The Resolution Trust Corporation (RTC) was a government-owned asset management company established in the United States in 1989. Its primary purpose was to address the savings and loan (S&L) crisis that occurred in the late 1980s and early 1990s. The RTC was created to manage and dispose of the assets, including real estate properties and loans, of failed savings and loan institutions. It played a vital role in restoring stability to the S&L industry and protecting depositors' interests. The RTC operated for several years and oversaw the resolution and liquidation of hundreds of failed S&Ls, helping to mitigate the financial impact of the crisis on the economy. The RTC took control of assets and liabilities when a thrift institution failed. It then managed and disposed of the assets, often through sales to private investors or other financial institutions. The process aimed to recover as much of the taxpayers' funds spent on addressing the crisis as possible while promoting stability in the financial sector. Estate-planning lawyers played a crucial role in the RTC's activities, offering legal guidance to clients interested in acquiring RTC-managed properties or assets. These professionals ensured compliance with relevant regulations, facilitated transactions, and helped clients navigate the complexities of the RTC process. Throughout its operation from 1989 to 1995, the RTC resolved over 700 failed thrifts and managed billions of dollars in assets. Its efforts significantly contributed to the eventual stabilization of the financial industry and informed modern financial regulations and crisis response mechanisms. The RTC's experience serves as an essential lesson in the history of financial regulation, demonstrating the importance of proper oversight and risk management in preventing financial crises. One of the primary functions of the RTC was to sell assets from failed institutions. Estate planning lawyers played a key role in this process, offering legal guidance to clients interested in acquiring RTC-managed properties or assets. These professionals also facilitated transactions and ensured compliance with relevant regulations. In addition to managing assets, the RTC was responsible for finding solutions for failed thrifts. This often involved liquidations, mergers or acquisitions. Estate planning lawyers contributed to this process by providing legal advice, negotiating contracts, and assisting with the transfer of assets. The savings and loan crisis of the 1980s cost taxpayers billions of dollars. However, through the RTC's efforts, a significant portion of these funds were recovered. The organization's activities facilitated the eventual stabilization of the financial industry and contributed to the prevention of a more severe economic downturn. The RTC experience highlighted the importance of regulation and oversight in financial institutions. The crisis demonstrated the consequences of inadequate supervision and risk management, leading to the implementation of stricter regulations in the financial sector. Estate planning lawyers have played an ongoing role in promoting compliance with these regulations, helping to prevent future crises. Estate planning lawyers played a pivotal role in advising clients on opportunities related to RTC assets. By identifying potential acquisitions and providing guidance on the purchase process, these professionals helped clients navigate the complex landscape of RTC transactions. When handling RTC-related transactions, estate planning lawyers ensured that clients conducted thorough due diligence and adhered to relevant regulations. They also negotiated and drafted contracts, safeguarding clients' interests and facilitating smooth transactions. The RTC's activities had a lasting impact on financial regulation, with many of the lessons learned informing modern crisis response mechanisms. Estate planning lawyers continue to play a vital role in financial regulation, contributing to the development of policies and procedures that promote stability and prevent future crises. The experience of the RTC has led to the evolution of strategies and best practices in estate planning and asset management. Estate planning lawyers have adapted their services to reflect these changes, emphasizing the importance of risk management and regulatory compliance in their work. By doing so, they help clients make informed decisions and minimize the potential for financial loss. The Resolution Trust Corporation played a pivotal role in addressing the savings and loan crisis of the late 1980s and early 1990s. It managed and disposed of assets from failed savings and loan institutions, contributing to the recovery of taxpayers' funds and stability in the financial sector. Estate-planning lawyers played a crucial role in providing legal guidance, ensuring compliance, and facilitating transactions related to RTC-managed assets. The RTC's activities had a significant impact on financial regulation, leading to stricter oversight and risk management practices. Estate planning lawyers continue to play a vital role in financial regulation, helping clients navigate RTC-related opportunities and ensuring compliance with regulations. The legacy of the RTC has influenced estate planning and asset management strategies, emphasizing risk management and regulatory compliance in these areas.What Is Resolution Trust Corporation (RTC)?

