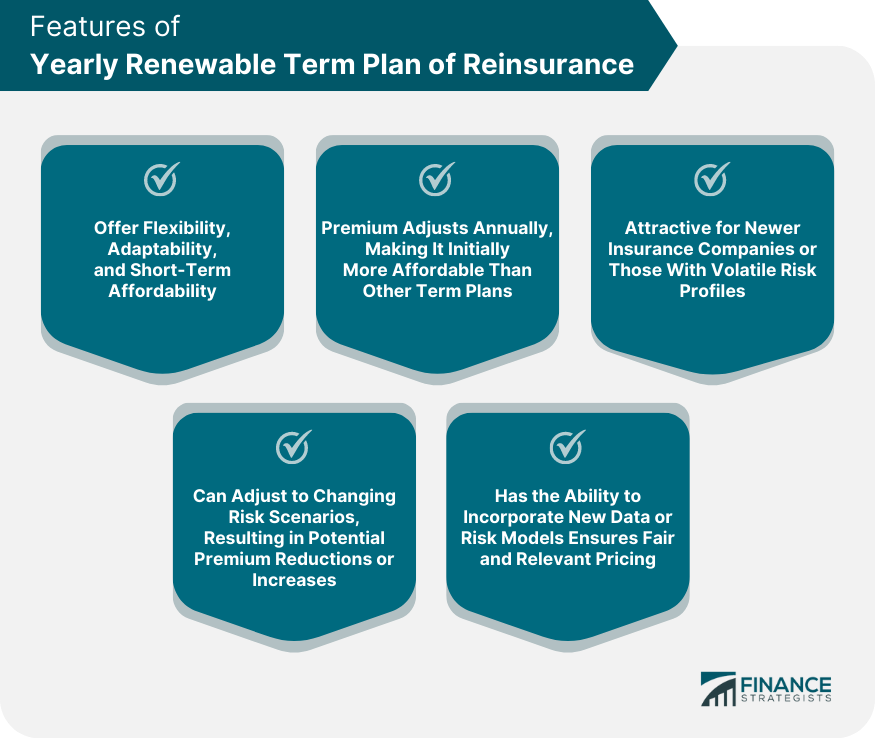

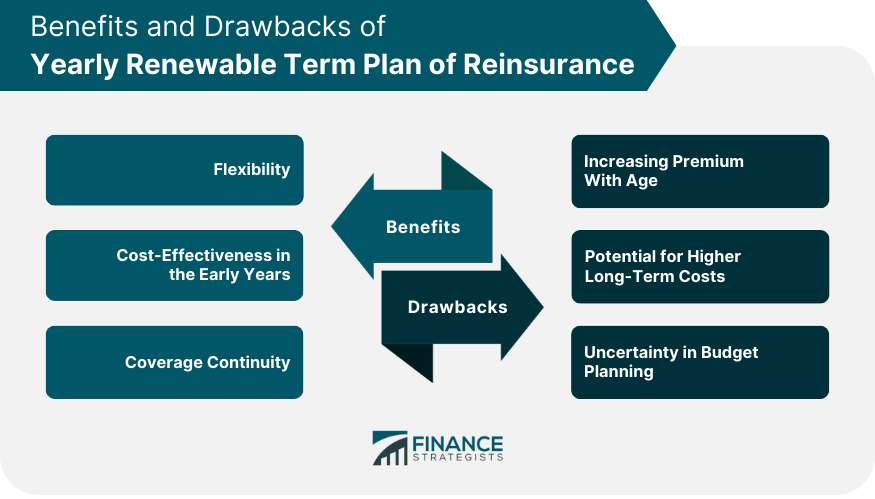

Reinsurance is when an insurance company transfers some of its risk to another company. It helps insurers mitigate losses, expand their business, and maintain financial stability. There are two types of reinsurance: proportional and non-proportional. Proportional reinsurance involves sharing risks and premiums based on a predetermined percentage, benefiting both parties. Non-proportional reinsurance covers losses exceeding a specified threshold, providing high protection but higher premiums. Term plans in reinsurance offer structured risk-sharing for a fixed period, providing predictability, stability, and flexibility. Yearly Renewable Term allows yearly renewal, while Level Term offers fixed premiums and coverage throughout the term. Within the range of term plans, Yearly Renewable Term (YRT) holds a significant position due to its unique structure and flexibility. A Yearly Renewable Term plan is a type of reinsurance term plan that offers coverage for one year at a time. The premium for a YRT plan is recalculated each year, based on the risk profile at the time of renewal. This means that the premium can increase or decrease each year, reflecting the changes in the underlying risk. The key features of a YRT plan include flexibility, adaptability, and short-term affordability. Because the premium adjusts annually, a YRT plan can initially be more affordable than other term plans. This affordability makes YRT plans attractive for newer insurance companies or those dealing with volatile risk profiles. Moreover, YRT plans offer the flexibility to adjust to changing risk scenarios. For instance, if an insurer finds that their risk profile has improved, they might benefit from reduced premiums in the following year. Conversely, if their risk profile worsens, the reinsurer is protected from long-term losses by the ability to increase the premium at the next renewal. Lastly, the adaptability of YRT plans allows for the incorporation of new data or risk models into the premium calculations, ensuring that the pricing remains relevant and fair for both parties. The workings of a YRT plan can be understood through a simple example. Suppose an insurer underwrites a large volume of flood insurance policies in a certain geographical area. Given the unpredictability of weather events, the insurer seeks reinsurance to protect against potentially catastrophic losses. They opt for a YRT plan due to its initial affordability and flexibility. In the first year, the premium is set based on the current risk profile, which includes factors like the number of policies, total insured values, historical flood data, and climate predictions. At the end of the year, the insurer and the reinsurer review the performance of the business, and the premium for the next year is recalculated. This renewal process takes into account any changes in the risk profile, including new policies, claims paid, updated flood data, and revised climate predictions. If there were a significant number of flood claims, indicating a higher risk than initially assumed, the premium for the next year would likely increase. Conversely, if there were few claims and the risk profile improved, the premium might decrease. This annual recalibration ensures that the reinsurance coverage remains aligned with the evolving risk landscape, providing a dynamic safety net for the insurer. YRT plans offer a high degree of flexibility, allowing for yearly adjustments to the premium based on changes in the underlying risk. This dynamism can be beneficial in volatile or rapidly evolving risk environments. In the early years, YRT plans tend to be more cost-effective than other term plans. The premium is generally lower at the outset, making it an attractive option for insurers with limited budgets or those just entering the market. With YRT plans, insurers can maintain continuous coverage without committing to a long-term contract. This continuity can be especially valuable in an uncertain market or during periods of business growth or contraction. The premium for YRT plans tends to increase over time, reflecting the aging of the risk portfolio. This