Financial statement preparation is a crucial aspect of a company's financial management, involving the recording and reporting of its financial transactions and activities. Financial statements provide a comprehensive overview of a company's financial performance, position, and cash flows, aiding in decision-making and financial analysis. Proper financial statement preparation requires a thorough understanding of accounting principles, standards, and regulations, as well as attention to detail and accuracy in recording and reporting financial data. The first step in financial statement preparation is identifying and gathering relevant financial data from a company's accounting records. This process involves collecting information on transactions, such as sales, expenses, investments, and borrowings, and organizing it in a systematic manner. After gathering financial data, accountants must adjust and classify transactions according to the appropriate accounting principles and standards. Adjusting entries ensure that revenues and expenses are recorded in the correct accounting period, while classifying transactions involves grouping similar items into appropriate categories, such as assets, liabilities, revenues, and expenses. Once the transactions have been adjusted and classified, the next step is preparing the individual components of the financial statements, including the balance sheet, income statement, statement of cash flows, and statement of stockholders' equity. If a company has subsidiaries or other related entities, it may need to prepare consolidated financial statements. This process involves combining the financial information of the parent company and its subsidiaries to present a unified view of the entire corporate group's financial position and performance. After preparing the individual components and consolidating financial statements (if applicable), the final step is to review and finalize the financial statements. This process ensures that all information is accurate, complete, and compliant with the relevant accounting standards. Once finalized, the financial statements are presented to the company's management, board of directors, and other stakeholders. The balance sheet, also known as the statement of financial position, presents a company's assets, liabilities, and stockholders' equity at a specific point in time. It provides a snapshot of the company's financial position and is based on the fundamental accounting equation: Assets = Liabilities + Stockholders' Equity. The income statement, or the statement of comprehensive income, summarizes a company's revenues and expenses over a specified period. It shows the company's ability to generate profits by measuring the difference between revenues and expenses. The primary components of the income statement include revenues, cost of goods sold, gross profit, operating expenses, and net income. The statement of cash flows tracks the cash inflows and outflows during a specific period. It categorizes cash flows into three main activities: operating, investing, and financing activities. This statement is essential for understanding a company's liquidity and solvency, as well as its ability to generate and use cash effectively. The statement of stockholders' equity, or the statement of changes in equity, shows the changes in the components of stockholders' equity over a specified period. It includes elements such as common stock, preferred stock, additional paid-in capital, retained earnings, and treasury stock. Accrual accounting is the primary method used in financial statement preparation. It records transactions when they are incurred, regardless of when the cash is exchanged. This method ensures that financial statements provide a more accurate representation of a company's financial performance and position. Materiality is an accounting concept that refers to the significance of a piece of information or a transaction. An item is considered material if its omission or misstatement could influence the economic decisions of users based on the financial statements. Consistency is the practice of using the same accounting methods and policies from one accounting period to another. It allows for more reliable and comparable financial statements. Comparability refers to the ability to analyze and compare financial information across different companies or time periods. It enables stakeholders to evaluate the relative financial performance of different companies and make informed decisions. Conservatism is an accounting principle that requires accountants to exercise caution when making judgments and estimates. It suggests that, when in doubt, accountants should choose the option that will least overstate assets and income and least understate liabilities and expenses. GAAP is a set of accounting standards and guidelines used in the United States. These principles provide a framework for financial statement preparation and ensure that financial statements are consistent, reliable, and comparable. IFRS is a set of accounting standards developed by the International Accounting Standards Board (IASB) for use in over 140 countries. IFRS aims to harmonize accounting practices globally and enhance the comparability of financial statements. The FASB is a private organization responsible for establishing and maintaining accounting standards in the United States. It develops GAAP and ensures that these standards are regularly updated to reflect evolving business practices and economic conditions. The IASB is an independent, international organization responsible for developing and promoting the adoption of IFRS worldwide. It aims to create a single set of global accounting standards that enhance transparency, comparability, and efficiency in financial reporting. Ratio analysis is a fundamental tool in financial statement analysis that involves calculating various financial ratios to assess a company's performance, liquidity, solvency, and efficiency. These ratios include liquidity ratios, solvency ratios, profitability ratios, and efficiency ratios. Trend analysis involves examining a company's financial statements over multiple periods to identify patterns and trends in financial performance. This method helps stakeholders understand the company's historical performance and make predictions about its future performance. Vertical analysis, also known as common-size analysis, involves expressing each item on a financial statement as a percentage of a base item, such as total assets or total revenues. This method allows for easy comparison of financial statements across different companies or time periods. Horizontal analysis, on the other hand, involves comparing financial statement items across multiple periods to identify changes and trends in a company's financial performance. DuPont analysis is a technique that breaks down Return On Equity (ROE) into three components: profit margin, asset turnover, and financial leverage. This method helps stakeholders understand the drivers of a company's ROE and evaluate its financial performance more effectively. There are several types of audits, including internal audits, external audits, and regulatory audits. Internal audits are conducted by a company's internal audit team to assess the effectiveness of internal controls and risk management practices. External audits are performed by independent accounting firms to provide assurance on the accuracy and reliability of a company's financial statements. Regulatory audits are conducted by government agencies to ensure compliance with laws and regulations. Auditors play a crucial role in financial statement preparation by providing assurance on the accuracy, reliability, and compliance of financial statements. They review a company's accounting records, internal controls, and financial reporting processes to ensure that financial statements are free from material misstatements and are prepared in accordance with the relevant accounting standards and regulations. Audit opinions are the conclusions auditors reach after reviewing a company's financial statements. The four main types of audit opinions are unqualified, qualified, adverse, and disclaimer of opinion. An unqualified opinion indicates that the financial statements are fairly presented and comply with the relevant accounting standards. A qualified opinion suggests that there are specific issues or departures from accounting standards, but the financial statements are still fairly presented. An adverse opinion means that the financial statements are materially misstated and do not accurately represent the company's financial position. A disclaimer of opinion occurs when the auditor is unable to form an opinion due to a lack of sufficient evidence or a significant limitation in the scope of the audit. Internal controls are the policies, procedures, and mechanisms implemented by a company to ensure the accuracy and reliability of its financial reporting, safeguard its assets, prevent fraud, and comply with laws and regulations. Effective internal controls play a vital role in financial statement preparation by ensuring that transactions are recorded accurately and consistently, and that financial statements are prepared in accordance with the relevant accounting standards. Accountants involved in financial statement preparation must act with integrity and objectivity, ensuring that they do not compromise their professional judgment due to personal interests or external pressures. They must provide unbiased, accurate, and complete information in the financial statements to protect the interests of all stakeholders. Accountants must maintain the confidentiality of a company's financial information and only disclose it to authorized parties. They should not use confidential information for personal gain or share it with unauthorized individuals. Accountants must possess the necessary skills, knowledge, and expertise to perform their duties effectively. They should stay updated on the latest accounting standards, regulations, and industry practices to ensure that they prepare financial statements accurately and in compliance with the relevant guidelines. Accountants must exercise due diligence in the financial statement preparation process by thoroughly reviewing and verifying financial data, ensuring that transactions are accurately recorded and classified and that the financial statements comply with the relevant accounting regulations. Financial statement preparation is a critical component of a company's financial management, providing a comprehensive overview of its financial performance, position, and cash flows. Proper financial statement preparation requires a thorough understanding of accounting principles, standards, and regulations, as well as attention to detail and accuracy in recording and reporting financial data. Financial statements are essential tools for decision-making and financial analysis, aiding in assessing a company's worth and potential investment attractiveness. Various analytical techniques, such as ratio analysis, trend analysis, vertical and horizontal analysis, and DuPont analysis, can be applied to interpret financial statements and evaluate a company's performance. Auditors play a vital role in financial statement preparation by providing assurance on the accuracy, reliability, and compliance of financial statements, and effective internal controls are crucial for ensuring the accuracy and reliability of financial reporting. Finally, ethical considerations such as integrity, objectivity, confidentiality, professional competence, and due diligence must be taken into account to ensure accurate financial statement preparation.Financial Statement Overview

