Garage liability insurance is a specialized form of business insurance designed to protect businesses in the automotive industry from financial losses resulting from accidents, injuries, or damages that occur on their premises or as a result of their operations. This type of insurance is essential for businesses that work with vehicles, as they face unique risks not covered by general liability insurance. For businesses in the automotive industry, having garage liability insurance can mean the difference between staying afloat or going under in the event of a costly claim. Accidents and damages can occur at any time, and without the proper coverage, a business may find itself facing significant financial strain, legal troubles, and a tarnished reputation. Several types of businesses in the automotive industry can benefit from garage liability insurance, as they all face unique risks associated with their operations. Auto repair shops are exposed to various risks, such as potential damage to customer vehicles, employee injuries, and accidents involving shop equipment. Garage liability insurance provides protection against these risks, ensuring that the business can continue operating even in the face of unexpected events. Car dealerships not only face the risk of damage to their inventory of vehicles but also potential accidents involving test drives or customers on their premises. Garage liability insurance can help protect against property damage and bodily injury claims that may arise in these situations. Auto body shops work with hazardous materials, heavy machinery, and vehicles, creating numerous opportunities for accidents to occur. Garage liability insurance can help protect the business from the financial fallout of property damage, employee injuries, and other liabilities. Towing companies face the risk of damaging the vehicles they tow, as well as potential accidents involving their own trucks and drivers. Garage liability insurance can provide coverage for these risks, ensuring that the business can continue to operate even in the face of costly claims. Vehicle storage facilities are responsible for safeguarding their customers' vehicles, and any damage to these vehicles can result in significant financial liability. Garage liability insurance can help protect the business from the financial consequences of property damage claims. Garage liability insurance offers a range of coverage options to protect businesses from various risks associated with their operations. This coverage protects the business from claims resulting from damage to customers' vehicles or other property while on the business premises or as a result of the business's operations. Bodily injury coverage protects the business from claims arising from injuries sustained by customers, employees, or other individuals on the business premises or as a result of the business's operations. This coverage helps protect the business from claims arising from faulty workmanship, parts, or repairs that cause damage or injury after the work has been completed. Garage liability insurance typically includes coverage for legal defense costs in the event that the business is sued for property damage or bodily injury claims. This coverage helps pay for medical expenses incurred by individuals who are injured on the business premises or as a result of the business's operations, regardless of fault. It is important to understand the difference between garage liability insurance and garagekeepers liability insurance to ensure that a business has the proper coverage in place. Garagekeepers liability insurance is a separate type of coverage designed to protect businesses from claims arising from damage to customers' vehicles while they are in the business's care, custody, or control. This coverage is essential for businesses that store or work on customers' vehicles, such as auto repair shops and vehicle storage facilities. While garage liability insurance covers claims related to property damage, bodily injury, and other general liabilities, garagekeepers liability insurance specifically covers damage to customers' vehicles. Some businesses may need both types of coverage to ensure comprehensive protection against potential risks. A business should carefully evaluate its operations and risks to determine which type of insurance is most suitable. Businesses that primarily work with customer vehicles, such as auto repair shops and storage facilities, may need both garage liability and garagekeepers liability insurance. In contrast, businesses with less direct interaction with customer vehicles, such as car dealerships, may only require garage liability insurance. Several factors can impact the cost of garage liability insurance premiums, including the size and location of the business, the types of services offered, the business's claims history, and the chosen deductibles and policy limits. Larger businesses or those located in areas with higher crime rates or more frequent accidents may face higher premiums due to the increased risk associated with their operations. Businesses that offer more specialized or high-risk services, such as auto body repair or towing, may face higher premiums due to the increased likelihood of accidents or damages. A business with a history of frequent or high-cost claims may be considered a higher risk by insurance providers, leading to higher premiums. Higher deductibles and policy limits can result in lower premiums, as the business is taking on more financial responsibility in the event of a claim. However, this also means that the business will need to cover more of the costs associated with a claim out-of-pocket. Selecting the right garage liability insurance policy requires assessing the business's unique needs, comparing insurance providers, and evaluating coverage options and policy limits. Take the time to thoroughly evaluate your business's operations, potential risks, and financial situation to determine the type and amount of coverage needed. Research and compare multiple insurance providers, considering factors such as their financial stability, reputation, and customer service. Review each provider's coverage options, policy limits, and endorsements to ensure that the policy offers comprehensive protection against your business's unique risks. Depending on your business's needs, you may want to consider adding endorsements to your policy, such as business interruption coverage, workers' compensation, or commercial auto insurance. Implementing safety measures and procedures can help reduce the likelihood of accidents and claims, potentially lowering insurance premiums and protecting the business's reputation. Establish and enforce safety procedures, such as proper use of equipment, handling of hazardous materials, and maintenance of a clean and organized workspace. Provide ongoing training and certification for employees to ensure they are knowledgeable about safety procedures and best practices. Regularly inspect and maintain equipment and tools to ensure they are in proper working condition and reduce the risk of accidents. Follow all regulations and best practices for storing and disposing of hazardous materials to minimize the risk of spills, leaks, or other accidents. In the event of an accident or damage, it is essential to follow the proper procedures for filing a garage liability insurance claim to ensure a smooth and timely resolution. Immediately contact your insurance provider to report the incident and receive guidance on the next steps in the claims process. Be prepared to provide details about the incident, including the date, location, and a description of the damages or injuries. Thoroughly document the incident, including taking photographs of the damages, collecting witness statements, and recording any relevant information about the event. This documentation will be crucial in supporting your claim. An insurance claims adjuster will likely be assigned to investigate your claim. Cooperate with the adjuster by providing requested documentation and answering any questions they may have about the incident. Retain receipts and records of any expenses incurred as a result of the incident, such as repair costs or medical bills. These records will be necessary for reimbursement from your insurance provider. Stay in contact with your insurance provider and claims adjuster to monitor the progress of your claim and ensure that it is resolved in a timely manner. Garage liability insurance is a crucial aspect of protection for businesses in the automotive industry. It safeguards against various risks, including property damage, bodily injury, and other general liabilities. To secure the right coverage, businesses must carefully evaluate their unique needs, compare insurance providers, and implement safety measures. By doing so, they can minimize the risk of costly claims and maintain their financial stability. In the event of an accident or damage, it is essential to follow the proper procedures for filing a garage liability insurance claim. This ensures a smooth and timely resolution, allowing the business to recover from the incident more quickly. By obtaining the appropriate coverage and being prepared to handle potential claims, businesses in the automotive industry can protect their financial interests and maintain a strong reputation in their field.What Is Garage Liability Insurance?

