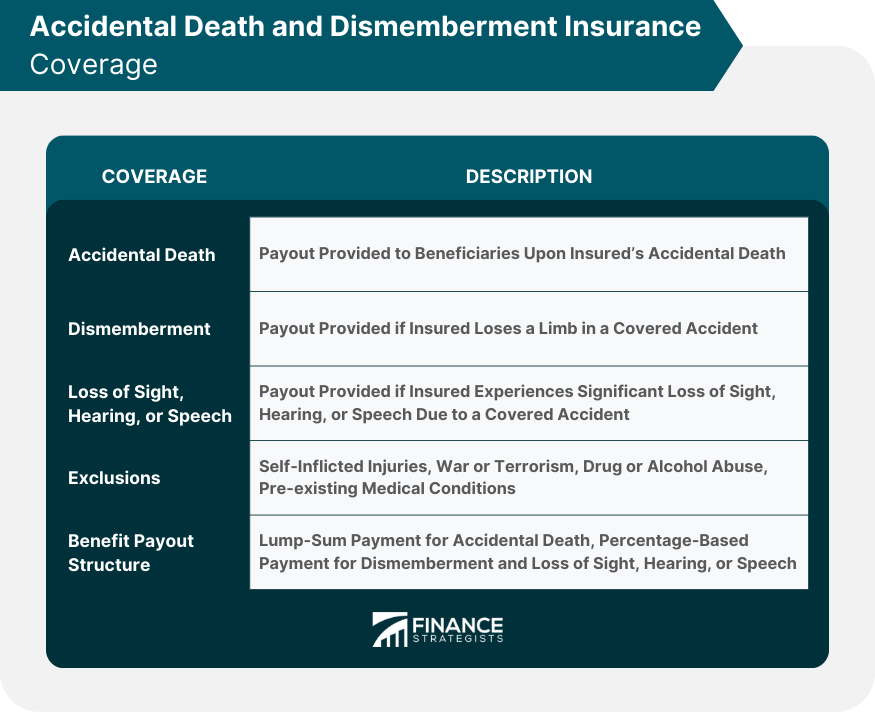

Accidental Death and Dismemberment Insurance is a specialized form of insurance coverage that provides financial protection in the event of accidental death or severe bodily injury resulting in dismemberment. It is designed to supplement traditional life insurance policies by offering additional benefits specifically tailored to accidents. AD&D insurance policies typically cover a wide range of accidents, including but not limited to car accidents, falls, drowning, fires, and other unexpected incidents that result in death or dismemberment. The coverage is not limited to a specific location and applies worldwide, offering individuals protection no matter where they may be. AD&D insurance provides coverage for a variety of incidents, including: 1. Accidental Death: A payout is provided to the policyholder's beneficiaries if the insured dies due to a covered accident. 2. Dismemberment: A payout is provided if the insured loses a limb, such as an arm or leg, in a covered accident. 3. Loss of Sight, Hearing, or Speech: A payout is provided if the insured suffers a significant loss of sight, hearing, or speech due to a covered accident. Like any insurance policy, AD&D insurance has certain exclusions and limitations. Common exclusions include: 1. Self-Inflicted Injuries: Injuries resulting from intentional self-harm or suicide are not covered. 2. War or Terrorism: Injuries sustained during acts of war or terrorism are generally excluded from coverage. 3. Drug or Alcohol Abuse: Injuries resulting from drug or alcohol abuse may not be covered. 4. Pre-existing Medical Conditions: Injuries related to pre-existing medical conditions may be excluded from coverage. AD&D insurance policies typically offer two types of benefit payouts: 1. Lump-Sum Payment: A single, lump-sum payment is provided to the beneficiaries in the event of accidental death. 2. Percentage-Based Payment for Dismemberment: In the event of dismemberment or loss of sight, hearing, or speech, the payout is typically based on a percentage of the policy's face value. While traditional life insurance policies provide coverage for death due to any cause (with certain exceptions), AD&D insurance covers only accidental death and specific injuries resulting from accidents. This makes AD&D a supplemental form of insurance that can be used in conjunction with traditional life insurance. AD&D insurance is generally less expensive than traditional life insurance because it covers a narrower range of incidents. However, the exact cost of premiums will depend on factors such as age, health, and the chosen coverage amount. Both AD&D and traditional life insurance policies provide lump-sum payouts to beneficiaries. However, AD&D insurance also offers percentage-based payouts for dismemberment and loss of sight, hearing, or speech. Both types of insurance policies can be customized with additional riders and options, such as waiver of premium or child rider benefits, to tailor coverage to individual needs. Insurance brokers to play a crucial role in helping clients identify their insurance needs, including whether AD&D insurance is appropriate for their situation. Brokers can provide clients with a range of policy options and help them compare coverage, premiums, and benefit payouts. Based on the client's needs and financial situation, brokers can offer expert advice on selecting the most suitable policy. In the event of a claim, insurance brokers can help clients navigate the process, ensuring that all necessary documentation is submitted and that clients receive the benefits they are entitled to. Before purchasing an AD&D insurance policy, individuals should carefully consider their personal and family needs, including their financial obligations, dependents, and existing insurance coverage. It's essential to choose a coverage amount that adequately protects the policyholder's family in the event of an accident. Factors such as income, existing debts, and future expenses should be taken into account when determining the appropriate coverage amount. When considering an AD&D policy, individuals should weigh the cost of premiums against the potential benefits to determine if the coverage is a worthwhile investment. AD&D insurance can be purchased as an individual policy or as part of a group plan, such as an employer-sponsored benefit. Individuals should evaluate the pros and cons of each option before making a decision. To effectively sell AD&D insurance, brokers must educate clients on the unique benefits of this type of coverage and how it can complement their existing insurance portfolio. Brokers should help clients understand that AD&D insurance is a valuable addition to a comprehensive insurance plan, providing additional protection against unforeseen accidents. Insurance brokers must be prepared to address common misconceptions and objections regarding AD&D insurance, such as the belief that it is unnecessary or too expensive. By offering personalized advice and tailored policy recommendations, brokers can help clients make informed decisions about AD&D insurance and ensure they choose the most appropriate coverage for their needs. Accidental Death and Dismemberment Insurance (AD&D) is a vital form of financial protection that offers additional coverage for accidents and related injuries, complementing traditional life insurance policies. This specialized insurance can provide policyholders and their families with peace of mind and financial security in the event of unexpected accidents. By understanding the key features and benefits of AD&D insurance, such as the covered incidents, benefit payout structure and common exclusions, individuals can make informed decisions about their insurance needs. Insurance brokers play a crucial role in helping clients navigate the decision-making process by offering personalized advice, comparing policy options, and assisting with claims. Ultimately, the value of AD&D insurance depends on each individual's circumstances, but it can be a valuable addition to a comprehensive insurance plan, providing additional protection for unforeseen events.Definition of Accidental Death and Dismemberment Insurance (AD&D)

