A co-trustee is an individual or entity appointed to serve as a trustee alongside another trustee for a trust. The concept of co-trusteeship allows two or more trustees to manage and administer the trust assets collectively. This arrangement is particularly useful in estate planning, as it provides a way to manage complex estate plans, distribute responsibilities, and ensure continuity. Co-trustees share the responsibility of managing and distributing trust assets according to the trust's terms. Their duties include investing assets prudently, maintaining accurate records, providing regular accountings to beneficiaries, and making distributions as outlined in the trust document. In estate planning, appointing co-trustees can help ensure that the trust is managed effectively and according to the grantor's wishes. Co-trustees can provide checks and balances, prevent fraud, and bring their unique expertise and perspectives to the trust administration process. When selecting co-trustees, it is essential to consider their trustworthiness, competence, and willingness to serve. A co-trustee should have a strong ethical foundation, relevant knowledge or experience, and a genuine interest in fulfilling the trust's objectives. Potential co-trustees can be found among family members, friends, professional advisors (such as attorneys or accountants), or trust companies. Each type of co-trustee offers unique advantages and disadvantages, depending on the trust's specific needs and objectives. A co-trustee agreement outlines the roles, responsibilities, and decision-making processes for co-trustees. This document serves as a roadmap for how co-trustees will work together and manage the trust effectively. A well-drafted co-trustee agreement should address the following areas: Allocation of Responsibilities: Clearly define each co-trustees duties and tasks. Decision-Making processes: Establish guidelines for making decisions, including majority or unanimous consent requirements. Dispute Resolution: Detail mechanisms for resolving disputes among co-trustees. Compensation and Expenses: Outline any compensation or expense reimbursement for co-trustees. Removal and Replacement Provisions: Specify procedures for removing or replacing a co-trustee, if necessary. Having co-trustees allows for more balanced decision-making, as multiple parties contribute their perspectives and expertise. This arrangement can lead to better-informed decisions, which ultimately benefit the trust beneficiaries. Co-trustees can share the workload and responsibilities associated with administering a trust. This division of labor can lead to a more efficient and effective trust administration process. If one trustee becomes incapacitated or passes away, the other co-trustee(s) can continue to administer the trust without disruption. This ensures a smooth transition and continued management of the trust assets. Co-trustees may have complementary skills and knowledge, which can be advantageous in managing complex assets or addressing unique issues that arise during trust administration. By working together, co-trustees can leverage their combined expertise for the benefit of the trust beneficiaries. Effective communication and cooperation are crucial for co-trustees to work together efficiently. Establishing regular communication channels and clear expectations can help mitigate potential misunderstandings and conflicts. Co-trustees must be vigilant about avoiding conflicts of interest. If a conflict arises, it should be disclosed and addressed promptly to maintain the trust's integrity. Deadlocks in decision-making can hinder the effective administration of the trust. Co-trustee agreements should include provisions for resolving deadlocks, such as mediation or arbitration. In the event of a co-trustees incapacity or death, provisions in the co-trustee agreement or trust document should outline the process for appointing a successor co-trustee, ensuring a smooth transition and continued trust administration. Co-trustees have a fiduciary duty to act in the best interests of the trust beneficiaries. They must act prudently, diligently, and with loyalty to the trust's objectives. Failure to uphold these duties can result in legal liability for the co-trustee. Co-trustees may be held liable for any breach of their fiduciary duties, including negligence or mismanagement of trust assets. It is essential to establish indemnification provisions within the co-trustee agreement, protecting co-trustees from liability in certain situations. Co-trustees are responsible for ensuring that the trust complies with all relevant tax laws and regulations. They must file appropriate tax returns, pay required taxes, and maintain accurate records to support tax filings. In addition to tax compliance, co-trustees must also ensure the trust adheres to any other applicable laws and regulations, such as investment regulations and reporting requirements. Co-trustees play a vital role in effective trust administration and estate planning. By sharing responsibilities and bringing diverse expertise, they can make balanced decisions and ensure the smooth transition of trust management. Selecting trustworthy and competent co-trustees from various sources, such as family members, friends, professional advisors, or trust companies, is crucial. Co-trustee agreements serve as essential guidelines for co-trustees, addressing allocation of responsibilities, decision-making processes, dispute resolution, compensation, and removal provisions. The advantages of co-trustees include balanced decision-making, distributed duties, continuity, and collaborative expertise. However, challenges such as communication, conflicts of interest, decision-making deadlocks, and addressing incapacity or death of a co-trustee must be considered and managed through clear agreements and effective communication. Co-trustees have fiduciary duties, legal liabilities, and tax compliance responsibilities that require careful attention to ensure proper trust administration and regulatory compliance.Definition of Co-Trustees

