International Asset Protection Trusts, or IAPTs, are legal structures set up in offshore jurisdictions. They provide a robust layer of protection for assets against potential future creditors and litigants, making them an essential part of strategic wealth planning. The history of IAPTs dates back to the mid-20th century, evolving from the concept of trusts in English law. The primary purpose of these instruments is to secure assets from potential threats such as legal judgments, bankruptcy, or divorce proceedings. IAPTs have become an integral part of modern financial planning. They are increasingly employed by high net-worth individuals and families to secure their wealth against unforeseen financial downturns and potential creditor claims. Trusts, including IAPTs, are predominantly a feature of common law jurisdictions. Civil law jurisdictions traditionally do not recognize the division of ownership inherent in the trust structure. The principle of fraudulent conveyance refers to the transfer of property with the intent to hinder, delay, or defraud creditors. Duress is a concept wherein actions are taken under coercion or pressure, which can be invoked in the establishment of an IAPT. The Statute of Elizabeth, a historical legal provision, is often considered when examining the legality of IAPTs. It provided the basis for the fraudulent conveyance laws that exist today. Each jurisdiction has unique laws and regulations for IAPTs, often designed to attract trust business from abroad. Understanding these is crucial for anyone considering an IAPT. Asset Protection: IAPTs offer significant asset protection against creditors and litigants, hence their name. Estate Planning Benefits: IAPTs can be used to ensure an efficient transfer of wealth to the next generation, making them a powerful tool for estate planning. Tax Benefits: In some jurisdictions, IAPTs may offer tax advantages, depending on the country of the settlor's and beneficiaries' residence. Confidentiality and Privacy: IAPTs often offer a high degree of confidentiality and privacy, protecting the settlor's identity and the details of the trust assets. Flexibility and Control: IAPTs can be customized to suit the unique needs of the settlor, offering flexibility and control over assets. Legal Risks: There is a risk that courts in the settlor's home country may not recognize or enforce the IAPT, potentially leaving the assets exposed to creditors. Reputational Risks: Establishing an IAPT may raise questions about the settlor's financial integrity, and they may face reputational damage as a result. Financial Risks: The costs of setting up and maintaining an IAPT can be significant, and there is always a risk that the expected benefits may not materialize. Ethical and Moral Considerations: There are ethical and moral questions surrounding the use of IAPTs, particularly in cases where they are used to avoid legitimate claims from creditors or to evade taxes. The Cook Islands were the first jurisdiction to establish specific legislation for IAPTs and remain a popular choice. Nevis offers robust protection for IAPTs and is known for its stringent privacy laws. Belize offers a cost-effective jurisdiction for IAPTs with strong asset protection laws. The Isle of Man is a reputable jurisdiction for IAPTs, offering a combination of strong protection and high-quality professional services. Each jurisdiction has its strengths and weaknesses, and choosing the right one depends on the unique circumstances of the settlor. The selection of trustworthy and competent trustees is a crucial step in setting up an IAPT. The process of transferring assets into the trust, known as funding, must be done with careful consideration to avoid potential legal challenges. A trust deed is a legal document that sets out the terms and conditions of the IAPT, while a letter of wishes provides guidance to the trustees on how the settlor would like the trust assets to be managed and distributed. It is essential to consider the legal and financial implications of setting up an IAPT, including understanding the tax consequences, reporting requirements, and potential challenges from creditors. IAPTs are powerful tools for asset protection and estate planning. Choosing the right jurisdiction and understanding the legal and financial implications are essential for success. While there are risks and criticisms, a well-structured IAPT can offer significant benefits. In an increasingly complex and litigious world, IAPTs remain a valuable tool for those seeking to protect their assets and ensure a secure financial future for themselves and their families. IAPTs are a complex area of wealth management and require careful consideration and professional advice. It is recommended that anyone interested in setting up an IAPT consult with experienced legal and financial professionals to ensure the best possible outcome.What Are International Asset Protection Trusts (IAPTs)?

