Probate is a legal procedure in which a deceased person's estate is administered and distributed under court supervision. The process involves authenticating the decedent’s will (if available), inventorying their assets, paying any outstanding debts or taxes, and finally, distributing the remaining assets to the rightful beneficiaries as stipulated in the will or according to state laws in the absence of a will. The purpose of probate is to ensure the fair and lawful distribution of a deceased person's assets. The process prevents fraudulent claims and disputes over the estate and protects the interests of the creditors and heirs. In essence, probate provides a structured, legal method of transferring property from the deceased to the living. The need for probate generally depends on the value of the deceased's estate. Estates of higher value typically require probate, while those of lesser value may not. It's essential to determine the estate's value accurately because this information guides the probate process and influences tax considerations. Furthermore, understanding the value of the estate aids in the preparation of estate plans, ensuring the efficient distribution of assets upon the estate holder's demise. The threshold value for probate can vary significantly from one jurisdiction to another. Each state or country establishes its specific monetary value or range for probate initiation. For instance, in some US states, probate is required for estates valued at $50,000 or more, while others may set the bar at $100,000. Whether or not real estate is included in the estate can also affect the need for probate. In some regions, even a small piece of real estate necessitates probate, irrespective of its value. However, this rule may differ if the property was held jointly with the right of survivorship. Certain assets may be exempt from the estate's total value for probate. These typically include assets held in joint tenancy, pay-on-death accounts, life insurance or retirement accounts that have a designated beneficiary, and assets held in a living trust. While each jurisdiction will have specific regulations, there are some typical value ranges for when an estate requires probate. For example, in California, estates valued at $166,250 or more require probate. Meanwhile, in New York, the threshold is $30,000. These are merely examples and may change over time due to legislation amendments or inflation. In many jurisdictions, small estates are eligible for a simplified probate process, or they may bypass the probate process entirely. The rules for what constitutes a "small estate" differ significantly, depending on the state or country's laws. Generally, the procedure for small estates involves less paperwork and less court involvement, reducing the time and expense associated with probate. For larger estates that exceed the threshold value, a more extensive probate process is usually required. This process typically involves the appointment of a personal representative or executor, who manages the estate's affairs. They are responsible for notifying creditors, paying taxes and debts, and distributing assets to the beneficiaries according to the will or state law. This process is generally more time-consuming and costly than the small estate procedure. The valuation of an estate for probate purposes is a crucial task, primarily performed by the appointed executor or personal representative. The process begins with a comprehensive inventory of the deceased's assets. This includes tangible and intangible assets, like real property, personal belongings, investments, and bank accounts. It also involves determining their fair market value at the time of the deceased's death, which may require professional appraisals or valuations. Real estate constitutes a significant part of many estates. To determine its value, it's often best to enlist a professional appraiser. They will assess the market conditions, property condition, location, and comparable sales to deliver an accurate valuation. The value of personal property, such as furniture, jewelry, art, and collectibles, can vary widely. Items of significant value should be professionally appraised. For items of lesser value, a reasonable estimate of their current market value may suffice. Financial assets like stocks, bonds, mutual funds, and bank accounts are usually straightforward to value. The value is typically the account balance or the investment's market value on the date of the deceased's death. Assets may include everything from real estate and personal belongings to intangible assets like investments and intellectual property rights. Any assets left unaccounted for can significantly skew the estate's value and lead to an incorrect assessment of the need for probate or potential tax liabilities. In estate valuation, the date used for determining the value of assets is as crucial as the assets themselves. For probate purposes, assets are generally valued based on their fair market value at the date of the owner's death. Using a different date can result in an incorrect valuation and potential legal issues. While it's essential to account for all assets, it's equally important to consider the estate's debts and liabilities. These could include mortgages, credit card debts, medical bills, or any other outstanding obligations. Ignoring these liabilities can overinflate the value of the estate, leading to a higher probate threshold and potentially more taxes. Many people underestimate the need for professional appraisers in estate valuation, especially when it comes to valuable and complex assets like real estate or unique collectibles. An experienced appraiser can provide a more accurate and unbiased valuation, helping to prevent disputes among beneficiaries and ensuring compliance with tax authorities. A living trust is a legal entity into which a person can transfer ownership of their assets while they're alive. When the individual passes away, the assets in the trust are distributed directly to the beneficiaries named in the trust, bypassing the probate process entirely. Assets owned jointly with the "right of survivorship" pass directly to the surviving owner upon the death of the other owner, bypassing probate. This is commonly used for homes and bank accounts. However, it's essential to understand the potential tax and long-term implications before transferring assets to joint ownership. Certain assets like life insurance policies, retirement accounts, and pay-on-death bank accounts allow the owner to designate a beneficiary. Upon the owner's death, these assets are directly transferred to the beneficiary without going through probate. The probate process is an essential legal procedure to ensure the fair and orderly distribution of a deceased person's assets. The value of an estate, which varies by jurisdiction, determines whether probate is required. Valuation of the estate involves a comprehensive assessment of all assets, which may necessitate professional appraisals, especially for real estate and valuable personal property. Common mistakes in estate valuation, such as failing to consider all assets and liabilities or using incorrect valuation dates, can lead to incorrect assessments and legal complications. While navigating the complexities of estate valuation can be challenging, strategies such as using living trusts, joint ownership, and designating beneficiaries for specific assets can help to avoid probate and simplify the asset distribution process. Ultimately, the efficient preparation of estate plans and an accurate valuation of the estate will ensure a smoother transfer of assets upon the estate holder's demise.Overview of Probate

