Carriage and Insurance Paid To is a commonly used Incoterm in international trade that outlines the responsibilities of both buyers and sellers in the transportation and insurance of goods. CIP is particularly useful for transactions that involve multiple modes of transportation, as it provides flexibility and clarity regarding the parties' respective roles. The primary purpose of CIP is to clarify the terms and conditions of shipping contracts, particularly with respect to the allocation of costs, risks, and responsibilities between the buyer and seller. By utilizing Incoterms like CIP, businesses can avoid misunderstandings and potential disputes that may arise during the transportation process. Additionally, CIP provides a benchmark for comparing different shipping terms and conditions, which can be valuable when negotiating international trade agreements. Under CIP, the seller is responsible for delivering the goods to a carrier or a specified place agreed upon with the buyer. This may involve loading the goods onto the transport vehicle and ensuring they are properly packed and prepared for shipment. The seller is also responsible for obtaining and providing the necessary export documentation, including customs clearance and any required permits. In addition to arranging transportation, the seller must cover the carriage cost up to the agreed delivery point. This includes any expenses related to transporting goods, such as freight charges and handling fees. The seller is required to provide insurance coverage for the goods up to the named place of destination. However, it is important to note that this insurance coverage may be minimal, and the buyer may need to obtain additional coverage if desired. The buyer, on the other hand, is responsible for paying the agreed price for the goods in accordance with the terms of the sales contract. Upon receiving the goods at the specified delivery point, the buyer assumes all risks and responsibilities associated with the goods, including any damages or losses that may occur during further transportation. Additionally, the buyer is responsible for obtaining and providing any necessary import documentation and ensuring that the goods clear customs at their destination. Under CIP, the buyer may also be responsible for any additional transportation costs incurred after the goods have been delivered to the named place. This can include expenses related to the unloading of goods, storage fees, or onward transportation to the final destination. As a result, buyers must be aware of their responsibilities under CIP and factor in any potential additional costs when negotiating sales contracts. One of the primary advantages of CIP is its flexibility in terms of transport mode. Unlike some other Incoterms that are restricted to specific modes of transport, CIP can be applied to any combination of transportation methods, making it a versatile option for buyers and sellers alike. This flexibility allows businesses to select the most efficient and cost-effective transport solutions for their specific needs. Another advantage of CIP is that the seller assumes responsibility for arranging and paying for the carriage and insurance of the goods up to the named place of destination. This can benefit buyers, as it simplifies the process and ensures that the goods are properly insured during the initial stages of transportation. Additionally, the risk transfer point is clearly defined in CIP transactions, providing both parties with a clear understanding of when responsibility for the goods shifts from the seller to the buyer. One notable disadvantage of CIP is the limited insurance coverage provided by the seller. Since the seller is only required to offer minimal insurance coverage for the goods, the buyer may need to secure additional insurance to protect against potential risks during the remaining transportation process. This added responsibility can increase the complexity and cost for the buyer. Another drawback of CIP is that the buyer is responsible for any additional costs incurred after the goods have been delivered to the named place of destination. This can include unloading, storage, and onward transportation expenses, which may require more work for buyers to anticipate and manage effectively. Additionally, CIP may not be the most efficient option for certain situations, such as transactions involving a single mode of transport, where other Incoterms may be more suitable. When incorporating CIP into sales contracts, it is essential to consider several factors. First, the delivery point must be clearly identified, as this will determine when the risk and responsibility for the transfer of the goods from the seller to the buyer. Second, the specific insurance coverage provided by the seller should be outlined in the contract to ensure that both parties have a clear understanding of their respective responsibilities in case of loss or damage during transit. Another crucial consideration when implementing CIP in sales contracts is the allocation of costs and responsibilities between the buyer and seller. This includes detailing which party is responsible for customs clearance, documentation, and any additional transportation expenses that may arise during shipping. Businesses can minimize the potential for misunderstandings and disputes by clearly outlining these aspects in the contract. When drafting CIP clauses in sales contracts, it is important to clearly describe the goods being shipped, including their quantity, quality, and any specific packaging requirements. The contract should also explicitly outline pricing and payment terms to ensure both parties know their financial obligations. Transport and delivery details, such as the mode of transport and the named place of destination, must be clearly specified in the CIP clause. This information is vital for determining the risk and responsibility for transferring the good between the parties. Additionally, the insurance requirements under CIP should be defined in the contract, including the scope of coverage and any additional insurance the buyer may need. Finally, dispute resolution mechanisms should be incorporated into the sales contract to provide both parties with a clear process for addressing any disagreements that may arise during the transaction. This can include negotiation, mediation, arbitration, or litigation, depending on the preferences and needs of the parties involved. Carriage and Insurance Paid To is a valuable Incoterm that effectively outlines the responsibilities of buyers and sellers in terms of transportation and insurance of goods, particularly in cases involving multiple modes of transportation. By utilizing CIP and other Incoterms, businesses can avoid disputes and misunderstandings that can arise during the shipping process. CIP serves as a benchmark for comparing shipping terms and conditions, facilitating negotiations in international trade agreements. However, it is important to consider the limitations of CIP. The insurance coverage provided by the seller may be minimal, necessitating additional insurance for buyers to safeguard against potential risks during transportation. Furthermore, buyers are responsible for any extra costs incurred after the goods have been delivered to the designated location, which requires careful planning and management. When implementing CIP in sales contracts, it is crucial to clearly define delivery points, insurance coverage, and cost allocation between the parties. The inclusion of comprehensive clauses in the contract ensures that both parties understand their obligations and responsibilities.What Is Carriage and Insurance Paid To (CIP)?