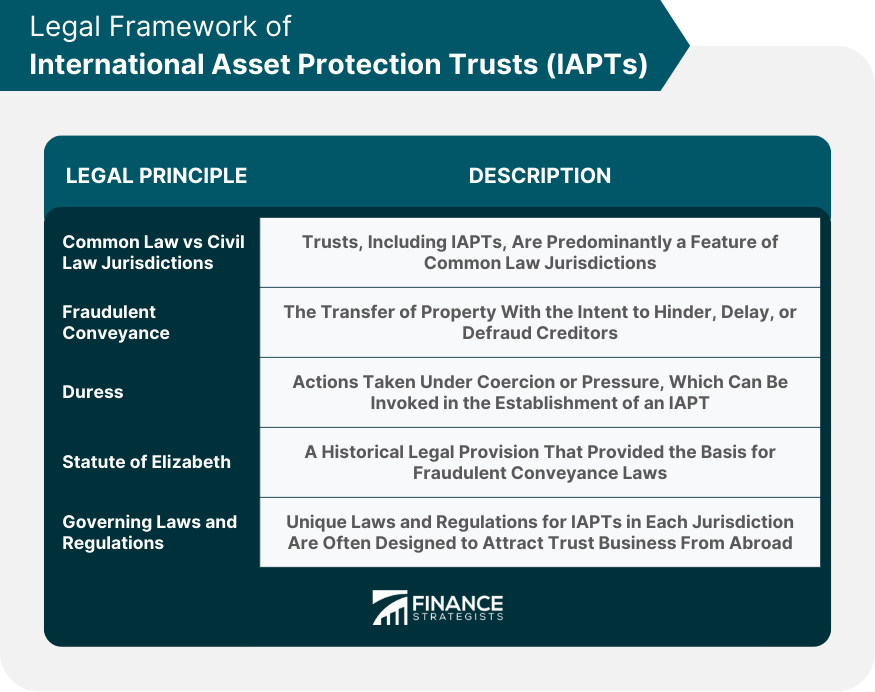

Legal Framework of IAPTs

Common Law vs Civil Law Jurisdictions

Key Legal Principles Underpinning IAPTs

Fraudulent Conveyance

Duress

Statute of Elizabeth

Governing Laws and Regulations for IAPTs

Benefits and Features of IAPTs

Risks and Criticisms of IAPTs

Jurisdictions for IAPTs

Offshore Jurisdictions

Cook Islands

Nevis

Belize

Isle of Man

Evaluation of Jurisdictional Strengths and Weaknesses

Setting up an IAPT

Selection of Trustees

Funding the Trust

Trust Deed and Letter of Wishes

Legal and Financial Considerations

The Bottom Line

International Asset Protection Trusts (IAPTs) FAQs

International Asset Protection Trusts (IAPTs) are legal structures set up in offshore jurisdictions to protect assets from potential creditors and litigants. They are important for wealth management as they offer a robust layer of protection and can play a crucial role in estate planning and tax optimization.

IAPTs can be established in several offshore jurisdictions, including the Cook Islands, Nevis, Belize, and the Isle of Man. Each jurisdiction has its strengths and weaknesses, so it is essential to carefully evaluate them based on your unique needs and circumstances.

The key benefits of IAPTs include asset protection against creditors and litigants, estate planning benefits, potential tax advantages, confidentiality and privacy, and flexibility and control over assets.

The risks and criticisms associated with IAPTs include legal risks, such as the possibility that courts in the settlor's home country may not recognize or enforce the IAPT, reputational risks, financial risks, and ethical and moral considerations, particularly if they are used to avoid legitimate claims or evade taxes.

Setting up an IAPT involves selecting a suitable jurisdiction, choosing competent trustees, funding the trust with assets, and creating a trust deed and letter of wishes. It is essential to consult with experienced legal and financial professionals to navigate the complex legal and financial implications associated with IAPTs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.