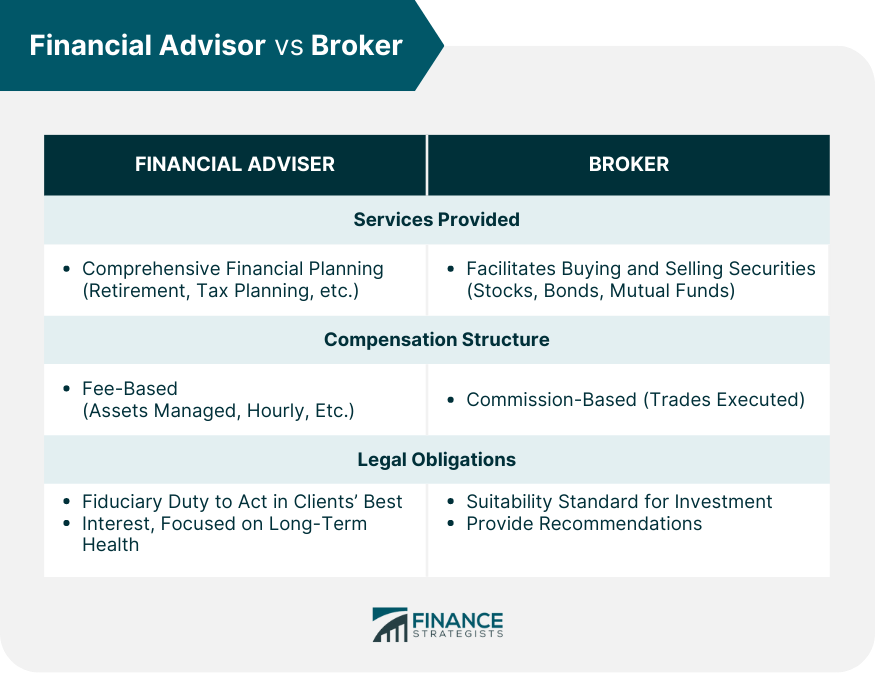

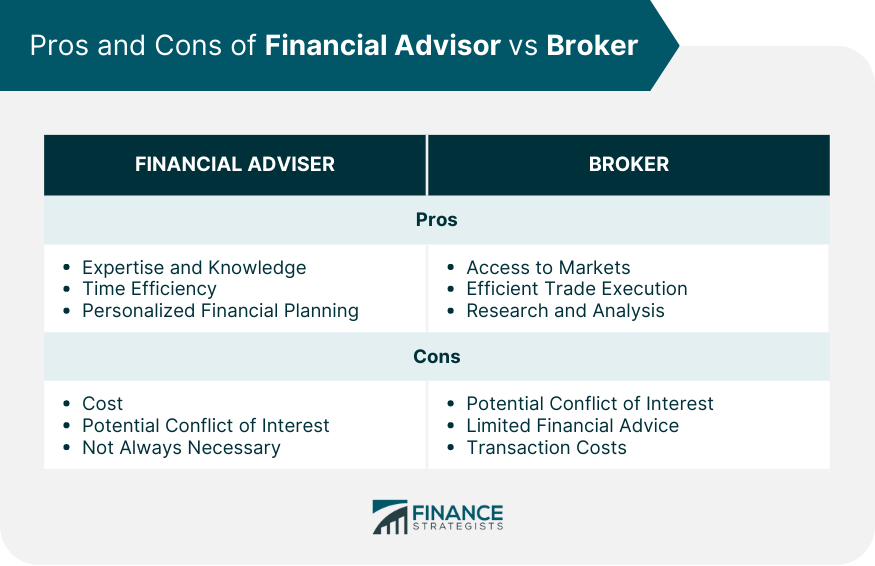

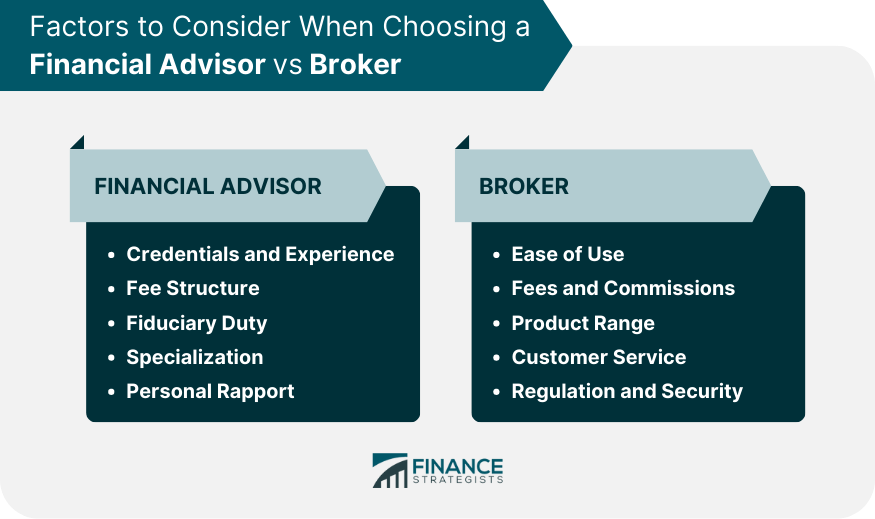

The primary difference between a financial advisor and a broker lies in their role and service scope. A financial advisor provides comprehensive financial planning, offering guidance on saving, investing, retirement, and tax strategies. They are typically bound by a fiduciary duty to act in their client's best interest, focusing on long-term financial health. In contrast, a broker primarily facilitates buying and selling securities, such as stocks, bonds, and mutual funds, focusing on efficient trade execution. While some brokers offer advice, they are usually subject to a suitability standard, ensuring recommended investments are suitable but not necessarily the best option. Therefore, the choice between a financial advisor and a broker depends on your financial needs: comprehensive planning and advice or efficient trade execution and investment accessibility. The primary difference between a financial advisor and a broker lies in the range of services provided. A financial advisor provides comprehensive financial planning services, including retirement planning, tax planning, estate planning, risk management, and investment advice. They help clients plan for long-term financial goals, such as retirement, buying a house, or saving for a child's education. They may also manage their clients' investment portfolios on an ongoing basis, making adjustments as necessary to reflect changes in the client's life circumstances or financial goals. Brokers, on the other hand, focus primarily on buying and selling securities on behalf of their clients. They do not typically provide comprehensive financial planning services or manage their clients' investment portfolios on an ongoing basis. Some brokers may offer investment advice, but this advice is usually centered around specific securities and not part of a holistic financial plan. Financial advisors and brokers also differ in terms of their compensation structure. Financial advisors may charge a fee based on a percentage of the assets they manage for their clients, a flat fee, or an hourly fee. These fee structures align the advisor's interests with those of the client—the more the client's assets grow, the more the advisor earns. Brokers, by contrast, typically earn commissions on the trades they execute on behalf of their clients. This means their earnings depend on the volume and frequency of their clients' trading activity. Some brokers may also earn a fee for providing investment advice, though this is less common. Another key difference between financial advisors and brokers pertains to their legal obligations to their clients. Financial advisors are usually fiduciaries, meaning they are legally obligated to act in the best interest of their clients. They must provide advice and recommend financial products that best serve their client's financial goals, rather than the products that would earn them the highest fees or commissions. Brokers, on the other hand, are typically held to a suitability standard. This means they must recommend investments that are suitable for their clients based on the client's financial situation, objectives, and risk tolerance. However, they are not necessarily required to recommend the best or cheapest product. Financial advisors offer in-depth knowledge of financial planning and investment strategies. They can guide you through complex financial decisions, helping to maximize your returns and minimize risks. Managing finances can be time-consuming. A financial advisor takes on the task of managing your investments and planning for your financial future, saving you valuable time. Financial advisors provide tailored financial plans based on your goals, risk tolerance, and financial situation. This personalized approach ensures your financial plan aligns with your individual needs and objectives. Financial advisors aren't free. They charge fees, which may be a percentage of your