Understanding CIP

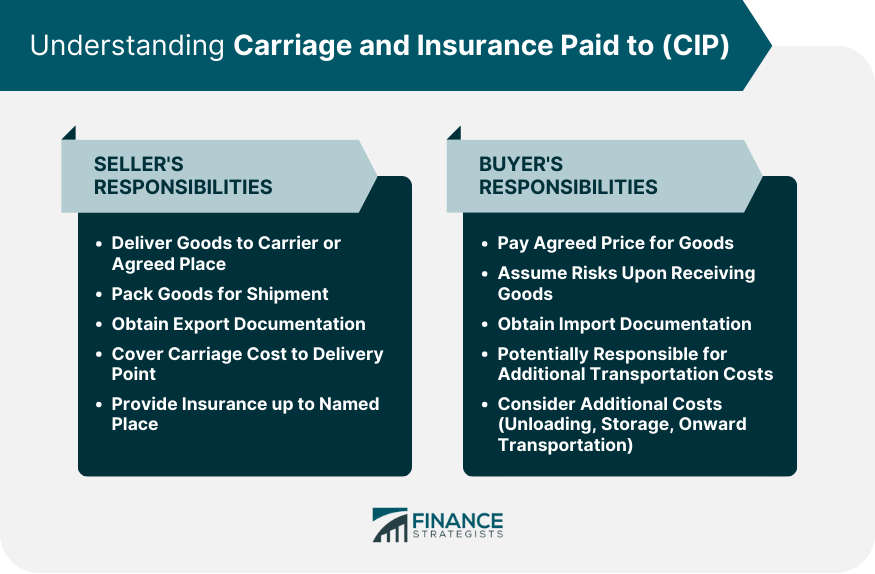

Seller's Responsibilities

Buyer's Responsibilities

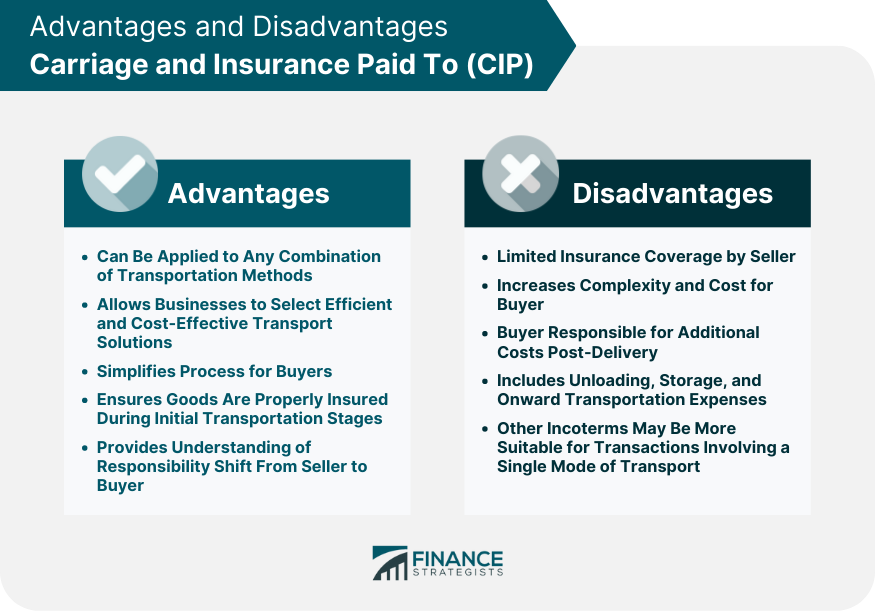

Advantages of CIP

Disadvantages of CIP

Implementation of CIP in Sales Contracts

Key Considerations

Drafting CIP Clauses

Conclusion

Carriage and Insurance Paid To (CIP) FAQs

Carriage and Insurance Paid To (CIP) is an international trade term where the seller is responsible for delivering the goods to the nominated carrier and covering the transportation costs to the specified destination. At that point, the risk of loss, damage, and any subsequent expenses incurred are shifted from the seller to the buyer.

The seller is responsible for delivering the goods to a carrier or agreed-upon place, arranging transportation, covering carriage costs, and providing insurance coverage up to the named place of destination.

The buyer is responsible for paying the agreed price for the goods, assuming risks upon delivery at the specified location, obtaining necessary import documentation, and covering any additional transportation costs beyond the named place of destination.

The insurance coverage provided by the seller is minimal, so the buyer may need to obtain additional insurance to ensure adequate protection during the remaining transportation process.

The specific allocation of responsibilities for customs clearance should be clearly outlined in the sales contract, but generally, the buyer is responsible for customs clearance under CIP.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.