A Charitable Remainder Annuity Trust is a legal arrangement where an individual transfers assets to a trust, which then pays a fixed annual income to the donor or a beneficiary for a specified period. After the trust term ends, the remaining assets are transferred to a designated charity. The donor receives an immediate tax deduction for the charitable portion of the trust, and the trust provides a stable income stream while supporting charitable causes. A CRAT is established by transferring assets, such as cash, stocks, or real estate, into an irrevocable trust. The trustee then manages the trust assets and makes annual fixed payments to the donor or other named beneficiaries. The annuity payments are based on a predetermined percentage of the initial trust assets' value, and the payout rate must be at least 5% but cannot exceed 50%. Once the trust term ends or the last beneficiary passes away, the remaining trust assets are distributed to the designated charity or charities. There are no specific eligibility requirements for donors who wish to establish a CRAT. However, donors should have a sizable amount of assets to transfer into the trust, as the trust must generate sufficient income to cover the annuity payments and any administrative costs associated with the trust. When establishing a CRAT, donors must select a trustee to manage the trust assets and oversee the distribution of annuity payments. The trustee can be an individual, a bank, a trust company, or a combination of these. It is crucial to choose a trustee with a strong background in managing trust assets and a track record of acting in the best interests of the trust beneficiaries. A CRAT can be funded with various assets, including cash, stocks, bonds, real estate, or other income-generating assets. The choice of assets to fund the trust will impact the trust's performance and the annuity payments to the beneficiaries. Donors should consult with a trusted financial advisor to determine the best assets for their CRAT. The annuity payout in a CRAT is a fixed amount based on a predetermined percentage of the initial trust assets' value. The payout rate must be at least 5% but cannot exceed 50%. The annuity payments are made annually to the donor or other designated beneficiaries and remain constant throughout the trust term. One of the main benefits of a CRAT is the ability to generate a steady income stream for the donor or other named beneficiaries. The fixed annuity payments provide financial stability, making CRATs an attractive option for donors who require income during their retirement or for other beneficiaries who rely on the income for their living expenses. CRATs allow donors to make substantial charitable contributions while still providing for their own financial needs or those of their beneficiaries. This can help donors fulfill their philanthropic goals while also ensuring their financial well-being. CRATs offer various tax benefits to donors, including income tax deductions, capital gains tax avoidance, and estate tax savings. These tax advantages can make CRATs an attractive estate planning tool for individuals with significant assets. Once a CRAT is established, it is irrevocable, meaning the donor cannot change the terms or beneficiaries of the trust, nor can they access the trust assets for any reason. This lack of control and flexibility may be a disadvantage for some individuals, particularly those with changing financial circumstances or needs. The performance of a CRAT's investments may impact the overall value of the trust assets. While the annuity payments are fixed and do not change based on the trust's investment performance, a poorly performing trust may result in a smaller amount of assets remaining for the designated charity after the trust term ends. Establishing and administering a CRAT can be a complex and costly process, requiring the assistance of legal, financial, and tax services professionals. Donors should carefully weigh these costs against the potential benefits before deciding to establish a CRAT. The annuity payout in a CRAT is a fixed amount based on a predetermined percentage of the initial trust assets' value. This fixed payment is made annually to the donor or designated beneficiaries, providing a consistent income stream throughout the trust term. Annuity payments are calculated by multiplying the predetermined percentage by the initial value of the trust assets. The payment amount remains constant throughout the