A Letter of Administration is a legal document issued by the court that grants an appointed individual the authority to manage the estate of a deceased person who left no will or whose named executor is unable or unwilling to perform their duties. This individual, referred to as the administrator, has the responsibility to settle the deceased person's estate, including managing debts, taxes, and asset distribution. Without a will to determine how an estate should be managed, a Letter of Administration provides a means to ensure that the deceased’s assets are distributed according to state laws and that all debts are appropriately paid. In this case, the court appoints an administrator to handle the estate's management and distribution according to state intestacy laws, which typically favor direct relatives like spouses, children, and parents. Even if a will exists, there may be circumstances where the named executor is unable or unwilling to perform their duties. This situation might arise if the executor predeceases the testator, the individual who wrote the will, or if the executor declines the role due to personal reasons or incapacity. In certain scenarios, even with a will and a willing executor, the court may deem it necessary to issue a Letter of Administration. This situation might occur if there are doubts about the will's validity, if the will is contested, or if the executor is found to be unfit for the role due to reasons such as criminal conduct or conflict of interest. The deceased person, often referred to as the decedent, is the individual whose estate requires administration. The need for a Letter of Administration arises if they die intestate or if their appointed executor cannot perform their duties. The probate court, or its equivalent in different jurisdictions, is the legal authority that issues the Letter of Administration. The court oversees the administration of the decedent's estate to ensure compliance with state laws and protect the interests of all parties involved, particularly the beneficiaries. These individuals bear the responsibility of administering the estate faithfully and in the best interest of the beneficiaries. The administrator could be a relative of the decedent, a friend, or a professional such as a solicitor or a trust company. In the absence of a will, beneficiaries are usually determined based on intestacy laws, which typically favor direct relatives. Beneficiaries have a vested interest in the estate and may have legal recourse if they believe the administrator is not managing the estate appropriately. To obtain a Letter of Administration, a petition must be filed with the appropriate probate court. This petition typically includes information about the decedent, their estate, the proposed administrator, and the potential heirs. Some jurisdictions may require a bond to protect the estate's value. Once the petition is filed, the court reviews it, verifies the information provided, and considers whether the proposed administrator is suitable. The court may require a hearing where interested parties can voice any objections. If the court approves the petition, it will issue a Letter of Administration to the proposed administrator. The Letter of Administration officially appoints the administrator to handle the decedent's estate. The administrator is then legally bound to act in the best interests of the beneficiaries and the estate, managing it according to the law and to the court's directives. This document serves as official recognition of the administrator's role, authorizing them to carry out the complex task of managing the deceased's estate. As a legally recognized document, the Letter of Administration is accepted by financial institutions, government agencies, and others who may hold the deceased's assets. With this letter, the administrator can perform various tasks, such as accessing bank accounts, selling property, and paying outstanding debts. The legal process outlined by this document helps maintain an organized progression of tasks, preventing potential disorder or confusion during the administration of the estate. This structure is especially beneficial when dealing with complicated estates, multiple beneficiaries, or potential disputes. By delineating a clear roadmap, the Letter of Administration enables the administrator to effectively carry out their responsibilities. As long as the administrator acts in good faith, in accordance with the law, and fulfills their duties diligently, they are generally shielded from personal liability. For instance, if the estate's liabilities exceed its assets, the administrator is typically not personally responsible for settling these outstanding debts, offering them a significant layer of protection. The effectiveness of a Letter of Administration is generally restricted to a specific period, the length of which can vary depending on the jurisdiction in which it is issued. This time limit is set based on the expectation that the appointed administrator would be able to settle the deceased's estate within the allocated timeframe. If the administrator is unable to complete the process within the set period, they would need to apply to the court for an extension, adding to the administrative burden. A Letter of Administration provides authority to the appointed administrator only within the jurisdiction in which it was granted. This can create complications if the deceased had assets scattered across different states or countries. To gain control over these assets, the administrator might need to apply for separate Letters of Administration in all other jurisdictions where assets are located. This multi-jurisdictional process can be both time-consuming and costly. In the absence of a will, the administrator's hands are tied when it comes to distributing the assets of the estate. They are bound by the state's intestacy laws, which might not reflect the true wishes of the deceased. This lack of control can lead to unsatisfactory outcomes and potential conflict among the beneficiaries. A will is a legal document that clearly expresses the individual's wishes regarding the distribution of their assets post-death. An executor is named in the will, identifying the person entrusted with the responsibility of administering the estate. As a result, the probate court does not need to appoint an administrator, making a Letter of Administration unnecessary. In a living trust, the individual transfers their assets into the trust and appoints a trustee, which can be themselves, to manage these assets. Upon their death, the successor trustee, who has been named in advance, steps in and distributes the assets to the beneficiaries as per the trust's terms. Since the assets are owned by the trust and not the individual, they are not subject to probate, and there's no need for a Letter of Administration. While establishing a living trust involves some upfront effort and expense, it can provide significant benefits, including privacy, flexibility, and the potential to save time and money by avoiding probate. Assets owned in this manner automatically pass to the surviving owner upon the death of the other, bypassing the probate process. Common examples of jointly owned assets include real estate, bank accounts, and other financial assets. When one owner dies, the surviving owner typically needs to present a death certificate to the relevant institution to have the deceased's name removed from the asset. It's worth noting, however, that joint ownership might not be suitable for all types of assets or in all circumstances. It's also crucial to understand the potential implications, including tax consequences and issues that might arise if the joint owners have a falling out or if one owner incurs significant debts. Therefore, individuals considering this strategy should consult with an estate planning attorney or financial advisor to fully understand the benefits and drawbacks. A Letter of Administration grants an appointed individual the authority to manage the estate of a deceased person who did not leave a will or whose named executor cannot fulfill their duties. It provides an organized and legally recognized process for settling the estate, ensuring that assets are distributed according to state laws and debts are properly addressed. While the document offers benefits such as legal authority, order in the settlement process, and protection for the administrator, it also has limitations, including a limited duration, jurisdictional restrictions, and limited control over estate distribution. To avoid the need for a Letter of Administration, individuals can take proactive steps such as creating a comprehensive will, establishing a living trust, and utilizing joint ownership with rights of survivorship for certain assets. However, it is crucial to seek professional advice and carefully consider the implications of each approach to make informed decisions, ensuring their assets are managed and distributed according to their desires.What Is a Letter of Administration?

