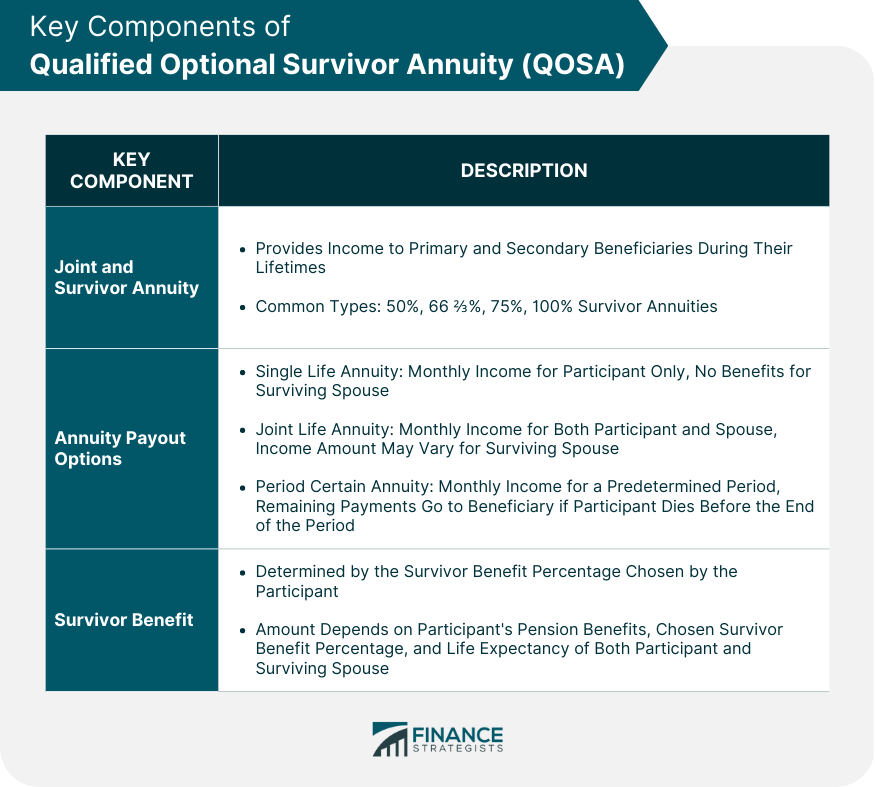

QOSA is a type of annuity payout option available in certain pension plans, providing financial protection to the surviving spouse of a pension plan participant after the participant's death. QOSA ensures that the surviving spouse receives a predetermined portion of the participant's pension benefits for the remainder of their life. The primary purpose of a QOSA is to safeguard the financial well-being of the surviving spouse after the death of the pension plan participant. This financial protection is critical for spouses who may not have sufficient retirement savings or income sources of their own. QOSA is a component of qualified pension plans regulated under the Employee Retirement Income Security Act and the Internal Revenue Code. It is an option that can be selected by participants in these plans to ensure that their spouse continues to receive benefits after their death. A joint and survivor annuity is a type of annuity payout that provides income to both the primary beneficiary (the pension plan participant) and a secondary beneficiary (typically the participant's spouse) during their respective lifetimes. There are different types of joint and survivor annuities, with varying percentages of the primary annuity paid to the surviving spouse. Common types include 50%, 66 ⅔%, 75%, and 100% survivor annuities. A single life annuity provides a monthly income to the pension plan participant for their lifetime. However, no benefits are paid to a surviving spouse upon the participant's death. A joint life annuity provides a monthly income to both the pension plan participant and their spouse for their respective lifetimes. The income amount can be the same or reduced for the surviving spouse, depending on the plan's terms. A period certain annuity provides a monthly income to the pension plan participant for a predetermined period (e.g., 10, 15, or 20 years). If the participant dies before the end of the specified period, the remaining payments are made to their beneficiary. The survivor benefit percentage determines the portion of the primary annuity paid to the surviving spouse after the participant's death. This percentage is typically chosen by the participant when selecting the QOSA option. The survivor benefit amount depends on the participant's pension benefits, the chosen survivor benefit percentage, and the life expectancy of both the participant and the surviving spouse. Married participants in qualified pension plans are generally eligible for QOSA. The pension plan must offer QOSA as an option for participants to select. Certain pension plans may exclude some participants from QOSA eligibility based on specific criteria, such as age or years of service. Pension plan administrators are required to notify participants of their QOSA options and provide relevant information to help them make informed decisions. Participants who wish to select a QOSA option must obtain written consent from their spouse. Alternatively, the spouse may waive their right to the QOSA benefit, allowing the participant to choose a different payout option. Participants must elect the QOSA option within a specified timeframe, typically during a designated election period prior to their retirement date or pension plan distribution. Life insurance policies can provide financial