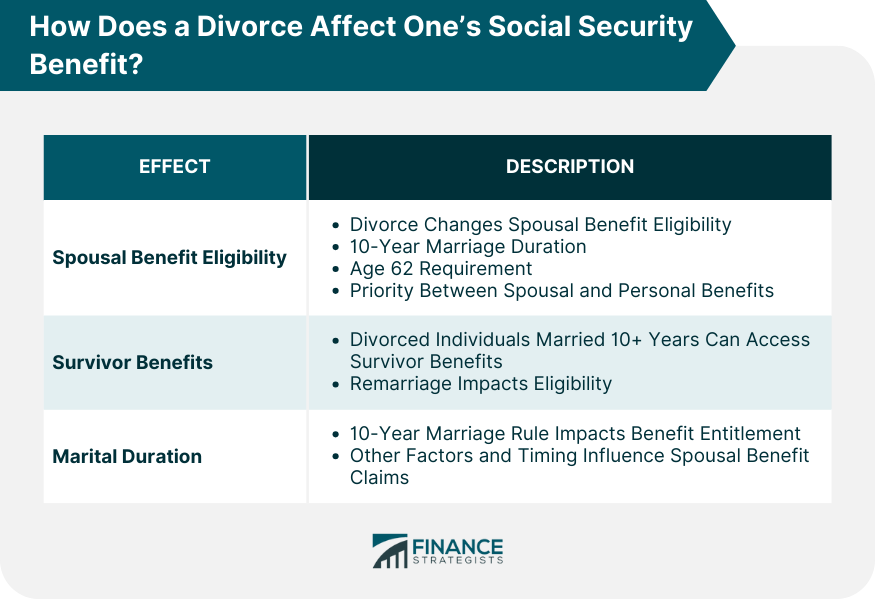

Divorce, while fundamentally a legal and personal decision, carries with it a myriad of financial ramifications that can shape an individual's economic landscape for years to come. From the division of shared assets and liabilities to the establishment of separate financial identities, the process often necessitates a thorough reassessment of both parties' fiscal realities. Considerations span a range of issues, including property divisions, alimony, child support, and the division of retirement assets. Each aspect of the financial equation has its complexities and requires careful navigation. Moreover, these economic implications extend beyond the immediate logistics of asset division. For many, divorce can mean a significant change in lifestyle, driven by a shift from dual to single income, or the costs associated with legal proceedings. There's also the potential challenge of managing previously shared financial responsibilities alone, such as mortgages, loans, or children's educational expenses. Amidst these multifaceted financial considerations, one particular aspect that often gets overlooked is the way divorce affects Social Security benefits. The Social Security system in the U.S. allows for spousal benefits, wherein even if one spouse hasn't worked (or has had a limited work history), they can receive benefits based on the working spouse's record. When married, a non-working or lower-earning spouse can receive up to 50% of the working spouse's benefit amount. Post-divorce, this dynamic changes. If the marriage lasted ten years or more, the lower-earning spouse may still be eligible for benefits based on the ex-spouse's record. However, to claim this, the claimant must be unmarried and at least 62 years old. It's essential to note that if the lower-earning ex-spouse is entitled to benefits based on their work record, that will be paid out first. Only if the spousal benefit is higher will they receive the additional amount to match the spousal benefit. Survivor benefits are another crucial facet of the Social Security system. When a worker passes away, their spouse may be entitled to receive survivor benefits based on the deceased's earning record. Divorce complicates this matter. Much like with spousal benefits, if the marriage lasted ten years or longer, the surviving divorced spouse can claim survivor benefits. These benefits can be significant, amounting to 100% of the deceased ex-spouse's benefit if the survivor has reached full retirement age. But there are nuances: if the survivor remarries before age 60 (or 50 if disabled), they cannot receive these benefits unless the subsequent marriage ends. A recurring theme in the Social Security implications of divorce is the ten-year threshold. The duration of the marriage plays a pivotal role in determining benefit entitlement for divorced spouses. The ten-year rule is a cornerstone of the system, designed to protect lower-earning spouses who might otherwise be left financially vulnerable after a divorce. However, it's worth noting that while the ten-year mark is crucial, other factors also play a role. For example, even if eligible, one cannot claim spousal benefits based on an ex-spouse's record until the ex-spouse claims their benefits. However, if two years have passed since the divorce, and both parties are at least 62, the claim can be made even if the higher-earning ex-spouse has not yet started collecting their benefits. The earning histories of both spouses play a pivotal role in the potential Social Security benefits one can claim post-divorce. Generally, the Social Security Administration (SSA) calculates benefits based on the 35 years in which the worker earned the most. If there were years with little or no income, they would be included in the average, potentially decreasing the benefit amount. Therefore, if one spouse was the primary breadwinner while the other either stayed at home or had sporadic employment, the former's earning history becomes crucial. The higher-earning spouse's record serves as the foundation for the spousal benefit entitlement of the lower-earning spouse, making the dynamic between the couple's earning histories a significant factor. Moreover, the difference in earnings between spouses can also determine the amount the lower-earning spouse is eligible to claim. While they could get up to 50% of the higher-earning spouse's benefit, this percentage might decrease if the lower-earning spouse has a significant earning history of their own. The