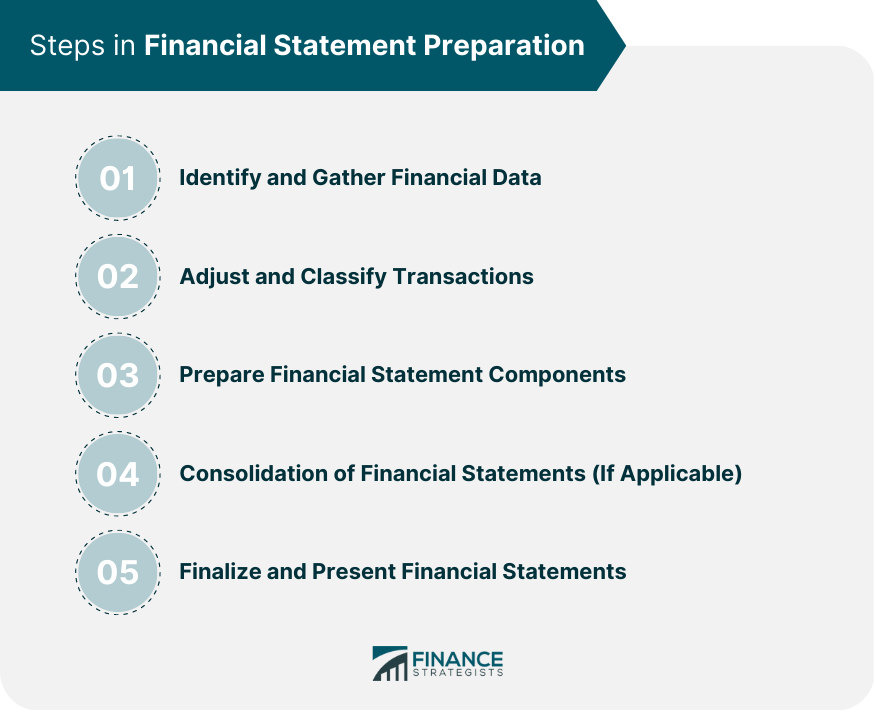

Steps in Financial Statement Preparation

Identifying and Gathering Financial Data

Adjusting and Classifying Transactions

Preparing Financial Statement Components

Consolidation of Financial Statements (If Applicable)

