A Modified Endowment Contract is a life insurance policy that has exceeded certain premium payment limits established by the Internal Revenue Service (IRS). As a result, the policy is subject to different tax rules compared to traditional life insurance contracts. MECs were introduced in 1988 under the Technical and Miscellaneous Revenue Act (TAMRA) as a response to individuals using life insurance policies primarily as tax-advantaged investment vehicles. The legislation aimed to limit the amount of premiums that could be paid into a policy within a certain timeframe, effectively creating a distinction between life insurance policies and MECs. While both MECs and traditional life insurance policies offer death benefits to beneficiaries, the primary difference between the two lies in the tax treatment of policy loans, withdrawals, and death benefits. In addition, MECs are subject to different rules regarding premium payments and policy loans. To better understand MECs, it's important to explore how a life insurance policy can become a MEC, as well as the implications of policy loans and withdrawals. A life insurance policy becomes a MEC when it fails the 7-Pay Test, a cumulative premium payment test established by the IRS. The test limits the total amount of premiums that can be paid into a policy within the first seven years. If the cumulative premiums paid exceed the limit, the policy is reclassified as a MEC. The 7-Pay Test sets a limit on the amount of premiums that can be paid into a life insurance policy within the first seven years. If the total premiums paid exceed this limit, the policy is considered a MEC. When a policy becomes a MEC, it is subject to different tax rules, particularly regarding policy loans and withdrawals. In addition, there may be penalties for early withdrawals and policy loans. Policy loans and withdrawals are ways policyholders can access the cash value of their MEC. However, there are tax implications and potential penalties to consider. With a MEC, policy loans and withdrawals are subject to income tax on the gains in the policy. This differs from traditional life insurance policies, where policy loans and withdrawals are generally tax-free. Policyholders who withdraw funds or take out policy loans from a MEC may be subject to surrender charges and penalties, particularly if the withdrawals or loans occur within the first few years of the policy. While the death benefit of a traditional life insurance policy is generally income tax-free, the death benefit of a MEC may be partially taxable if the policy has a gain at the time of the policyholder's death. Proper management of a MEC can help policyholders maximize its benefits and minimize potential drawbacks. Policyholders can work with a financial advisor or insurance agent to structure their policy in a way that avoids MEC status, ensuring that they are not subject to the additional tax implications associated with a MEC. Regularly monitoring policy performance and cash value can help policyholders make informed decisions about withdrawals, loans, and premium payments. Policyholders should carefully consider the tax implications and potential penalties of policy loans and withdrawals, and use them strategically to minimize potential drawbacks. Consulting with a financial advisor or tax professional can provide valuable guidance in managing a MEC and understanding the associated tax implications. Individuals considering a MEC should also be aware of alternative investment and insurance options. Traditional life insurance policies, such as whole life or universal life, may offer more favorable tax treatment on policy loans and withdrawals compared to MECs. Annuities are another option for individuals seeking tax-deferred growth and a guaranteed income stream in retirement, without the limitations and tax implications associated with MECs. Investing in mutual funds, stocks, or bonds can provide the potential for long-term growth, though without the same tax advantages as MECs or other tax-advantaged investment vehicles. Individuals seeking tax-deferred growth and retirement savings options may consider contributing to tax-advantaged retirement accounts, such as IRAs or 401(k)s, as an alternative to MECs. Despite the tax implications, there are several potential benefits to holding a MEC. MECs offer tax-deferred growth, meaning the cash value of the policy grows without being subject to income taxes until funds are withdrawn or a policy loan is taken out. Policyholders can access the cash value of their MEC through policy loans and withdrawals, providing a source of liquidity when needed. This can be useful for emergency expenses, funding a child's education, or supplementing retirement income. MECs often allow for flexible premium payments, enabling policyholders to adjust their premiums based on their financial situation and needs. This flexibility can be advantageous for individuals with variable income or changing financial circumstances. While not guaranteed, MECs may offer the potential for higher returns compared to traditional savings vehicles, such as bank accounts or certificates of deposit, due to the tax-deferred growth and potential for investment gains within the policy. MECs also have several drawbacks that must be considered before choosing this type of policy. One of the primary disadvantages of a MEC is the tax implications on policy loans and withdrawals. Unlike traditional life insurance policies, loans and withdrawals from a MEC are subject to income tax on the gains in the policy. Excessive withdrawals from a MEC can lead to a policy lapse, resulting in the loss of death benefit protection and potential tax consequences on the cash value. MECs may have limited access to funds during the initial policy years due to surrender charges and penalties, which can be problematic for policyholders who require immediate liquidity. MECs may have higher fees and costs compared to other investment vehicles, such as mutual funds or ETFs, which can impact the overall return on investment. A Modified Endowment Contract is a life insurance policy that has exceeded certain premium payment limits established by the IRS. Modified Endowment Contracts offer potential benefits, such as tax-deferred growth and flexibility in premium payments. But it also comes with disadvantages, including tax implications on policy loans and withdrawals, as well as the potential for higher fees and costs compared to other investment vehicles. Understanding the mechanics, advantages, and disadvantages of MECs is crucial when considering this type of policy. It's essential for individuals to carefully weigh their options and consider alternatives, such as traditional life insurance policies, annuities, and tax-advantaged retirement accounts, before choosing a MEC. Consulting with a financial advisor or tax professional can provide valuable guidance and insights, helping individuals make the best decisions for their financial goals and circumstances.Definition of a Modified Endowment Contract

