Deciding whether couples should have separate bank accounts is a complex choice that depends on the unique dynamics of each relationship. On one hand, joint accounts promote transparency, demonstrating trust and fostering financial unity. They simplify bill paying and savings for common goals such as vacations, homes, or children's education. On the other hand, separate accounts allow for individual financial autonomy, can lessen potential conflicts over spending habits, and ensure privacy. They may also be beneficial in situations of financial inequality or in case of relationship breakdowns. It's crucial that couples openly communicate their financial expectations and concerns, choosing the option that best supports their mutual goals and respects individual preferences. Many couples find that a hybrid approach, maintaining a joint account for shared expenses and separate ones for personal spending, balances both unity and autonomy effectively. When couples maintain separate bank accounts, it allows for a degree of financial independence. Each individual can manage their finances without needing to discuss or justify every purchase. This independence can be liberating and foster a sense of individual autonomy, even within a partnership. Having separate bank accounts can also help minimize conflicts related to money. Different spending habits and financial priorities are common reasons for disagreements among couples. By keeping finances separate, these potential points of contention are often avoided. Separate bank accounts mean that each partner has control over their spending. This set-up can be beneficial, especially when the spending habits of partners greatly differ. Separate accounts also offer a measure of protection from any potential financial discrepancies or difficulties faced by the other partner. For instance, in the unfortunate event of debt or bankruptcy, having separate accounts can protect one partner's finances. However, having separate bank accounts can potentially create a communication gap between partners. Sharing financial decisions and bank statements is a part of open communication in a relationship, which might be less frequent with separate accounts. Separate accounts can also make handling joint expenses and investments more complicated. For example, who pays for what can become a confusing and sometimes contentious issue. There might also be a sense of financial imbalance if one partner earns significantly more than the other. This situation can potentially lead to feelings of dependency or inadequacy, exacerbating power dynamics within the relationship. Finally, in case of emergencies, accessing your partner's account might not be as straightforward if you have separate accounts. This could potentially create complications when immediate financial actions are required. A significant benefit of having a joint bank account is the transparency it brings to a relationship. Sharing an account means that both partners have a clear view of their combined income, expenditure, and savings. This transparency can encourage open discussion about money and foster trust. Joint accounts also simplify the process of managing household expenses. All shared costs, including mortgage or rent, utility bills, groceries, and more, can be paid from a single account. This arrangement saves the trouble of deciding who pays for what and avoids any potential misunderstandings. When a couple shares a bank account, it becomes easier to plan and achieve collective financial goals. Whether it's saving for a dream vacation, a new car, or a home, a joint account can help couples visually track their progress and encourage a sense of shared responsibility. Despite the benefits, joint accounts can also potentially lead to financial disagreements. For example, if one partner is a saver while the other is a spender, conflicts could arise over how the money in the joint account is used. Joint accounts can make it harder to keep track of individual spending habits. Each transaction affects the balance of the joint account, making it harder to determine who spent what and potentially leading to misunderstandings. There are also certain legal and relationship risks associated with joint accounts. In the event of a separation or divorce, dividing the assets into a joint account can be a complex and contentious process. Additionally, in case of a partner's death, the other partner could potentially face difficulties accessing the funds, depending on the banking and legal regulations in their region. The hybrid approach involves maintaining a joint account for shared expenses and investments, while also keeping separate personal accounts for individual spending. This setup allows couples to experience the benefits of both separate and joint bank accounts. In the hybrid approach, couples can decide what percentage of their income goes into the joint account for shared expenses, and what remains in their personal accounts. T his method provides financial transparency, facilitates shared financial goals, and still preserves individual financial autonomy. One of the potential downsides to the hybrid approach is that it can complicate finances. Couples will need to manage three accounts instead of one or two, which might require additional time and organization. The division of money into separate and joint accounts also requires regular attention and management. For some couples, this could be a time-consuming process that they would rather avoid. Deciding between separate, joint, or hybrid bank accounts is a deeply personal decision and should be based on the unique dynamics of each relationship. Here are some factors to consider: Assess your individual financial habits. If one person is more conservative with their spending and the other is more liberal, separate accounts or the hybrid approach might be better suited to manage these differences. If there is a significant income disparity between partners, having a joint account or a hybrid approach where contributions are proportional to income could be an equitable solution. Consider your shared future financial goals. If you're planning for large shared expenses or investments (such as buying a house), a joint account or the hybrid approach can facilitate these shared goals. Evaluate your comfort level with financial transparency. If both partners are comfortable sharing all financial transactions, a joint account could work well. If more financial privacy is desired, separate accounts or a hybrid approach might be more suitable. Deciding between separate, joint, or hybrid bank accounts is an intricate matter, reflecting the unique financial dynamics and values within each relationship. Joint accounts, while fostering transparency, trust, and simplifying shared expenses, can sometimes become a source of contention due to divergent spending habits. On the other hand, separate accounts uphold individual autonomy but may introduce potential barriers to communication and joint financial ventures. The hybrid approach appears as a middle ground, amalgamating the best of both worlds, though not without its own complexities. Ultimately, the key lies in open communication, an honest evaluation of individual financial habits, income dynamics, shared goals, and comfort levels with transparency. Choosing an account structure is not just about practicality, but also about mutual respect and understanding. Seek expert banking advice tailored to your unique circumstances. Explore the diverse banking services available today to make an informed choice for your future.Deciding Whether Couples Should Have Separate Bank Accounts

