Divorce can significantly impact a person's retirement goals. When a couple separates, their retirement plans may change, and their retirement goals may need to be adjusted. The financial impact of a divorce can be substantial, and it can take years for a person to recover financially. One of the most significant impacts of divorce on retirement goals is the loss of retirement assets. If a couple has retirement assets, such as 401(k) plans or IRAs, the assets may be divided between the spouses, reducing the amount each spouse has for retirement. Additionally, if one spouse was not working during the marriage, they may have a smaller retirement nest egg than they anticipated. Divorce can also impact a person's ability to save for retirement. After a divorce, a person may have higher living expenses, such as rent or mortgage payments, and may need to support themselves on a single income. This can make it difficult for them to save for retirement, especially if they are also responsible for paying child support or alimony. During the divorce process, it is essential to accurately identify and value all retirement assets to ensure a fair division between both parties. Retirement assets can include various types of accounts and plans, such as: 1. Pensions: Employer-sponsored defined benefit plans that provide a fixed income during retirement. 2. 401(k) and 403(b) Plans: Employer-sponsored defined contribution plans that allow employees to contribute a portion of their salary to a retirement account, often with an employer match. 3. Individual Retirement Accounts (IRAs): Tax-advantaged retirement accounts that can be opened by individuals, with contributions subject to annual limits. 4. Annuities: Financial products purchased from insurance companies that guarantee a steady income stream during retirement. To determine the value of these assets, consider the current account balances, vested amounts, and any expected future contributions or growth. Retirement assets are generally divided according to state laws, which fall into two categories: 1. Equitable Distribution: Assets are divided fairly but not necessarily equally, considering factors such as the length of the marriage, each spouse's income and earning potential, and contributions to the marriage. 2. Community Property: Assets acquired during the marriage are considered jointly owned and are typically divided equally between the spouses. A Qualified Domestic Relations Order (QDRO) may be required to divide retirement assets, such as pensions and 401(k) plans, without incurring taxes or penalties. Divorce often necessitates a reassessment of financial goals and retirement plans to account for changes in income, expenses, and assets. Post-divorce, it is important to evaluate your financial goals and the time remaining until retirement. Consider factors such as your age, career trajectory, and life expectancy to determine a realistic retirement age and the amount of savings needed to maintain your desired lifestyle. Revise your retirement income projections to account for the division of assets, changes in income, and potential support payments. Ensure that your projections include income from Social Security, pensions, annuities, and withdrawals from retirement accounts. Divorce often leads to significant lifestyle changes, such as downsizing or relocating, which can affect your retirement expenses. Adjust your retirement budget to account for these changes and any ongoing financial obligations, such as spousal or child support. Spousal and child support payments can have long-term implications for retirement planning. Consider how these obligations may affect your ability to save for retirement and factor them into your financial projections. Adapting your retirement strategies in light of your new financial situation is crucial to ensuring a secure retirement. To compensate for the division of retirement assets, you may need to increase your savings rate to achieve your retirement goals. Consider options such as maximizing employer-sponsored retirement plan contributions, opening or contributing to an IRA, or investing in a taxable brokerage account. Reevaluate your investment portfolio's asset allocation and risk tolerance in light of your new financial situation and revised retirement goals. You may need to adjust the balance of stocks, bonds, and other investments to align with your risk tolerance, time horizon, and financial objectives. Divorce typically results in a change in filing status, which can affect your tax liability. Review your tax situation to determine the most advantageous filing status and adjust your withholding allowances as necessary. Plan for tax-efficient withdrawals from your retirement accounts to minimize the impact of taxes on your retirement income. Consider the tax treatment of different types of accounts (e.g., traditional IRAs, Roth IRAs, and taxable accounts). Develop a withdrawal strategy to optimize your after-tax income. If you were married for at least ten years, you may be eligible for Social Security benefits based on your ex-spouse's earnings record. Evaluate your options for claiming benefits, including whether to claim on your own record or your ex-spouse's and the timing of your claim. The age at which you claim Social Security benefits can significantly impact your monthly income. Consider factors such as your life expectancy, financial needs, and potential spousal benefits when deciding when to claim benefits. After a divorce, it is essential to review and update your estate plan to ensure that your assets are distributed according to your wishes and to minimize potential conflicts. Review and update the beneficiary designations on your retirement accounts and life insurance policies to ensure that they reflect your current wishes. Update your will and any trusts to reflect your new circumstances, including changes in asset ownership and the appointment of new executors or trustees. Ensure that your powers of attorney for financial and healthcare decisions and any advance directives (e.g., living wills or healthcare proxies) are updated to reflect your current preferences and appoint appropriate agents. Navigating the complexities of retirement planning during and after divorce can be challenging. Consider seeking the guidance of experienced professionals to ensure a secure financial future. A financial advisor can help you assess your financial situation, develop a personalized retirement plan, and recommend suitable investment strategies. An attorney specializing in divorce can provide legal advice and representation during the divorce process, including negotiating the division of assets and drafting necessary legal documents. CDFAs are financial professionals who specialize in divorce-related financial planning. They can help you understand the financial implications of divorce and develop strategies to protect your retirement assets. A tax professional can assist you in navigating the tax implications of divorce and recommend strategies to minimize your tax liability during and after the divorce process. Divorce can have significant financial implications on retirement planning. It is essential to understand the impact of divorce on retirement goals and adjust them accordingly. During the divorce process, accurately identifying and valuing all retirement assets is crucial to ensure a fair division between both parties. Furthermore, reassessing financial goals, updating retirement income projections, and considering lifestyle changes and expenses are necessary to develop a realistic retirement plan. Revising retirement strategies, such as increasing the savings rate, adjusting asset allocation and risk tolerance, and planning for tax-efficient retirement withdrawals, can help compensate for the division of retirement assets. Additionally, understanding the impact of spousal and child support payments and revising estate planning considerations are crucial to ensuring a secure financial future. Seeking the guidance of experienced professionals, such as financial advisors, divorce attorneys, certified divorce financial analysts, and tax professionals, can also be beneficial in navigating the complexities of retirement planning during and after divorce. Overall, taking the necessary steps to address divorce's financial implications on retirement planning can lead to a more secure financial future.Impact of Divorce on Retirement Goals