can result in higher long-term costs compared to other term plans. While YRT plans may be cheaper in the early years, the annual premium recalculations can lead to higher costs over the long term, especially if the risk profile worsens. The variability of YRT premiums introduces a degree of uncertainty in budget planning. Insurers need to account for potential premium increases in their financial forecasts. Understanding the nuances of different term plans is essential to making an informed decision in reinsurance. Unlike YRT plans, Level Term plans offer a fixed premium and coverage amount for the duration of the term. This stability can be beneficial for budgeting and long-term financial planning. However, Level Term plans lack the flexibility of YRT plans and may be more expensive initially. The choice between YRT and Level Term plans depends on several factors, including the insurer's risk tolerance, financial capacity, business goals, and the nature of the underlying risks. For example, a stable, mature insurer might prefer a Level Term plan for its predictability, while a growing insurer with a changing risk profile might favor the flexibility of a YRT plan. The Yearly Renewable Term (YRT) plan of reinsurance offers significant advantages and considerations for insurers. The YRT plan's key features include flexibility, adaptability, and short-term affordability, allowing for adjustments to the premium based on changes in the underlying risk. It is particularly attractive for newer insurance companies or those with volatile risk profiles. The YRT plan's ability to adjust to changing risk scenarios provides potential premium reductions or increases, ensuring fair and relevant pricing. However, there are drawbacks to consider, such as increasing premiums with age and the potential for higher long-term costs. When comparing the YRT plan with other term plans, such as the Level Term plan, factors like risk tolerance, financial capacity, and business goals influence the choice. Overall, the YRT plan provides insurers with the flexibility, affordability, and coverage continuity they need in an ever-changing reinsurance landscape.Reinsurance Overview

Understanding Yearly Renewable Term (YRT) Plan of Reinsurance

Definition of YRT

Features of YRT

How YRT Works

Benefits of YRT Plan of Reinsurance

Flexibility

Cost-Effectiveness in the Early Years

Coverage Continuity

Drawbacks of YRT Plan of Reinsurance

Increasing Premium With Age

Potential for Higher Long-Term Costs

Uncertainty in Budget Planning

Comparing YRT Plan of Reinsurance With Other Term Plans

Comparison With Level Term Plan of Reinsurance

Factors Influencing the Choice of Term Plans

Final Thoughts

Yearly Renewable Term Plan of Reinsurance FAQs

A Yearly Renewable Term (YRT) Plan of Reinsurance is a type of reinsurance term plan that provides coverage for one year at a time. The premium for a YRT plan is recalculated annually, reflecting the changes in the underlying risk profile.

A YRT plan works by recalculating the premium each year based on the risk profile at the time of renewal. This means that the premium can increase or decrease annually, aligning with the changes in the underlying risk.

The advantages of a YRT plan include flexibility, cost-effectiveness in the early years, and coverage continuity. The plan allows for yearly adjustments to the premium based on changes in the risk, which can be beneficial in volatile or rapidly evolving risk environments.

The potential drawbacks of a YRT plan include increasing premiums over time, the potential for higher long-term costs, and uncertainty in budget planning. As the premium adjusts annually, it can lead to higher costs over the long term, especially if the risk profile worsens.

Unlike YRT plans, Level Term plans offer a fixed premium and coverage amount for the duration of the term. This stability can be beneficial for budgeting and long-term financial planning. However, Level Term plans lack the flexibility of YRT plans and may be more expensive initially. The choice between the two depends on factors like the insurer's risk tolerance, financial capacity, and business goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.