Deferred Compensation Life Insurance is a type of life insurance that is used by employers to provide a deferred compensation benefit to key employees or executives. This type of insurance policy is designed to provide a death benefit to the beneficiary of the policy in the event that the insured employee passes away. The deferred compensation aspect of the policy refers to the fact that the employee's compensation is deferred until a future date, such as retirement. At that time, the employee receives the accumulated funds from the policy, which have been growing tax-deferred over the years. Deferred Compensation Life Insurance is often used as a way for employers to provide an additional retirement benefit to their key employees or executives. It can also be used as a way to attract and retain top talent within an organization. A deferred compensation life insurance plan is a contractual agreement between an employee and their employer. The employee agrees to defer a portion of their income, which is then invested and paid out at a later date, usually during retirement. In return, the employer agrees to fund the plan and provide specific benefits. There are several funding methods for deferred compensation life insurance plans. Employers can choose to fund the plans with Corporate-Owned Life Insurance (COLI) policies or other investment options, such as mutual funds or annuities. A vesting schedule determines when an employee becomes entitled to the benefits of a deferred compensation life insurance plan. These schedules can be based on years of service, performance goals, or other criteria. Deferred compensation life insurance plans have significant tax implications for both employers and employees. Generally, contributions to these plans are tax-deferred, meaning they are not subject to income tax until the benefits are paid out. Nonqualified deferred compensation plans are not subject to the same regulations as qualified plans, providing more flexibility for both employers and employees. Examples of NQDC plans include: Employees agree to defer a portion of their salary, which is then invested and paid out at a later date, usually during retirement. These plans allow employees to defer bonuses, which are then invested and paid out in the future. SERPs are designed to provide additional retirement benefits to key executives, often to make up for limitations in qualified plans. These plans are subject to strict regulations under the Employee Retirement Income Security Act (ERISA). Examples of qualified deferred compensation plans include: A 401(k) is a type of retirement savings plan sponsored by employers, allowing employees to save and invest a portion of their paycheck before taxes are taken out. Similar to 401(k) plans, 403(b) plans are designed for employees of public schools, nonprofit organizations, and certain churches. 457(b) plans are designed for employees of state and local governments and certain tax-exempt organizations. Deferred compensation life insurance plans offer significant tax advantages for both employers and employees: Employees can defer income tax on their contributions and investment earnings until the benefits are paid out, usually during retirement when they may be in a lower tax bracket. Employers can deduct their contributions to deferred compensation life insurance plans, providing tax savings. Deferred compensation life insurance plans can help employees save for retirement and provide a source of income during their retirement years. Offering deferred compensation life insurance plans can help employers attract and retain key employees by providing valuable retirement benefits and financial security. These plans can also offer estate planning benefits, such as providing a death benefit to beneficiaries and potentially reducing estate taxes. Employees face the risk that their employer may not be solvent when it is time to pay out the benefits of the deferred compensation life insurance plan. This can result in a loss of some or all of the expected benefits. Both employers and employees may face regulatory and legal risks associated with deferred compensation life insurance plans. Compliance with applicable laws and regulations is essential to avoid penalties and potential litigation. Changes in tax laws can impact the tax advantages of deferred compensation life insurance plans, potentially reducing their benefits for both employers and employees. Deferred compensation life insurance plans typically have restrictions on accessing funds before retirement, which may limit an employee's financial flexibility in case of emergencies or other financial needs. Employers should carefully assess their specific needs and objectives when considering a deferred compensation life insurance plan. Factors to consider include company size, industry, employee demographics, and the desired level of benefits. It is important for employers to evaluate different plan options and funding methods, taking into consideration factors such as tax implications, regulatory requirements, and investment options. Employers and employees alike can benefit from working with a financial professional who specializes in deferred compensation life insurance plans. These professionals can provide guidance and expertise in selecting and managing the right plan. Regular review and management of a deferred compensation life insurance plan are essential to ensure that the plan continues to meet the needs of both employers and employees and to adapt to changes in the economic and regulatory environment. Deferred compensation life insurance plans serve as valuable financial planning tools for both employers and employees. These plans provide significant benefits, including tax advantages, retirement planning, income security, and attracting and retaining key employees. There are two main types of plans: nonqualified deferred compensation plans and qualified deferred compensation plans, each with its unique features and regulations. However, it is crucial to consider the potential risks and drawbacks, such as employer solvency risks, regulatory and legal risks, tax law changes, and limited access to funds before retirement. Employers should assess their company's specific needs and objectives, evaluate various plan options and funding methods, and work with a financial professional specializing in deferred compensation life insurance plans. Regular review and management of the chosen plan are essential for adapting to changes in the economic and regulatory environment, ensuring that the plan continues to meet the needs of both employers and employees.What Is Deferred Compensation Life Insurance?

