An estate represents a person's total property, including but not limited to real and personal property, owned or controlled by an individual at the time of their death. Probate is the legal process whereby a deceased person's estate is administered and processed. The process includes validating a will if one exists, paying off debts, and distributing the remaining assets according to the will or the state's laws of intestacy if no will exists. Probate starts when the executor, who is nominated by the decedent in their will, or the administrator (if no will exists), presents the will for probate in a courthouse in the county where the deceased property owner lived. If the will is deemed valid and there are no disputes, the executor or administrator will then proceed to inventory and appraise the estate's assets, pay off debts and taxes, and distribute the remaining assets to the rightful beneficiaries. Size of the Estate: In many states, small estates are exempt from probate. The threshold defining a "small estate" differs by state but generally ranges from $50,000 to $200,000. Existence of a Will: Estates with a valid will typically undergo the probate process to ensure the deceased person's wishes are followed. However, a will alone does not avoid probate. Type and Distribution of Assets: How assets are owned at the time of death affects whether an estate must go through probate. Certain types of property ownership and designated beneficiaries may bypass probate. State Laws on Probate: Each state has its probate laws, which can affect whether an estate must go through probate. For example, some states have simplified probate procedures for smaller estates. Assets Held in Joint Tenancy: Assets owned in joint tenancy with the right of survivorship pass automatically to the surviving owner(s) upon death and thus avoid probate. Life Insurance or Retirement Accounts with Designated Beneficiaries: Assets such as life insurance proceeds and retirement accounts usually have designated beneficiaries and are, therefore, not subject to probate. Real Estate With a Transfer-On-Death Deed: In some states, real estate can be transferred to beneficiaries via a transfer-on-death deed, avoiding probate. Trust-Based Estates: Assets held in a trust, such as a living trust, bypass probate because the trust controls their distribution after the owner's death. Small Estates as per State Law: As previously mentioned, states often exclude small estates from probate, but the threshold amount varies by state. 1. Filing a Petition With the Probate Court: The probate process begins with filing a petition in the appropriate probate court. This step often requires the assistance of a probate attorney. 2. Notification of Interested Parties: After the petition is filed, interested parties must be notified. These parties usually include creditors, potential heirs, and beneficiaries. 1. Validation of the Will: The court first verifies the validity of the will if one exists. The will's authenticity is established during a court hearing. 2. Appointing an Executor or Administrator: The court will then appoint an executor named in the will. If no executor is named, or there's no will, the court will appoint an administrator. 3. Identifying and Appraising Assets: The executor or administrator will identify, locate, and appraise the decedent's assets. 4. Paying Estate Debts, Claims, and Taxes: The executor or administrator will pay off any valid debts or claims against the estate. They also must pay any estate taxes due. 5. Distribution of Assets to Beneficiaries: Once debts and taxes are paid, the remaining assets are distributed to the beneficiaries according to the will or state law if no will exists. The duration of the probate process can vary greatly, depending on the size and complexity of the estate, any disputes or contests over the will, and the efficiency of the court system. Probate can be expensive. Costs may include court fees, appraisal costs, executor's fees, attorney's fees, and bond fees. The size and complexity of the estate typically determine these fees. While probate can be a valuable process for some estates, it is not the only way to handle the transfer of assets following death. There are several alternatives to probate, including joint ownership, transfer-on-death designations, trusts, and gifting assets before death. Joint tenancy with the right of survivorship means that when one joint owner dies, the surviving joint owner automatically becomes the sole owner of the property. This transfer of ownership occurs outside the probate process. Tenancy by entirety is a form of joint ownership available only to married couples in certain states. Similar to joint tenancy, when one spouse dies, the surviving spouse becomes the sole owner of the property, bypassing probate. In community property states, spouses can also hold property as community property with right of survivorship. Upon the death of one spouse, the surviving spouse automatically receives the deceased spouse's share of the community property, avoiding probate. Transfer-on-death (TOD) and payable-on-death (POD) designations are another way to avoid probate. These designations can be used on bank accounts, securities, and, in some states, real estate and vehicles. The asset will automatically transfer to the designated beneficiary upon the owner's death, bypassing probate. A revocable living trust allows you to transfer your assets into a trust during your lifetime. Upon your death, the assets are distributed to the trust beneficiaries by the successor trustee, avoiding probate. The trust can be altered or revoked at any time during your life. An irrevocable trust cannot be altered or revoked without the beneficiaries' consent once it has been established. It provides stronger protection against creditors and can have tax benefits, but you give up control over the assets in the trust. Gifting assets before death can also avoid probate because anything you gift is no longer part of your estate when you die. However, there may be gift tax implications to consider. Time and Cost Savings: Avoiding probate can save significant time and costs associated with court proceedings and attorney's fees. Privacy: Probate is a public process, so any documents, including your will and the value of your assets, become part of the public record. Avoiding probate can help keep your estate matters private. Immediate Access to Assets: Assets can be tied up in probate for months or even years. Avoiding probate can allow your heirs to access their inheritance faster. Difficulty in Planning: Avoiding probate often requires careful and complex estate planning. It may be more straightforward to let your estate go through probate, particularly for small estates. Potential Tax Implications: While avoiding probate may have tax benefits, it may also have potential tax consequences, such as triggering capital gains tax. It's important to consider these implications as part of your estate planning. Risks Associated With Joint Ownership: While joint ownership can avoid probate, it also comes with risks. For instance, the property may be exposed to the joint owner's debts, or the joint owner may decide to sell their share. Probate, while seemingly daunting, plays a key role in the legal and organized distribution of an individual's estate after death, validating the will, settling debts, and distributing remaining assets according to the deceased's wishes or state law. However, probate isn't always required, depending on the size of the estate, the existence of a will, and specific state laws. Thorough estate planning can streamline or even bypass the probate process. By comprehending which types of assets and designations avoid probate, one can strategically minimize expenses, maintain privacy, and expedite the distribution of assets. Probate management can be complex and emotionally challenging. Hence professional assistance is often beneficial to navigate effectively. Though strategies to circumvent probate have advantages, they may also come with pitfalls that need careful consideration. An estate planning lawyer can help circumvent potential legal issues and ensure that assets are distributed in line with your wishes.Overview of Estate and Probate