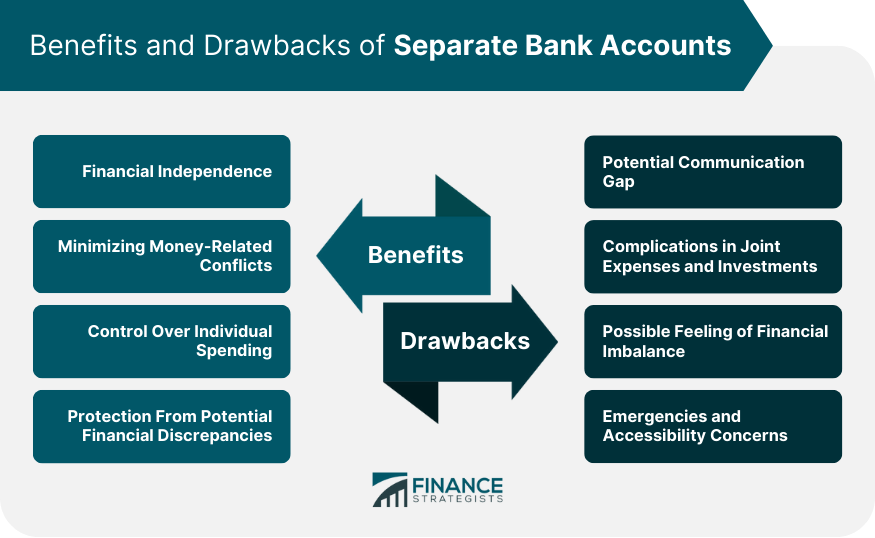

Benefits and Drawbacks of Separate Bank Accounts

Benefits of Having Separate Bank Accounts

Financial Independence

Minimizing Money-Related Conflicts

Control Over Individual Spending

Protection From Potential Financial Discrepancies

Drawbacks of Having Separate Bank Accounts

Potential Communication Gap

Complications in Joint Expenses and Investments

Possible Feeling of Financial Imbalance

Emergencies and Accessibility Concerns

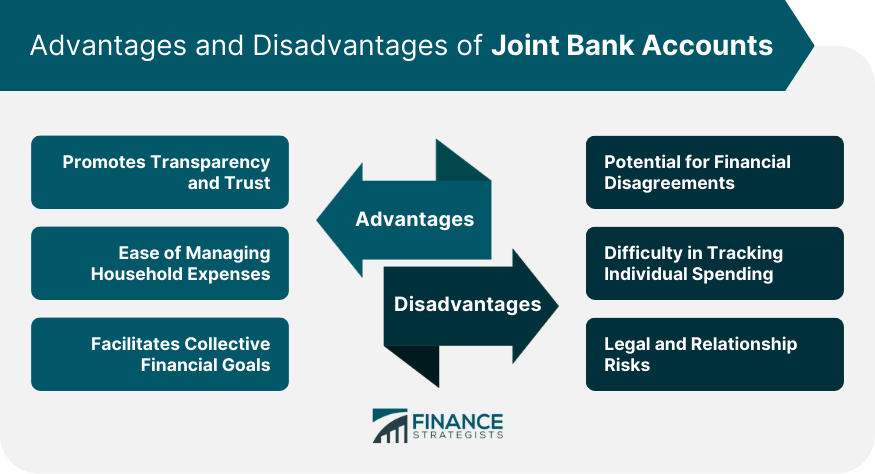

Advantages and Disadvantages of Joint Bank Accounts

Advantages of Joint Bank Accounts

Promotes Transparency and Trust

Ease of Managing Household Expenses

Facilitates Collective Financial Goals

Disadvantages of Joint Bank Accounts

Potential for Financial Disagreements

Difficulty in Tracking Individual Spending

Legal and Relationship Risks

Understanding the Hybrid Approach

Concept and Benefits of a Hybrid Approach

Combination of Joint and Separate Accounts

Allocation of Funds

Potential Downsides of the Hybrid Approach

