When it comes to pursuing a career in finance or accounting, many professional certifications are available to help individuals enhance their knowledge and skills. Two popular certifications are the Certified Investment Management Analyst (CIMA) and the Chartered Financial Analyst (CFA). While both certifications indicate a high level of expertise in finance, there are significant differences between the two that can make one more suitable than the other for an individual's specific career goals. The CIMA certification is designed to provide individuals with expertise in strategic financial management. It is an international certification offered by the Investments and Wealth Institute (IWI). In contrast, the CFA certification is aimed at professionals who work in the field of investment reporting and analysis. It is a globally recognized certification offered by the CFA Institute and is one of the most respected certifications in the finance industry. While both certifications cover a range of finance-related topics, the focus and nature of the courses differ significantly. The CIMA certification focuses more on investment consulting and strategic financial management, while the CFA certification focuses more on investment analysis and portfolio management. Additionally, the eligibility criteria, exam format, and career opportunities differ between the two certifications. The CIMA certification is an internationally recognized certification offered by IWI. The certification is designed to provide individuals with expertise in strategic financial management. It is aimed at professionals who work in the investment management industry and want to expand their knowledge in areas such as asset allocation, risk management, and portfolio performance evaluation. The CIMA course covers a range of topics related to investment management. These topics include: Fundamentals. This covers the foundational knowledge required for investment management consulting. It includes topics such as statistics and methods, applied finance and economics, and global capital markets. This domain makes up 15% of the CIMA exam. Investments. This domain covers the different types of investment vehicles, including equity, fixed income, alternative investments, options/futures, and real assets. It makes up 20% of the CIMA exam. Portfolio Theory and Behavioral Finance. This domain covers the theories and models used in portfolio management, as well as behavioral finance, investment philosophies and styles, and tools and strategies. It makes up 20% of the CIMA exam. Risk and Return. This domain covers the attributes of risk, risk measurements, and performance measurement and attribution. It makes up 20% of the CIMA exam. Portfolio Construction and Consulting Process. This domain covers the consulting process, including ethics, client discovery, investment policy, portfolio construction, manager search and selection, and portfolio review and revisions. It makes up 25% of the CIMA exam. To be eligible for the CIMA certification, candidates must meet the following requirements: Candidates must have at least three years of experience working in the financial services industry, which can include work in areas such as investment management, financial planning, or securities analysis. This experience must be within the past five years. This is determined by the Investments & Wealth Institute Admissions Committee. Candidates must demonstrate a commitment to upholding the highest ethical standards in their work in the financial services industry. Holders of the CIMA certification have a wide range of career opportunities in the investment management industry. Some of the most common roles that CIMA holders take on include: Investment Consultant. An investment consultant analyzes market trends, evaluates investment options, and makes recommendations to clients to help them achieve their investment goals. Portfolio Manager. A portfolio manager oversees a portfolio of investments and makes investment decisions to meet specific goals. They may manage investments for individuals, corporations, or institutions. Financial Planner. A financial planner works with clients to create financial plans that meet their specific needs and goals, including retirement planning, investment planning, and risk management. Wealth Manager. A wealth manager works with high-net-worth clients to manage their investments and advice on estate planning, tax strategies, and other financial matters. In addition to these roles, CIMA holders may work in risk management, investment analysis, and asset allocation. To obtain the CIMA certification, candidates must have at least three years of professional experience in investment consulting or a related field and must pass the CIMA course and certification exam. The exam consists of 140 multiple-choice questions and requires around 150 hours of self-study to prepare for. In addition to passing the exam, candidates must also pass a background check, provide compliance disclosure, complete the license agreement, and pay the initial certification fee to become a CIMA holder. The CIMA certification provides individuals with expertise in strategic financial management and can open up career opportunities in areas such as risk management, investment analysis, and asset allocation. The CFA certification is aimed at professionals who work in the field of investment reporting and analysis. The CIMA designation primarily emphasizes expertise in areas such as investment consulting, ethical practices, asset allocation, risk measurement, investment policy, and performance measurement. Individuals with this certification tend to work for bigger financial consulting companies and are responsible for managing large accounts and interacting with clients. Due to their comprehensive knowledge and expertise in the field, they can provide investment advice to individuals and corporations using different investment analysis methods, particularly large firms and high-net-worth individuals. The CFA course covers various topics related to investment analysis and management. These topics include: Ethical and Professional Standards. This topic covers the ethical and professional standards that govern the investment management industry, including the CFA Institute's Code of Ethics and Standards of Professional Conduct. Quantitative Methods. This topic covers the quantitative methods used in investment analysis, including statistical methods, probability, and time series analysis. It teaches candidates how to apply quantitative methods to financial analysis. Economics. This topic covers the macroeconomic and microeconomic principles that underlie investment analysis, including monetary and fiscal policy, international trade, and market structures. Financial Statement Analysis. This topic covers the principles of financial reporting and analysis, including financial statement analysis, ratio analysis, and cash flow analysis. Corporate Issuers. This topic covers the principles of corporate finance, including capital budgeting, capital