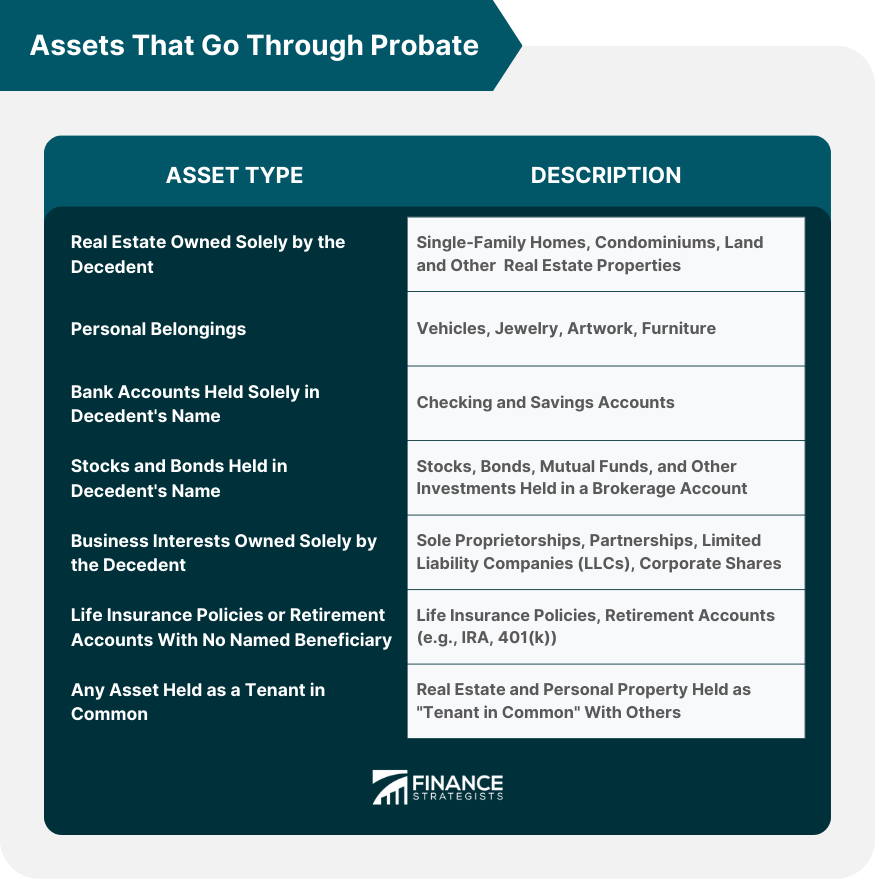

Probate is the legal process through which a deceased person's estate is managed and distributed. It involves verifying the validity of their will, cataloguing their assets, appraising property values, settling debts and taxes, and distributing the remaining assets to heirs and beneficiaries as dictated by the will or state law if no will exists. The purpose of probate is to prevent fraud after someone's death. It's a way to freeze the estate until a judge determines that the Will is valid, that all relevant people have been notified, that all property in the estate has been identified and appraised, that the creditors have been paid, and that all taxes have been paid. Once all of these tasks are complete, the court will issue an order distributing the property and the estate will be closed. In probate, an appointed executor, or personal representative, is tasked with managing the decedent's estate. This includes identifying, securing, and eventually distributing assets. Not all assets, however, are subject to probate. The following are examples of the types of assets that typically go through probate. A single-family home owned outright by the deceased person will typically have to go through probate. If the decedent has a Will, the house will be distributed according to the wishes stated in the Will. If there is no Will, the property will be divided according to the laws of intestacy of the state. Condominiums, like single-family homes, go through probate when owned solely by the deceased. The process is identical to that of single-family homes. All types of real estate properties, including vacant land, rental properties, and commercial properties, must go through probate if solely owned by the deceased. The probate court oversees the transfer of these properties to the beneficiaries. Cars, motorcycles, boats, and other vehicles owned by the deceased will typically need to go through probate. The probate court will oversee the transfer of these assets to the beneficiaries. Jewelry is another personal belonging that must be probated. High-value items may need to be appraised as part of the probate process. Artwork, including paintings, sculptures, and other forms of artistic creations owned by the decedent, will need to be probated. Much like jewelry, artwork of significant value will require appraisal. Furniture, along with other household items, also falls under probatable assets. Although individual pieces of furniture may not hold substantial value, taken as a whole, they may represent a significant portion of an estate. Bank accounts that are only in the decedent's name at the time of death will have to go through probate. This includes both checking and savings accounts. Investment accounts solely owned by the decedent are also subject to probate. This can include stocks, bonds, mutual funds, and other investments held in a brokerage account. If the decedent was a sole proprietor, their interest in the business is considered a personal asset and is subject to probate. The probate court will oversee the disposition of the business. If the decedent was a partner in a business partnership, their interest in the business must go through probate. The partnership agreement, however, may dictate how the decedent's interest is to be handled upon their death. The handling of an LLC after an owner's death depends on the terms of the LLC operating agreement. However, if there are no provisions for the death of a member, the decedent's interest in the LLC will typically need to go through probate. If the decedent held shares in a corporation, those shares will usually need to be probated. The probate court will oversee the transfer of these shares to the beneficiaries. If a life insurance policy or retirement account, such as an IRA or 401(k), does not have a named beneficiary or if the named beneficiary is deceased, the policy or account will have to go through probate. When property is held as a "tenant in common," the decedent's interest in the property is an asset of their estate and subject to probate. This applies to both real estate and personal property that the decedent and others owned together. Although many assets go through probate, there are several types of assets that can bypass this legal process. Certain financial instruments, such as bank accounts, certificates of deposit, and even securities, can be designated as Pay-On-Death (POD) or Transfer-On-Death (TOD). In these cases, the assets will transfer directly to the named beneficiary