Necessity of Probate in Estate Settlement

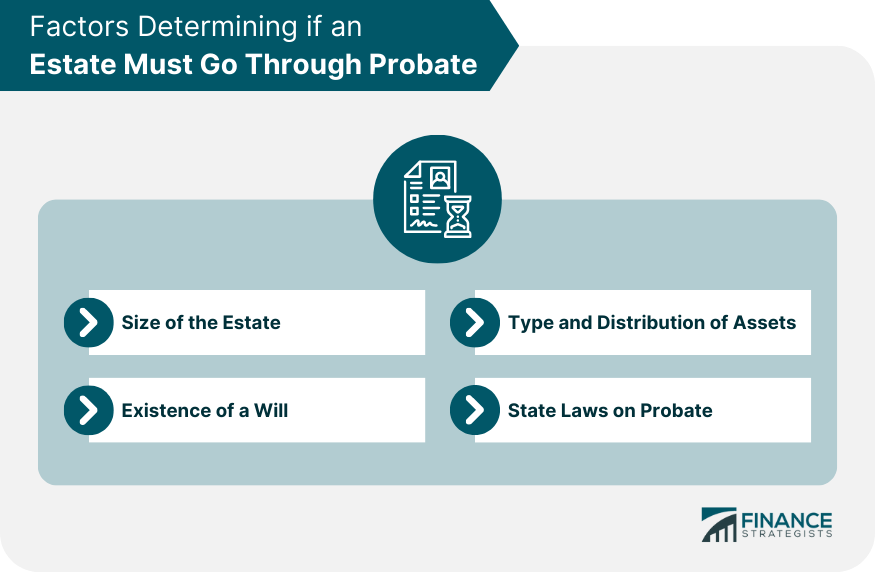

Factors Determining if an Estate Must Go Through Probate

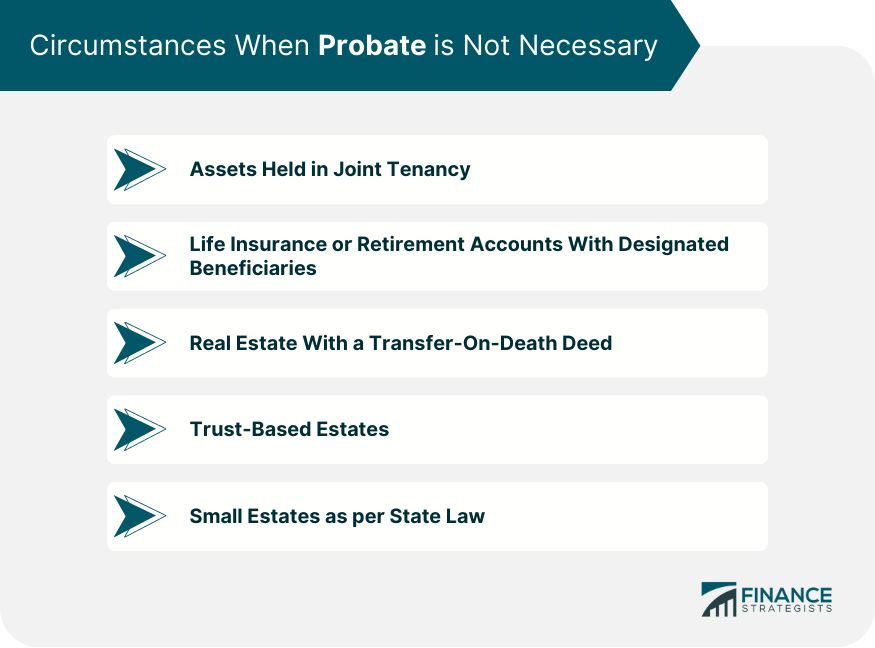

Circumstances When Probate is Not Necessary

Probate Process

Beginning the Probate Process

Steps Involved in Probate

Length and Cost of the Probate Process

Factors Affecting the Duration of Probate

Probate Fees and Expenses

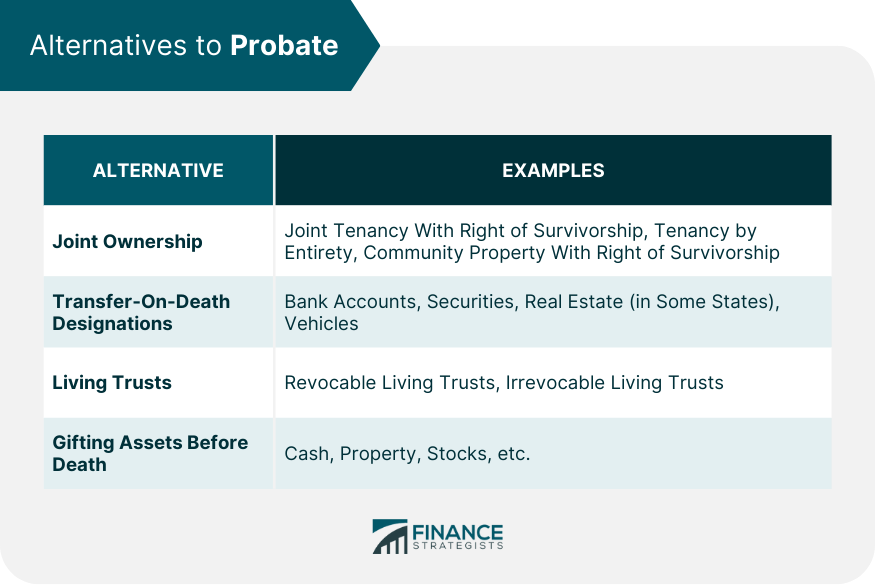

Alternatives to Probate

Joint Ownership

Joint Tenancy With Right of Survivorship

Tenancy by Entirety

Community Property With Right of Survivorship

Transfer-On-Death and Payable-On-Death Designations

Living Trusts

Revocable Living Trusts

Irrevocable Living Trusts

Gifting Assets Before Death

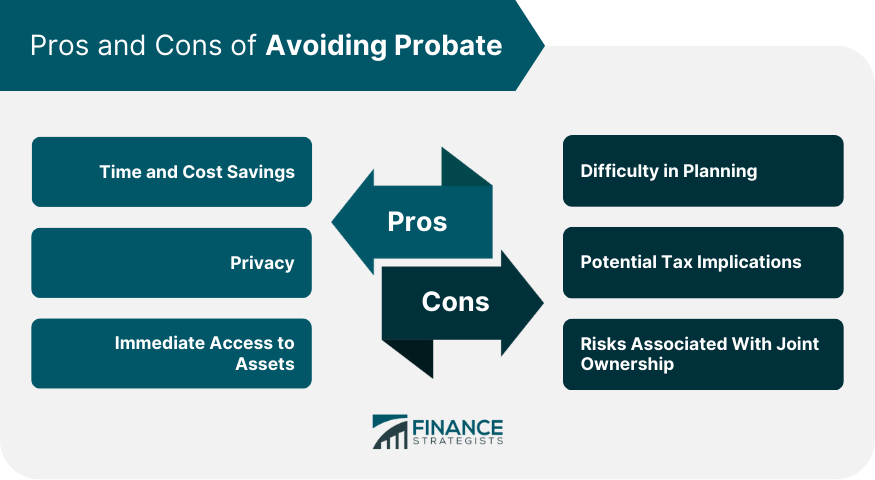

Advantages and Disadvantages of Avoiding Probate

Pros of Avoiding Probate

Cons of Avoiding Probate

Bottom Line

When Does an Estate Have to Go Through Probate? FAQs

No, not all estates have to go through probate. Factors such as the size of the estate, how assets are titled, and the state's probate laws influence the necessity of probate.

Having a will does not automatically bypass probate. The will itself often needs to go through probate to validate it and carry out the decedent's wishes.

Assets held in joint tenancy, retirement accounts with designated beneficiaries, assets held in a trust, and assets with transfer-on-death or payable-on-death designations usually avoid probate.

Most states have simplified probate processes or even exemptions for small estates. The definition of a "small estate" varies by state.

If an estate has significant debts, probate could be necessary to handle the debts properly. Creditors are typically paid from the estate's assets during probate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.