A life insurance policy review is an evaluation of your current life insurance policy to determine whether it still meets your needs and goals. A life insurance policy review typically involves a thorough analysis of your current coverage, premiums, and beneficiaries, as well as an assessment of any changes in your life circumstances that may affect your insurance needs. The purpose of a life insurance policy review is to ensure that your policy is up-to-date and that you have the right amount and type of coverage for your current situation. This can help you avoid paying for unnecessary coverage or missing out on important benefits that you may need. There are several types of life insurance policy reviews, and the specific type you need will depend on your individual circumstances and goals. Here are some common types of life insurance policy reviews: This type of review focuses on the amount and type of coverage you have. It helps ensure that your policy still meets your needs and goals and that you have adequate coverage to protect your loved ones. A premium review helps you assess the cost of your coverage and determine if you're paying too much for your policy. It may involve evaluating your premium payments and exploring ways to reduce your costs. A beneficiary review is a check on the people or organizations that will receive the proceeds of your life insurance policy when you pass away. This type of review helps ensure that your beneficiaries are up-to-date and that your policy will be paid out to the right people or organizations. This type of review evaluates the performance of your policy over time, including investment returns and cash value growth. It helps you assess the financial strength of your policy and determine if any changes need to be made. A life events review is conducted when there has been a significant change in your life circumstances, such as a marriage, divorce, the birth of a child, or a change in employment status. This type of review helps ensure that your policy still meets your needs after a significant life change. Compile all necessary documents, such as policy statements, premium payment records, and beneficiary designations, before beginning the review process. Assess your current life insurance coverage and evaluate whether it still meets your needs based on your personal and financial circumstances. Examine the performance of your policy, including investment returns and interest rate fluctuations, to determine if any adjustments are necessary. Research alternative policies and compare them with your current policy to identify if a more suitable option exists. Seek advice from a financial professional to ensure that your policy review is thorough and accurate, and to receive personalized recommendations. Based on the findings of your policy review, make any necessary updates or changes to your coverage, beneficiaries, or investment allocations. 1. Marriage: A change in marital status may necessitate an update in coverage to ensure the financial security of your spouse. 2. Divorce: A divorce may require policy adjustments, such as beneficiary changes or coverage reductions. 3. Birth or Adoption of a Child: The addition of a child to your family typically calls for an increase in coverage to protect their financial future. 4. Career Changes: Job changes, promotions, or unemployment can impact your life insurance needs and affordability. 5. Retirement: Retirement may prompt a reassessment of coverage, as income and financial responsibilities change. 1. Increased Income: A significant increase in income may warrant higher coverage to maintain your family's standard of living. 2. Debt Reduction: Reduced debt levels can lead to a decrease in life insurance coverage needs. 3. Inheritance or Windfall: A sudden influx of wealth may affect your life insurance needs or the investment component of your policy. 1. Investment Returns: The performance of investment components in permanent life insurance policies should be reviewed to ensure alignment with financial goals. 2. Interest Rate Fluctuations: Changes in interest rates can impact the performance of certain life insurance policies, particularly universal life policies. 1. Changes in Estate Tax Laws: Alterations in estate tax laws can influence your life insurance needs, particularly if your estate's value is near the taxable threshold. 2. Updates to Insurance Regulations: New insurance regulations may impact your policy's terms or performance, necessitating a review. Regularly review your life insurance policy, ideally every one to three years, or when significant life changes occur. Ensure that your beneficiary designations are up-to-date and aligned with your wishes. Keep a close eye on your policy's performance, particularly if it includes an investment component, and make adjustments as needed. Stay informed about changes in estate tax laws and insurance regulations that may impact your life insurance needs or policy performance. Consult with a financial professional to receive personalized recommendations and ensure that your policy review is thorough and accurate. Life insurance policy reviews are an essential part of ensuring the financial security of your loved ones. By understanding the various types of life insurance policies available and the reasons for conducting reviews, you can evaluate your coverage and make adjustments as needed. Following the steps involved in conducting policy reviews and keeping in mind the tips for effective reviews can help ensure that your coverage remains aligned with your needs and circumstances. Regular reviews, updates to beneficiaries, monitoring policy performance, staying informed on legal and tax changes, and seeking professional advice can all contribute to maintaining peace of mind and financial security for you and your loved ones.What Is Life Insurance Policy Review?

