Wealth replacement trusts are specialized estate planning tools designed to protect and transfer wealth to future generations while minimizing tax liabilities and providing for charitable giving. These trusts are often used in conjunction with other estate planning strategies to optimize the preservation and distribution of assets. In the complex world of estate planning, wealth replacement trusts offer a versatile solution for individuals seeking to reduce estate and gift taxes, protect assets from creditors, and provide for charitable causes. These trusts can be tailored to meet the unique needs of each individual and family, making them an essential component of a comprehensive estate plan.

The grantor is the individual who establishes the wealth replacement trust, transfers assets into the trust, and defines its terms and conditions. The grantor's primary goal is to ensure the proper management and distribution of their assets according to their wishes. The trustee is a person or entity responsible for administering the trust and managing its assets on behalf of the beneficiaries. This may include investment management, tax reporting, and distribution of assets according to the trust's terms. The beneficiary is the individual or entity designated by the grantor to receive the benefits of the trust. In a wealth replacement trust, there may be multiple beneficiaries, including family members, friends, and charitable organizations. Trust assets are the property or funds transferred into the trust by the grantor. These assets can include cash, real estate, stocks, bonds, and other investments. An ILIT is a type of wealth replacement trust designed specifically to hold life insurance policies. The ILIT owns the policy, pays the premiums, and distributes the death benefit to the designated beneficiaries, often providing liquidity to the estate and minimizing estate taxes. Before establishing a wealth replacement trust, it is essential to define the specific objectives and goals that the trust should accomplish. This may include estate tax reduction, asset protection, and charitable giving. Based on the grantor's objectives, the appropriate type of trust must be selected. This may be an ILIT, a Charitable Remainder Trust (CRT), a Charitable Lead Trust (CLT), or another type of trust that best suits the grantor's needs. The grantor must carefully choose the trustee and beneficiaries to ensure that the trust is managed effectively and the assets are distributed according to the grantor's wishes. The grantor transfers assets into the trust, either during their lifetime or upon their death, to fund the trust. The assets must be properly retitled in the name of the trust to ensure proper administration. A well-drafted trust document is crucial to the successful implementation of a wealth replacement trust. An experienced estate planning attorney should be consulted to ensure that the trust document accurately reflects the grantor's objectives and complies with all relevant laws and regulations. Proper trust administration is vital to the success of a wealth replacement trust. The trustee must manage the trust assets, file tax returns, and distribute assets to the beneficiaries according to the trust's terms. Wealth replacement trusts can help reduce or eliminate estate taxes by removing assets from the grantor's taxable estate. When structured correctly, wealth replacement trusts can also minimize or eliminate gift taxes on assets transferred to the trust. Wealth replacement trusts can provide a layer of protection for the grantor's assets against creditors and legal claims. By transferring assets into the trust, the grantor effectively separates them from their personal estate, making them more difficult for creditors to access. Wealth replacement trusts can be an effective way to support charitable causes while minimizing tax liabilities. By incorporating charitable giving into the trust structure, the grantor can leave a lasting philanthropic legacy. Wealth replacement trusts offer a high degree of flexibility and control, allowing the grantor to tailor the trust