protection for the surviving spouse in the event of the participant's death, offering a potential alternative to QOSA. Participants may consider saving for retirement through IRAs, which can provide a source of income for the surviving spouse after the participant's death. Non-qualified annuities offer flexible payout options and may provide an additional source of retirement income for the surviving spouse. ERISA sets forth the legal requirements for QOSA, including eligibility criteria, disclosure obligations, and spousal consent provisions. The IRC provides tax-related guidelines for QOSA, such as tax-deferral rules and minimum distribution requirements. The DOL and IRS are responsible for overseeing and enforcing the compliance of pension plans with QOSA regulations. QOSA ensures that the surviving spouse receives a portion of the participant's pension benefits, providing financial security and stability during their lifetime. QOSA payments to the surviving spouse are generally tax-deferred, which may result in lower overall tax liability compared to other income sources. Participants can choose the appropriate survivor benefit percentage based on their financial goals and their spouse's needs, allowing for greater flexibility and control over retirement planning. QOSA provides peace of mind to both the participant and their spouse, knowing that the surviving spouse will receive financial support after the participant's death. Selecting a QOSA option may result in lower monthly income for the pension plan participant during their lifetime, as a portion of their benefits will be reserved for the surviving spouse. Once a QOSA option is selected, it typically cannot be changed or revoked. This may limit the participant's ability to adjust their retirement plans if their financial needs or circumstances change. Choosing a QOSA may affect the participant's overall retirement planning strategy especially for late starters, including the distribution of other retirement assets or benefits. Understanding the Qualified Optional Survivor Annuity is crucial for married pension plan participants looking to ensure their spouse's financial security after their death. The key components of QOSA include joint and survivor annuities, annuity payout options, and survivor benefits. In evaluating QOSA options, participants must balance their own retirement income requirements with the financial needs of their surviving spouse. This involves understanding the trade-offs between reduced income during their lifetime and the security provided to their spouse through the QOSA benefit. Moreover, participants should consider alternative financial planning tools, such as life insurance policies, individual retirement accounts (IRAs), and non-qualified annuities, when crafting their retirement strategy. Given the complexity of QOSA and its potential impact on retirement planning, participants are encouraged to seek guidance from financial advisors, insurance brokers, or other professionals in tax services. These experts can help navigate the legal and regulatory framework surrounding QOSA, including the Employee Retirement Income Security Act and Internal Revenue Code requirements, as well as provide tailored advice based on each participant's unique financial situation and goals.What Is a Qualified Optional Survivor Annuity (QOSA)?

