In financial markets, buy-in refers to a broker buying securities in the open market to cover a failed delivery from a short sale. This ensures the transaction is completed and the buyer receives the purchased securities. Buy-ins play a crucial role in maintaining the integrity and efficiency of securities trading. They ensure that transactions are completed as agreed, fostering trust in the trading system and protecting buyers' interests. Buy-ins are particularly relevant to short selling, a practice where sellers borrow securities to sell, intending to repurchase them at a lower price. If the original seller fails to deliver the borrowed securities, buy-in can be initiated to fulfill the obligation. If the shares being shorted are not readily available in the market, it could lead to a buy-in. The broker or exchange could demand the short seller to cover their position to return the borrowed shares. This can happen with thinly traded or small-cap stocks where available shares to be borrowed are limited. If a particular stock has a high short interest (i.e., a high number of shares have been borrowed to short sell), it increases the chances of a buy-in. When many investors are betting against a stock, the pool of available shares to borrow can dry up quickly. Sometimes, buy-ins are initiated due to changes in regulatory requirements. For example, the regulatory body may reduce the maximum allowable limit of open short positions in a specific security. Brokers have the right to call in a buy-in at their discretion, usually to protect their interests. If they perceive the risk associated with the short sale to be too high, they may ask the short seller to cover their position. A short squeeze happens when a stock's price increases significantly, and short sellers rush to cover their positions to cut their losses. This surge in buying activity can drive the price up even further. If a short squeeze is suspected or underway, it might prompt a buy-in. Events such as mergers and acquisitions, or special dividends can also trigger a buy-in. Such actions can create market uncertainty and volatility, prompting brokers to reduce risk by calling in short positions. During periods of significant market volatility, the risk associated with short selling increases. In such situations, a broker might initiate a buy-in to limit potential losses. A buy-in is typically initiated by the clearing house or the buyer's broker. This happens when the selling party fails to deliver the securities within the stipulated time frame. Once initiated, the broker purchases the required securities from the open market. The buy-in cost, including any fees or commissions, is usually charged to the party that failed to deliver the securities. After the execution of the buy-in, the purchased securities are delivered to the buyer, completing the original transaction. The clearing house or broker then settles the accounts, ensuring that all parties fulfill their financial obligations. A buy-in can impact shareholders in several ways. If a company decides to buy back its own shares (a corporate buy-in), it could increase the value of the remaining shares, benefiting shareholders. However, in the case of a buy-in due to failed delivery of securities, the effect on shareholders is indirect, influencing their perception of the company's reliability or stability. Shareholders are entitled to receive accurate and timely information about any actions that might affect the value of their shares, including buy-ins. They are also responsible for understanding the implications of these actions for their investment. The potential benefits of a shareholder buy-in include increased share value and improved market confidence. The drawbacks include financial losses if the buy-in results in a higher price than the original sale and potentially reduced liquidity if large amounts of shares are removed from the market. In the US, the SEC regulates buy-ins under Rule 204 of Regulation SHO. This rule requires brokers to complete a short sale transaction settlement by purchasing securities of like kind and quantity if the seller fails to deliver the securities within a specified period. FINRA, a self-regulatory organization in the US, also provides guidelines relating to buy-ins. These standards are designed to protect investors and ensure the integrity of the securities markets. The regulation of buy-ins varies internationally. In many jurisdictions, including the European Union, regulations similar to those of the SEC exist to ensure the proper settlement of securities transactions. Buy-ins are crucial in financial markets, ensuring transaction completion and protecting buyers' interests. They maintain market integrity and efficiency, fostering trust in the system. Factors such as lack of liquidity, high short interest, regulatory requirements, brokers' discretion, short squeezes, and corporate actions influence buy-ins. Market volatility can also prompt buy-ins to limit potential losses. The process involves initiation, execution, settlement, and completion, with clearing houses or brokers initiating buy-ins for failed deliveries. Shareholders are impacted indirectly by buy-ins, with potential benefits including increased share value and market confidence, but drawbacks of potential financial losses and reduced liquidity. Regulatory bodies like the SEC and FINRA establish rules and standards to ensure proper settlement, with similar regulations internationally. Understanding buy-ins is essential for market participants and investors to navigate the complexities of financial markets and regulatory environments, ensuring transparency and reliability.What Is Buy-In?