assets, hourly rates, or fixed amounts. This cost might not be affordable for everyone. Some financial advisors might be incentivized to recommend certain products or services based on the commission they receive, which could lead to conflicts of interest. For those with straightforward financial situations or a willingness to learn and manage their own finances, the benefits of a financial advisor might not outweigh the costs. Brokers provide access to a range of markets and financial products, enabling investors to diversify their portfolios. Brokers specialize in executing trades quickly and efficiently, which is critical in fast-moving markets. Many brokers offer market research and analysis as part of their services, providing clients with valuable insights to inform their investment decisions. Brokers often earn commissions on trades, which might incentivize frequent trading, potentially leading to higher costs for the investor. While some brokers provide advice, it typically centers around trading and investment strategies, rather than holistic financial planning. Trading through a broker involves transaction costs, including fees and commissions, which can add up, particularly for frequent traders. It's important to understand these costs before engaging a broker. Check the qualifications and track record of potential financial advisors. Credentials like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) indicate professional expertise. Understand how the advisor is compensated. Options include commission-based, fee-only, or fee-based. Align their fee structure with your financial situation and preferences. Ensure your advisor has a fiduciary duty, which obligates them to act in your best interest, providing unbiased advice that serves your financial goals. Choose an advisor who specializes in areas aligned with your financial needs, such as retirement planning or wealth management. Choose an advisor you feel comfortable with, as you will be entrusting your financial future to them. Good communication and mutual understanding are vital for a successful relationship. Select a broker with an intuitive and user-friendly platform. Ease of use enhances your trading experience, reduces errors, and facilitates quick decision-making. Brokers charge for their services. Evaluate fee structures, including trading commissions, account maintenance fees, and charges for additional services. Choose a broker whose fees align with your trading frequency and budget. The ideal broker offers a wide range of investment products such as stocks, bonds, ETFs, and mutual funds. A diverse product range allows for more versatile investment strategies. Robust customer service is critical. You should be able to rely on prompt, accurate responses to queries or technical issues. Ensure your broker is regulated by relevant financial authorities, ensuring compliance with legal standards. Additionally, consider their security measures to safeguard your investments and personal information. The decision between a financial advisor and a broker largely depends on an individual's financial needs and circumstances. Financial advisors offer a holistic approach to managing your finances, providing personalized strategies based on your long-term financial goals. They work under a fiduciary duty, ensuring their advice aligns with your best interests. Conversely, brokers specialize in efficient trade execution and provide access to a wide array of investment products, focusing more on short-term trading strategies. Their compensation typically comes from trade commissions, and they are bound by a suitability standard. Understanding these differences, along with the pros and cons of each, is crucial in making an informed decision. Moreover, when choosing either a financial advisor or broker, one must consider factors such as fees, expertise, regulation, and customer service. Ultimately, it's about finding the professional who best aligns with your financial goals and preferences.Financial Advisor vs Broker Overview

