Professional trustees are individuals or organizations that are appointed to act as trustees in a trust arrangement. These trustees have expertise in managing trusts, and they typically possess legal, financial, or investment management backgrounds. Their primary responsibility is to manage the assets held in the trust according to the trust's terms and to act in the best interests of the beneficiaries. Individual professionals, such as attorneys or certified public accountants, may serve as professional trustees. They offer personalized services and often have extensive experience in their respective fields, which can be valuable for trust administration. Trust companies specialize in providing trust administration services and can handle complex and high-value trusts. They have a team of professionals, including legal and financial experts, who work together to manage trusts effectively. Corporate trustees, such as banks or financial institutions, offer trust administration services as part of their broader portfolio. They typically have a vast array of resources and expertise at their disposal, which can benefit the management of trust assets. Some professional trustees focus on specific types of trusts, such as special needs trusts or charitable trusts. These specialized trustees have unique expertise in their niche, ensuring the best possible administration of the trust. Professional trustees usually hold a bachelor's or advanced degree in law, finance, or a related field. Their education provides them with the foundational knowledge required for trust administration. Experience in trust and estate administration, tax planning, or financial management is essential for professional trustees. This experience ensures that they are well-equipped to handle the complexities of trust administration. Certifications, such as the Certified Trust and Financial Advisor (CTFA) or the Trust and Estate Practitioner (TEP), demonstrate a professional trustee's commitment to maintaining the highest standards in trust administration. 1. Legal Knowledge: Professional trustees must have a solid understanding of trust law and related regulations to ensure compliance. 2. Financial Expertise: They should be adept at managing trust assets, making investment decisions, and handling financial reporting. 3. Communication Skills: Effective communication with grantors, beneficiaries, and other professionals is crucial for successful trust administration. 4. Attention to Detail: Trustees must be thorough and meticulous in their work to avoid errors and omissions. 5. Ethical Conduct: Professional trustees must act in the best interests of the beneficiaries and adhere to a strict code of ethics. 6. Problem-Solving Ability: Trustees should be able to identify and address issues that may arise during trust administration. Evaluate a professional trustee's reputation and track record by seeking references and conducting online research to ensure their competence and reliability. Compare the fees and charges of various professional trustees to find a service that fits within your budget while still providing the necessary expertise and quality. Consider the range of services offered by a professional trustee, ensuring that they can adequately address the specific needs and objectives of the trust. Choose a professional trustee who is geographically accessible and can meet with the grantor and beneficiaries as needed to facilitate effective communication and trust administration. Select a professional trustee who understands and aligns with the grantor's vision, goals, and values to ensure the trust is administered according to the grantor's intentions. Professional trustees are independent and objective, ensuring that trust assets are administered without favoritism or bias. Professional trustees possess the knowledge and skills required for efficient trust administration, reducing the likelihood of mistakes or mismanagement. By acting as an impartial third party, professional trustees can help minimize conflicts among family members or beneficiaries. Professional trustees provide continuity in trust administration, ensuring that trust assets are managed consistently even in the event of the grantor's death or incapacity. Professional trustees are familiar with the relevant laws and regulations governing trust administration, reducing the risk of non-compliance. Professional trustees have access to a network of professionals, such as attorneys and financial advisors, who can assist in various aspects of trust administration. Professional trustees must be vigilant in avoiding conflicts of interest that could compromise their ability to act in the best interests of the beneficiaries. Incompetence or negligence on the part of the professional trustee can result in mismanagement of trust assets, negatively impacting the beneficiaries. Disagreements between the professional trustee and beneficiaries can lead to legal disputes, causing delays in trust administration and potentially damaging relationships. A professional trustee may not have the same personal connection with beneficiaries as a family member or close friend, which could lead to misunderstandings or misinterpretations of the grantor's intentions. Some professional trustees may charge high fees for their services, which can erode the value of the trust assets over time. Professional trustees are subject to legal requirements and industry standards that govern their activities, ensuring they adhere to best practices in trust administration. Depending on the jurisdiction, professional trustees may be required to obtain a license or register with a regulatory authority to ensure they meet the necessary qualifications and comply with relevant regulations. Professional trustees must participate in continuing education and professional development programs to stay current with industry trends, legal developments, and best practices in trust administration. American College of Trust and Estate Counsel (ACTEC): ACTEC is a professional organization dedicated to promoting excellence in trust and estate planning and administration. Society of Trust and Estate Practitioners (STEP): STEP is an international organization that focuses on advancing the education and professional standards of trust and estate practitioners worldwide. Professional trustees play a pivotal role in contemporary estate planning and trust administration. They bring impartiality, objectivity, and specialized expertise to the management of trust assets, ensuring that the grantor's intentions are honored and the beneficiaries' interests are safeguarded. To select the right professional trustee, it is essential to consider factors such as their reputation, track record, fees, services offered, geographic location, and compatibility with the grantor's needs and objectives. Although there are challenges and risks associated with using professional trustees, such as conflicts of interest and potential mismanagement, careful evaluation and ongoing monitoring can mitigate these risks. By staying informed about the qualifications, skills, benefits, and potential challenges of professional trustees, grantors, and beneficiaries can make informed decisions and ensure effective trust administration.What Are Professional Trustees?

