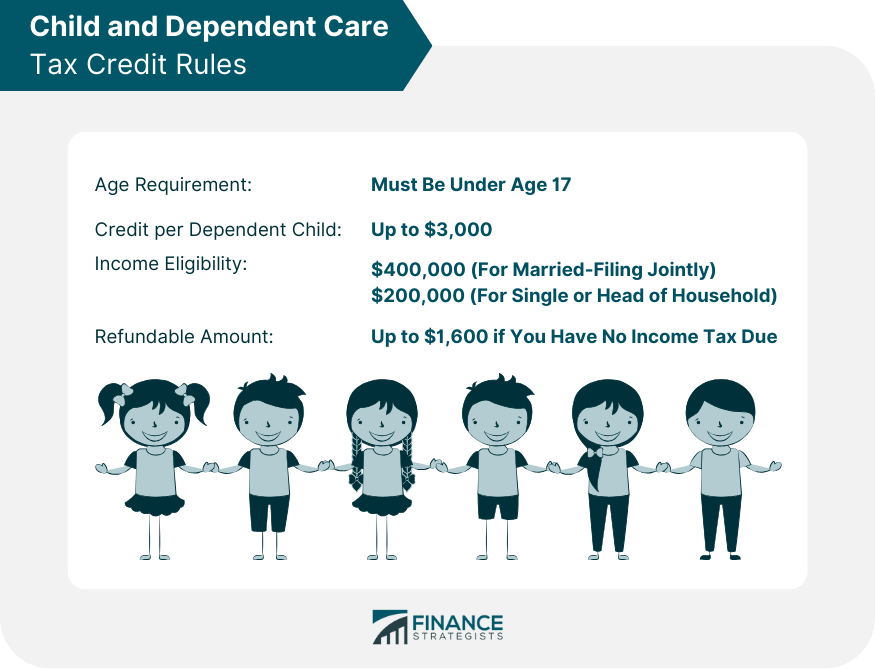

Child support is a legal responsibility that mandates one parent to contribute financially to the needs of their child or children following divorce or separation. It is intended to cover costs involved with raising a child, which include food, housing, transportation, clothes, and standard educational fees. The child support process starts in two ways: when you apply for child support services or when another public assistance program sends a referral to your local child support office. Each state approaches child support legislation and calculation differently, but it is generally based on gross incomes, financial capacity, and particular circumstances of parents. The Internal Revenue Service (IRS) stipulates that child support is not taxable. The parent who receives child support is not required to pay taxes on the payments. The custodial parent is using the money to support the child and not using it for personal gain, so the IRS does not consider it taxable income. If you are receiving around $5,000 per year as child support, there is no need to indicate this amount in your total annual income. The parent who pays child support must report the total amount of their income on their tax return. Child support payments are not deducted from gross income. Child support is seen as a personal expense under tax guidelines. Thus, it cannot be written off as a business expense. It remains so regardless of how many children the parent supports or how much overall assistance is given. In certain conditions, the noncustodial parent paying child support may take advantage of the common possible credits and deductions. IRS Form 8332. This form is used when a divorce or separate support agreement indicates that a noncustodial parent may claim the dependent children. In general, only the parent with primary custody may claim the child as a dependent. However, suppose the custodial parent gives the noncustodial parent a written and signed statement giving them that right. In that case, the child could be declared dependent. Child and Dependent Care Tax Credit. This tax credit may help you pay for the support and care of eligible children. Only one parent can claim under the condition that the income is below the benefit threshold. For 2024, the following rule applies: You can consult with a tax accountant to confirm the tax benefits available for your specific situation. Child support is a legal duty that requires one parent to contribute financially to the needs of their child or children following divorce or separation. Child support payments are neither deductible for the payer nor taxable income for the recipient since these payments are regarded as personal expenses. In some cases, the noncustodial parent can take advantage of some credits and deductions, such as claiming the dependent children. Such credit helps pay for child care if the parent’s income is low. The federal law on child support reinforces that they have the same obligations towards their children, even if they are no longer living together.Child Support Overview

Is Child Support Taxable?

Is Child Support Tax Deductible?

Is There Any Tax Benefit Available?

Final Thoughts

Is Child Support Taxable or Tax-Deductible? FAQs

A child support order is necessary to ensure that both parents financially support their child. This court order provides stability and peace of mind for both the custodial and noncustodial parent and helps ensure the child's needs are met.

The child support order amount is based on several factors, including each parent's income and custody arrangement. The calculation is provided by each state for the parents and is based on their gross incomes, taking deductions such as health and work-related child care into account.

No, the parent who pays child support cannot deduct the payments on their taxes. The party paying child support must report the entire income on their tax return and cannot deduct child support payments.

No, the parent who receives child support does not have to pay taxes on the payments. The custodial parent is using the money to support the child.

Most states terminate child support responsibilities when a child reaches the age of majority, usually at 18 years old, but it depends on the state or when they complete high school. Other states extend until the child reaches the age of 21 or even longer if they are enrolled in a post-secondary institution or have a disability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.