Trust income and principal allocation refers to the process of categorizing and distributing a trust's earnings and assets to its beneficiaries according to the terms of the trust agreement and applicable law. This allocation ensures that the trust is managed appropriately and its assets are distributed fairly among beneficiaries. Proper allocation in trust management is essential for maintaining trust integrity, ensuring beneficiaries receive their designated share of trust assets, and minimizing potential disputes or legal issues. It also helps maintain a clear record of trust activities, which aids in tax reporting and compliance. Revocable trusts are legal entities created by a grantor who can modify or terminate the trust during their lifetime. These trusts offer flexibility and control, allowing the grantor to make changes in response to changing circumstances or beneficiary needs. Irrevocable trusts are permanent and cannot be changed or terminated once established, providing a higher level of asset protection and potential tax benefits. These trusts are often used for estate planning, asset protection, and wealth transfer purposes. Testamentary trusts are created through a will and only take effect upon the grantor's death. These trusts provide a mechanism to control the distribution of assets after death, protecting beneficiaries and ensuring the grantor's wishes are fulfilled. Grantor trusts are those where the grantor retains certain powers or interests in the trust, making the trust's income taxable to the grantor. These trusts can be advantageous for tax planning purposes and allow the grantor to maintain some control over trust assets. Non-grantor trusts are established without the grantor retaining any control or interest in the trust. The trust itself is responsible for paying taxes on its income, providing a separation of assets and tax liability from the grantor. Trust income refers to the earnings generated by trust assets, which may include: Interest: Interest income is derived from various sources, such as savings accounts, bonds, or loans, and is taxable to the trust or beneficiaries, depending on the trust agreement and tax rules. Dividends: Dividends are payments made by corporations to shareholders, which can include trusts. These payments are considered income and must be allocated according to the trust's provisions. Rental Income: Rental income is generated from real estate properties owned by the trust. This income must be properly allocated and reported for tax purposes. Royalties: Royalties are payments made to the trust for the use of intellectual property, such as patents or copyrights. This income must also be allocated according to the trust's terms and tax regulations. The taxation of trust income depends on several factors, including: Income Distribution Deduction: Trusts may deduct income distributed to beneficiaries, reducing the trust's taxable income. The income then becomes taxable to the beneficiary, who must report it on their personal tax return. Tax Brackets for Trusts: Trusts are subject to specific tax brackets, which may be higher than individual tax rates. Understanding these brackets is essential for proper tax planning and compliance. Grantor Trust Taxation Rules: Grantor trust taxation rules stipulate that the grantor is responsible for paying taxes on the trust's income, essentially treating the trust as an extension of the grantor's personal finances. Trust principal consists of the initial assets contributed to the trust and any additional assets acquired by the trust. These assets may include: Original Contributions: Original contributions refer to the assets initially transferred into the trust by the grantor. These assets form the basis of the trust and may generate income for beneficiaries. Real Property: Real property includes land, buildings, and other real estate assets owned by the trust. These assets can appreciate in value and generate rental income. Investments: Investment assets within a trust may consist of stocks, bonds, mutual funds, and other securities. These investments can produce income through interest, dividends, and capital gains. Business Interests: Business interests, such as ownership stakes in private companies or partnerships, can also be held within a trust. These interests can generate income through profit distributions or appreciation in the value of the business. The taxation of trust principal depends on various factors, including: Capital Gains and Losses: Capital gains and losses result from the sale or exchange of trust assets, such as investments or real property. These gains or losses must be reported and may be subject to taxes. Asset Basis Determination: Asset basis refers to the original value of an asset when it was acquired by the trust. Understanding the basis of trust assets is crucial for calculating capital gains or losses and determining tax liability. Tax Implications for Beneficiaries: When trust principal is distributed to beneficiaries, they may be subject to taxes on any capital gains realized. Beneficiaries should be aware of potential tax consequences when receiving distributions from a trust. The Uniform Principal and Income Act (UPIA) provides guidance on allocating trust income and principal between beneficiaries. Adopted by many states, the UPIA helps trustees make fair and equitable decisions regarding trust distributions. Trustees often have discretion in making allocation decisions, considering the trust's provisions and the needs of the beneficiaries. This discretion allows trustees to adapt to changing circumstances and ensure the trust's objectives are met. Several factors can influence the allocation of trust income and principal, including: The trust agreement's terms and provisions play a significant role in determining how income and principal are allocated among beneficiaries. These terms may specify how income and principal are distributed, or they may give the trustee discretion in making allocation decisions. State laws governing trusts can also impact allocation decisions. These laws may provide guidance on how income and principal should be allocated, or they may come into play when the trust's provisions are unclear or ambiguous. Trustees must be aware of these laws and how they may affect allocation decisions. Trustees should consider the individual circumstances of each beneficiary, including their financial needs and goals, when making allocation decisions. By doing so, trustees can ensure that the trust's objectives are met and that assets are distributed fairly among beneficiaries. Disagreements between beneficiaries can arise when they have conflicting interests or differing interpretations of the trust's provisions. These disputes can create tension and potentially lead to legal action. Trustees have a fiduciary duty to act in the best interests of the trust and its beneficiaries. A breach of this duty, such as improper allocation of income or principal, can lead to disputes and legal consequences. When disputes arise, several methods can help resolve the issue, including: Mediation involves a neutral third party who helps facilitate a resolution between the disputing parties. This method is often preferred for its cost-effectiveness and ability to maintain privacy and preserve relationships. Arbitration is a more formal process where an impartial arbitrator hears both sides of the dispute and makes a binding decision. This approach can provide a quicker resolution compared to court litigation but may be more expensive than mediation. Court intervention may be necessary when mediation and arbitration fail to resolve the dispute. In these cases, a judge will make a decision based on the trust's provisions and applicable laws, although this process can be time-consuming and costly. Ensuring trust documents are clear and unambiguous is essential for proper allocation of trust income and principal. Clearly defined terms and provisions can help minimize disputes and misunderstandings among beneficiaries and trustees. Regular communication between trustees and beneficiaries can facilitate transparency and understanding of the allocation process. Open dialogue can help address concerns and resolve potential issues before they escalate into disputes. Trustees should regularly review and update trust allocations to ensure they remain aligned with the trust's objectives and beneficiaries' needs. This practice can help address changing circumstances and maintain the trust's effectiveness. Trustees may benefit from seeking professional advice and guidance, such as consulting with attorneys, accountants, or financial advisors. These professionals can provide valuable insights and ensure proper trust management and compliance with tax and legal requirements. Proper allocation of trust income and principal is critical for maintaining the integrity of a trust, ensuring beneficiaries receive their designated share of trust assets, and minimizing potential disputes or legal issues. Understanding the types of trusts and their respective taxation rules, as well as the factors affecting allocation decisions, can help trustees make fair and equitable decisions. Challenges and disputes may arise, but seeking professional advice and following best practices such as clear trust documents, regular communication, and regular review and updates to trust allocations can help mitigate these issues. Careful management and allocation of trust income and principal can help ensure the effective functioning of trusts and the fulfillment of their intended purposes. Ensure that your assets are properly managed and distributed according to your wishes by seeking the services of an experienced estate planning lawyer. By working with a qualified professional, you can navigate the complexities of trust income and principal allocation, tax compliance, and dispute resolution with confidence.What Is Trust Income and Principal Allocation?