Financial Advisor vs Broker Overview Differences

Services Provided

Compensation Structure

Legal Obligations

Pros of Using a Financial Advisor

Expertise and Knowledge

Time Efficiency

Personalized Financial Planning

Cons of Using a Financial Advisor

Cost

Potential Conflict of Interest

Not Always Necessary

Pros of Using a Broker

Access to Markets

Efficient Trade Execution

Research and Analysis

Cons of Using a Broker

Potential Conflict of Interest

Limited Financial Advice

Transaction Costs

Factors to Consider When Choosing a Financial Advisor

Credentials and Experience

Fee Structure

Fiduciary Duty

Specialization

Personal Rapport

Factors to Consider When Choosing a Broker

Ease of Use

Fees and Commissions

Product Range

Customer Service

Regulation and Security

Conclusion

Financial Advisor vs Broker FAQs

The primary difference between a financial advisor and a broker lies in the scope of services they offer. A financial advisor provides comprehensive financial planning services, including advice on saving, investing, retirement planning, and tax strategies. On the other hand, a broker primarily facilitates the buying and selling of securities like stocks, bonds, and mutual funds.

Both financial advisors and brokers can play a crucial role in managing your investments. If you need personalized advice and comprehensive financial planning, a financial advisor might be a better choice. However, if you're primarily looking for efficient trade execution and access to a wide range of investment products, a broker could be more suitable.

No, not necessarily. Registered financial advisors are usually bound by a fiduciary duty to act in their client's best interest. Brokers, however, typically adhere to the less stringent suitability standard, which means they must recommend investments that are suitable for their clients but not necessarily the best option.

When choosing between a financial advisor and a broker, you should consider your financial needs and goals, the cost of services, and the professional's experience and qualifications. If you need comprehensive advice and a long-term financial plan, a financial advisor may be better suited. However, if you are an active trader or prefer to manage your investments, a broker may be more appropriate.

Yes, you can certainly work with both a financial advisor and a broker. Many people choose to do so, utilizing the services of a financial advisor for overall financial planning and the services of a broker for executing trades and managing specific investments. The decision depends on your individual financial needs and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.