

Time and Effort Required

How to Obtain Valuable Papers Insurance

Evaluating Your Need

Choosing the Right Insurance Provider

Assessing Your Policy Needs

Final Thoughts

Valuable Papers Insurance FAQs

Valuable Papers Insurance is a type of insurance that provides coverage for the loss or damage of important documents.

Valuable Papers Insurance typically covers documents such as manuscripts, blueprints, securities, and other important papers.

Valuable Papers Insurance offers protection against loss or damage of important documents, reimbursement for costs associated with recreating or restoring valuable papers, and coverage for loss or damage caused by a variety of perils.

Valuable Papers Insurance can be costly, have limitations on coverage, and require time and effort to document and prove the value of lost or damaged papers.

To obtain Valuable Papers Insurance, evaluate your need for it, choose the right insurance provider, and assess your policy needs. It's also important to properly document and value your papers to ensure adequate coverage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.