Accountants offer significant value, providing expertise in financial management, tax planning, and ensuring compliance with laws. They can save individuals and businesses time and resources, allowing them to focus on core functions or personal pursuits. However, the worth of hiring an accountant depends on individual circumstances. For those with complex finances or limited time to manage financial tasks, an accountant could be a worthy investment. But there are potential downsides, including cost and concerns about data privacy. Ultimately, the decision should be based on a cost-benefit analysis, factoring in your financial complexity, available time, and comfort with managing finances. The importance of this question lies in the substantial impact that hiring an accountant can have on personal finances or business operations. The decision isn't merely about dollars spent on professional fees, but also about the potential for optimized financial management, minimized tax liability, and maximized profitability. Accountants are extensively trained in financial management, offering a depth of expertise that goes beyond basic bookkeeping. Their knowledge spans complex tax laws, financial analysis, and budgeting – crucial elements in making informed financial decisions. Accountants bring efficiencies that can save significant time and resources. By delegating financial tasks to an accountant, individuals and businesses can focus more on their core functions, leading to increased productivity and potentially greater returns. A key role of accountants is ensuring compliance with various tax laws and financial regulations. Their expertise can help mitigate the risk of costly fines and penalties due to non-compliance, not to mention the potential damage to reputation. I suggest asking me to continue with the next sections, "The Upsides of Engaging Accountants", "Potential Downfalls of Hiring Accountants", and "Factors to Evaluate If an Accountant Is Worth It", in subsequent questions to receive a comprehensive article based on your outline. One of the most compelling reasons to hire an accountant is their ability to create financial efficiency and provide potential tax savings. Accountants are well-versed in identifying tax deductions and credits that you might not be aware of. They can provide strategic advice on tax planning and help you leverage tax laws to your advantage. This can result in significant tax savings, making the cost of hiring an accountant worthwhile. Accountants can also introduce time savings and streamlined operations. By taking over time-consuming financial tasks, they free up time that you can invest in other productive activities. For businesses, this could mean more time spent on product development, sales, or customer service. For individuals, it might mean freeing up time for career development or personal pursuits. Accountants can serve as trusted advisors, providing expert financial guidance. They can help you understand your financial situation, plan for the future, and make informed decisions. This kind of guidance can be invaluable for long-term financial success, whether you're planning for retirement, looking to grow a business, or navigating financial challenges. While there are many benefits to hiring an accountant, there are also potential downfalls. One of the most common concerns is the cost. Accountant fees can vary widely, and for some individuals or small businesses, the cost might seem prohibitive. It's essential to consider these costs and ensure they fit within your budget. There's also a risk of becoming overly reliant on an accountant. It's important to maintain a basic understanding of your financial situation and not cede all control. Relying too heavily on an accountant could leave you vulnerable if they make a mistake or if they are not available when you need them. Another potential concern is the privacy and security of your financial data. When you hire an accountant, you're entrusting them with sensitive information. It's important to ensure that any accountant you hire takes adequate measures to protect your information. Whether an accountant is worth it can depend largely on the complexity of your personal or business finances. If you have multiple income streams, significant investments, or run a business with various financial transactions, an accountant can provide significant value. The cost-benefit ratio is another crucial factor. If the potential tax savings and efficiencies an accountant can provide outweigh their fees, then hiring an accountant could be a sound decision. Finally, your available time and comfort with financial management should factor into your decision. If managing your finances becomes too time-consuming or stressful, an accountant's expertise can prove to be worth the investment. Accountants offer substantial value, bringing expertise in financial management, tax planning, and ensuring compliance. Their services save time and resources, enabling a more focused approach to core functions or personal goals. However, hiring an accountant necessitates a nuanced cost-benefit analysis, weighing the cost of services, the complexity of personal or business finances, and your available time and financial management skills. With the potential benefits of tax savings, increased efficiency, expert guidance, and compliance assurance, an accountant can be a worthy investment for those with complex finances or limited time. However, due caution is required to avoid overreliance, maintain data privacy, and ensure services align with the budget. The decision ultimately lies with individuals or businesses, taking into account their specific circumstances and financial objectives.Are Accountants Worth It?