trust term, regardless of the trust's investment performance or fluctuations in the value of the assets. Annuity payments from a CRAT are subject to income tax. The tax treatment depends on the type of assets in the trust and the character of the income generated by the trust. The income may be taxed as ordinary income, qualified dividends, or capital gains, depending on the trust's investments. When a donor establishes a CRAT, they are eligible for an income tax deduction based on the present value of the remainder interest that will pass to the designated charity at the end of the trust term. This deduction can help offset the donor's taxable income, potentially reducing their income tax liability. When appreciated assets are transferred to a CRAT, the trust can sell those assets without incurring immediate capital gains tax. This allows the trust to diversify its investments and potentially enhance its performance without being burdened by capital gains taxes. Assets transferred to a CRAT are removed from the donor's taxable estate, potentially reducing the donor's estate tax liability. This can be particularly beneficial for individuals with large estates that may be subject to federal and state estate taxes. The annuity payout rate for a CRAT must be at least 5% but cannot exceed 50% of the initial trust assets' value. These limits are in place to ensure that a sufficient amount of assets remain in the trust for distribution to the designated charity at the end of the trust term. A CRAT can be established for a specified term of years, not exceeding 20 years, or for the lifetime of one or more beneficiaries. The trust term must be selected at the time the trust is established and cannot be changed once the trust is in place. Certain transactions are prohibited within a CRAT, including borrowing against the trust assets, pledging the trust assets as collateral for a loan, or engaging in any transaction that could jeopardize the tax-exempt status of the trust. A Charitable Remainder Unitrust (CRUT) is similar to a CRAT in that it provides an income stream to the donor or beneficiaries and distributes the remaining assets to a designated charity at the end of the trust term. However, unlike a CRAT, a CRUT's annual payments are based on a fixed percentage of the trust assets' value as revalued each year, rather than a fixed dollar amount. This means that the payments from a CRUT may fluctuate depending on the trust's investment performance, providing less predictability than a CRAT but potentially offering higher payments in years when the trust's investments perform well. A Charitable Gift Annuity (CGA) is another option for donors who want to make a charitable contribution while receiving an income stream. With a CGA, the donor makes an irrevocable gift to a charity in exchange for the charity's promise to pay a fixed annuity to the donor or another beneficiary for life. The annuity payments in a CGA are typically lower than those from a CRAT, and the donor does not have the same level of control over the assets as they would in a CRAT. However, CGAs are generally simpler and less expensive to set up than CRATs. Unlike a CRAT, a private foundation does not provide an income stream to the donor or beneficiaries but instead focuses on making grants to other charitable organizations or supporting charitable activities. Establishing and maintaining a private foundation can be more complex and costly than a CRAT, but it offers greater control over the assets and a broader range of charitable giving options. Charitable Remainder Annuity Trust (CRAT) is a type of trust that allows donors to receive an annual fixed payment while donating assets to a charitable organization. To establish a CRAT, a donor transfers assets to a trust managed by a trustee, who invests the assets and pays the donor a fixed annuity payment for a specified number of years or for life. CRATs offer donors various tax benefits, such as income, capital gains, and estate tax deductions, but they also come with risks, including the irrevocability of the trust and the effect of the trust's investment performance on annuity payments and charitable contributions. By carefully evaluating their charitable goals, financial needs, and the advantages and disadvantages of a CRAT compared to other charitable giving strategies, donors can make informed decisions about whether a CRAT is the right choice for their situation.What Is a Charitable Remainder Annuity Trust (CRAT)?