without having to go through the probate process. Jointly owned assets with rights of survivorship are not subject to probate. Upon the death of one owner, full ownership automatically passes to the surviving owner. This is commonly seen with jointly owned real estate and joint bank accounts. Life insurance policies and retirement accounts with designated beneficiaries do not go through probate. The funds from these accounts or policies are paid directly to the named beneficiaries, regardless of what the Will might state. A living trust, also known as an inter-vivos trust, is a legal entity created during an individual's lifetime where a designated person, the trustee, is given responsibility for managing that individual's assets for the benefit of eventual beneficiaries. Assets within a living trust bypass probate entirely. A revocable trust, often used in estate planning, allows you to retain control of all the assets in the trust, and you are free to revoke or change the terms of the trust at any time. Assets in a revocable trust bypass the probate process, transferring directly to the beneficiaries. The probate process begins with the appointment of an executor (if there's a Will) or an administrator (if there's no Will). This person is responsible for managing the probate process. They will collect the decedent's assets, pay any debts or taxes owed by the estate, and distribute the remaining assets to the named beneficiaries (or according to state law if there's no Will). This process is supervised by a probate court. The executor plays a vital role in the probate process. The executor's duties encompass locating and securing probate and non-probate assets, determining creditors, paying debts, calculating estate taxes, and ensuring proper filing and payment of taxes. In the probate process, known and potential creditors, beneficiaries, and heirs of the decedent must be notified of the decedent's death and the probate proceedings. This is typically done through direct notice and, in some cases, publication in a newspaper. Probate can often be a long and costly process, and therefore, many individuals choose to take steps to avoid it. Methods of avoiding probate include the creation of living trusts, joint property ownership, gifts, and the use of pay-on-death and transfer-on-death accounts. Given the complexities and potential challenges of the probate process, it's important to consider the impact of probate on estate planning. Proper estate planning can help to reduce the assets that must go through probate, thereby potentially saving time, expense, and complexity. It also ensures that your wishes are carried out after your death and can help to minimize the potential for disputes among surviving family members. Wills and trusts play a crucial role in avoiding probate. While assets specified in a will cannot avoid probate, a properly executed will can streamline the process. Trusts, on the other hand, can be used to avoid probate altogether, as assets held in a trust will transfer directly to the named beneficiaries upon the trustor's death. Probate assets are subject to estate taxes. For most people, federal estate taxes are not a concern. There may, however, be state-level estate taxes that apply. In some cases, proper estate planning can help to minimize estate tax liability. The impact of probate on estate planning underscores the importance of understanding the probate process. By taking the time to plan your estate properly, you can help to ensure that your assets will be distributed according to your wishes and potentially save your heirs time, money, and complexity. Probate is a legal process that validates a will and ensures the proper distribution of a decedent's assets and payment of their debts. Not all assets go through probate. Those that do include real estate, personal belongings, bank accounts, stocks and bonds, and business interests owned solely by the decedent, life insurance policies or retirement accounts with no named beneficiary, and any asset held as a tenant in common. Assets that avoid probate include those held in trusts, pay-on-death and transfer-on-death assets, jointly owned assets, and life insurance or retirement accounts with a named beneficiary. Understanding the probate process and the types of assets that go through it is essential for effective estate planning. Proper estate planning can potentially save time, reduce expenses, and minimize complexity, ensuring that your assets are distributed according to your wishes.Overview of Probate