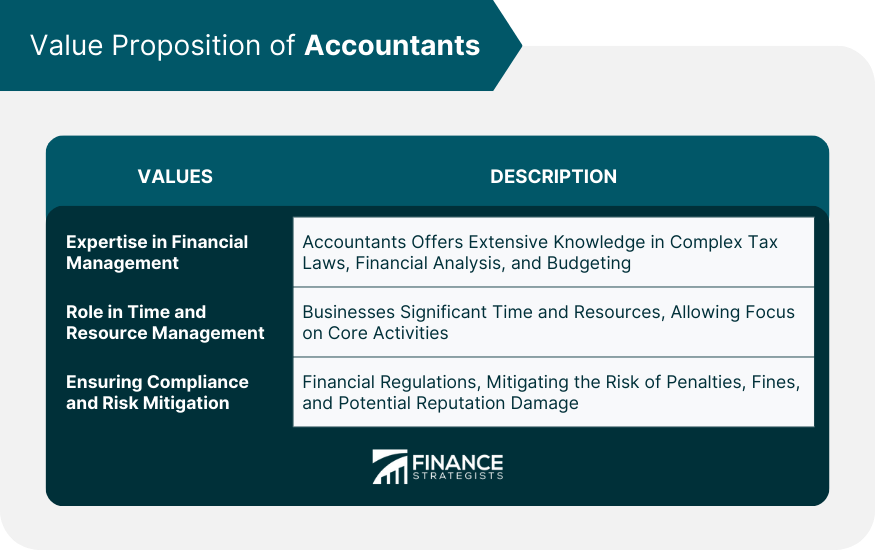

Value Proposition of Accountants

Expertise in Financial Management

Role in Time and Resource Management

Ensuring Compliance and Risk Mitigation

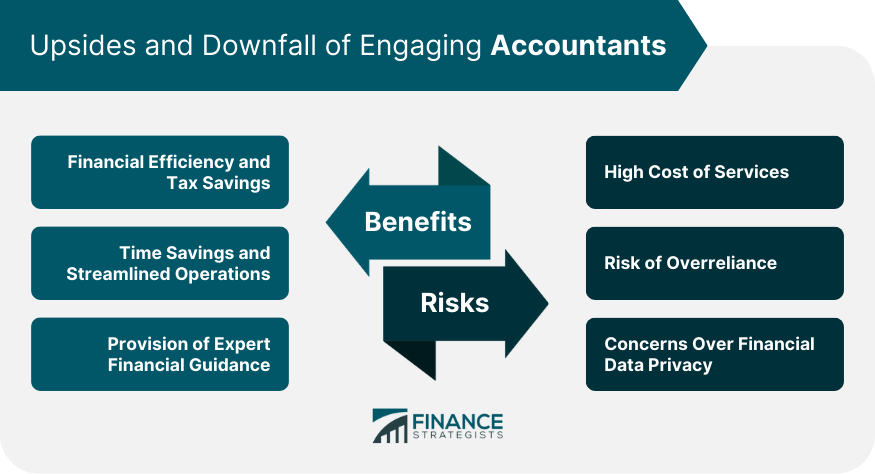

Benefits of Engaging Accountants

Financial Efficiency and Tax Savings

Time Savings and Streamlined Operations

Provision of Expert Financial Guidance

Potential Risks of Hiring Accountants

High Cost of Services

Risk of Overreliance

Concerns Over Financial Data Privacy

Factors to Evaluate If an Accountant Is Worth It

Complexity of Personal or Business Finances

Assessing the Cost-Benefit Ratio

Consideration of Time and Financial Management Skills

Conclusion

Are Accountants Worth It? FAQs

Accountants offer benefits such as expert financial management, tax savings, time efficiencies, and ensuring compliance with tax laws and regulations.

Yes, accountants can be worth it for small businesses. They can manage complex financial tasks, ensure compliance, offer strategic financial advice, and save business owners valuable time.

Accountants can save you money by optimizing your tax strategy, identifying potential deductions and credits, and providing advice on financial efficiency.

Drawbacks can include the cost of services, potential overreliance on their expertise, and concerns about the privacy and security of financial data.

Evaluate the complexity of your financial situation, the potential benefits versus costs of hiring an accountant, and your own comfort and time availability for managing financial tasks. A cost-benefit analysis can guide this decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.