Threshold Value of Estate Requiring Probate

General Rule and Importance of Determining Estate Value

Factors Affecting the Threshold Value of Estate

Jurisdictional Differences

Inclusion of Real Estate

Specific Assets That May Not Count Toward the Total

Typical Value Ranges by State and Country

Probate Process for Different Estate Values

Small Estate Probate Procedure

Regular Estate Probate Procedure

How to Determine the Value of an Estate for Probate

Estate Valuation Basics

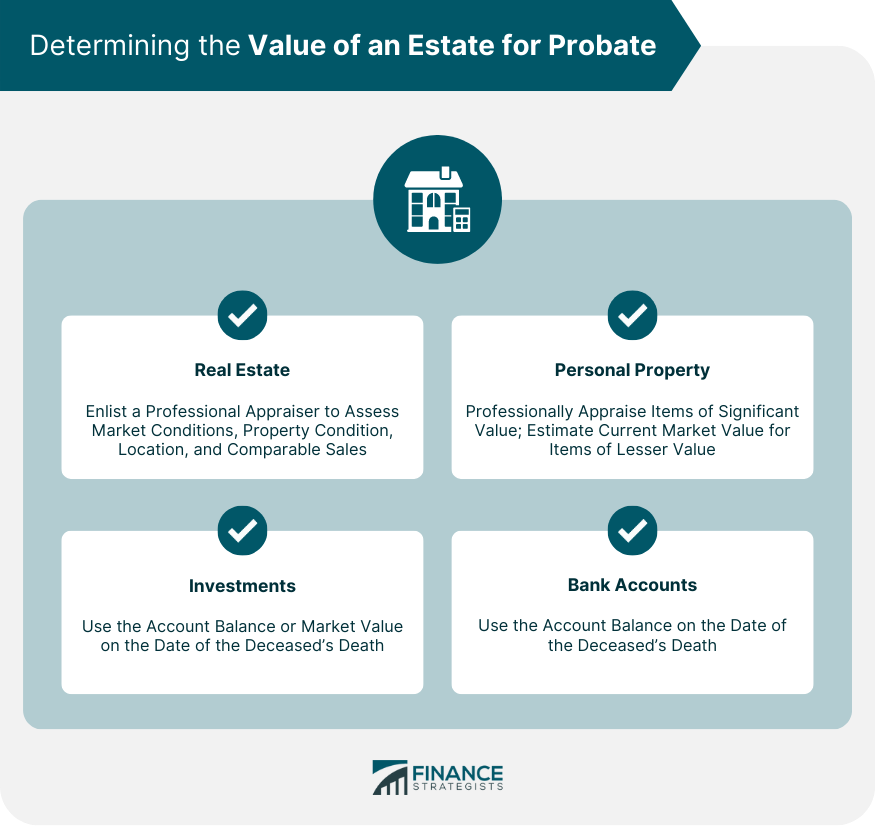

Valuation of Common Assets

Real Estate

Personal Property

Investments and Bank Accounts

Common Mistakes in Estate Valuation

Neglecting to Value All Assets

Using Incorrect Valuation Dates

Failing to Consider Debts and Liabilities

Not Using a Professional Appraiser When Needed

Estate Planning Strategies to Avoid Probate

Use of Living Trusts

Joint Ownership With Right of Survivorship

Designated Beneficiaries for Certain Assets

The Bottom Line

Value of Estate Requiring Probate FAQs

The value of an estate that requires probate varies by jurisdiction. Some states in the U.S., for example, might require probate for estates valued at $50,000 or more, while others might set the limit at $100,000.

The value of an estate for probate is determined by a comprehensive inventory of the deceased's assets. This includes real estate, personal property, and financial assets like investments and bank accounts. Professional appraisals may be needed to determine the fair market value of some assets.

Yes, the value of an estate can significantly affect the probate process. Smaller estates might be eligible for a simplified probate process or might bypass probate entirely, while larger estates typically require a more comprehensive probate process.

No, certain assets may not count toward the total value of an estate for probate. These include assets held in joint tenancy, pay-on-death accounts, life insurance or retirement accounts with a designated beneficiary, and assets held in a living trust.

Strategies to avoid probate include the use of living trusts, joint ownership with the right of survivorship, and designating beneficiaries for certain assets like life insurance policies and retirement accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.