age at which an individual decides to claim Social Security benefits can greatly influence the monthly benefit amount. Claiming benefits before the full retirement age (FRA) will reduce the benefit amount, while delaying it past the FRA can result in a credit, thereby increasing the monthly payout. This dynamic also affects divorced spouses. The age at which the higher-earning spouse claims benefits can influence the benefits available to the lower-earning spouse, especially if they're dependent on the spousal benefit. Furthermore, there's a waiting period implication. Even if a divorced spouse is entitled to benefits based on the ex-spouse's record, they cannot claim this benefit until the ex-spouse starts claiming their own. However, a caveat exists: if the couple has been divorced for at least two years and both are at least 62, the lower-earning spouse can begin claiming benefits regardless of the ex-spouse's decisions. Remarriage introduces another layer of complexity in the realm of Social Security benefits post-divorce. For divorced spouses who are drawing benefits based on their ex-spouse's record, remarrying can cease their eligibility for this particular benefit. If they were receiving spousal benefits based on their ex-spouse's earning record, those would typically stop upon remarriage. However, nuances exist. For instance, if a divorced spouse remarries after age 60 (or 50 if they're disabled), they can still claim survivor benefits based on their deceased ex-spouse's record. It's a scenario that underscores the importance of understanding the intricacies of remarriage and its implications on Social Security benefits. Coordinating when and how to claim Social Security benefits can help in optimizing the amounts received. If one is eligible for both a personal benefit based on their earning record and a spousal benefit, it's crucial to strategize the timing for each. By perhaps claiming one benefit first and allowing the other to grow, one can maximize the overall benefit received over time. Furthermore, divorced couples can also potentially benefit from coordination. Even if no longer on good terms, understanding the implications of each other's claiming decisions can help both parties optimize their benefits. Some divorced individuals might find it beneficial to claim their own benefits early and switch to a higher spousal or survivor benefit later. The divorce settlement process is not only an avenue to divide assets but also a platform to discuss and strategize about future financial implications, including Social Security benefits. Parties can negotiate terms that consider when each individual will claim benefits, ensuring that both are aware of and can plan for the financial outcomes. While the SSA doesn't recognize private agreements about benefits, being informed allows both parties to make decisions in their best interests. Navigating the financial intricacies post-divorce can be a daunting task. Seeking professional guidance from financial planners or advisors who understand the nuances of Social Security, especially concerning divorce, can be invaluable. These experts can offer personalized strategies, ensuring that one is making informed decisions that optimize potential benefits and financial stability. The financial consequences of divorce extend beyond immediate asset division and lifestyle adjustments. Understanding how divorce influences Social Security benefits is paramount for ensuring long-term financial security. Divorce alters spousal and survivor benefits eligibility, with the ten-year marriage threshold playing a key role. Spousal benefits based on ex-spouses' records are attainable if certain conditions are met, while remarriage poses unique challenges. The dynamic between spouses' earning histories and the timing of benefit claims also significantly shape post-divorce outcomes. To mitigate potential losses and optimize benefits, individuals should strategize coordination, utilize divorce settlement agreements, and seek professional advice. As Social Security benefits often constitute a substantial portion of retirement income, being well-informed about the impact of divorce on these benefits empowers individuals to make informed decisions that can safeguard their financial future. Amid the complexities, expert guidance becomes an essential tool for navigating this intricate terrain, ensuring that divorce doesn't compromise one's retirement security.Financial Implications of Divorce

How Does a Divorce Affect One’s Social Security Benefit?