structure, and dividend policy. It teaches candidates how to analyze the financial health of corporations and make investment decisions. Equity Investments. This topic covers the valuation of equity securities, including common stocks and preferred stocks. It teaches candidates how to analyze equity investments and make informed investment decisions. Fixed Income. This topic covers the valuation and analysis of fixed-income securities, including bonds, Treasury bills, and corporate debt. It teaches candidates how to analyze fixed-income investments and make informed investment decisions. Derivatives. This topic covers the valuation and analysis of derivative securities, including futures, forwards, options, and swaps. It teaches candidates how to analyze derivative investments and make informed investment decisions. Alternative Investments. This topic covers the valuation and analysis of alternative investments, including private equity, real estate, and commodities. It teaches candidates how to analyze alternative investments and make decisions. Portfolio Management and Wealth Planning. This topic covers the principles of portfolio management and wealth planning, including portfolio construction, risk management, and asset allocation. The CFA certification has specific eligibility criteria that must be met before pursuing the certification. These include: Bachelor's degree or equivalent, regardless of the field of study In the final year of a Bachelor's degree program at the time of registration is also acceptable Relevant work experience of at least four years at the time of registration Individuals who hold the CFA certification have a variety of career opportunities available to them in the finance industry. Some of the most common roles that CFA holders take on include: Investment Analyst. An investment analyst is responsible for researching and analyzing financial data to make investment recommendations. Portfolio Manager. A portfolio manager is responsible for overseeing a portfolio of investments and making investment decisions to meet specific goals. Financial Planner. A financial planner works with clients to create financial plans that meet their specific needs and goals, including retirement planning, investment planning, and risk management. Research Analyst. A research analyst is responsible for analyzing financial data and market trends to identify investment opportunities and make investment recommendations. Risk Manager. A risk manager is responsible for identifying, analyzing, and managing risks associated with financial investments. To become a certified CFA holder, candidates must meet the eligibility criteria and pass all three levels of the CFA exam. The exam is offered three times a year and requires significant study time, with a recommended 300 hours for each level. The exam rigorously tests candidates' knowledge of investment tools, asset classes, portfolio management, ethics, and wealth planning. Each level of the exam has a different focus, with Level I covering basic knowledge, Level II emphasizing complex analysis, and Level III focusing on portfolio management. After passing the exam and becoming a member of the CFA Institute, individuals must pay annual dues and adhere to the institute's standards. CIMA and CFA are professional certifications in the finance industry, but there are notable differences in the nature and focus of the courses, certification requirements, exam format, difficulty level, and career opportunities. The CIMA course is designed to provide individuals with expertise in strategic financial management, with a focus on areas such as asset allocation, risk management, and portfolio performance evaluation. In contrast, the CFA course is aimed at professionals who work in investment reporting and analysis, with a focus on areas such as ethics, financial statement analysis, and wealth planning. While both certifications cover investment management, the CIMA course focuses more on investment consulting, while the CFA course focuses on investment analysis and management. To be eligible for the CIMA certification, candidates must have at least three years of professional experience in investment consulting or a related field. In contrast, candidates must have a bachelor's degree or four years of relevant full-time work experience to be eligible for the CFA certification. The CIMA certification exam is five hours long and has 140 multiple-choice questions. The CFA certification exam consists of three levels, with each level having a different focus and a rigorous exam format that includes multiple-choice questions, essay questions, and case studies. CIMA holders have career opportunities in investment consulting, portfolio management, financial planning, and risk management. CFA holders have career opportunities in investment analysis, portfolio management, research analysis, and risk management. To further compare and contrast the CIMA and CFA certifications, the following table provides a summary of their differences in terms of various aspects. When considering which certification to pursue, individuals should take into account their personal interests and career goals. Those interested in investment consulting and strategic financial management may find that the CIMA certification aligns better with their goals. On the other hand, individuals interested in investment analysis, portfolio management, and research analysis may find that the CFA certification is a better fit. In addition to personal interests, candidates should evaluate the eligibility requirements and exam format of each certification. For CIMA, candidates must have at least three years of experience in investment consulting or a related field, while for CFA, candidates must have a bachelor's degree or equivalent or four years of relevant full-time work experience. Another important factor to consider is the job market and career opportunities in the industry of interest. Candidates should research the career prospects for both CIMA and CFA holders and evaluate which certification will provide them with the best opportunities in their desired field. The CIMA and CFA certifications are two popular certifications in the finance industry that can help individuals enhance their knowledge and skills. Both certifications indicate a high level of expertise in finance, but they differ significantly in their nature and focus of the courses, certification requirements, exam format, difficulty level, and career opportunities. Therefore, individuals should consider their personal interests and career goals, eligibility requirements, and the job market to decide which certification is the best fit for them. As the finance industry continues to evolve, having a professional certification such as CIMA or CFA can help individuals stay competitive and advance their careers. Ultimately, individuals should take the time to research and evaluate each certification to determine which one will provide them with the best opportunities to achieve their career goals.CIMA vs CFA: Overview