Types of Businesses That Need Garage Liability Insurance

Auto Repair Shops

Car Dealerships

Auto Body Shops

Towing Companies

Vehicle Storage Facilities

Coverage Provided by Garage Liability Insurance

Property Damage

Bodily Injury

Products and Completed Operations

Legal Defense Costs

Medical Payments

Garagekeepers Liability Insurance vs Garage Liability Insurance

Definition of Garagekeepers Liability Insurance

Comparison of Coverage

When to Choose Each Type of Insurance

Factors That Affect Garage Liability Insurance Premiums

Business Size and Location

Types of Services Offered

Claims History

Deductibles and Policy Limits

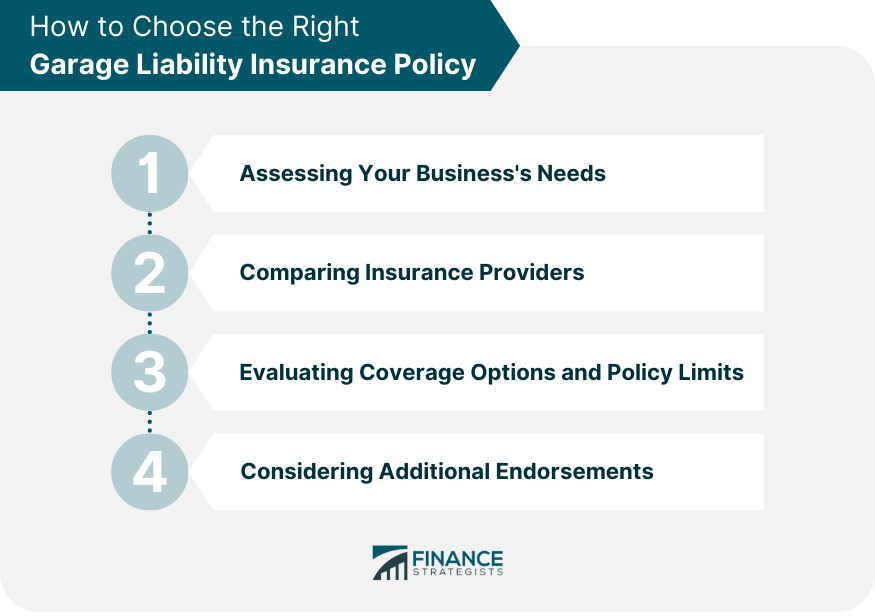

How to Choose the Right Garage Liability Insurance Policy

Assessing Your Business's Needs

Comparing Insurance Providers

Evaluating Coverage Options and Policy Limits

Considering Additional Endorsements

Tips for Reducing the Risk of Garage Liability Insurance Claims

Implementing Safety Procedures

Employee Training and Certification

Regular Maintenance of Equipment and Tools

Proper Storage and Disposal of Hazardous Materials

Filing a Garage Liability Insurance Claim

Contact Your Insurance Provider

Document the Incident

Cooperate With the Claims Adjuster

Keep Track of Expenses and Repairs

Monitor the Progress of Your Claim

Conclusion

Garage Liability Insurance FAQs

Garage Liability Insurance provides protection for auto dealerships, auto repair shops, and service stations. It covers property damage and bodily injury caused by the business operations or by someone using a vehicle provided by the business.

Garage Liability Insurance covers the costs of bodily injury and property damage to third parties that occur in the course of business operations. It may also cover the costs of legal fees if the business is sued.

Auto dealerships, auto repair shops, and service stations typically need Garage Liability Insurance. Anyone who operates a business that involves vehicles, even if only as a part of their operations, should consider purchasing this type of insurance.

Garage Liability Insurance provides protection against costly lawsuits and damages caused by business operations. It also provides peace of mind to business owners and may help attract and retain customers who value businesses that take the necessary precautions to protect themselves and their customers.

The cost of Garage Liability Insurance varies based on a number of factors, including the size of the business, the type of business, and the coverage limits. The average cost for this type of insurance is around $1,000 to $2,000 per year.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.