Understanding the Resolution Trust Corporation

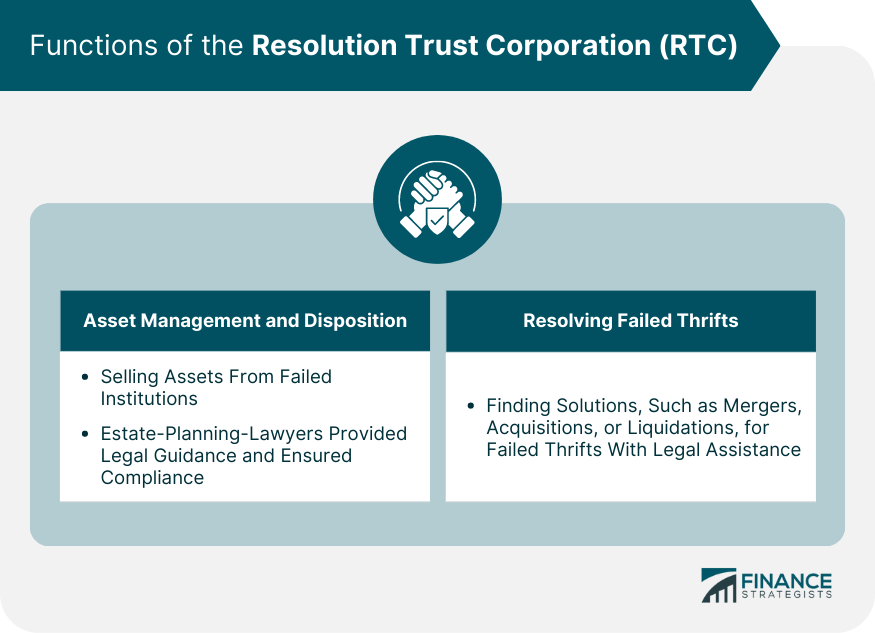

Functions of the Resolution Trust Corporation

Asset Management and Disposition

Resolving Failed Thrifts

Impact of the Resolution Trust Corporation

Financial and Economic Implications

Lessons Learned

Estate Planning Lawyer and RTC-Related Services

Advising Clients on RTC Assets

Legal Considerations in RTC Transactions

Legacy of the Resolution Trust Corporation

Influence on Modern Financial Regulation

RTC's Lasting Impact on Estate Planning and Asset Management

Conclusion

Resolution Trust Corporation (RTC) FAQs

The Resolution Trust Corporation (RTC) was a government agency established in 1989 in response to the savings and loan crisis of the 1980s. Its primary purpose was to manage and liquidate the assets of failed thrift institutions, promoting stability in the financial sector.

The RTC managed and disposed of assets from failed thrift institutions, often by selling them. Estate-planning lawyers played a crucial role in this process by offering legal guidance to clients interested in acquiring RTC-managed properties or assets and ensuring compliance with relevant regulations.

The RTC played a significant role in stabilizing the financial industry following the savings and loan crisis of the 1980s. By managing and liquidating the assets of failed thrifts, the RTC helped to recover a considerable portion of the taxpayer funds spent on addressing the crisis, and its activities informed modern financial regulations and crisis response mechanisms.

The RTC experience highlighted the importance of estate planning lawyers in navigating complex financial situations and promoting stability in the financial sector. These professionals played a critical role in advising clients on RTC assets, facilitating transactions, and ensuring compliance with regulations, shaping the way they approach financial regulation and asset management today.

The RTC's legacy can be seen in the evolution of financial regulations and crisis response mechanisms, informed by the lessons learned during the savings and loan crisis. Estate planning lawyers have adapted their services to reflect these changes, emphasizing risk management and regulatory compliance to help clients make informed decisions and prevent future financial crises.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.