A Charitable Remainder Unitrust is a type of irrevocable trust that provides income to its beneficiaries for a specified period, usually the life of the grantor, after which the remaining assets are transferred to a designated charity. The trust is created by the grantor, who transfers assets into the trust and names a trustee to manage the assets on behalf of the beneficiaries. The primary purpose of a CRUT is to provide a steady stream of income to the beneficiaries while also benefiting a charity. The trust allows the grantor to make a significant charitable contribution, enjoy tax advantages, and potentially reduce estate taxes.

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. By transferring assets into a Charitable Remainder Unitrust (CRUT), you not only secure a steady stream of lifetime income but also benefit from immediate tax deductions and potential capital gains tax avoidance. After your passing or a specified term, the remaining assets go to your chosen charity, aligning your financial strategy with your philanthropic values. Interested how a CRUT can enhance your financial and charitable legacy? Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation To establish a CRUT, the grantor must create an irrevocable trust document, specifying the terms and conditions of the trust, including the fixed percentage to be distributed to the beneficiaries, the length of the trust term, and the designated charitable remainder beneficiary. The trust document must also name a trustee, who will be responsible for managing the trust's assets and making the required income distributions. Once the trust document is in place, the grantor transfers assets into the CRUT. These assets can include cash, stocks, bonds, real estate, and other types of property. The value of the assets transferred to the trust will determine the amount of the charitable deduction available to the grantor for tax purposes. The trustee is responsible for managing the assets held in the CRUT, including making investment decisions and ensuring that the trust complies with all applicable laws and regulations. The trustee's primary goal is to generate sufficient income for the beneficiaries while preserving the trust's principal for the designated charity. The trustee must also provide annual reports to the beneficiaries and the Internal Revenue Service (IRS) detailing the trust's financial activities. The income generated by the CRUT's investments is distributed to the beneficiaries according to the terms of the trust. This distribution can occur annually, semi-annually, quarterly, or monthly, as specified in the trust document. The amount of income distributed to the beneficiaries will depend on the type of CRUT and the fixed percentage established when the trust was created. CRUTs offer several tax advantages to the grantor and the beneficiaries. First, when assets are transferred to the trust, the grantor is eligible for a charitable income tax deduction based on the present value of the remainder interest that will eventually pass to the charity. Second, the assets in the CRUT grow tax-free, allowing for potentially higher investment returns over time. Finally, when the trust distributes income to the beneficiaries, the income is taxed at their individual income tax rates, which may be lower than the grantor's tax rate. A Standard CRUT, also known as a Fixed Percentage CRUT, pays a fixed percentage of the trust's net asset value to the beneficiaries each year. This percentage is determined at the time the trust is established and remains constant throughout the term of the trust. The trust's assets are revalued annually, which can result in fluctuations in the amount of income distributed to the beneficiaries. A Net Income CRUT pays the lesser of the trust's net income or the fixed percentage of the trust's net asset value to the beneficiaries each year. If the trust's net income is less than the fixed percentage, the beneficiaries receive only the net income for that year. This type of CRUT can be beneficial for grantors who want to ensure that the trust's principal is preserved for the charity. A Flip CRUT is a type of CRUT that begins as a Net Income CRUT and converts to a Standard CRUT upon the occurrence of a specific triggering event. This event is usually the sale of an illiquid or hard-to-value asset held by the trust, such as real estate or a business. Once the triggering event occurs, the trust "flips" to a Standard CRUT and begins paying the fixed percentage to beneficiaries. A NIMCRUT, or Net Income with Make-Up Charitable Remainder Unitrust, is a variation of the Net Income CRUT that allows for the possibility of making up for any shortfall in income distributions in future years when the trust's net income exceeds the fixed percentage. This feature provides the beneficiaries with the potential to receive additional income in years when the trust's income is higher than the fixed percentage. One of the key benefits of a CRUT is the ability to provide a steady stream of income to the grantor and/or other beneficiaries for their lifetime or for a specified term of years. This can be particularly valuable for individuals who are seeking financial security in retirement or those who have loved ones with long-term financial needs. A CRUT allows the grantor to make a significant charitable contribution that will benefit a chosen charity after the trust term ends or upon the death of the last income beneficiary. This can be a meaningful way for individuals to support causes that are important to them and leave a lasting legacy. CRUTs offer various tax benefits to the grantor, including an immediate charitable income tax deduction, tax-free growth of assets within the trust, and potential estate tax savings. These benefits can be particularly appealing for individuals in high tax brackets or those with large estates. By transferring assets to a CRUT, the grantor can potentially reduce the size of their taxable estate, thereby lowering the amount of estate taxes owed upon their death. Additionally, CRUTs can be structured to provide income to surviving family members, helping to ensure their financial well-being. Once assets are transferred to a CRUT, the grantor relinquishes control over those assets. The trustee is responsible for managing the trust's investments and making decisions that affect the trust's performance. This loss of control may be a concern for some individuals. CRUTs are irrevocable, meaning that once the trust is established, the grantor cannot change its terms or revoke the trust. This makes it crucial for grantors to carefully consider their objectives and the potential impact of a CRUT on their financial situation before establishing the trust. Creating and maintaining a CRUT involves navigating complex legal and tax requirements. It is essential to work with experienced professionals, such as attorneys and accountants, to ensure that the trust is structured correctly and complies with all applicable laws and regulations. Assets transferred to a CRUT will ultimately pass to the designated charity, reducing the amount available for inheritance by the grantor's heirs. This potential reduction in inheritance should be carefully weighed against the other benefits provided by the CRUT. CRUT is a type of trust that provides an income for life to a beneficiary, with the remainder going to a charity. To establish a CRUT, the assets are transferred to the trust, which then pays the beneficiary a fixed percentage of the assets' value each year. After the beneficiary's death, the remaining assets go to the designated charity. There are different types of CRUTs, including Standard CRUT, Flip CRUT, Net Income CRUT, and NIMCRUT, each with unique features and requirements. While CRUTs offer significant tax and estate planning benefits, they also have certain disadvantages, such as the irrevocable nature of the trust, possible loss of control over assets, complex legal requirements, and potential reduction in inheritance. By understanding how CRUTs work, the different types of CRUTs available, and their advantages and disadvantages, individuals can make informed decisions about whether a CRUT is the right choice for their unique financial situation and goals.What Is a Charitable Remainder Unitrust (CRUT)?