Factors Influencing Buy-In

Lack of Liquidity

High Short Interest

Regulatory Requirements

Brokers' Discretion

Short Squeeze

Corporate Actions

Market Volatility

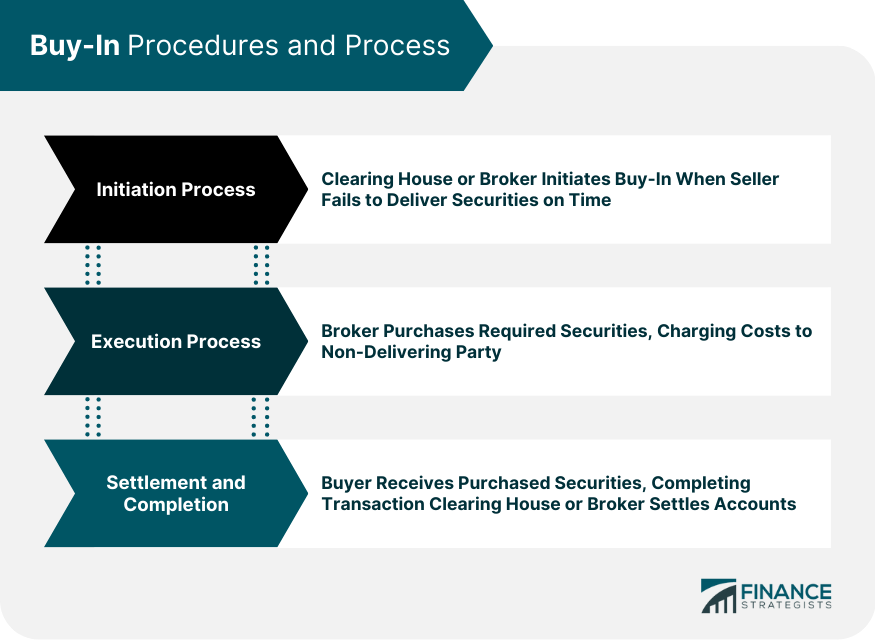

Buy-In Procedures and Process

Initiation Process

Execution Process

Settlement and Completion

Buy-In and Shareholders

Impact on Shareholders

Rights and Obligations

Potential Benefits and Drawbacks

Regulatory Aspects of Buy-In

Securities and Exchange Commission (SEC) Rules

Financial Industry Regulatory Authority (FINRA) Standards

International Regulatory Environment

Conclusion

Buy-In FAQs

A buy-in refers to a broker purchasing securities in the open market to cover a failed delivery from a short sale. It ensures the completion of the transaction and that the buyer receives the securities they purchased.

A buy-in can occur when the original seller fails to deliver the borrowed securities within the stipulated time frame, typically in short selling. It ensures that the transaction is fulfilled and protects the buyer's interests.

Several factors can trigger a buy-in, including a lack of liquidity in the market for the shorted shares, high short interest in a stock, regulatory requirements, brokers exercising their discretion, short squeezes, corporate actions, and market volatility.

The impact on shareholders varies. In the case of a corporate buy-in, where a company buys back its own shares, it can potentially increase the value of the remaining shares, benefiting shareholders. However, a buy-in due to failed securities delivery may indirectly influence shareholders' perception of a company's reliability or stability.

Buy-ins are subject to regulations to ensure proper settlement and market integrity. In the United States, the Securities and Exchange Commission (SEC) regulates buy-ins under Rule 204 of Regulation SHO. The Financial Industry Regulatory Authority (FINRA) also provides guidelines. Similar regulations exist internationally to govern the settlement of securities transactions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.