Trust risk management refers to the process of identifying, assessing, and mitigating potential risks associated with the establishment, administration, and ongoing management of a trust within the context of estate planning. This includes addressing potential legal, financial, and interpersonal risks to protect trust assets and ensure the trust's objectives are achieved. Trust risk management is essential in estate planning because it helps ensure the smooth and effective administration of the trust, protects trust assets, and minimizes potential disputes among beneficiaries or between beneficiaries and trustees. By proactively managing trust-related risks, settlors can better safeguard their estates and provide greater peace of mind to all parties involved. One potential risk in trust management is the presence of inadequate or unclear trust terms and provisions. This can lead to confusion, disputes, or misinterpretation of the settlor's intentions, ultimately undermining the trust's effectiveness. To avoid this risk, it is essential to work with an experienced estate planning attorney to create a well-drafted and comprehensive trust document. Another potential risk is the selection of an incompetent or untrustworthy trustee. A trustee is responsible for managing the trust assets and making decisions in the best interests of the beneficiaries. If a trustee is not capable of fulfilling their duties or does not act in good faith, the trust's assets and objectives may be jeopardized. Careful selection of trustees is crucial in mitigating this risk. Disputes and conflicts among beneficiaries or between beneficiaries and trustees can threaten the effective management of a trust and create emotional turmoil within a family. Identifying potential areas of conflict and addressing them proactively can help minimize disputes and maintain family harmony. Trusts are subject to a variety of tax rules and regulations, and failure to comply with these requirements can result in financial penalties or other liabilities. Effective trust risk management includes staying informed about applicable tax laws and ensuring the trust is structured and managed in a tax-efficient manner. Trust assets can be at risk due to mismanagement or loss through poor investment decisions, fraud, or negligence. Implementing proper oversight, diversification, and asset protection strategies can help minimize these risks and preserve the trust's assets. One of the most important trust risk management strategies is the careful selection of trustees. Choosing competent, trustworthy, and experienced trustees is crucial to ensure that the trust is managed effectively and the beneficiaries' best interests are served. Creating clear and comprehensive trust documentation is essential in mitigating risks associated with inadequate or unclear trust terms and provisions. Working with an experienced estate planning attorney can help ensure that the trust document is well-drafted, comprehensive, and accurately reflects the settlor's intentions. Conducting regular trust reviews can help identify potential issues or areas of concern that may need to be addressed. By staying proactive and addressing problems early, trustees can help ensure the trust remains effective and compliant with the settlor's intentions and any applicable laws. Diversifying trust assets can help minimize the risk of loss or mismanagement. By spreading investments across various asset classes and sectors, trustees can better protect the trust's assets and potentially improve its overall performance. Maintaining open lines of communication and providing regular reporting to beneficiaries can help build trust, reduce potential conflicts, and ensure that all parties remain informed about the trust's status and activities. Transparent communication can help address concerns or misunderstandings before they escalate into disputes. Effective trust risk management helps protect the trust's assets from potential loss or mismanagement. By implementing proper oversight and diversification strategies, trustees can safeguard assets and ensure they are used according to the settlor's intentions. Trust risk management allows the settlor to maintain a degree of control over how their assets are managed and distributed, even after their death. By carefully selecting trustees and outlining clear trust terms and provisions, settlors can ensure their estate is managed according to their wishes. By proactively managing trust-related risks, trustees can potentially reduce costs associated with disputes, tax penalties, or other liabilities. Effective trust risk management can help preserve the trust's assets and maximize the resources available to beneficiaries. Trust risk management can help minimize disputes among beneficiaries or between beneficiaries and trustees by addressing potential areas of conflict and ensuring clear communication. This can help maintain family harmony and prevent costly legal battles. By addressing potential conflicts and ensuring the trust is managed effectively, trust risk management can contribute to preserving family harmony. This is particularly important in cases where family members have different interests or needs. Trustees play a central role in trust risk management. Their duties include overseeing the trust administration, making prudent investment decisions, ensuring compliance with applicable laws and regulations, and acting in the best interests of the beneficiaries. By fulfilling these responsibilities, trustees can help mitigate risks and ensure the trust achieves its objectives. Trustees can be held liable for mismanagement, negligence, or breach of fiduciary duty. This can include failing to properly manage trust assets, failing to comply with tax laws, or engaging in self-dealing. Trustees must be vigilant in their duties and act in the best interests of the beneficiaries to minimize potential liabilities. Trust risk management involves identifying and mitigating potential risks associated with trusts, including legal, financial, and operational risks. It is an important aspect of estate planning that helps ensure the proper management and distribution of trust assets according to the grantor's wishes. Trust risks can include inadequate or unclear trust terms, untrustworthy or incompetent trustees, conflict among beneficiaries or between beneficiaries and trustees, taxation issues and potential liability, mismanagement or loss of trust assets. Effective trust risk management strategies can include careful selection of trustees, clear and comprehensive trust documentation, regular trust reviews, diversification of trust assets, regular communication and reporting, and seeking professional advice. Proper trust risk management can help protect assets, maintain control over the management and distribution of assets, reduce costs, minimize disputes, preserve family harmony, facilitate estate planning, mitigate legal and financial risks, and enhance trust performance. Trustees have a fiduciary duty to act in the best interests of the beneficiaries and manage trust assets prudently. They can be held liable for breaches of fiduciary duty, mismanagement of trust assets, failure to properly document trust activities, and failure to comply with applicable laws.What Is Trust Risk Management?