terms to their specific needs and objectives. This includes the ability to dictate how the trust assets are managed, distributed, and ultimately passed on to the beneficiaries. Wealth replacement trusts are typically irrevocable, which means that once they are established, the terms cannot be easily changed. This can limit the grantor's ability to adapt the trust to changing circumstances or needs. Administering a wealth replacement trust can be complex and time-consuming, often requiring the services of professional advisors such as attorneys, accountants, and investment managers. These administration costs can add up over time, potentially reducing the overall benefits of the trust. In some cases, conflicts may arise between beneficiaries regarding the management and distribution of trust assets. Proper communication and clear trust terms can help mitigate these conflicts, but they may still pose challenges for the trustee. A CRT is a type of wealth replacement trust that allows the grantor to receive income from the trust assets for a specified period or for their lifetime, with the remaining assets passing to a designated charity upon the grantor's death. This structure provides the grantor with an income stream while also benefiting a charitable cause. A CLT is another type of wealth replacement trust focused on charitable giving. In a CLT, a designated charity receives income from the trust assets for a specified period, with the remaining assets eventually passing to the grantor's chosen beneficiaries. This allows the grantor to support a charitable cause during their lifetime while also providing for their beneficiaries. Wealth replacement trusts can help grantors maximize their philanthropic impact by combining estate planning strategies with charitable giving. This allows grantors to leave a lasting legacy while also benefiting from tax advantages and asset protection. Wealth replacement trusts should be integrated with other estate planning tools, such as wills, powers of attorney, and advance healthcare directives, to create a cohesive and comprehensive estate plan. Estate plans should be regularly reviewed and updated to ensure that they continue to meet the grantor's objectives and accommodate changes in circumstances, laws, and regulations. This includes reviewing and potentially modifying wealth replacement trusts as needed. A team of professional advisors, including estate planning attorneys, accountants, and financial planners, should be involved in the creation and administration of wealth replacement trusts. Their expertise can help ensure the successful implementation and ongoing management of these complex estate planning tools. Wealth replacement trusts are a powerful and flexible estate planning tool that can help individuals achieve their wealth preservation, tax minimization, and charitable giving objectives. By understanding the key components, advantages, and potential disadvantages of wealth replacement trusts, individuals can make informed decisions about whether to incorporate these tools into their comprehensive estate plan. With the assistance of professional advisors, wealth replacement trusts can provide a valuable solution for preserving and transferring wealth to future generations while also supporting important charitable causes. It is crucial for grantors to carefully consider their unique circumstances, goals, and objectives when deciding whether to establish a wealth replacement trust. By working closely with a team of professional advisors and regularly reviewing and updating their estate plan, grantors can ensure that their wealth replacement trust is optimally structured to meet their needs and the needs of their beneficiaries. In conclusion, wealth replacement trusts can play a vital role in a comprehensive estate plan, offering tax benefits, asset protection, and support for charitable causes. By understanding the intricacies of these trusts and engaging professional advisors, individuals can make informed decisions and create a lasting legacy for themselves and their beneficiaries.What Are Wealth Replacement Trusts?