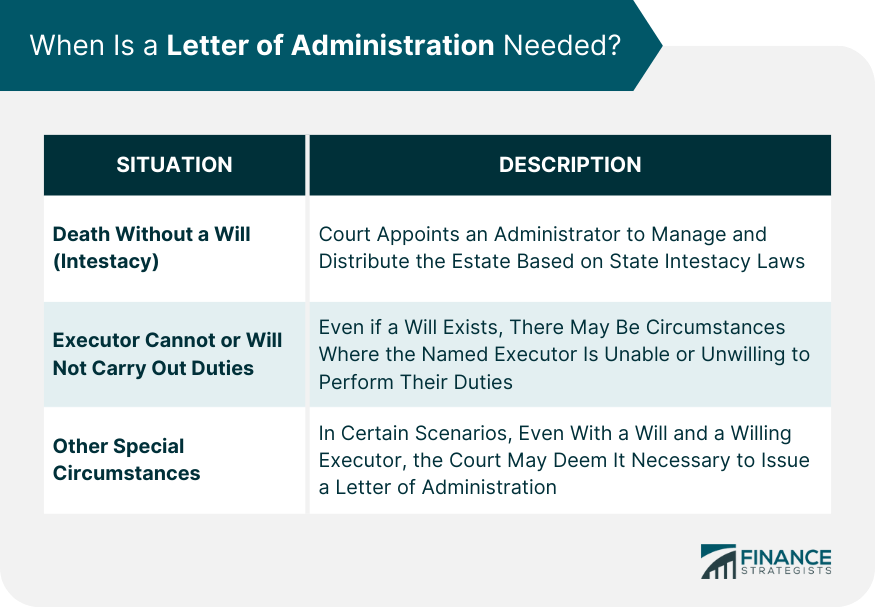

When Is a Letter of Administration Needed?

Death Without a Will (Intestacy)