Evaluating Retirement Assets

Identifying and Valuing Retirement Assets

Understanding the Division of Retirement Assets

Adjusting Retirement Goals

Reassessing Financial Goals and Time Horizon

Updating Retirement Income Projections

Considering Lifestyle Changes and Expenses

Understanding the Impact of Spousal and Child Support

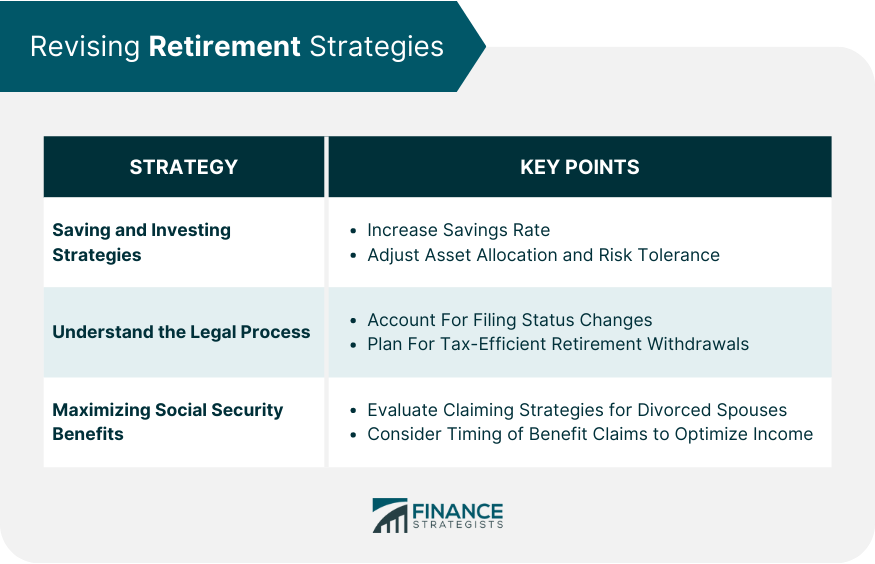

Revising Retirement Strategies

Saving and Investing Strategies

Increasing Savings Rate

Adjusting Asset Allocation and Risk Tolerance

Tax Implications and Strategies

Filing Status Changes

Tax-Efficient Retirement Withdrawals

Maximizing Social Security Benefits

Claiming Strategies for Divorced Spouses

Timing of Benefit Claims

Estate Planning Considerations

Updating Beneficiary Designations

Revising Wills and Trusts

Reviewing and Updating Powers of Attorney and Advance Directives

Seeking Professional Assistance

Financial Advisors

Divorce Attorneys

Certified Divorce Financial Analysts (CDFAs)

Tax Professionals

Conclusion

Retirement and Divorce Considerations FAQs

Retirement and divorce considerations can significantly impact your retirement savings and goals, as the division of assets may reduce your retirement savings, and changes in income and expenses may require adjustments to your financial objectives. Carefully evaluating your new financial situation and revising your retirement strategies are crucial steps to ensure a secure financial future.

When dividing retirement assets during a divorce, important considerations include accurately identifying and valuing all retirement assets, understanding the applicable state laws governing the division of assets (equitable distribution or community property), and obtaining a Qualified Domestic Relations Order (QDRO) if necessary to divide certain retirement assets without incurring taxes or penalties.

To adjust your retirement plans based on retirement and divorce considerations, reassess your financial goals and time horizon, update your retirement income projections, consider lifestyle changes and expenses, and understand the impact of spousal and child support. You may also need to revise your saving and investing strategies, tax planning, and Social Security claiming strategies.

Retirement and divorce considerations necessitate reviewing and updating your estate plan, including updating beneficiary designations on retirement accounts and life insurance policies, revising wills and trusts, and reviewing and updating powers of attorney and advance directives to ensure your assets are distributed according to your wishes and your chosen agents are up to date.

Professional assistance, such as financial advisors, divorce attorneys, Certified Divorce Financial Analysts (CDFAs), and tax professionals, can help you navigate the complex financial implications of retirement and divorce considerations. They can provide guidance on dividing retirement assets, adjusting retirement goals and strategies, understanding tax implications, and ensuring a secure financial future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.