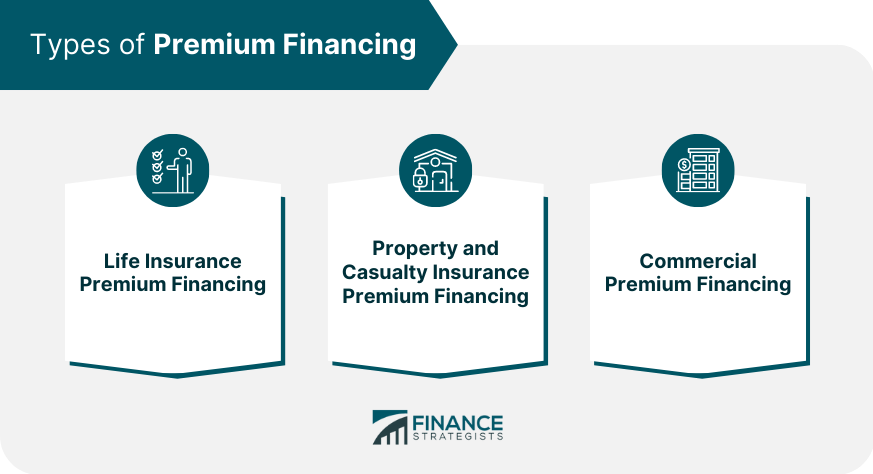

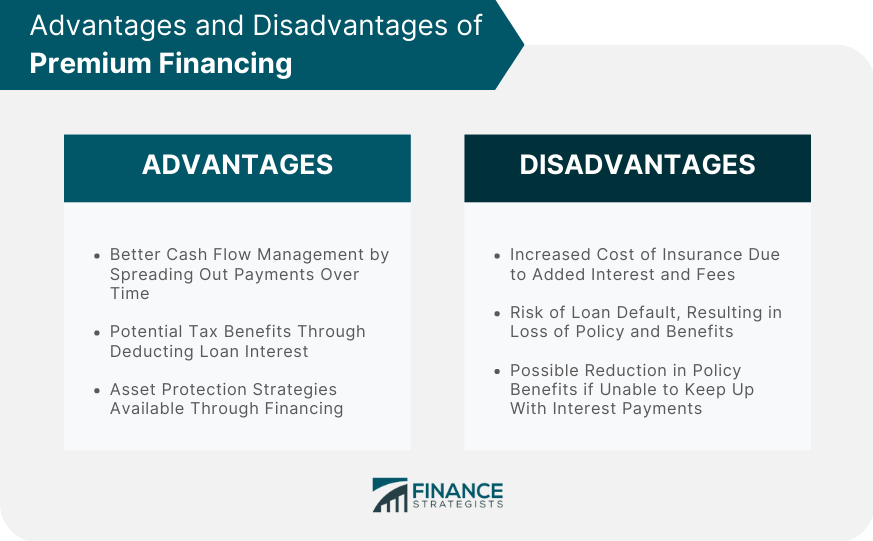

Premium financing is a specialized lending option that provides individuals and businesses with the funds needed to cover the cost of insurance premiums. By using this strategy, policyholders can avoid large upfront payments, manage cash flow more effectively, and potentially access tax benefits and asset protection strategies. The primary purpose of premium financing is to help policyholders manage their cash flow by spreading out the cost of insurance premiums over a longer period. This can be particularly beneficial for individuals and businesses with high-value insurance policies, such as life insurance or commercial insurance, where premiums can be expensive. The key participants in premium financing include the policyholder, the insurance company, and the premium finance company. The policyholder is the individual or business who requires insurance coverage, the insurance company provides the policy, and the premium finance company lends the funds needed to pay the premiums. There are several types of premium financing available, depending on the specific needs of the policyholder. These include life insurance premium financing, property and casualty insurance premium financing, and commercial premium financing. Life insurance premium financing involves borrowing funds to pay for the premiums on a life insurance policy. This strategy can be particularly beneficial for high-net-worth individuals who want to maintain their current lifestyle and assets while providing financial security for their beneficiaries. Life insurance premium financing can also help policyholders minimize the impact of estate taxes, as the policy proceeds can be structured to cover these costs. However, it is important to be aware of the risks associated with this strategy, such as potential loan default or the reduction of policy benefits due to unpaid interest. Property and casualty insurance premium financing enables policyholders to spread the cost of their property and casualty insurance premiums over time. This can help individuals and businesses manage their cash flow more effectively and avoid large upfront payments. Property and casualty insurance premium financing can also provide additional financial flexibility for policyholders, as the funds that would have been used to pay the premiums can be invested or used for other purposes. However, there are risks associated with this strategy, such as the potential for loan default or increased costs due to interest and fees. Commercial premium financing is used by businesses to finance the premiums for their commercial insurance policies, such as general liability, property, or workers' compensation insurance. This can help businesses manage their cash flow more effectively and avoid large upfront payments. Commercial premium financing can also provide businesses with additional financial flexibility, as the funds that would have been used to pay the premiums can be invested or used for other purposes. However, as with other types of premium financing, there are risks associated with this strategy, such as the potential for loan default or increased costs due to interest and fees. The premium financing process typically involves four main steps: application and underwriting, loan origination and agreement, collateral and security, and loan repayment and termination. The application and underwriting process for premium financing involves the policyholder submitting an application to the premium finance company, providing information about their financial situation, the insurance policy they wish to finance, and any collateral they may be offering. The premium finance company then evaluates the risk associated with lending to the policyholder and determines whether to approve the loan. In the loan origination and agreement phase, the premium finance company and the policyholder finalize the terms of the loan, including the interest rate, repayment schedule, and any fees associated with the financing. The policyholder and the premium finance company sign a loan agreement, which outlines the terms and conditions of the financing arrangement. Once the loan agreement is signed, the premium finance company pays the insurance premiums on behalf of the policyholder directly to the insurance company. The policyholder is then responsible for making periodic payments to the premium finance company, which typically include both principal and interest. In most premium financing arrangements, the policyholder is required to provide collateral or security to the premium finance company in order to secure the loan. This is typically done using the insurance policy itself, which serves as collateral for the loan. In the event of a loan default or failure to make timely payments, the premium finance company may have the right to take possession of the policy and its associated benefits, such as cash value or death benefits. This helps protect the premium finance company against the risk of loss in the event that the policyholder is unable to repay the loan. Throughout the term of the premium financing arrangement, the policyholder makes regular payments to the premium finance company, which typically include both principal and interest. The loan is considered fully repaid once the policyholder has paid off the principal balance, plus any accrued interest and fees. Upon full repayment of the loan, the premium financing arrangement is terminated, and the policyholder retains full ownership and control of their insurance policy. In some cases, the policyholder may choose to refinance the loan or enter into a new premium financing arrangement if they