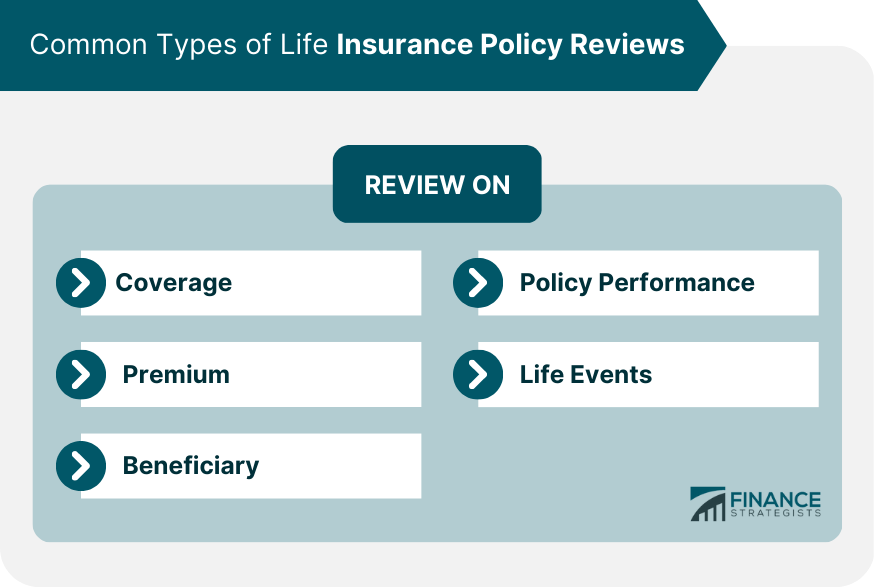

Types of Life Insurance Policy Reviews

Coverage Review

Premium Review

Beneficiary Review

Policy Performance Review

Life Events Review

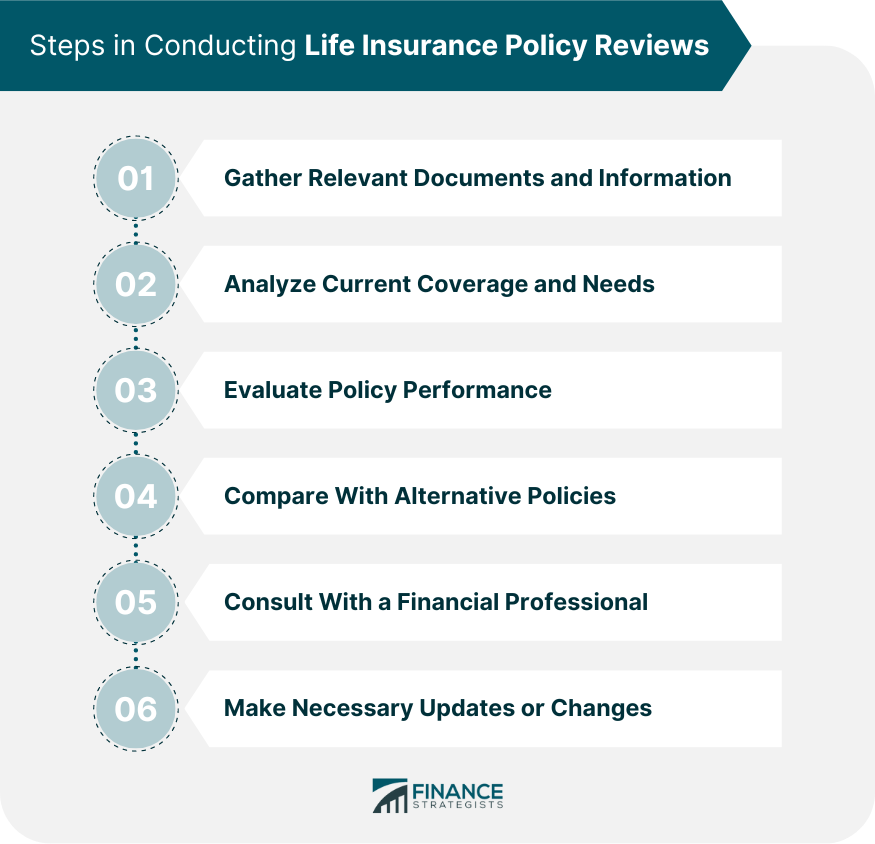

Steps in Conducting Life Insurance Policy Reviews

Gather Relevant Documents and Information

Analyze Current Coverage and Needs

Evaluate Policy Performance

Compare With Alternative Policies

Consult With a Financial Professional

Make Necessary Updates or Changes

Reasons for Conducting Life Insurance Policy Reviews

Personal Life Changes

Financial Changes

Policy Performance

Legal and Tax Changes

Tips for Effective Life Insurance Policy Reviews

Conduct Reviews Regularly

Update Beneficiaries as Needed

Monitor Policy Performance

Stay Informed on Legal and Tax Changes

Seek Professional Advice

Conclusion

Life Insurance Policy Review FAQs

You should conduct life insurance policy reviews every one to three years, or when significant personal or financial changes occur in your life. Regular reviews help ensure that your coverage remains aligned with your needs and circumstances.

Life insurance policy reviews are necessary to account for personal life changes (e.g., marriage, divorce, birth or adoption of a child, career changes, or retirement), financial changes (e.g., increased income, debt reduction, or inheritance), policy performance (e.g., investment returns or interest rate fluctuations), and legal and tax changes (e.g., updates to estate tax laws or insurance regulations).

During life insurance policy reviews, consider your current coverage and needs, policy performance, alternative policies, and any updates or changes required based on your personal and financial circumstances. It's also recommended to consult with a financial professional for personalized advice.

Yes, life insurance policy reviews can potentially help you save money on premiums by identifying coverage adjustments that better align with your needs or by comparing your current policy with alternative options that may offer better value or more suitable coverage.

For effective life insurance policy reviews, conduct them regularly, update beneficiaries as needed, monitor policy performance, stay informed on legal and tax changes, and seek professional advice to ensure a thorough and accurate review.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.