Spousal Benefit Eligibility

Survivor Benefits

Marital Duration

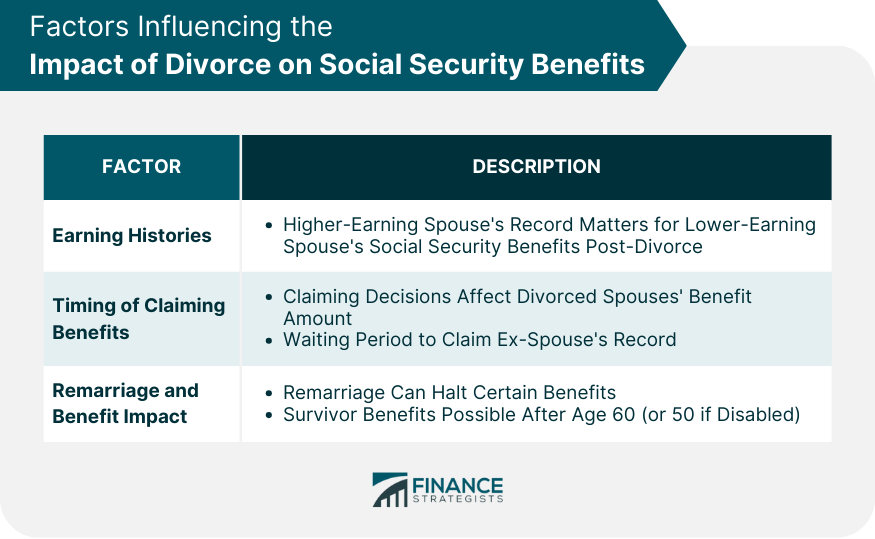

Factors Influencing the Impact of Divorce on Social Security Benefits

Earning Histories of Both Spouses

Timing of Claiming Social Security Benefits

Remarriage and Impact on Benefits

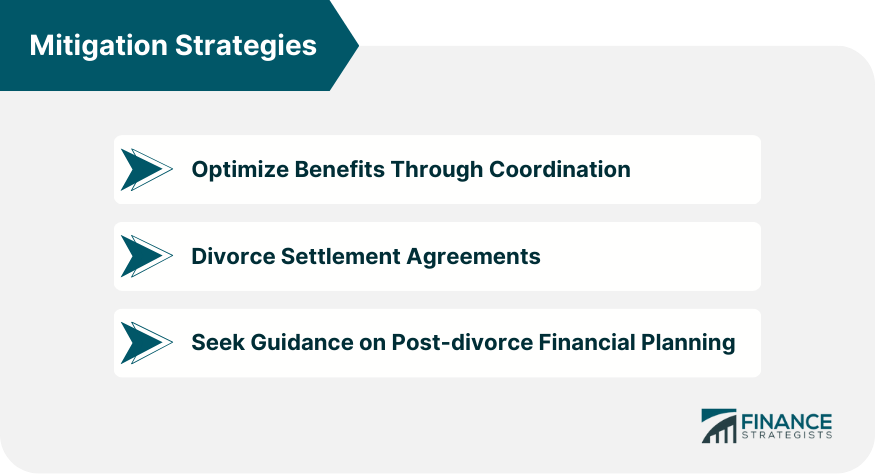

Mitigation Strategies

Optimize Benefits Through Coordination

Divorce Settlement Agreements

Seek Guidance on Post-divorce Financial Planning

Conclusion

How Does a Divorce Affect One’s Social Security Benefit? FAQs

If you have been divorced for at least two years, and both you and your ex-spouse are at least 62, you can claim benefits even if your ex-spouse hasn't started collecting theirs.

Yes, as long as you remarried after you turned 60, or 50 if you are disabled. If you remarry before these ages, you typically can't claim survivor benefits based on your deceased ex-spouse's record.

The marriage must have lasted at least ten years for you to claim spousal benefits post-divorce based on your ex-spouse's earning record.

No, your ex-spouse's decision to remarry does not impact your eligibility or the amount of Social Security benefits you can receive based on their record.

Yes, if you initially claim benefits based on your record, you can later switch to a spousal benefit if it's higher, particularly once you reach full retirement age.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.