Trust funds are an essential tool for many people who want to ensure their assets are managed and distributed according to their wishes. A trust fund is a legal entity that holds and manages assets on behalf of one or more beneficiaries. The trust is created by a grantor, who transfers assets to the trust, and is managed by a trustee, who is responsible for administering the trust according to the terms of the trust agreement. The beneficiaries are the individuals who receive the benefits of the trust, such as income, principal, or other assets.

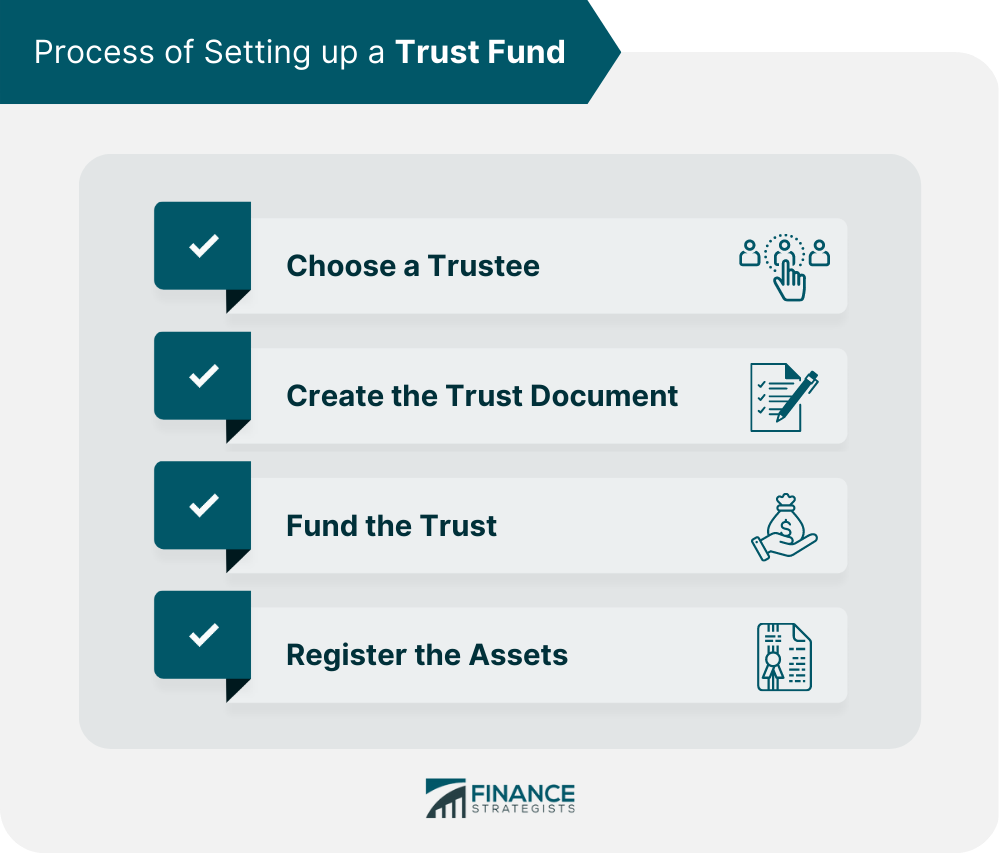

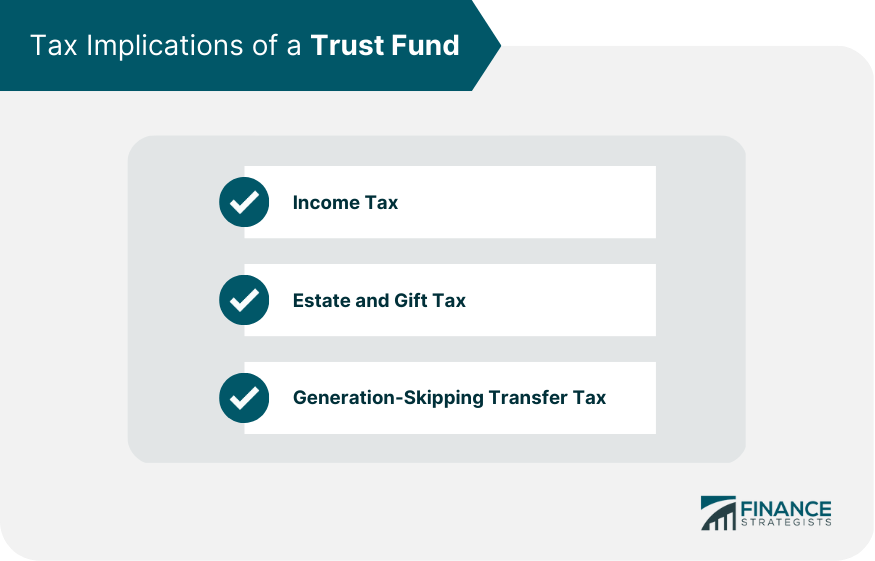

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Once, I guided a couple through setting up a trust fund for their daughter's education. Initially overwhelmed by options, they were concerned about ensuring the fund's security and purpose. By selecting a revocable trust and clearly defining the distribution conditions for educational expenses only, we created a flexible yet secure financial safeguard. This approach not only eased their worries but also introduced them to the benefits of early, targeted financial planning, highlighting the trust's adaptability to their evolving needs. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation Setting up a trust fund involves several steps, including choosing a trustee, creating the trust document, and funding the trust. The trustee is the one responsible for managing the trust assets and distributing the trust income and principal to the beneficiaries in accordance with the terms of the trust agreement. Trustees adhere to their fiduciary duty, acting in the beneficiary's best interest and following the instructions in the trust document. The chosen trustee can be a corporate trustee, such as a bank or an individual. Choose a trustee who is trustworthy, knowledgeable, and able to manage the trust assets effectively. The trust document is the legal document that establishes the trust and sets out the terms and conditions under which the trust will operate. The essential elements of a trust document include the name of the trust, the identity of the grantor and trustee, the identity of the beneficiaries, the purpose of the trust, the distribution of income and principal, and any special provisions or conditions. The trust document must comply with the legal requirements of the state in which it is established. The document should be prepared by an attorney who is experienced in trust and estate planning. The trust can be funded with various types of assets, including cash, stocks, bonds, real estate, and personal property. It is important to transfer the assets to the trust properly and to ensure that the assets are titled and registered in the name of the trust. The assets must be titled and registered in the name of the trust to ensure that they are owned by the trust and not the grantor. This involves changing the ownership of the assets and updating the beneficiary designations, if applicable. Setting up a trust fund can have tax implications, including income tax, estate tax and gift tax, and generation-skipping transfer tax. The trust is a separate legal entity for tax purposes and must file its own tax return. The trust income is taxed at the trust tax rates, which are generally higher than individual tax rates. The estate and gift tax applies to transfers of property during life or at death. The grantor's estate may be subject to estate tax if the total value of their assets exceeds the estate tax exemption amount. The gift tax applies to transfers of property during the grantor's lifetime and is subject to the gift tax exemption amount. The generation-skipping transfer tax applies to transfers of property to a skip