Trust Risks That Need to Be Managed

Inadequate or Unclear Trust Terms and Provisions

Incompetent or Untrustworthy Trustees

Conflict Among Beneficiaries or Between Beneficiaries and Trustees

Taxation Issues and Potential Liability

Mismanagement or Loss of Trust Assets

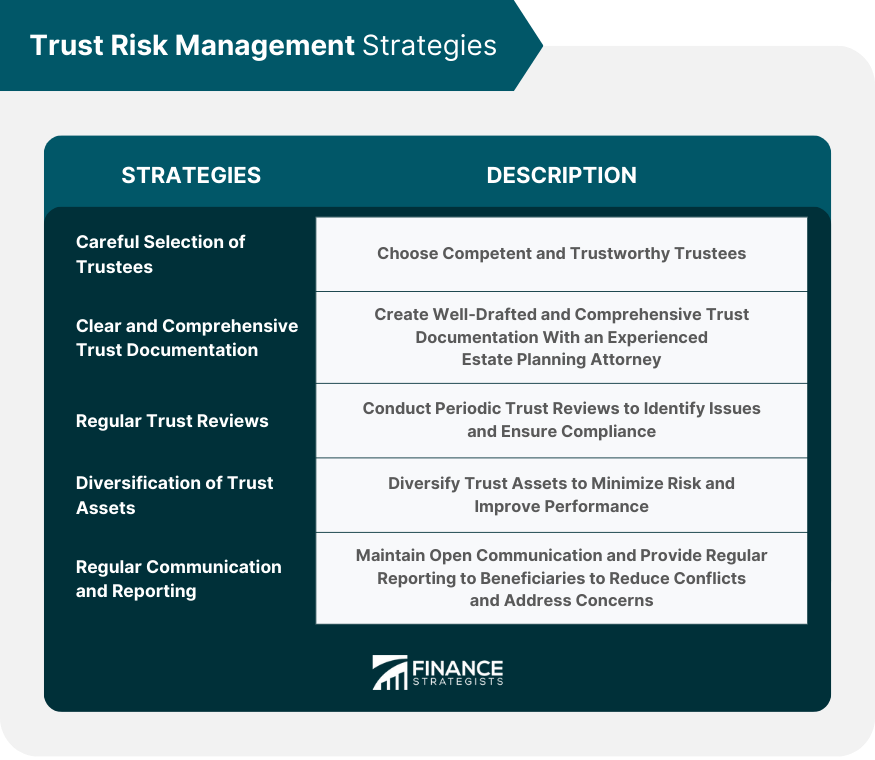

Strategies for Trust Risk Management

Careful Selection of Trustees

Clear and Comprehensive Trust Documentation

Regular Trust Reviews

Diversification of Trust Assets

Regular Communication and Reporting

Benefits of Trust Risk Management

Protecting Assets

Maintaining Control

Reducing Costs

Minimizing Disputes

Preserving Family Harmony

Trustee Duties in Trust Risk Management

Trustee Liabilities in Trust Risk Management

Final Thoughts

Trust Risk Management FAQs

Trust risk management involves identifying, assessing, and mitigating potential risks associated with trusts, including legal, financial, and operational risks.

Effective trust risk management can help protect assets, reduce costs, minimize disputes, preserve family harmony, facilitate estate planning, mitigate legal and financial risks, and enhance trust performance.

Trust Risk Management is important because it helps protect the assets and interests of beneficiaries, ensures compliance with legal and regulatory requirements, and minimizes the likelihood of financial losses or reputational damage.

The key steps in Trust Risk Management include identifying potential risks, evaluating their likelihood and potential impact, implementing risk mitigation strategies, and regularly monitoring and reviewing the effectiveness of risk controls.

Some best practices for trust risk management include regular trust reviews, diversification of trust assets, adequate insurance coverage, ongoing education and training, effective communication and reporting, proper succession planning for trustees, and collaboration between professional advisors and trustees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.