Understanding Accidental Death and Dismemberment Insurance Coverage

Covered Incidents

Exclusions and Limitations

Benefit Payout Structure

Comparing AD&D Insurance With Traditional Life Insurance

Coverage Differences

Premium Costs

Benefit Payout

Additional Riders and Options

Role of Insurance Brokers in AD&D Insurance

Identifying Client Needs

Comparing Policies and Coverage Options

Advising on Policy Selection

Assisting With Claims

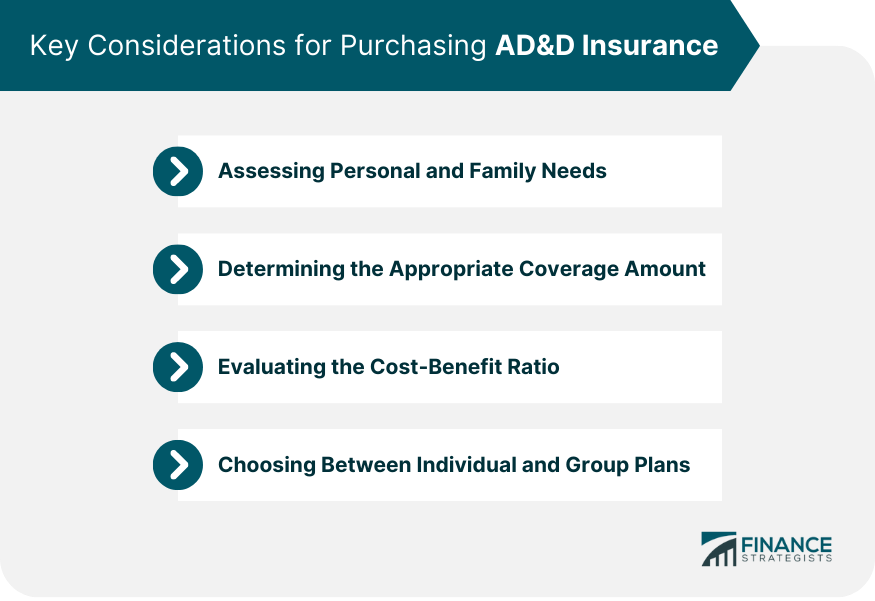

Key Considerations for Purchasing AD&D Insurance

Assessing Personal and Family Needs

Determining the Appropriate Coverage Amount

Evaluating the Cost-Benefit Ratio

Choosing Between Individual and Group Plans

Tips for Insurance Brokers on Selling AD&D Insurance

Educating Clients on the Benefits of AD&D Insurance

Demonstrating the Value of AD&D Insurance as Part of a Comprehensive Insurance Plan

Addressing Common Misconceptions and Objections

Providing Personalized Advice and Policy Recommendations

Conclusion

Accidental Death and Dismemberment Insurance (AD&D) FAQs

Accidental Death and Dismemberment Insurance (AD&D) is a specialized insurance policy that provides financial protection to policyholders and their beneficiaries in the event of an accident that results in death or serious injury, such as dismemberment or loss of sight, hearing, or speech. Unlike traditional life insurance, which covers death due to any cause (with certain exceptions), AD&D insurance specifically covers accidents and related injuries.

AD&D insurance covers accidental death, dismemberment (loss of a limb), and significant loss of sight, hearing, or speech resulting from a covered accident. However, it is essential to review the policy terms and conditions, as certain exclusions and limitations may apply.

Yes, common exclusions for AD&D insurance policies include self-inflicted injuries, war or terrorism, drug or alcohol abuse, and injuries related to pre-existing medical conditions. It's crucial to carefully review the policy terms and conditions to understand the specific exclusions and limitations that may apply.

Insurance brokers can help clients by identifying their insurance needs, comparing policy options and coverage, providing expert advice on policy selection, and assisting with claims in the event of an accident. By offering personalized guidance, brokers can ensure that clients make informed decisions and choose the most appropriate AD&D insurance coverage for their needs.

AD&D insurance can be a valuable addition to an individual's insurance portfolio, providing supplemental coverage for accidents and related injuries that may not be covered under traditional life insurance. By evaluating the cost-benefit ratio and considering personal and family needs, individuals can determine if AD&D insurance is a worthwhile investment for their specific situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.