person, who is two or more generations below the grantor, such as a grandchild or great-grandchild. The tax is designed to prevent the avoidance of estate and gift taxes. Setting up and maintaining a trust fund can involve several costs, including initial costs and ongoing fees and expenses. The cost of preparing the trust document can vary depending on the complexity of the trust and the attorney's fees. The cost may include drafting the trust document, transferring assets to the trust, and updating beneficiary designations. The cost of hiring a professional trustee must also be considered. The trustee's fees may include investment management fees, administrative fees, and trustee fees. The trustee's fees may include investment management fees, administrative fees, and trustee fees. The fees can vary depending on the size of the trust and the services provided. The investment management fees may include fees charged by the investment manager, such as a financial advisor or investment company, for managing the trust assets. The administrative expenses include expenses for maintaining the trust, such as legal and accounting fees, tax preparation fees, and record-keeping expenses. Setting up a trust fund is an important step in ensuring that your assets are managed and distributed according to your wishes. There are several types of trust funds, including revocable trusts, irrevocable trusts, testamentary trusts, living trusts, and special needs trusts. The process of setting up a trust fund involves several steps, including choosing a trustee, creating the trust document, and funding the trust. There are tax implications associated with setting up a trust fund, including income tax, estate and gift tax, and generation-skipping transfer tax. Finally, setting up and maintaining a trust fund can involve several costs, including initial costs and ongoing fees and expenses. It is important to work with an experienced estate planning attorney to ensure that your trust fund is set up properly and meets your needs.What Is a Trust Fund?

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Process of Setting up a Trust Fund

Choose a Trustee

Create the Trust Document

Fund the Trust

Register the Assets

Tax Implications of a Trust Fund

Income Tax

Estate and Gift Tax

Generation-Skipping Transfer Tax

Costs of Setting up and Maintaining a Trust Fund

Initial Costs

Ongoing Costs

Final Thoughts

How to Set up a Trust Fund FAQs

Setting up a trust fund involves several steps, including choosing a trustee, creating the trust document, and funding the trust. You may need to work with an experienced attorney and financial advisor to ensure that your trust fund is set up properly and meets your needs.

Setting up a trust fund can have tax implications, including income tax, estate and gift tax, and generation-skipping transfer tax. The tax rates and exemptions vary depending on the type of trust and the size of the estate.

Setting up and maintaining a trust fund can involve several costs, including initial costs such as legal fees and professional fees, as well as ongoing fees and expenses such as trustee fees, investment management fees, and administrative expenses.

There are several types of trust funds, including revocable trusts, irrevocable trusts, testamentary trusts, living trusts, and special needs trusts. Each type of trust has its own features, benefits, and drawbacks.

Anyone who wants to ensure their assets are managed and distributed according to their wishes may consider setting up a trust fund. Trust funds can be particularly useful for those with complex estates, minor or disabled beneficiaries, or those who want to minimize taxes and avoid probate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.