Probate is the legal process by which a deceased person's estate is settled. This includes validating their will (if any), paying off debts, and distributing assets as per the will or state law if there is no will. While probate can be straightforward, it can also be complex, costly, and time-consuming, particularly if the estate is large or if there are disputes over the will. As such, many people consider strategies to get around probate to make the process easier for their loved ones after they pass away. Probate is often overseen by a court, adding a layer of judicial scrutiny that can prolong the process. Consequently, understanding and implementing strategies to circumvent probate can alleviate potential burden, hasten asset distribution, and provide a sense of relief and certainty to grieving loved ones. A living trust is a legal entity you create to hold your assets during your lifetime. When you die, the assets in the trust are distributed directly to the beneficiaries you have named, without needing to go through probate. There are two main types of living trusts: revocable, which can be altered or revoked during your lifetime, and irrevocable, which cannot be changed without the beneficiaries' consent once established. The key advantage of a living trust is the direct, often speedy distribution of assets, saving time, court fees, and attorney costs. Creating a living trust involves several steps: 1. Decide on the Type of Trust: Determine whether a revocable or irrevocable trust suits your needs better. 2. Choose a Trustee: Select a trustworthy person or institution to manage the trust upon your incapacity or death. 3. Inventory Assets: List all your significant assets like real estate, investments, and valuable personal property. 4. Create the Trust Document: Draft the trust document, outlining how your assets should be managed and distributed. Use an attorney for complex estates. 5. Sign and Notarize: Sign the trust document in front of a notary public. 6. Fund the Trust: Transfer the ownership of your assets into the trust. 7. Update as Needed: Regularly review and update your trust to reflect life changes. Joint ownership of property is another strategy to avoid probate. Joint tenancy refers to an arrangement where two or more people own a property together, each with an equal share. If one owner dies, their share automatically passes to the surviving owner(s), bypassing probate. Tenancy by the entirety, similar to joint tenancy, is exclusively for married couples (or in some states, registered domestic partners). Joint ownership provides the benefit of bypassing probate and facilitating the immediate transfer of property. However, there are risks. These include a lack of control over the property (since changes require all owners' agreement) and exposure to creditors, who may target the property if one owner incurs debts. Joint ownership should therefore be considered carefully, taking into account all possible ramifications. Certain types of accounts allow for the designation of beneficiaries, thereby avoiding probate. These include retirement accounts like IRAs and 401(k)s, life insurance policies, and Payable-On-Death (POD) or Transfer-On-Death (TOD) accounts. Upon the account holder's death, the assets go directly to the designated beneficiary. Designating beneficiaries is generally straightforward. For most accounts, it involves filling out a form where you list the beneficiary's name and possibly their relationship to you and their Social Security number. You can usually change your beneficiaries at any time. While designating beneficiaries is a straightforward process, mistakes can have significant implications. For instance, if you forget to update your beneficiaries after a divorce, your ex-spouse may still inherit your assets. If no beneficiary is named, or if the beneficiary predeceases you and there's no contingent beneficiary, the assets may need to go through probate. It's crucial to review and update your beneficiary designations regularly and after major life events. One way to avoid probate is by gifting assets while still alive. In the United States, an individual can gift up to $18,000 per person per year in 2024 without incurring a gift tax. For gifts above this amount, the giver may have to file a gift tax return, and the amount could be subtracted from their lifetime gift and estate tax exemption. Consulting a tax advisor is essential to understanding how gift taxes work and to strategize appropriately. Gifting allows the immediate transfer of wealth and can potentially reduce the size of your estate, thus minimizing the estate tax (if applicable). However, there are risks, including loss of control over assets and potential gift tax liability. Additionally, if you're gifting property, consider the cost basis and potential capital gains tax implications for the recipient. Life insurance can play a crucial role in estate planning and avoiding probate. Upon the policyholder's death, the proceeds are paid directly to the named beneficiaries, bypassing the probate process. Life insurance can provide immediate liquidity for your heirs, cover estate taxes, and ensure that your loved ones are financially protected. Assigning life insurance beneficiaries is typically straightforward. When purchasing a policy, you'll be asked to name a primary beneficiary and, usually, contingent beneficiaries, who will receive the death benefit if the primary beneficiary cannot. It's essential to review and update your beneficiaries periodically and after significant life events. Payable-on-death (POD) accounts and registrations are another way to avoid probate. With a POD account, the account holder designates a beneficiary who will inherit the assets in the account upon their death, without going through probate. This designation can be added to checking and savings accounts, CDs, and even some securities and retirement accounts. To establish a POD account, you typically need to fill out a form provided by your bank or brokerage, listing your chosen beneficiary. If you want to change the beneficiary, you can usually do so by filling out a new form. Upon the account holder's death, the beneficiary can claim the assets directly from the bank or brokerage. Probate laws and strategies to avoid them can be complex. Each person's situation is unique, and what works best for one person may not be the best solution for another. Therefore, it's crucial to seek advice from professionals who understand your circumstances and can guide you in making informed decisions. Estate planning attorneys and financial advisors can play a vital role in helping you plan for the future. Attorneys can provide legal advice on wills, trusts, and estate laws in your state. Financial advisors can offer guidance on managing and distributing your assets to achieve your financial goals and can help minimize taxes. When seeking professional advice, consider the expert's qualifications, experience, and whether they understand your unique needs. Be sure to prepare for the consultation by gathering relevant information about your assets, liabilities, and financial goals. Remember, planning to avoid probate is not a one-time event, but a process that needs to be reviewed and updated as your situation changes. There are numerous strategies to avoid probate. These include creating a living trust, joint ownership of property, designating beneficiaries on accounts, gifting assets while still alive, using life insurance, and setting up payable-on-death accounts and registrations. Planning to avoid probate is not just about saving time and money, but also about ensuring a smooth transfer of assets to your loved ones, and potentially protecting your estate from significant tax liabilities. It is a critical part of estate planning that should not be overlooked. While it's possible to do some of this planning yourself, due to the complexities and potential for costly mistakes, it's advisable to seek advice from an estate planning attorney. They can provide tailored guidance based on your specific circumstances and goals, helping you navigate the legalities to ensure your assets are distributed as you wish, without unnecessary complications.Overview of Probate