What Is a CIMA?

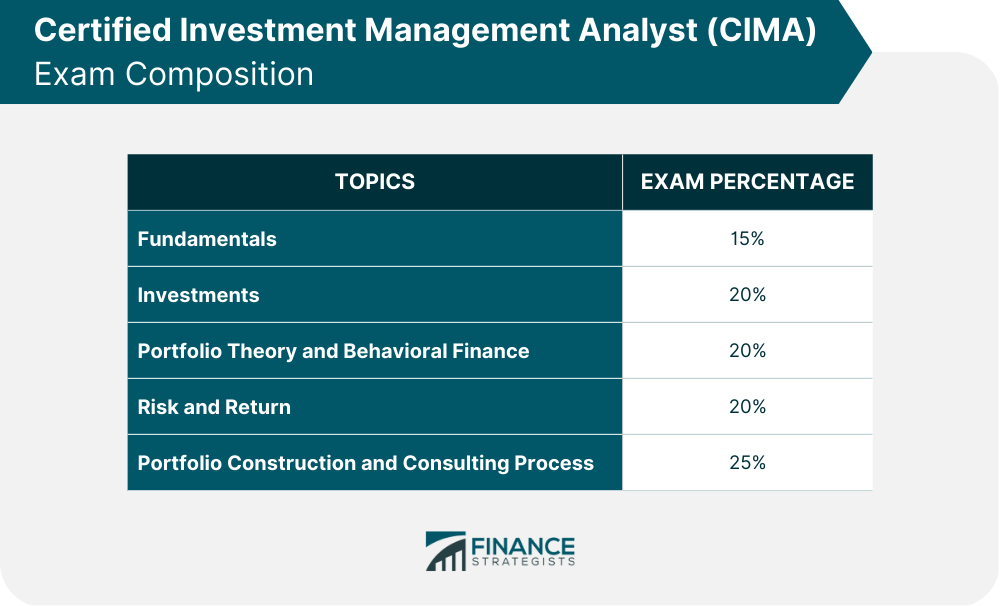

Topics Covered in the CIMA Course

Eligibility Criteria for CIMA Certification

Three Years of Financial Services Experience

Satisfactory Record of Ethical Conduct

Career Opportunities for CIMA Holders

CIMA Exam

What Is a CFA?