Background and History of MECs

Differences Between MECs and Traditional Life Insurance Policies

Mechanics of a Modified Endowment Contract

How a Life Insurance Policy Becomes a MEC

7-Pay Test

Consequences of Failing the 7-Pay Test

Policy Loans and Withdrawals

Tax Implications

Surrender Charges and Penalties

Death Benefits and Taxation

Strategies for Managing a Modified Endowment Contract

Properly Structuring Policy to Avoid MEC Status

Monitoring Policy Performance and Cash Value

Utilizing Policy Loans and Withdrawals Strategically

Working With a Financial Advisor or Tax Professional

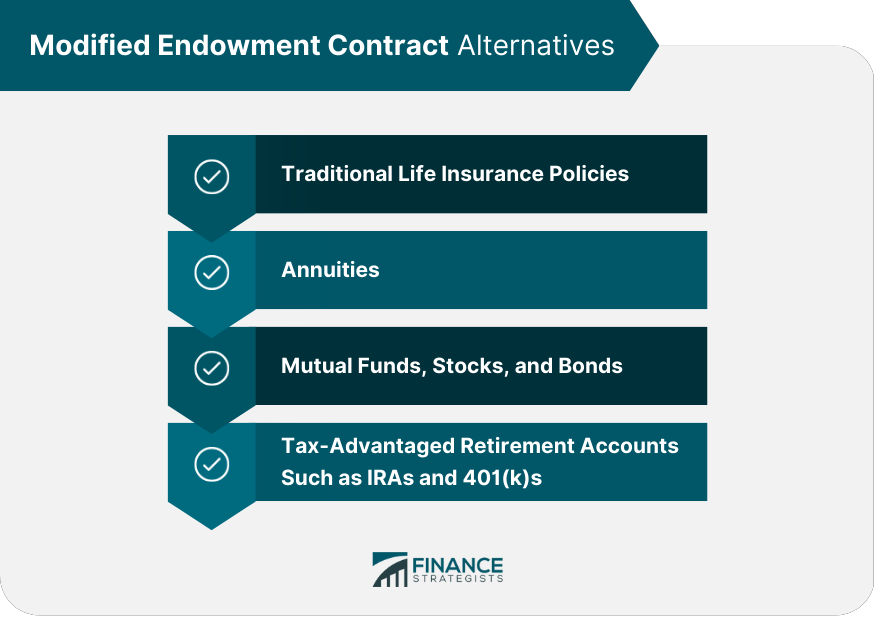

Modified Endowment Contract Alternatives

Traditional Life Insurance Policies

Annuities

Mutual Funds, Stocks, and Bonds

Tax-Advantaged Retirement Accounts Such as IRAs and 401(k)S

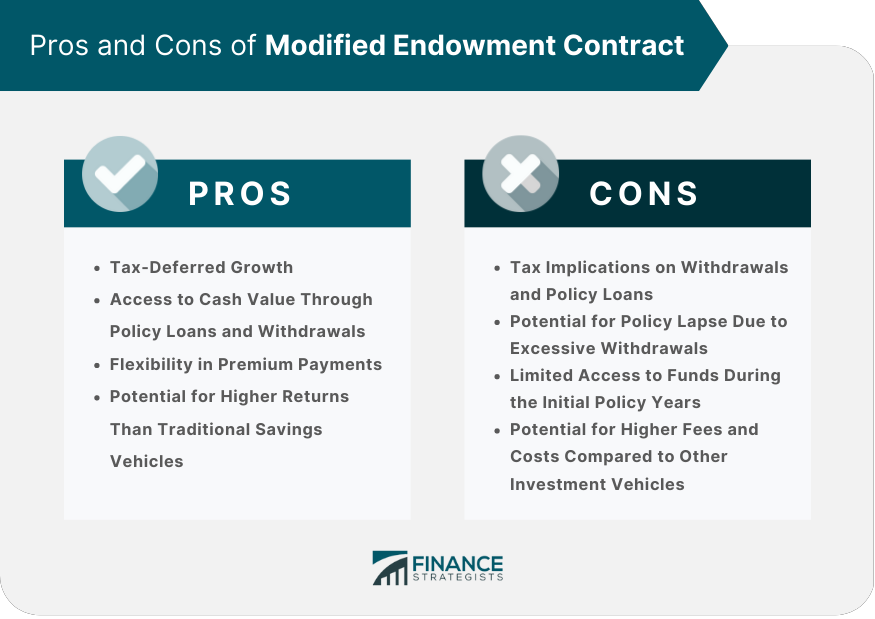

Pros of a Modified Endowment Contract

Tax-Deferred Growth

Access to Cash Value Through Policy Loans and Withdrawals

Flexibility in Premium Payments

Potential for Higher Returns Than Traditional Savings Vehicles

Cons of a Modified Endowment Contract

Tax Implications on Withdrawals and Policy Loans

Potential for Policy Lapse Due to Excessive Withdrawals

Limited Access to Funds During the Initial Policy Years

Potential for Higher Fees and Costs Compared to Other Investment Vehicles

Conclusion

Modified Endowment Contract (MEC) FAQs

A Modified Endowment Contract (MEC) is a life insurance policy that has exceeded certain premium payment limits set by the IRS, resulting in different tax rules compared to traditional life insurance policies. MECs were introduced to limit the use of life insurance policies as tax-advantaged investment vehicles.

A life insurance policy becomes a MEC when it fails the 7-Pay Test, a cumulative premium payment test established by the IRS. If the total premiums paid within the first seven years of the policy exceed the limit set by the 7-Pay Test, the policy is considered a MEC and is subject to different tax rules.

Policy loans and withdrawals from a MEC are subject to income tax on the gains in the policy, which is different from traditional life insurance policies where policy loans and withdrawals are generally tax-free. In addition, there may be penalties for early withdrawals and policy loans from a MEC.

Some advantages of a MEC include tax-deferred growth, access to cash value through policy loans and withdrawals, flexibility in premium payments, and the potential for higher returns compared to traditional savings vehicles. However, these advantages must be weighed against the tax implications and other potential drawbacks of MECs.

Yes, there are several alternatives to MECs for individuals seeking tax-deferred growth and investment opportunities. These include traditional life insurance policies, annuities, mutual funds, stocks, and bonds, as well as tax-advantaged retirement accounts like IRAs and 401(k)s. It's essential to explore these options and consult with a financial advisor or tax professional to determine the best choice for your financial goals and circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.