Finalizing and Presenting Financial Statements

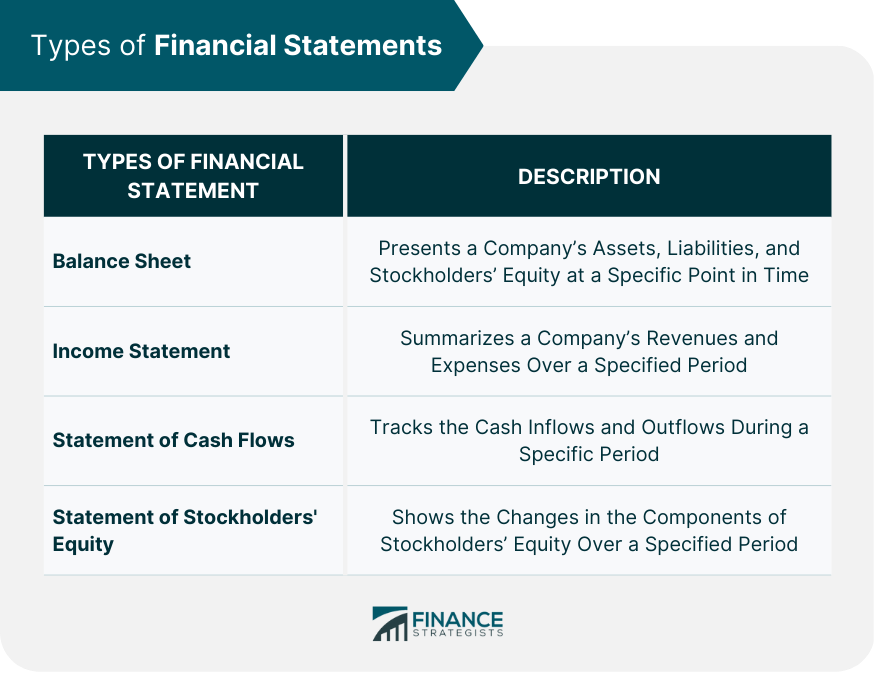

Types of Financial Statements

Balance Sheet

Income Statement

Statement of Cash Flows

Statement of Stockholders' Equity

General Principles and Concepts in Financial Statement Preparation

Accrual Accounting

Materiality

Consistency

Comparability

Conservatism

Regulatory Framework and Standards

Generally Accepted Accounting Principles (GAAP)

International Financial Reporting Standards (IFRS)

Financial Accounting Standards Board (FASB)

International Accounting Standards Board

Financial Statement Analysis and Interpretation

Ratio Analysis

Trend Analysis

Vertical and Horizontal Analysis

DuPont Analysis

Audit and Assurance of Financial Statements

Types of Audits

Roles of Auditors

Audit Opinions and Their Implications

Internal Controls and Their Impact on Financial Statement Preparation

Ethical Considerations in Financial Statement Preparation

Integrity and Objectivity

Confidentiality

Professional Competence

Due Diligence

Conclusion

Financial Statement Preparation FAQs

Financial statement preparation involves creating accurate and reliable financial documents that reflect a company's financial position and performance. It is essential for businesses because it helps stakeholders, such as investors, creditors, and regulators, make informed decisions based on the company's financial health, and it ensures compliance with accounting standards and regulations.

The key components of financial statement preparation include the balance sheet, income statement, statement of cash flows, and statement of stockholders' equity. These components provide a comprehensive view of a company's financial position, performance, cash flows, and changes in equity. They are interrelated, as the performance and financial activities captured in the income statement and statement of cash flows affect the balance sheet and statement of stockholders' equity.

The regulatory framework, consisting of accounting standards such as GAAP and IFRS, establishes guidelines and rules for financial statement preparation. These standards ensure that financial statements are consistent, reliable, and comparable across companies and time periods. Adhering to the regulatory framework is crucial for businesses to maintain trust among stakeholders and comply with legal requirements.

Financial statement analysis is the process of examining and interpreting a company's financial statements to assess its financial health and performance. While not a direct part of financial statement preparation, it is essential for stakeholders to derive meaningful insights from the prepared financial statements. Techniques such as ratio analysis, trend analysis, and vertical and horizontal analysis help stakeholders evaluate a company's performance, liquidity, solvency, and efficiency, enabling them to make informed decisions.

The audit process involves reviewing a company's financial statements, accounting records, and internal controls to verify their accuracy, reliability, and compliance with the relevant accounting standards and regulations. Auditors provide assurance on the financial statements by issuing audit opinions that indicate the level of confidence in the accuracy and fairness of the financial statements. This process helps maintain trust among stakeholders and ensures that the financial statement preparation adheres to the required guidelines and principles.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.