Executor Cannot or Will Not Carry Out Duties

Other Special Circumstances

Parties Involved in a Letter of Administration

The Deceased

The Court

The Administrator

Beneficiaries

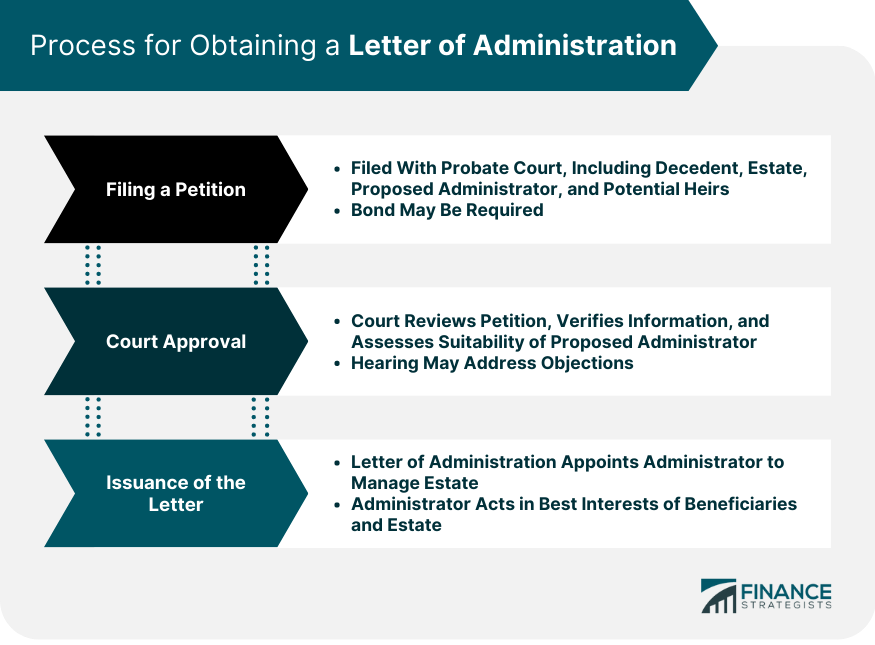

Process for Obtaining a Letter of Administration

Filing a Petition

Court Approval

Issuance of the Letter

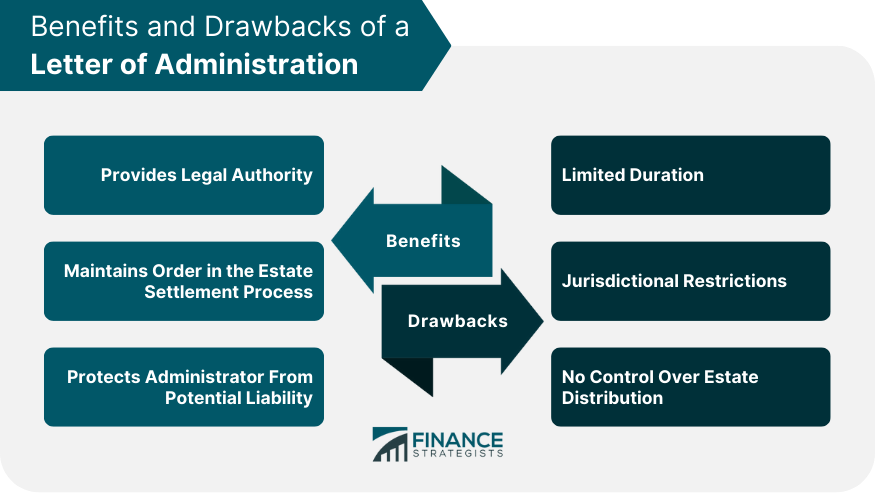

Benefits of a Letter of Administration

Provides Legal Authority

Maintains Order in the Estate Settlement Process

Protects Administrator From Potential Liability

Drawbacks of a Letter of Administration

Limited Duration

Jurisdictional Restrictions

No Control Over Estate Distribution

How to Avoid Needing a Letter of Administration

Creating a Comprehensive Will

Establishing a Living Trust

Utilizing Joint Ownership With Rights of Survivorship

Final Thoughts

Letter of Administration FAQs

The purpose of a Letter of Administration is to grant authority to an appointed individual, known as the administrator, to manage the estate of a deceased person who either left no will or whose named executor is unable or unwilling to fulfill their duties.

To obtain a Letter of Administration, a petition must be filed with the appropriate probate court. The court reviews the petition, considers the suitability of the proposed administrator, and may hold a hearing for any objections. If approved, the court issues the Letter of Administration to the proposed administrator.

The administrator can be a relative of the deceased, a friend, or a professional such as a solicitor or a trust company. The key requirement is that the administrator acts in the best interests of the beneficiaries and manages the estate faithfully.

A Letter of Administration provides legal authority to the administrator, enabling them to manage the complex tasks of settling the deceased's estate. It also maintains order in the estate settlement process, particularly in cases with complicated estates or multiple beneficiaries. Additionally, the administrator is generally protected from personal liability as long as they act in good faith and fulfill their duties diligently.

Yes, a Letter of Administration can be avoided through proper estate planning. Creating a comprehensive will that clearly expresses asset distribution and appoints an executor can eliminate the need for a Letter of Administration. Other alternatives include establishing a living trust, which bypasses probate, or utilizing joint ownership with rights of survivorship for certain assets, which allows automatic transfer to the surviving owner upon death. Consulting with an estate planning professional can provide further guidance on avoiding the need for a Letter of Administration.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.