Complication of Finances

Time-Consuming Money Management

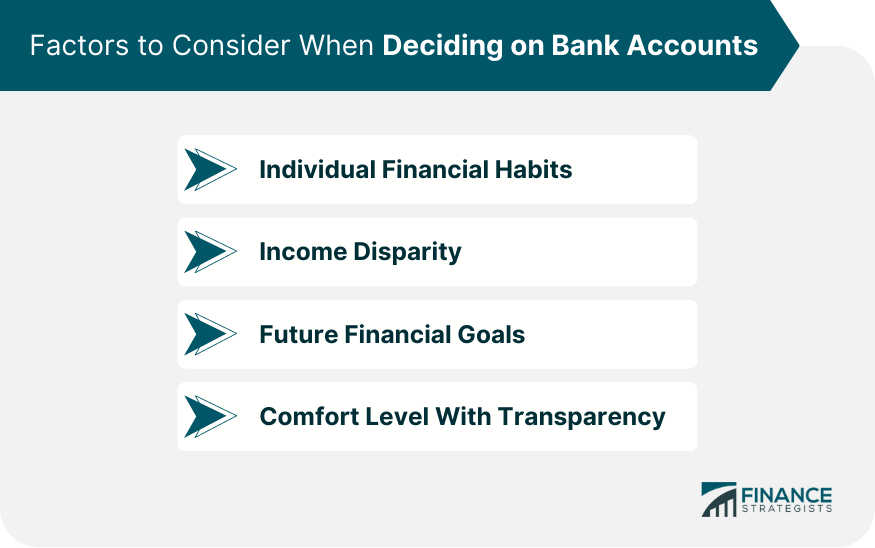

Factors to Consider When Deciding on Bank Accounts

Individual Financial Habits

Income Disparity

Future Financial Goals

Comfort Level With Transparency

Bottom Line

Should Couples Have Separate Bank Accounts? FAQs

There's no definitive answer as it depends on factors like income disparity, future financial goals, and individual spending habits.

Separate bank accounts provide financial independence, minimize money-related conflicts, and offer protection from financial discrepancies.

Joint bank accounts promote financial transparency, simplify managing household expenses, and facilitate achieving collective financial goals.

The hybrid approach involves maintaining both a joint account for shared expenses and separate personal accounts for individual spending.

Couples should consider individual financial habits, income disparity, future financial goals, and their comfort level with financial transparency.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.