Adding a spouse to a bank account transforms the account into a joint account, providing both parties with equal access to the funds. This process usually requires both individuals to visit the bank in person, providing relevant identification and documentation. Having a joint account can simplify household financial management, consolidating expenses and savings in one place. Each holder can deposit and withdraw funds, and in most cases, both parties are responsible for any overdrafts or fees. However, trust is essential, as either party can deplete the funds without the other's consent. Furthermore, in the event of disagreements or separations, disputes might arise over the ownership of the money. Additionally, the account can become subject to claims from creditors of either spouse. Despite potential challenges, many couples find joint accounts to be a testament to their trust and commitment, fostering transparency in financial matters. Before you begin the process of adding a spouse to a bank account, you'll need to gather the appropriate documents. These usually include identification for both parties—like driver's licenses or passports—as well as your marriage certificate. Some banks may also require proof of address, such as utility bills or lease agreements that show both names. It’s essential to have these documents readily available, ensuring a hassle-free process and reducing potential delays. While the digital age has brought many banking procedures online, adding a spouse to your bank account often requires an in-person visit. Banks have these policies in place as a security measure to prevent fraud. An appointment is usually not mandatory but is often beneficial, as it ensures you have a designated time slot with a bank representative who can guide you through the process. Visiting the bank can also be an opportunity to discuss other banking options and offers that may benefit you both. At the bank, you'll be asked to complete a joint account application form. This document requests detailed information about both account holders. Be prepared to review the terms and conditions thoroughly, ensuring that you understand the joint liabilities, account fees, withdrawal rights, and any other key terms. Taking your time to fill out the form accurately avoids potential complications and ensures that both parties' interests are considered. Once the form is complete, you'll submit it, along with your gathered documentation, to the bank representative. They'll review your submission, which may also involve a series of verification checks. These could include phone calls or emails to confirm the information you've provided. Being prompt in responding to any inquiries can speed up the verification process and get your joint account set up quicker. After submission, the bank will take some time to process the application. The waiting period can vary depending on the bank's processing speed and the verification checks they perform. They'll notify you once the joint account setup is complete, typically through a confirmation letter or email. This is a crucial step, and it's essential to store any documentation or confirmation details safely for future reference. One of the primary benefits of having a joint account is the simplicity it brings to managing finances. You can easily track your combined income, monthly expenses, and savings. Bill payments, too, become easier to handle, as you can set them up to auto-pay from your joint account. This streamlined approach reduces the chances of missing a payment and helps in maintaining a good credit score for both parties. A joint account ensures that both parties have access to funds in the case of an emergency. If one spouse becomes incapacitated, the other can manage financial obligations without any legal hurdles. This immediate access can be invaluable, especially during unexpected situations, providing peace of mind and financial stability. With a joint account, couples can work more efficiently towards shared financial goals, such as saving for a home, planning a vacation, or securing a stable retirement. It promotes transparency in your financial status and spending habits, which can lead to more productive financial planning. Together, both parties can monitor and celebrate the milestones achieved toward these mutual goals. A joint bank account means shared responsibility. If your spouse overdrafts the account or incurs fees, you're equally liable. This shared accountability requires trust and open communication about spending habits. Both parties need to be vigilant and ensure they understand their joint obligations, avoiding potential disputes or misunderstandings. Spouses often have different spending habits and financial management styles. One might be more inclined to save, while the other is more comfortable with spending. This discrepancy can lead to disagreements and tension, making it essential for both parties to find common ground. Regular discussions can help align financial goals and expectations, ensuring a harmonious financial relationship. A joint account means your financial transactions are transparent to your spouse and vice versa. For some, this lack of financial privacy can be uncomfortable. It's crucial to discuss this potential issue ahead of time and ensure both parties are comfortable with the transparency that comes with joint banking. This open dialogue ensures that both parties feel respected and understood in their financial partnership. If a joint account seems too invasive or problematic, many banks offer linked accounts. Each person maintains a separate account, but they can link them for certain features, like transferring funds or managing shared expenses. This option provides a degree of independence while still enjoying the benefits of combined financial management. Some banks offer the option to add a spouse as an authorized user rather than a joint account holder. This designation allows the spouse certain permissions, like making transactions, but they don't have full access or responsibility for the account. This setup provides flexibility and can be customized based on the couple's comfort level and financial needs. Another alternative is to open a joint account solely for shared expenses, like mortgage payments, utility bills, or groceries. Both parties can contribute a specified amount to this account while maintaining separate accounts for personal expenses. This approach balances independence with shared financial responsibilities. Regular reviews of your joint account statements can help you stay on top of your shared finances. It's an excellent opportunity to discuss your spending habits, notice any irregularities, and track your progress towards shared financial goals. Consistent reviews also foster a sense of accountability and encourage responsible financial behavior. In any financial relationship, communication is key. Make sure to have regular discussions about your spending, saving, and any large purchases you're planning. This openness can prevent misunderstandings and ensure you're both on the same page about your financial status. Proactive conversations help in preempting potential issues and ensure that both parties feel valued and heard. Setting shared financial goals can help guide your spending and saving habits. Whether you're saving for a vacation, planning to buy a house, or preparing for retirement, having shared objectives can make financial management more productive. Make sure to revisit these goals regularly to track your progress and make adjustments as needed. Celebrate your milestones, and remember that mutual financial goals are a testament to your shared vision for the future. In navigating the financial intricacies of marital life, couples face the decision of whether or not to merge their finances via a joint bank account. Such accounts undeniably offer ease in managing household finances and ensuring mutual access during emergencies. The transparency fostered by joint accounts bolsters trust, commitment, and shared financial objectives. However, they come with challenges: both partners bear the brunt of financial responsibilities, diverging spending habits can lead to friction, and there's a relinquishment of individual financial privacy. For those seeking a middle ground, options like separate accounts with linked features or designated account permissions offer flexibility and autonomy. Regardless of the chosen financial arrangement, the cornerstone of a harmonious monetary partnership is open communication, setting joint goals, and regular reviews. As each couple's financial needs and comfort levels are unique, it's paramount to find the setup that best suits the relationship.Understanding Joint Accounts