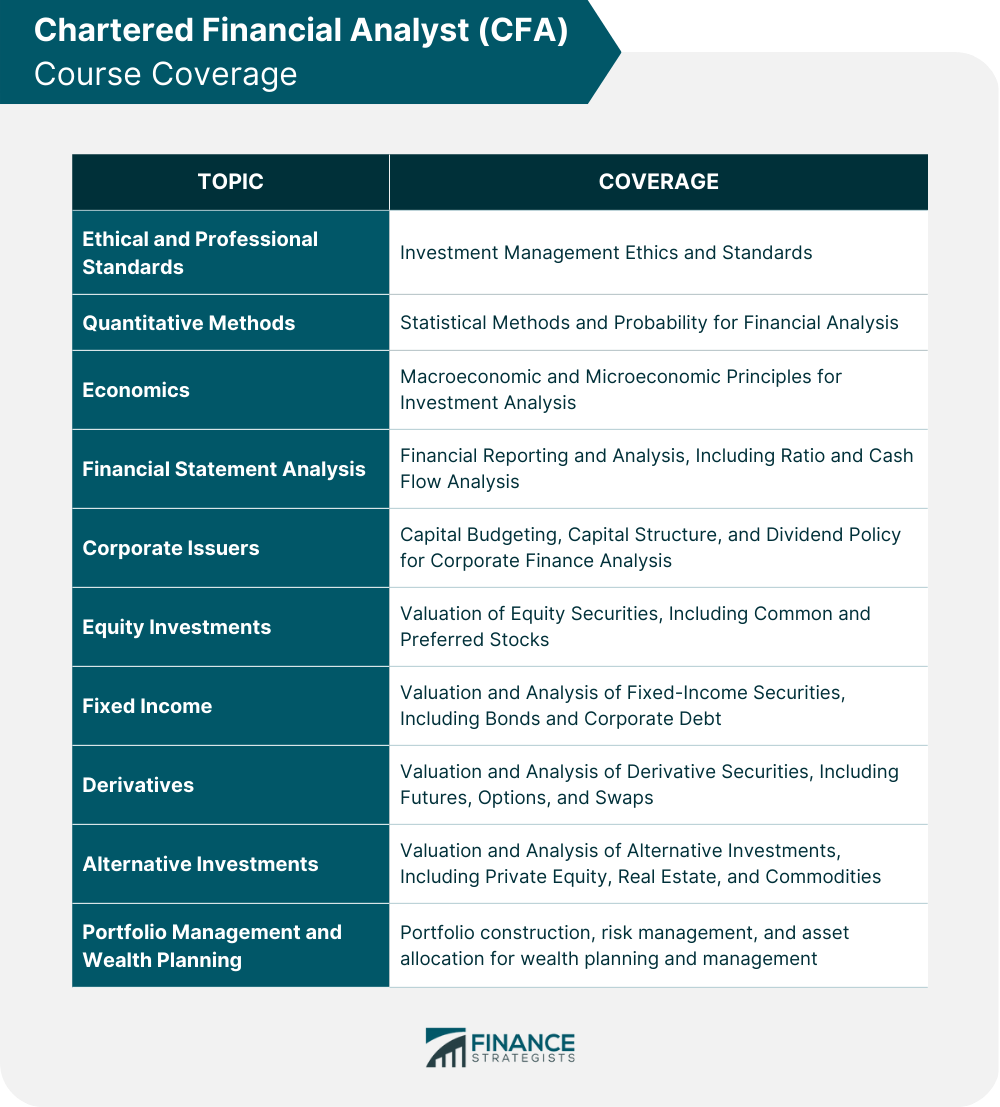

Topics Covered in the CFA Course

Eligibility Criteria for CFA Certification

Career Opportunities for CFA Holders

CFA Exam

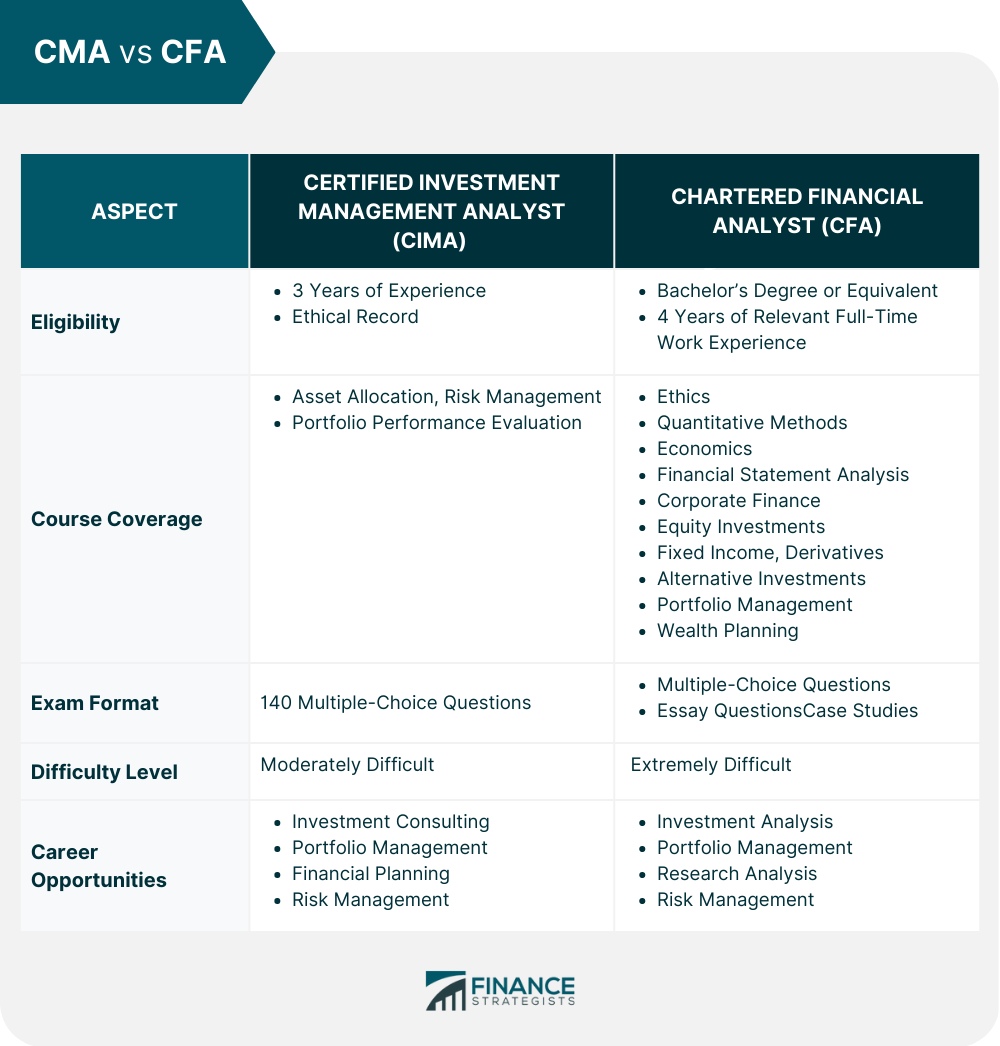

Differences Between CIMA and CFA

Nature of the Courses

Focus of the Courses

Certification Requirements

Exam Format and Difficulty Level

Career Opportunities

CIMA vs CFA: Comparative Table

CIMA vs CFA: Which Certification to Choose?

The Bottom Line

CIMA vs CFA FAQs

The CIMA certification is focused on strategic financial management, while the CFA certification is focused on investment analysis and management. They also have different eligibility criteria and exam formats.

CIMA requires candidates to have a bachelor's degree or equivalent and some relevant work experience. CFA requires candidates to have a bachelor's degree or equivalent or be in the final year of their undergraduate degree program.

CIMA and CFA certifications can lead to careers in investment management, financial analysis, portfolio management, risk management, and more.

Choosing between CIMA and CFA depends on your career goals and interests. CIMA is more focused on investment consulting and portfolio construction, while CFA is more focused on investment analysis and research.

Yes, it is possible to hold both a CIMA and CFA certification. However, obtaining both certifications requires a significant investment of time and money.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.