Assets That Go Through Probate

Real Estate Owned Solely by the Decedent

Single-Family Homes

Condominiums

Land and Other Real Estate Properties

Personal Belongings

Vehicles

Jewelry

Artwork

Furniture

Bank Accounts Held Solely in the Decedent's Name

Stocks and Bonds Held in a Brokerage Account in the Decedent's Name

Business Interests Owned Solely by the Decedent

Sole Proprietorships

Partnerships

Limited Liability Companies (LLCs)

Corporate Shares

Life Insurance Policies or Retirement Accounts With No Named Beneficiary

Any Asset Held as a Tenant in Common

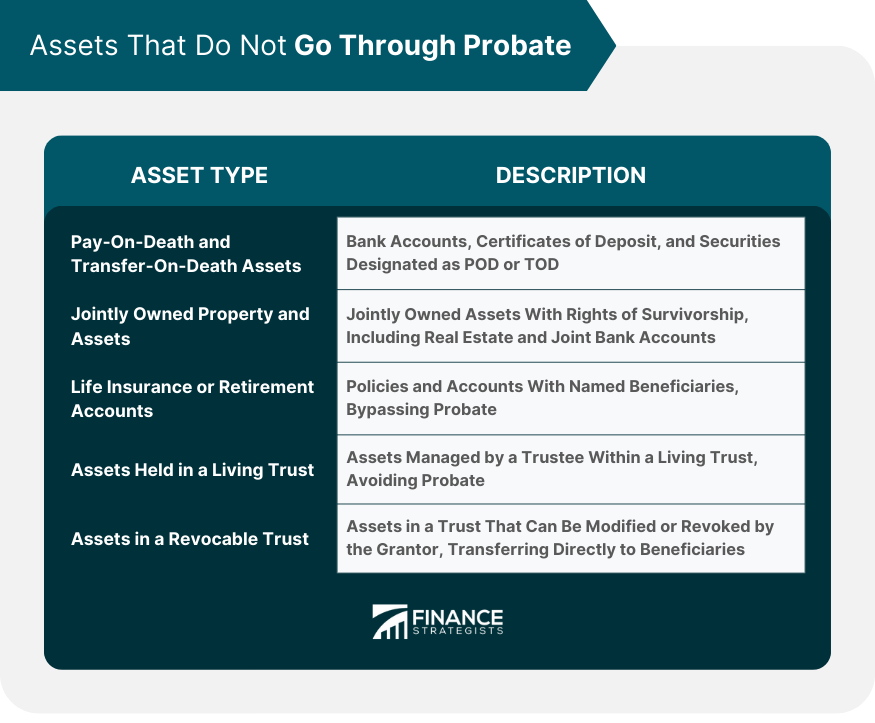

Assets That Do Not Go Through Probate

Pay-On-Death and Transfer-On-Death Assets

Jointly Owned Property and Assets

Life Insurance or Retirement Accounts With a Named Beneficiary

Assets Held in a Living Trust

Assets in a Revocable Trust

Probate Process

Overview of the Probate Process

Role of the Executor in Probate

How Beneficiaries are Notified in the Probate Process

How Probate Can Be Avoided

Impact of Probate on Estate Planning

Importance of Proper Estate Planning

Role of Wills and Trusts in Avoiding Probate

Tax Implications of Probate

The Bottom Line

What Assets Go Through Probate? FAQs

Assets that go through probate include solely-owned real estate, personal belongings, bank accounts, stocks and bonds, business interests, life insurance policies or retirement accounts with no named beneficiary, and any asset held as a tenant in common.

No, not all assets have to go through probate. Assets that bypass probate include those held in trusts, pay-on-death and transfer-on-death assets, jointly owned assets, and life insurance or retirement accounts with a named beneficiary.

No, jointly owned assets with rights of survivorship do not go through probate. Ownership automatically passes to the surviving owner.

Yes, a bank account held solely in the decedent's name will go through probate.

Life insurance policies with a named beneficiary do not go through probate. However, if there is no named beneficiary, or if the beneficiary is deceased, the policy will have to go through probate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.