Types of Professional Trustees

Individual Professionals

Trust Companies

Corporate Trustees

Specialized Professional Trustees

Qualifications and Skills of Professional Trustees

Educational Background

Relevant Experience

Professional Certifications

Key Skills and Attributes

Selection Criteria for Professional Trustees

Reputation and Track Record

Fees and Charges

Range of Services Offered

Geographic Location and Accessibility

Compatibility With Grantor's Needs and Objectives

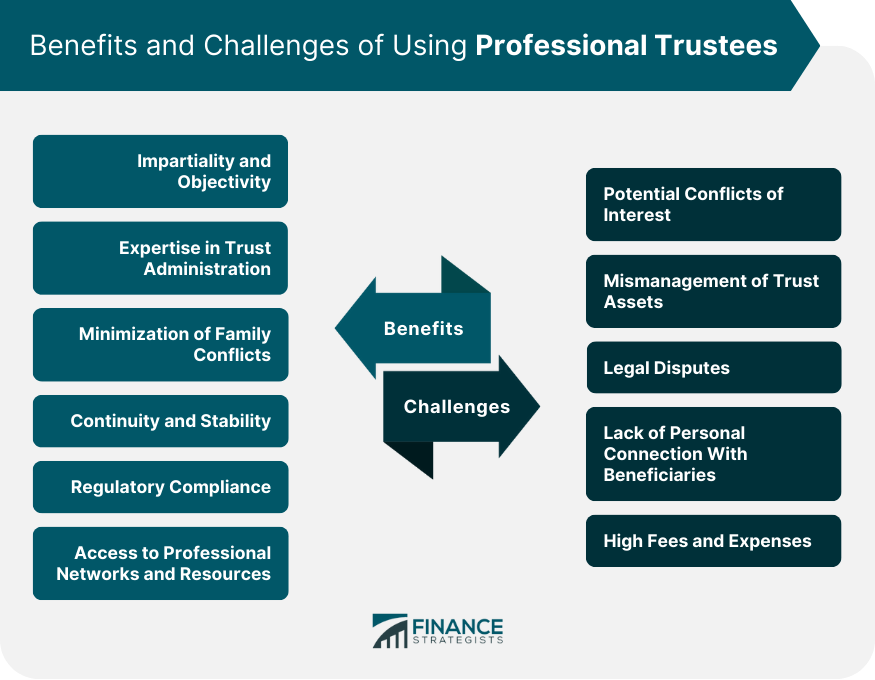

Benefits of Using Professional Trustees

Impartiality and Objectivity

Expertise in Trust Administration

Minimization of Family Conflicts

Continuity and Stability

Regulatory Compliance

Access to Professional Networks and Resources

Challenges and Risks Associated With Professional Trustees

Potential Conflicts of Interest

Mismanagement of Trust Assets

Legal Disputes

Lack of Personal Connection With Beneficiaries

High Fees and Expenses

Regulatory Framework and Professional Associations

Legal Requirements and Industry Standards

Licensing and Registration

Continuing Education and Professional Development

Professional Associations and Organizations

Conclusion

Professional Trustees FAQs

Professional trustees are responsible for managing and administering trusts in accordance with the grantor's wishes and applicable laws. Their duties include managing trust assets, making distributions to beneficiaries, maintaining accurate records, ensuring tax compliance, and acting in the best interests of beneficiaries.

While family member trustees may have a personal connection with the grantor and beneficiaries, professional trustees offer impartiality, objectivity, and expertise in trust administration. They have the necessary qualifications, skills, and experience to ensure efficient management of trust assets and minimize potential conflicts among beneficiaries.

Professional trustees should have a strong educational background in law, finance, or a related field, along with relevant experience in trust and estate administration, tax planning, or financial management. They may also hold professional certifications, such as the CTFA or TEP. Essential skills include legal knowledge, financial expertise, communication, attention to detail, ethical conduct, and problem-solving ability.

When selecting professional trustees, consider their reputation and track record, fees and charges, range of services offered, geographic location and accessibility, and compatibility with the grantor's needs and objectives. It is crucial to choose a professional trustee who understands and aligns with the grantor's vision, goals, and values.

Potential challenges and risks associated with using professional trustees include conflicts of interest, mismanagement of trust assets, legal disputes, lack of personal connection with beneficiaries, and high fees and expenses. It is essential to carefully evaluate and monitor professional trustees to ensure they act in the best interests of the beneficiaries and effectively manage trust assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.