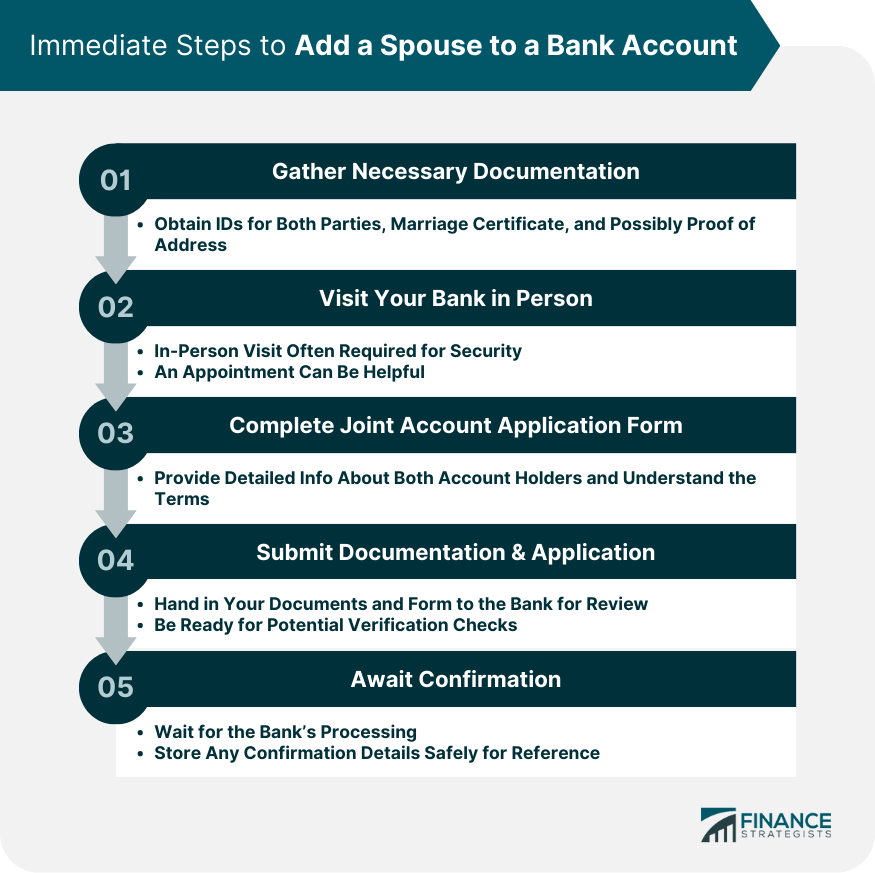

Immediate Steps to Add a Spouse to a Bank Account

Gather Necessary Documentation

Visit Your Bank in Person

Complete Joint Account Application Form

Submit the Documentation and Application Form

Await Confirmation

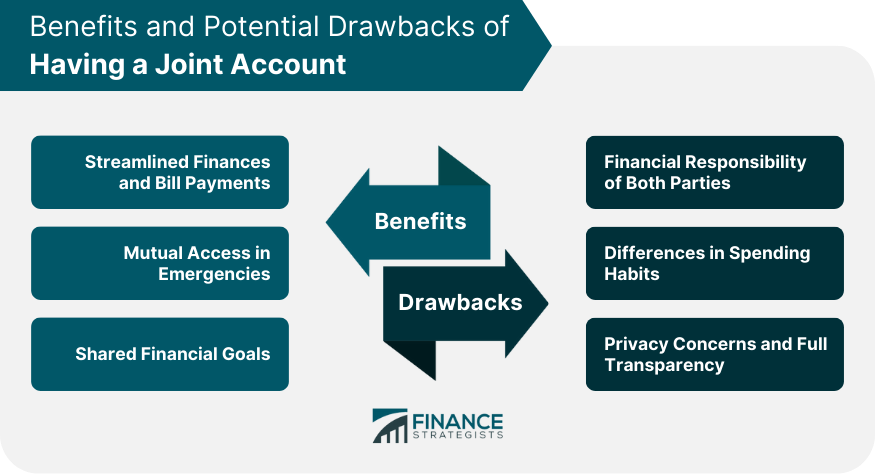

Benefits of Having a Joint Account

Streamlined Finances and Bill Payments

Mutual Access in Case of Emergencies

Shared Savings and Financial Goals

Potential Drawbacks of Having a Joint Account

Financial Responsibility of Both Parties

Differences in Spending Habits

Privacy Concerns and Full Transparency

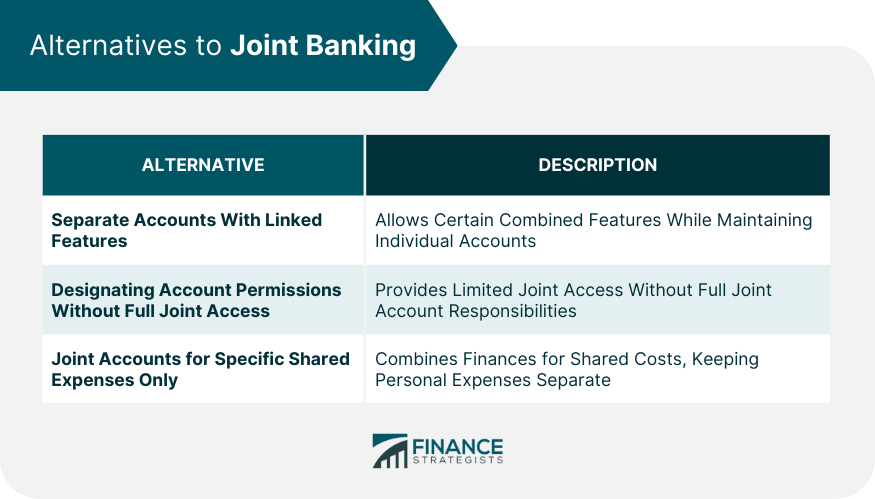

Alternatives to Joint Banking

Separate Accounts With Linked Features

Designate Account Permissions Without Full Joint Access

Use Joint Accounts for Specific Shared Expenses Only

Maintaining a Healthy Financial Relationship

Regularly Reviewing Joint Account Statements

Open Communication About Spending and Saving

Setting Joint Financial Goals and Revisiting Them

Bottom Line

How to Add a Spouse to a Bank Account FAQs

Gather the necessary documents, visit your bank, complete the application form, submit the details, and await confirmation.

Streamlined finances, mutual access during emergencies, and shared savings towards common financial goals.

Yes, it includes shared financial responsibility, differences in spending habits, and potential privacy concerns.

Options include separate accounts with linked features, designating account permissions, or joint accounts for specific shared expenses only.

Regularly review account statements, communicate openly about spending, and set joint financial goals that are revisited often.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.