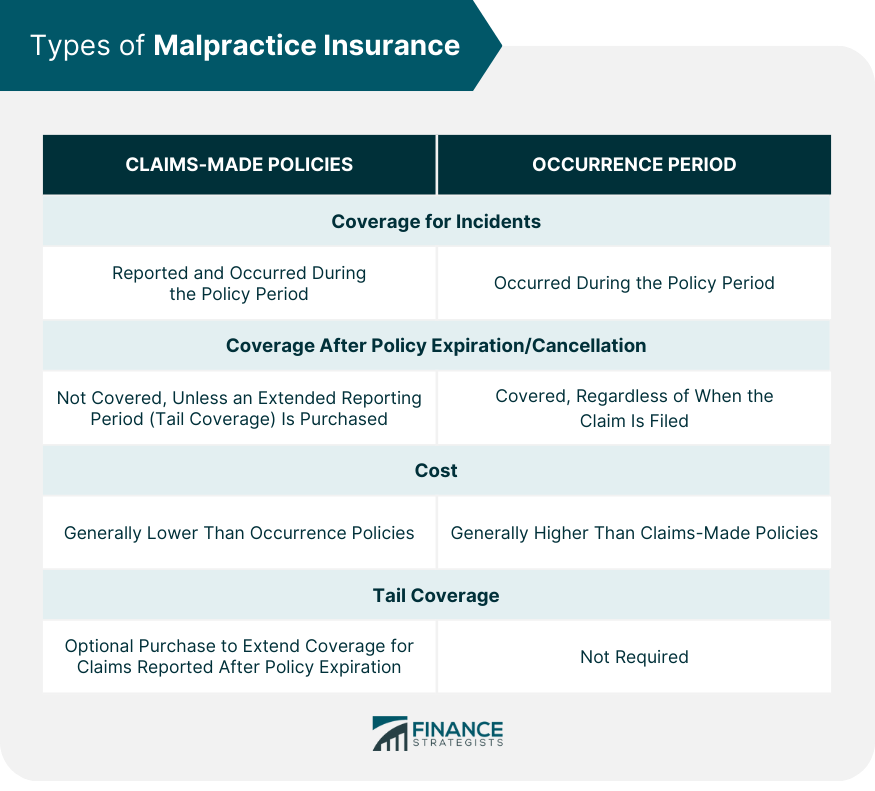

Malpractice insurance is a specialized type of liability coverage that protects professionals against claims of negligence or wrongdoing in their practice. It provides financial support for legal defense costs, settlements, and damages arising from a malpractice claim, ensuring professionals can continue their work without financial burden. Malpractice insurance is crucial in maintaining professional integrity and safeguarding a professional's financial stability. By providing a safety net in case of legal disputes, it ensures that professionals can focus on providing their services without the constant fear of financial ruin due to a lawsuit. There are two primary forms of malpractice insurance: claims-made policies and occurrence policies. Claims-made policies are a type of malpractice insurance that provides coverage for incidents that are both reported and occur during the policy period. This means that if a claim arises after the policy has expired or been canceled, the professional would not be covered for that incident, even if it occurred while the policy was active. However, claims-made policies often offer the option to purchase an extended reporting period, also known as "tail coverage," which provides coverage for claims reported after the policy's expiration but arising from incidents that occurred during the active policy period. Occurrence policies, on the other hand, cover incidents that occur during the policy period, regardless of when the claim is actually filed. This means that even if a claim is reported years after the policy has expired, as long as the incident occurred while the policy was active, the professional would still be covered. Occurrence policies tend to be more expensive than claims-made policies because they offer a more extensive range of protection and do not require the purchase of tail coverage. When selecting a malpractice insurance policy, professionals should carefully consider the differences between claims-made and occurrence policies and choose the type that best suits their needs and risk tolerance. Factors such as the nature of their profession, potential exposure to claims, and the duration of their professional practice can all play a role in determining the most suitable policy type. Medical professionals, such as physicians, surgeons, dentists, nurses, and pharmacists, are the most common group requiring malpractice insurance. Due to the sensitive nature of their work and the potential for harm to patients, they face a higher risk of malpractice claims and must protect themselves accordingly. Legal professionals, including lawyers and paralegals, also require malpractice insurance. These professionals work in high-stakes environments, and their decisions can significantly impact the lives and finances of their clients, making them susceptible to malpractice claims. Other professionals, such as architects, engineers, accountants, and financial advisors, may also require malpractice insurance. While not as commonly associated with malpractice claims, these professionals provide specialized services that, if performed incorrectly, can result in significant financial or structural damage. The specific profession and specialty of a professional play a significant role in determining malpractice insurance premiums. High-risk specialties, such as surgery or obstetrics, typically have higher premiums due to the increased likelihood of malpractice claims. The geographic location of a professional's practice can also impact malpractice insurance premiums. Areas with higher costs of living, higher claim rates, or more stringent regulatory environments may result in higher premiums. A professional's experience level can also influence the cost of malpractice insurance. More experienced professionals may have lower premiums due to their expertise, while new professionals or those with a history of claims may face higher premiums. A professional's claims history can significantly affect their malpractice insurance premiums. Professionals with a history of malpractice claims may be considered higher risk and face increased premiums, while those with a clean record may be eligible for lower rates. The policy limits and deductibles chosen by a professional can also impact their malpractice insurance premiums. Higher policy limits and lower deductibles generally result in higher premiums, while lower limits and higher deductibles can reduce premiums. One of the most effective risk management strategies for professionals is maintaining thorough and accurate documentation of their work. Proper documentation can help prevent misunderstandings and serve as essential evidence in the event of a malpractice claim. Clear communication with clients or patients is another crucial risk management strategy. By ensuring that all parties understand the scope of work, potential risks, and expected outcomes, professionals can reduce the likelihood of miscommunications that could lead to malpractice claims. Staying up-to-date with industry advancements and best practices through continuing education and professional development can help professionals reduce their risk of malpractice claims. By maintaining their expertise, professionals can better serve their clients or patients and avoid potential errors