Key Components of QOSA

Joint and Survivor Annuity

Annuity Payout Options

Single Life Annuity

Joint Life Annuity

Period Certain Annuity

Survivor Benefit

Eligibility and Enrollment

Eligible Participants

Married Participants in Qualified Retirement Plans

Exceptions and Exclusions

Enrollment Process

Notification and Disclosure Requirements

Spousal Consent and Waiver

Deadline for Election

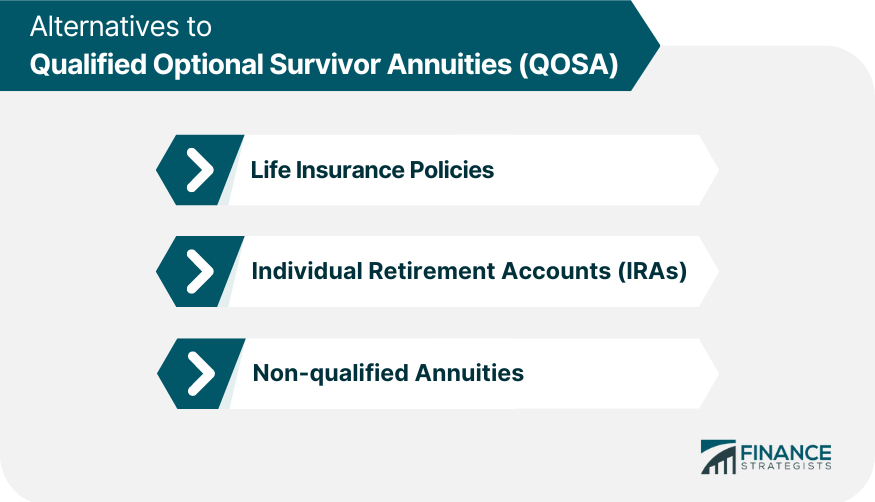

Alternatives to Qualified Optional Survivor Annuity (QOSA)

Life Insurance Policies

Individual Retirement Accounts (IRAs)

Non-qualified Annuities

Legal and Regulatory Framework

Employee Retirement Income Security Act (ERISA)

Internal Revenue Code (IRC) Requirements

Role of the Department of Labor (DOL) and Internal Revenue Service (IRS)

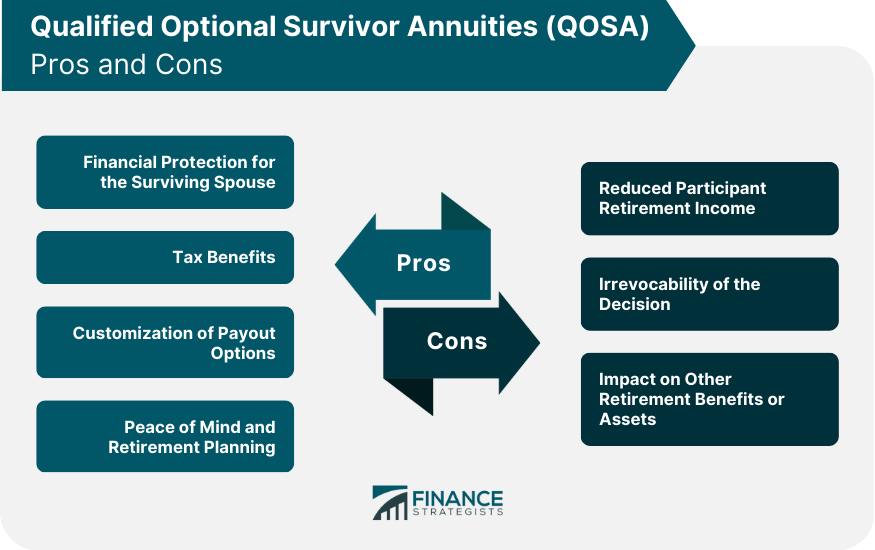

Advantages of Qualified Optional Survivor Annuity (QOSA)

Financial Protection for the Surviving Spouse

Tax Benefits

Customization of Payout Options

Peace of Mind and Retirement Planning

Disadvantages of Qualified Optional Survivor Annuity (QOSA)

Reduced Participant Retirement Income

Irrevocability of the Decision

Impact on Other Retirement Benefits or Assets

Final Thoughts

Qualified Optional Survivor Annuity (QOSA) FAQs

QOSA is a retirement plan feature that provides financial protection to the surviving spouse or beneficiary of a plan participant. It allows participants to elect to receive a lower monthly benefit in exchange for providing their spouse with a survivor benefit in the event of their death.

To be eligible for QOSA, the participant must be married and have a spouse. The spouse must consent to the election of QOSA. The eligibility criteria may vary by plan, but typically include factors such as age, service credit, and other plan-specific criteria.

The primary benefit of QOSA is that it provides income protection for survivors, ensuring that the surviving spouse or beneficiary receives a portion of the participant's retirement benefits after their death. It may also provide tax benefits and be a valuable retirement income planning tool.

One of the main disadvantages of QOSA is that it may reduce the monthly retirement income received by the annuitant. It may also limit the annuitant's flexibility in retirement planning and may have expensive QOSA premiums. Limitations to eligibility for QOSA may also apply.

Participants should consider several important factors, including the cost of QOSA premiums, their personal financial situation, the age and health of the annuitant and spouse, the impact on retirement income, and other sources of income and support. Participants should evaluate whether the reduction in monthly benefit is worth the survivor benefit provided by QOSA.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.