still require financial assistance to pay their insurance premiums. There are several advantages and disadvantages associated with premium financing that policyholders should consider before entering into a financing arrangement. One of the main advantages of premium financing is cash flow management. By spreading out the cost of insurance premiums over time, policyholders can avoid large upfront payments and manage their cash flow more effectively. Premium financing can also provide tax benefits, as the interest paid on the loan may be tax-deductible in some cases. Additionally, premium financing can offer asset protection strategies, as policyholders can use the financing to help protect their assets from creditors or legal claims. Despite its advantages, premium financing also comes with some disadvantages. One such disadvantage is the increased cost of insurance, as the interest and fees associated with the loan can add to the overall cost of the policy. Another potential disadvantage is the risk of loan default, which could result in the loss of the insurance policy and its associated benefits. Lastly, premium financing can also lead to a potential reduction in policy benefits if the policyholder is unable to keep up with the interest payments, which could affect the overall value of the policy. There are several regulatory and legal considerations that policyholders should be aware of when considering premium financing. Premium financing is regulated at the state level, with each state having its own specific laws and regulations governing the practice. In many states, premium finance companies are required to obtain a license and adhere to specific guidelines, such as maximum interest rates and disclosure requirements. Policyholders should familiarize themselves with the regulations in their state before entering into a premium financing arrangement. In many states, premium finance companies are required to provide clear and accurate disclosures to policyholders regarding the terms and conditions of the financing arrangement. This typically includes information about the interest rate, fees, repayment schedule, and any potential risks associated with the financing. Policyholders should carefully review these disclosures before signing a loan agreement to ensure that they understand the full terms and conditions of the financing arrangement. Policyholders should also be aware of the legal considerations and best practices associated with premium financing. This includes working with a reputable premium finance company that is licensed in their state and has a strong track record of success. It also involves carefully reviewing the loan agreement and seeking legal advice if necessary to ensure that the terms of the agreement are fair and reasonable. Finally, policyholders should be aware of the potential risks associated with premium financing and take steps to mitigate those risks. This includes maintaining adequate collateral and ensuring that loan payments are made on time to avoid the risk of loan default. The premium financing industry is expected to continue to grow and evolve in the coming years, with several trends shaping the future of the industry. The premium financing market is expected to continue to grow and expand, driven by increasing demand for insurance coverage and the growing popularity of premium financing as a cash flow management strategy. This is likely to lead to greater competition among premium finance companies and more flexible financing options for policyholders. Despite the growth and expansion of the premium financing industry, there are also several challenges and opportunities that policyholders and premium finance companies will need to navigate in the coming years. These include changing regulations, increasing competition, and evolving customer needs and preferences. Premium financing can be a useful strategy for individuals and businesses looking to manage their cash flow and access the benefits of insurance coverage. However, it is important for policyholders to carefully consider the risks and benefits of premium financing before entering into a financing arrangement, and to work with a reputable premium finance company that can provide the guidance and support needed to make informed decisions.What Is Premium Financing?

Types of Premium Financing

Life Insurance Premium Financing

Property and Casualty Insurance Premium Financing

Commercial Premium Financing

Premium Financing Process

Application and Underwriting

Loan Origination and Agreement

Collateral and Security

Loan Repayment and Termination

Advantages and Disadvantages of Premium Financing

Advantages

Disadvantages

Regulatory and Legal Considerations of Premium Financing

State Regulations and Licensing

Disclosure Requirements

Legal Considerations and Best Practices

Conclusion

Premium Financing FAQs

Premium financing is a loan arrangement used to finance insurance premiums, typically for high-value insurance policies.

Premium financing is typically used by individuals or businesses that need to pay high insurance premiums upfront but want to spread the payments over time.

Premium financing can be used for a wide range of insurance policies, including life insurance, property and casualty insurance, and professional liability insurance.

Premium financing involves taking out a loan to pay the insurance premiums upfront. The borrower then repays the loan over time, typically with interest.

Pros of premium financing include improved cash flow, access to higher coverage limits, and potential tax benefits. Cons include interest charges and the risk of defaulting on the loan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.