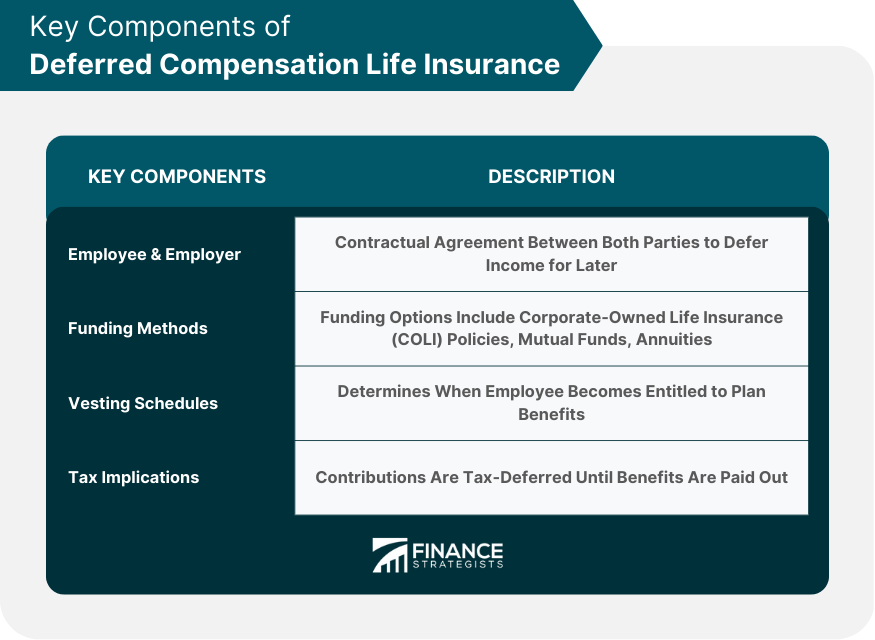

Key Components of Deferred Compensation Life Insurance

Employee and Employer Agreements

Funding Methods

Vesting Schedules

Tax Implications

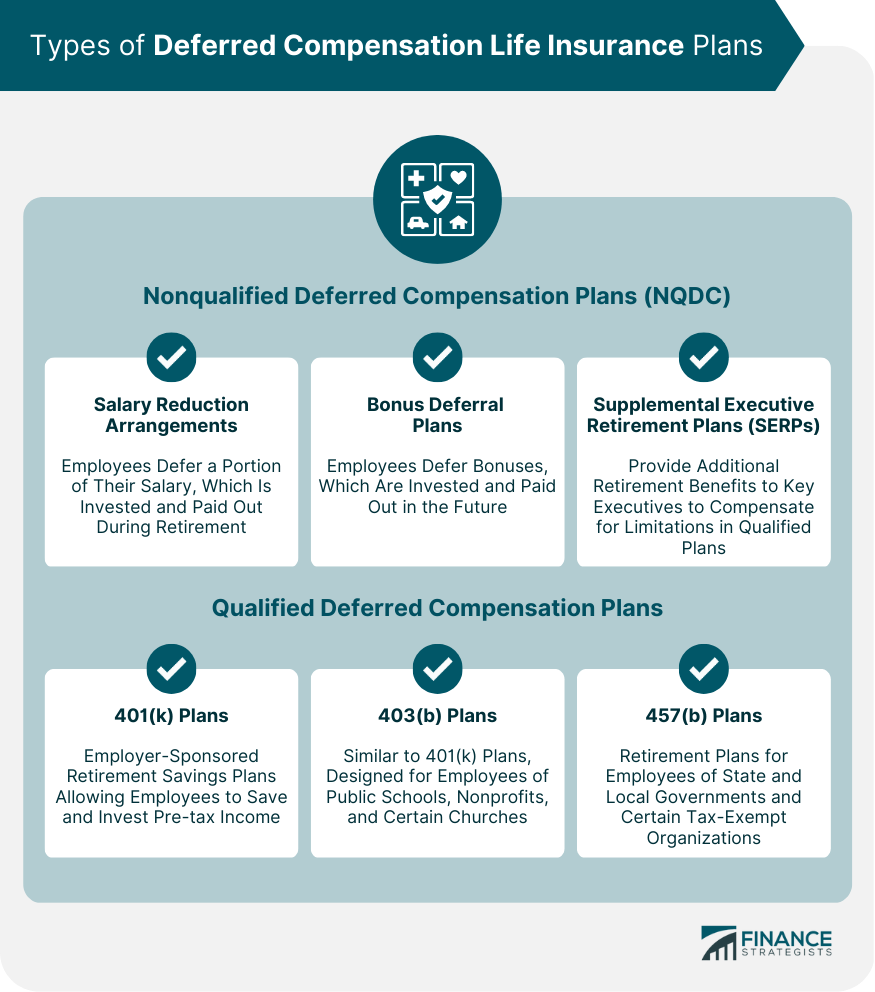

Types of Deferred Compensation Life Insurance Plans

Nonqualified Deferred Compensation Plans (NQDC)

Salary Reduction Arrangements

Bonus Deferral Plans

Supplemental Executive Retirement Plans (SERPs)

Qualified Deferred Compensation Plans

401(k) Plans

403(b) Plans

457(b) Plans

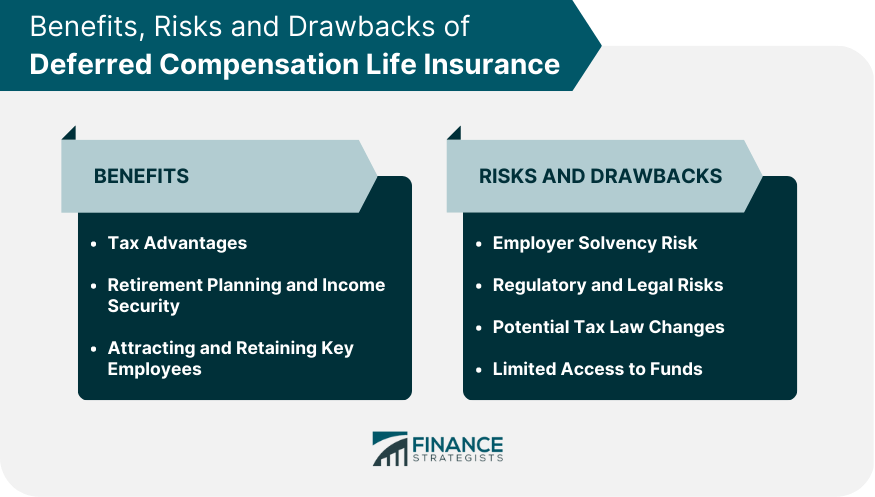

Benefits of Deferred Compensation Life Insurance

Tax Advantages

Employee Benefits

Employer Benefits

Retirement Planning and Income Security

Attracting and Retaining Key Employees

Estate Planning Advantages

Risks and Drawbacks of Deferred Compensation Life Insurance

Employer Solvency Risk

Regulatory and Legal Risks

Potential Tax Law Changes

Limited Access to Funds

Selecting the Right Deferred Compensation Life Insurance Plan

Assessing Company Needs and Objectives

Evaluating Plan Options

Working With a Financial Professional

Ongoing Plan Management and Review

The Bottom Line

Deferred Compensation Life Insurance FAQs

Deferred compensation life insurance is a type of financial planning tool that allows employees to defer a portion of their income, which is then invested and paid out at a later date, typically during retirement. Employers fund the plan and provide specific benefits, often through corporate-owned life insurance (COLI) policies or other investment options.

Deferred compensation life insurance offers tax advantages for both employees and employers, as contributions are generally tax-deferred. It also aids in retirement planning and income security for employees, while helping employers attract and retain key employees by providing valuable financial benefits.

There are two main types of deferred compensation life insurance plans: nonqualified deferred compensation plans (NQDC) and qualified deferred compensation plans. NQDC plans offer more flexibility and include salary reduction arrangements, bonus deferral plans, and supplemental executive retirement plans (SERPs). Qualified plans, such as 401(k), 403(b), and 457(b) plans, are subject to strict regulations under the Employee Retirement Income Security Act (ERISA).

Some risks and drawbacks of deferred compensation life insurance plans include employer solvency risk, regulatory and legal risks, potential tax law changes, and limited access to funds before retirement. It is essential to carefully consider these factors when selecting and managing a deferred compensation life insurance plan.

To select the right deferred compensation life insurance plan, employers should assess their company's specific needs and objectives, evaluate various plan options and funding methods, and work with a financial professional specializing in deferred compensation life insurance plans. Regular review and management of the chosen plan are also crucial for adapting to changes in the economic and regulatory environment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.