How Charitable Remainder Annuity Trust (CRAT) Works

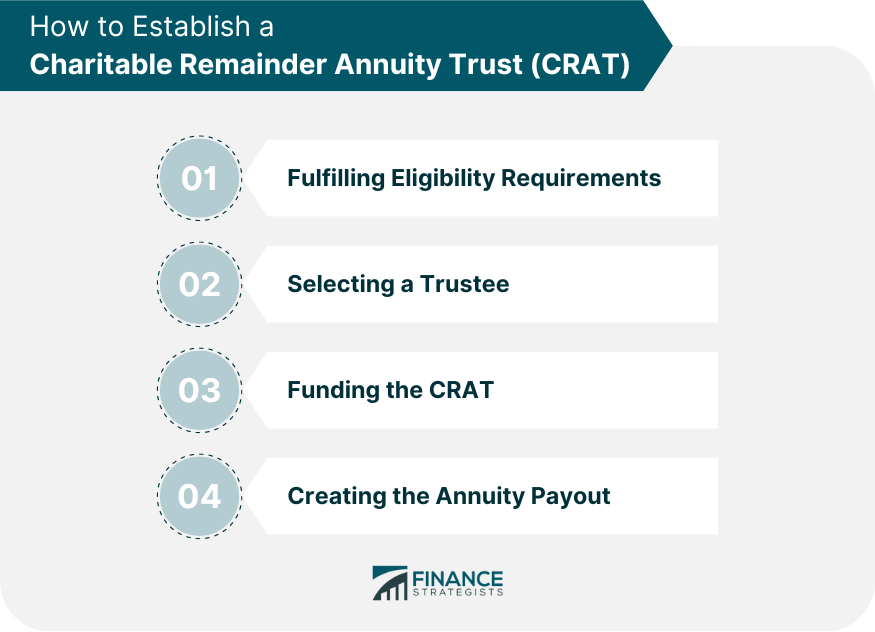

Establishing a CRAT

Eligibility Requirements

Trustee Selection

Funding a CRAT

Creating the Annuity Payout

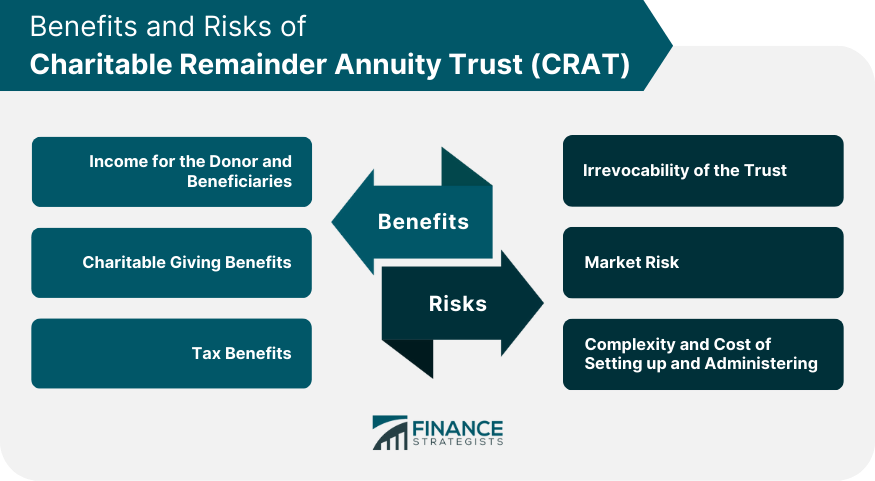

Benefits of CRATs

Income for the Donor and Beneficiaries

Charitable Giving Benefits

Tax Benefits

Risks of CRATs

Irrevocability of the Trust

Market Risk

Complexity and Cost of Setting up and Administering

CRAT Payouts

Annuity Payout Structure

Calculating Annuity Payments

Tax Implications of Annuity Payments

CRAT Taxation

Income Tax Benefits

Capital Gains Tax Benefits

Estate Tax Benefits

CRAT Requirements and Restrictions

Minimum and Maximum Payout Rates

Duration of CRAT

Prohibited Transactions

CRAT vs Other Charitable Giving Options

Charitable Remainder Unitrust

Charitable Gift Annuity

Private Foundation

Final Thoughts

Charitable Remainder Annuity Trust (CRAT) FAQs

A Charitable Remainder Annuity Trust (CRAT) is an irrevocable trust that enables individuals to donate assets to a charity while receiving a fixed annual income for a specified period. At the end of the term, the remaining trust assets are given to the designated charitable organization, providing potential tax advantages and supporting both philanthropy and financial security.

CRATs can benefit individuals who want to donate to a charity while receiving an annual fixed payment for life. They are also beneficial for individuals who want to reduce their estate taxes.

When a CRAT is established, the donor transfers assets to the trust, which is managed by a trustee. The trustee invests the assets and pays the donor a fixed annuity payment for a specified number of years or for life. After the specified period or upon the donor's death, the remaining assets in the trust are distributed to a charitable organization.

Donors may be eligible for income, capital gains, and estate tax deductions for contributions made to a CRAT. Additionally, donors can avoid capital gains taxes on appreciated assets donated to the trust.

One of the primary risks associated with a CRAT is that it is irrevocable, meaning the donor cannot change the terms of the trust once it is established. Additionally, the trust's investment performance can affect the size of the annuity payments and the amount ultimately given to charity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.