or omissions that could lead to legal disputes and financial liability. Additionally, ongoing professional development enables professionals to adapt to evolving industry standards and regulations, ensuring their practice remains compliant and minimizing the likelihood of facing malpractice claims. In many professions, continuing education is not only a risk management strategy but also a requirement for maintaining licensure and professional standing. Adhering to established safety protocols and best practices in their respective fields is vital for professionals to minimize the risk of malpractice claims. These measures help to ensure that professionals consistently provide high-quality services and reduce the chances of errors or oversights that could lead to legal disputes. Addressing complaints and concerns from clients or patients in a timely and effective manner is another important risk management strategy. By acknowledging and resolving issues proactively, professionals can demonstrate their commitment to the client or patient satisfaction and potentially prevent malpractice claims from arising. When selecting a malpractice insurance policy, professionals should first assess their coverage needs based on factors such as their profession, specialty, and potential exposure to liability. This assessment will help to ensure that they choose a policy that provides adequate protection without being unnecessarily expensive. Before selecting a malpractice insurance policy, professionals should compare multiple insurance providers based on factors such as reputation, financial stability, customer service, and tailored policy options. This comparison will help them find a provider that best meets their needs and offers a reliable source of protection. When comparing malpractice insurance policies, professionals should carefully evaluate features such as policy limits, deductibles, coverage for legal defense costs, and coverage for settlements and damages. These features will determine the extent of protection provided by the policy and should be chosen based on the professional's unique needs and risk exposure. Finally, professionals must understand any exclusions or limitations within their malpractice insurance policies. By being aware of what is not covered, professionals can make informed decisions about additional coverage or risk management strategies to ensure they are adequately protected against potential claims. The malpractice claims process typically involves four stages: filing a claim, investigation, negotiation and settlement, and litigation. Understanding this process can help professionals better navigate the complexities of a malpractice claim and ensure they are prepared to defend themselves effectively. The statute of limitations for malpractice claims varies by jurisdiction and the type of professional service provided. Professionals should be aware of these limitations to understand the time frame during which a claim can be filed against them and to ensure they maintain the necessary documentation and records for the required period. Professionals should be familiar with the liability and negligence standards that apply to their profession and jurisdiction. These standards determine the level of care and competence that is expected of professionals and are crucial in establishing whether malpractice has occurred. The benefits of malpractice insurance include providing financial protection for professionals, compensating injured parties, and encouraging ethical and responsible practice. By offering a financial safety net, malpractice insurance enables professionals to continue their work while ensuring that individuals harmed by their actions receive compensation. Despite its benefits, malpractice insurance has been criticized for contributing to high premiums, encouraging defensive medicine, and limiting access to healthcare professionals in high-risk specialties. These criticisms highlight the need for ongoing evaluation and reform in the malpractice insurance industry. Malpractice insurance is a critical component for professionals in protecting themselves against claims of negligence or wrongdoing. It provides financial support for legal defense, settlements, and damages, allowing professionals to focus on their work without the fear of financial ruin. There are two main types of malpractice insurance: claims-made policies and occurrence policies. Claims-made policies cover incidents reported and occurred during the policy period, while occurrence policies cover incidents that occur during the policy period, regardless of when the claim is filed. Factors such as profession, geographic location, experience level, claims history, and policy limits can influence the cost of malpractice insurance premiums. When selecting a malpractice insurance policy, professionals should assess their coverage needs, compare insurance providers, evaluate policy features, and understand policy exclusions and limitations. Malpractice insurance provides benefits by offering financial protection for professionals, compensating injured parties, and promoting ethical practice. However, it also faces criticisms for high premiums, defensive medicine practices, and limited access to healthcare professionals in high-risk specialties.What Is Malpractice Insurance?