Roles and Responsibilities of Co-Trustees

Importance of Co-Trustees in Estate Planning

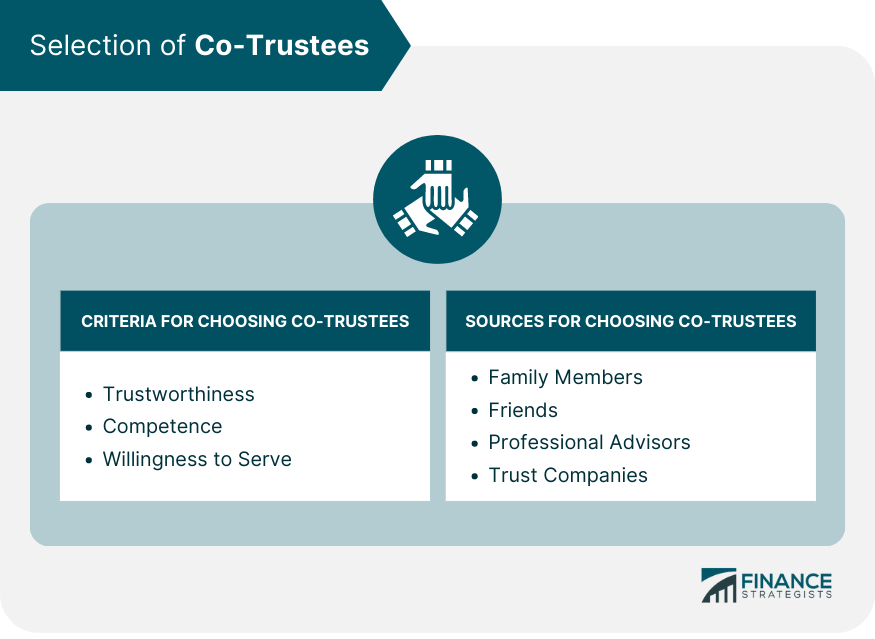

Selection of Co-Trustees

Criteria for Choosing Co-Trustees

Sources for Potential Co-Trustees

Co-Trustee Agreements

Purpose of Co-Trustee Agreements

Key Components of Co-Trustee Agreements

Advantages of Co-Trustees

Balanced Decision-Making

Distribution of Duties and Responsibilities

Continuity and Smooth Transition

Expertise and Collaboration

Potential Challenges and Solutions

Communication and Cooperation

Conflicts of Interest

Decision-Making Deadlocks

Addressing Incapacity or Death of a Co-Trustee

Legal Considerations for Co-trustees

Fiduciary Duties

Liability and Indemnification

Tax Implications

Regulatory Compliance

Conclusion

Co-Trustees FAQs

Co-trustees share the responsibility of managing and distributing trust assets according to the trust's terms. Their duties include investing assets prudently, maintaining accurate records, providing regular accountings to beneficiaries, and making distributions as outlined in the trust document.

Co-trustees can provide balanced decision-making, distribute duties and responsibilities, ensure continuity and smooth transition, and collaborate to bring their unique expertise to the trust administration process. These benefits can lead to more effective estate planning and better outcomes for beneficiaries.

When choosing co-trustees, consider their trustworthiness, competence, and willingness to serve. Potential co-trustees can be found among family members, friends, professional advisors, or trust companies. Each type of co-trustee offers unique advantages and disadvantages, depending on the trust's specific needs and objectives.

A co-trustee agreement should address the allocation of responsibilities, decision-making processes, dispute resolution mechanisms, compensation and expenses, and removal and replacement provisions. These components help to provide a clear roadmap for how co-trustees will work together and manage the trust effectively.

Co-trustees can mitigate potential challenges by establishing regular communication channels, setting clear expectations, disclosing and addressing conflicts of interest promptly, and including provisions for resolving decision-making deadlocks in the co-trustee agreement, such as mediation or arbitration.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.