Key Components of Wealth Replacement Trusts

Grantor

Trustee

Beneficiary

Trust Assets

Irrevocable Life Insurance Trust (ILIT)

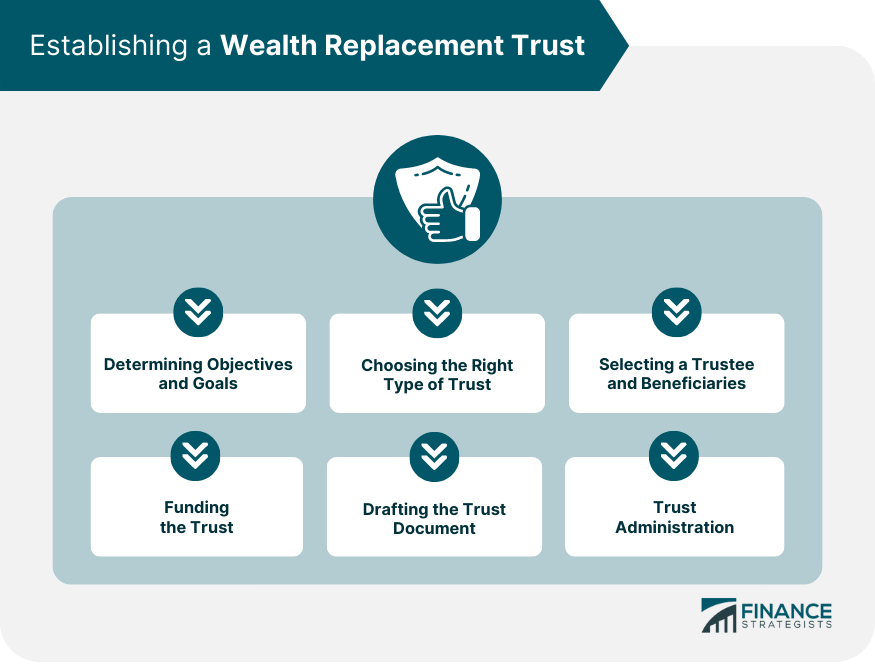

Establishing a Wealth Replacement Trust

Determining Objectives and Goals

Choosing the Right Type of Trust

Selecting a Trustee and Beneficiaries

Funding the Trust

Drafting the Trust Document

Trust Administration

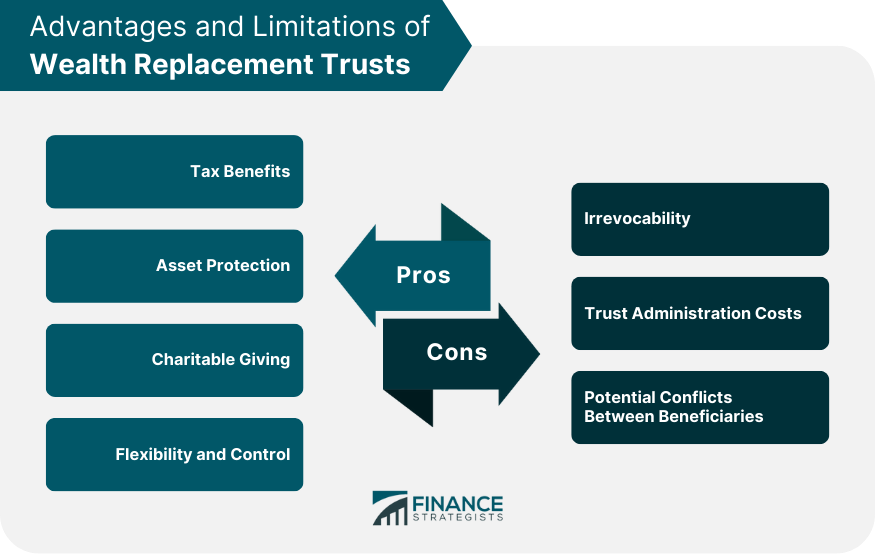

Advantages of Wealth Replacement Trusts

Tax Benefits

Estate Tax Reduction

Gift Tax Benefits

Asset Protection

Charitable Giving

Flexibility and Control

Potential Disadvantages and Limitations

Irrevocability

Trust Administration Costs

Potential Conflicts Between Beneficiaries

Wealth Replacement Trusts and Charitable Giving

Charitable Remainder Trust

Charitable Lead Trust

Maximizing Philanthropic Impact

Integrating Wealth Replacement Trusts Into a Comprehensive Estate Plan

Coordination With Other Estate Planning Tools

Regular Review and Updates

Involvement of Professional Advisors

Final Thoughts

Wealth Replacement Trusts FAQs

A Wealth Replacement Trust is a type of trust that is designed to replace the value of assets that are gifted to charity during an individual's lifetime or upon their death. The trust provides an income stream or lump sum payment to the individual's heirs or beneficiaries.

When an individual donates assets to charity, the assets are removed from their estate and may reduce the value of their estate that would otherwise pass to their heirs or beneficiaries. A Wealth Replacement Trust is established to provide an income stream or lump sum payment to the individual's heirs or beneficiaries, which can replace the value of the assets that were donated to charity.

A Wealth Replacement Trust provides several benefits, including the ability to make a significant charitable gift while still preserving assets for heirs or beneficiaries. The trust can also provide tax benefits, as the charitable donation may be tax-deductible and the trust assets may grow tax-free.

Any individual can establish a Wealth Replacement Trust. It is typically established as part of an overall estate planning strategy that includes charitable giving.

A Wealth Replacement Trust is typically structured as an irrevocable trust, which means it cannot be changed once it is established. The trust is funded with assets, which are used to generate income that is paid to the beneficiaries. Upon the death of the individual, any remaining assets in the trust may pass to the beneficiaries or may be donated to charity. The structure of the trust can vary depending on the individual's goals and objectives. It is recommended that individuals consult with an attorney or financial advisor to understand their options when establishing a Wealth Replacement Trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.