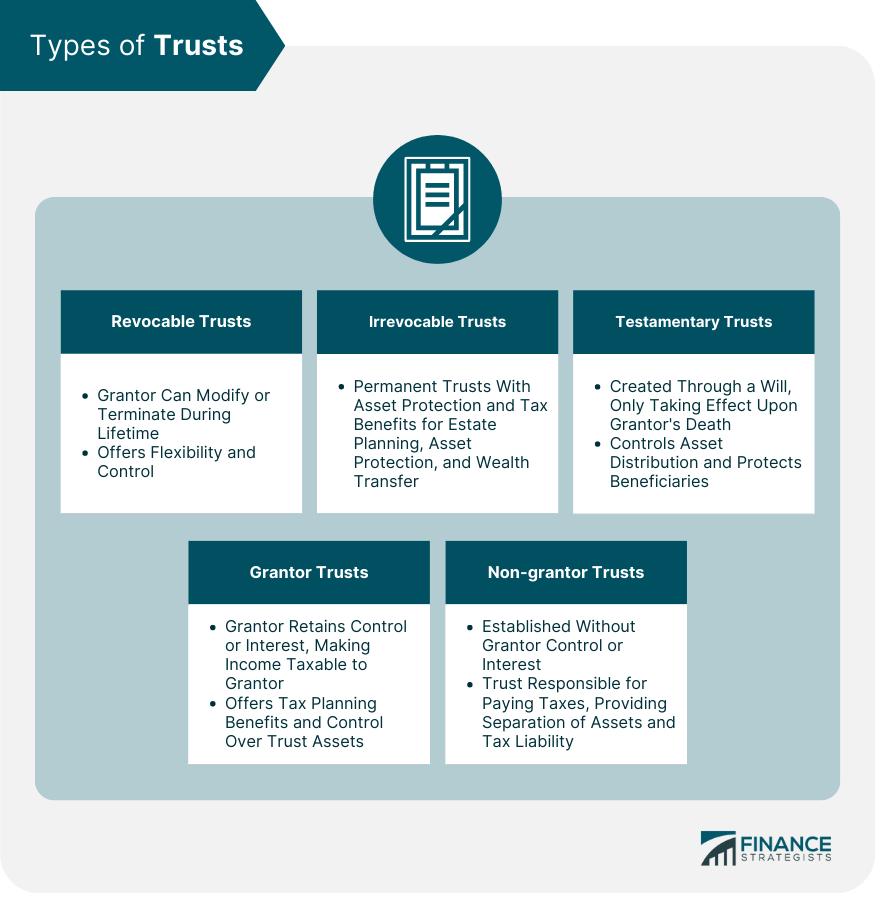

Types of Trusts

Revocable Trusts

Irrevocable Trusts

Testamentary Trusts

Grantor Trusts

Non-grantor Trusts

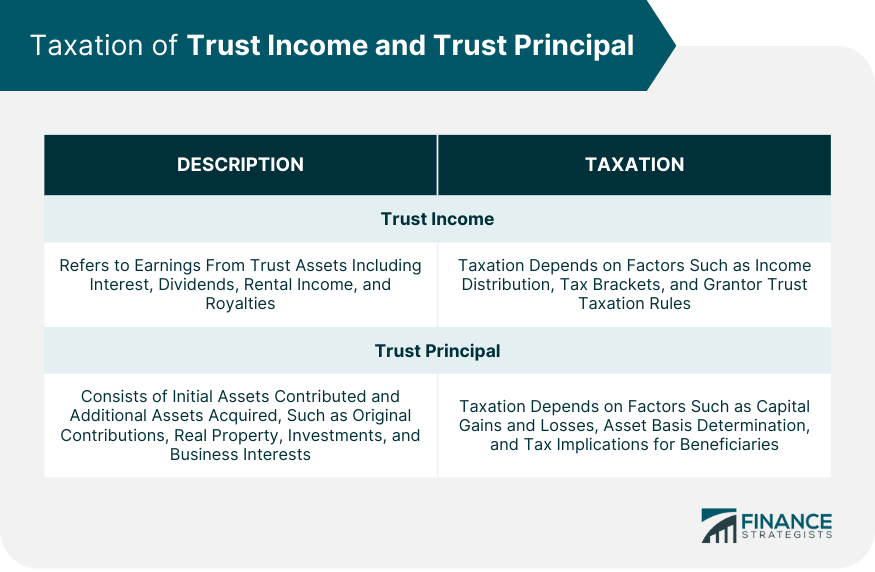

Trust Income

Taxation of Trust Income

Trust Principal

Taxation of Trust Principal

Allocation of Trust Income and Principal

The Uniform Principal and Income Act (UPIA)

Trustee Discretion and Allocation Decisions

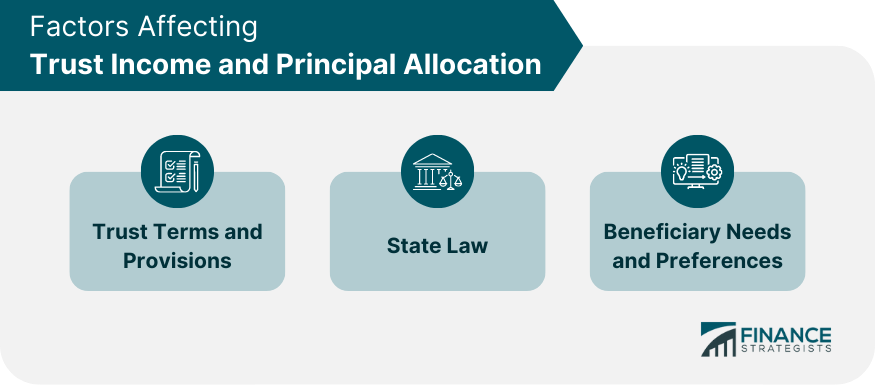

Factors Affecting Trust Income and Principal Allocation

Trust Terms and Provisions

State Law

Beneficiary Needs and Preferences

Challenges and Disputes in Trust Income and Principal Allocation

Disagreements Between Beneficiaries

Breach of Fiduciary Duty by Trustees

Legal Remedies and Resolution Methods

Mediation

Arbitration

Court Intervention

Best Practices for Trust Income and Principal Allocation

Clarity in Trust Documents

Communication Between Trustees and Beneficiaries

Regular Review and Updates to Trust Allocations

Seeking Professional Advice and Guidance

Final Thoughts

Trust Income and Principal Allocation FAQs

Trust income and principal allocation is essential for maintaining trust integrity, ensuring beneficiaries receive their designated share of trust assets, and minimizing potential disputes or legal issues. Proper allocation also aids in tax reporting and compliance.

The Uniform Principal and Income Act (UPIA) provides guidance on allocating trust income and principal between beneficiaries. Adopted by many states, the UPIA helps trustees make fair and equitable decisions regarding trust distributions, ensuring compliance with the law.

Disagreements between beneficiaries can be resolved through various methods, including mediation, arbitration, or court intervention. These approaches aim to find a fair and equitable resolution based on the trust's provisions and applicable laws.

Best practices for trust income and principal allocation include ensuring clarity in trust documents, maintaining regular communication between trustees and beneficiaries, conducting regular reviews and updates to trust allocations, and seeking professional advice and guidance from attorneys, accountants, or financial advisors.

An estate planning lawyer can provide valuable guidance on trust income and principal allocation by drafting clear trust documents, advising on tax implications, and offering strategies for preserving and distributing your wealth. Their expertise ensures proper trust management, compliance with tax and legal requirements, and minimizes the risk of disputes among beneficiaries.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.