Hear It From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

How CRUTs Work

Establishment of CRUT

Funding CRUT

Management of CRUT Assets

Distribution of Income

Taxation of CRUTs

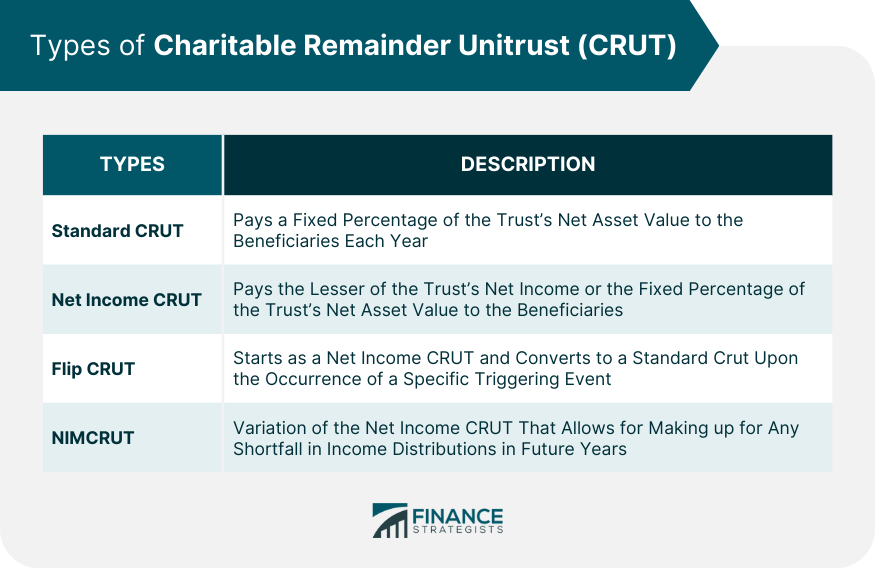

Types of Charitable Remainder Unitrusts

Standard CRUT

Net Income CRUT

Flip CRUT

NIMCRUT

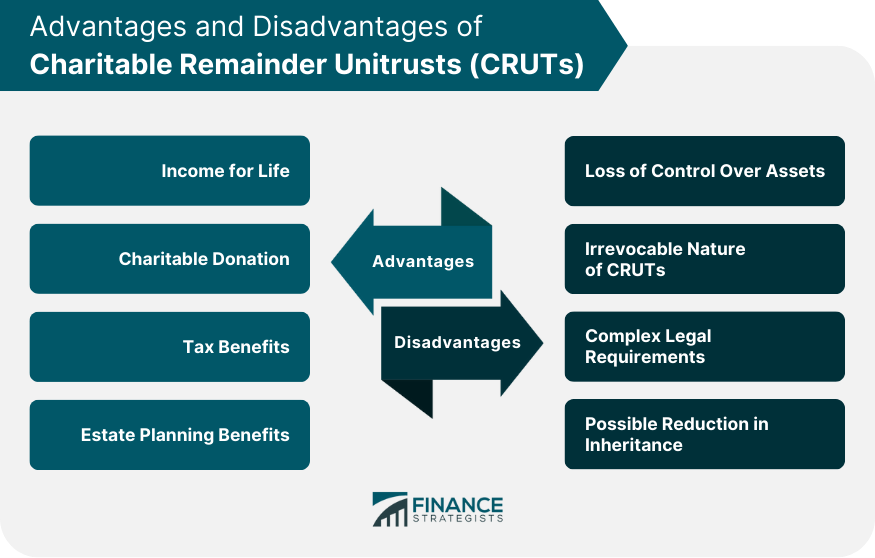

Advantages of Charitable Remainder Unitrusts

Income for Life

Charitable Donation

Tax Benefits

Estate Planning Benefits

Disadvantages of Charitable Remainder Unitrusts

Loss of Control Over Assets

Irrevocable Nature of CRUTs

Complex Legal Requirements

Possible Reduction in Inheritance

The Bottom Line

Charitable Remainder Unitrust (CRUT) FAQs

CRUTs, or Charitable Remainder Unitrusts, are trusts that provide annual payments to beneficiaries based on a fixed percentage of the trust's net asset value or net income, while supporting a designated charity.

The benefits of CRUT include receiving an income for life, reducing taxes, and making a charitable donation.

No, CRUT is an irrevocable trust, and its terms cannot be changed after it's established.

Assets are transferred to the trust, which then pays the beneficiary a percentage of the assets' value each year. After the beneficiary's death, the remaining assets go to the charity.

Cash, securities, real estate, and other valuable assets can be used to fund a CRUT. However, it's crucial to consult with a financial advisor and a tax professional to determine the best option.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.