Types of Malpractice Insurance

Claims-Made Policies

Occurrence Policies

Professionals Requiring Malpractice Insurance

Medical Professionals

Legal Professionals

Other Professionals

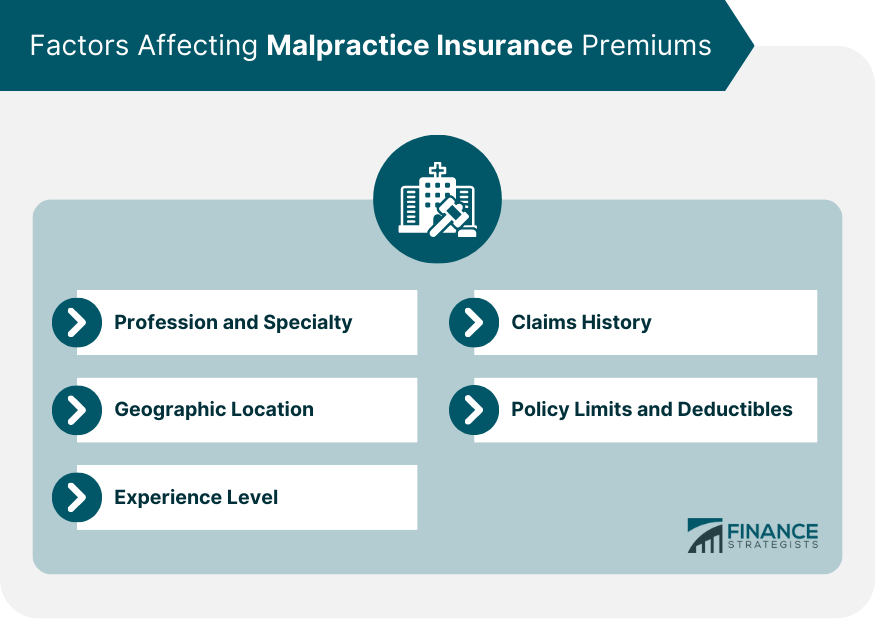

Factors Affecting Malpractice Insurance Premiums

Profession and Specialty

Geographic Location

Experience Level

Claims History

Policy Limits and Deductibles

Risk Management Strategies

Maintain Proper Documentation

Ensure Clear Communication

Continuing Education and Professional Development

Implement Safety Protocols and Best Practices

Handle Complaints and Concerns Promptly

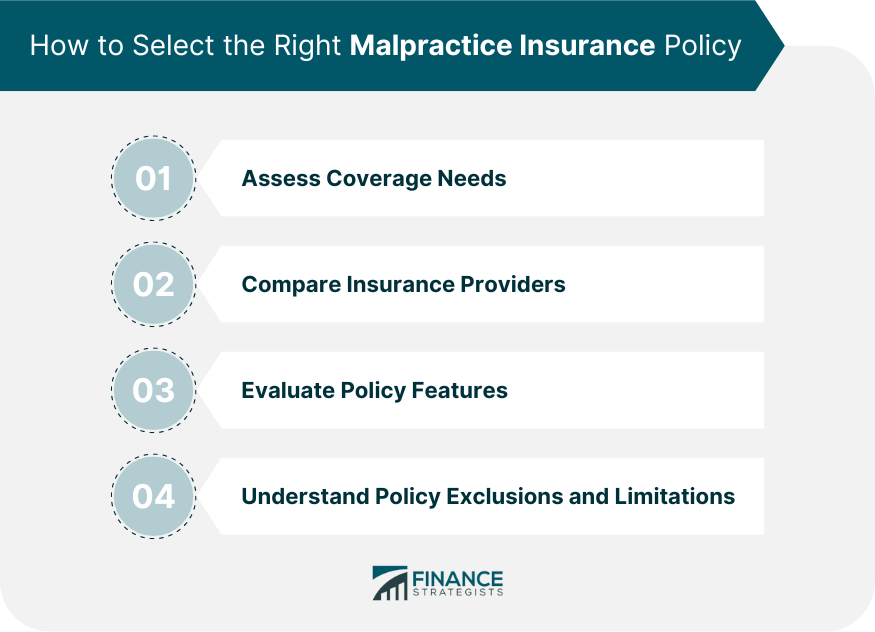

Selecting the Right Malpractice Insurance Policy

Assess Coverage Needs

Compare Insurance Providers

Evaluate Policy Features

Understand Policy Exclusions and Limitations

Legal Aspects of Malpractice Insurance

Malpractice Claims Process

Statute of Limitations for Malpractice Claims

Liability and Negligence Standards

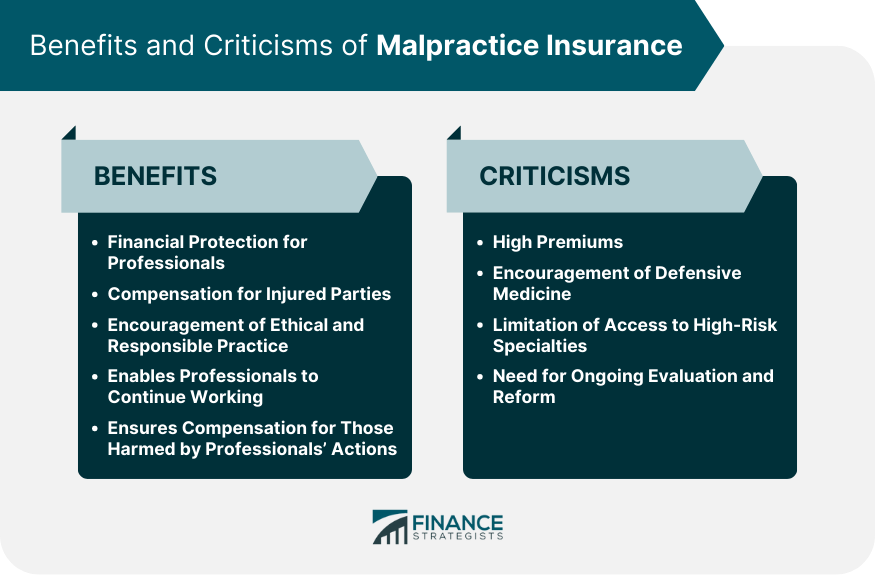

Impact of Malpractice Insurance on Society

Benefits of Malpractice Insurance

Criticisms of Malpractice Insurance

Final Thoughts

Malpractice Insurance FAQs

Malpractice insurance is a specialized form of liability coverage that protects professionals against claims of negligence or wrongdoing in their practice. It is important because it provides financial support for legal defense costs, settlements, and damages arising from a malpractice claim, ensuring professionals can continue their work without financial burden.

Professionals in various fields, including medical professionals (physicians, surgeons, dentists, nurses, and pharmacists), legal professionals (lawyers and paralegals), and others (architects, engineers, accountants, and financial advisors) typically require malpractice insurance due to the potential consequences of errors or omissions in their services.

Malpractice insurance premiums are determined based on factors such as the profession and specialty, geographic location, experience level, claims history, and policy limits and deductibles. High-risk specialties and professionals with a history of claims may face higher premiums.

Some effective risk management strategies include maintaining proper documentation, ensuring clear communication with clients or patients, continuing education and professional development, implementing safety protocols and best practices, and promptly handling complaints and concerns.

To choose the right malpractice insurance policy, professionals should assess their coverage needs, compare insurance providers based on factors such as reputation and financial stability, evaluate policy features (policy limits, deductibles, coverage for legal defense costs, and coverage for settlements and damages), and understand any policy exclusions and limitations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.