Immediate Strategies to Get Around Probate

Creation of a Living Trust

Definition and Advantages of a Living Trust

Step-By-Step Guide on Setting up a Living Trust

Joint Ownership of Property

Types of Joint Ownership: Joint Tenancy and Tenancy by the Entirety

Benefits and Risks of Joint Ownership

Designating Beneficiaries on Accounts

Types of Accounts With Beneficiary Designations

Process of Designating Beneficiaries

Implications of Incorrect Beneficiary Designations

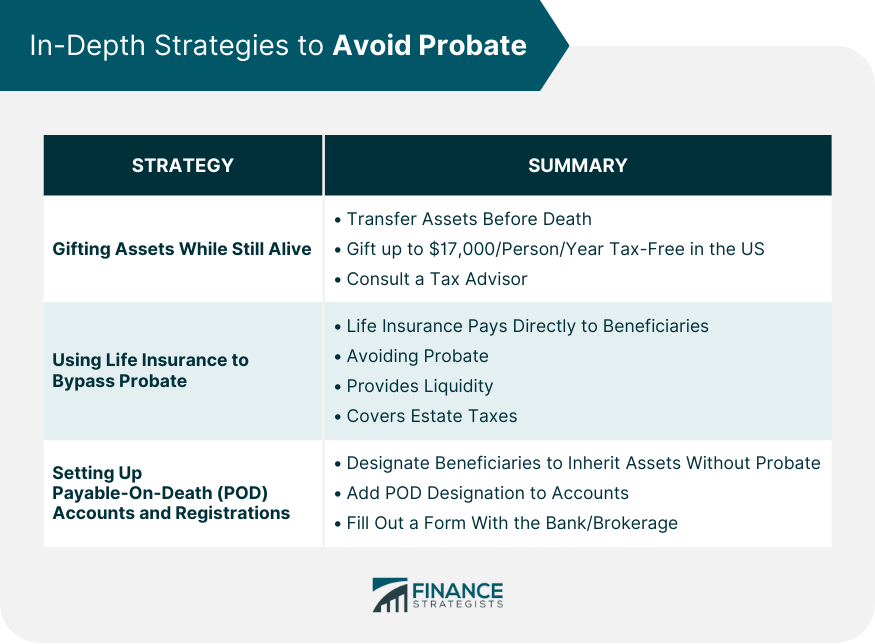

In-Depth Strategies to Avoid Probate

Gifting Assets While Still Alive

Understanding Gift Tax Laws

Advantages and Risks of Gifting Assets

Using Life Insurance to Bypass Probate

Role of Life Insurance in Estate Planning

Process of Assigning Life Insurance Beneficiaries

Setting up Payable-On-Death Accounts and Registrations

Explanation and Benefits of Payable-On-Death Arrangements

How to Establish Payable-On-Death Accounts and Registrations

Legal and Financial Advice

Importance of Seeking Legal and Financial Advice

Role of Estate Planning Attorneys and Financial Advisors

Key Considerations When Seeking Professional Advice

The Bottom Line

How to Get Around Probate FAQs

There are several ways to get around probate, including creating a living trust, jointly owning property, designating beneficiaries on accounts, gifting assets while alive, using life insurance, and setting up payable-on-death accounts.

Getting around probate can speed up the distribution of assets, reduce costs associated with the probate process, and ensure a smoother transition of assets to your loved ones.

Yes, a living trust is a common and effective strategy to get around probate. Assets held in a trust are not subject to probate and are directly transferred to the beneficiaries.

Yes, joint ownership, such as joint tenancy or tenancy by the entirety, can help avoid probate. Upon the death of one owner, their share automatically passes to the surviving owner(s), bypassing probate.

You should consider consulting with an estate planning attorney and a financial advisor. These professionals can provide personalized advice based on your specific situation and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.