An executor is a person named in a will to manage the deceased person's estate, including their financial obligations and assets. The executor's responsibilities include applying for probate, a legal process where a court recognizes the validity of a will and authorizes the executor to carry out the terms of the will. If the executor fails to apply for probate, several potential issues could arise. If an executor doesn't apply for probate, the administration of the estate may be delayed or even halted. Without the authority granted by the probate court, the executor cannot legally distribute assets, pay debts, or take other actions necessary to manage the estate. Beneficiaries, creditors, or other interested parties might bring legal challenges against the executor if probate isn't sought when required. This can lead to a protracted legal dispute, potentially causing stress and financial burden for all involved. If an executor does not fulfill their duties, including applying for probate when necessary, they could face personal liability. This means they may be financially responsible for any losses incurred by the estate or the beneficiaries due to their negligence or inaction. The court can decide to replace the executor if they fail to apply for probate, especially if this failure negatively impacts the estate or the beneficiaries. The court may appoint a new executor who will be responsible for obtaining probate and administering the estate. In cases where the appointed executor does not apply for probate, there are legal options to address the situation: The first step is to check if the will designates an alternate or backup executor. If such a provision exists, the alternate executor can step in and apply for probate. If there is no alternate executor named in the will, it may be necessary to petition the court for the appointment of a substitute executor. This involves providing evidence and reasons for the need to replace the original executor. When the appointed executor fails to fulfill their responsibilities, it may be necessary to petition the court for the appointment of a new executor: To successfully petition the court, it is essential to provide evidence showing that the original executor has not fulfilled their duties or has acted in a manner contrary to the best interests of the estate and beneficiaries. Along with demonstrating the executor's failure, it is crucial to present evidence supporting the appointment of a new executor. This evidence may include the qualifications and suitability of the proposed new executor, such as their experience in estate administration and their ability to act in the best interests of the estate and beneficiaries. When an executor fails to apply for probate, the court may intervene and appoint an administrator to handle the estate administration: The court will carefully consider the qualifications and capabilities of potential administrators before making a selection. This individual may be a professional executor or an attorney experienced in estate administration. Once appointed, the administrator assumes the duties and responsibilities typically performed by an executor. These include inventorying assets, paying debts and taxes, managing estate finances, and distributing assets in accordance with applicable laws and court instructions. In the absence of a will or when the will is deemed invalid, the court follows intestacy laws to determine the distribution of assets: Intestacy laws establish a hierarchy of beneficiaries, typically starting with close family members, such as a surviving spouse, children, parents, and siblings. The court will identify and verify the legal heirs and determine their respective shares of the estate. The court aims to distribute the assets in a fair and equitable manner among the eligible beneficiaries. This may involve considering factors such as the relationship of the heirs to the deceased, their financial needs, and any special circumstances. Inaction on the part of the executor can lead to significant delays in the administration of the estate. Until probate is granted, the executor does not have the legal authority to distribute the deceased's assets or settle their debts, leaving the estate in limbo. The executor may face financial and legal repercussions for their inaction. If the delay results in financial loss for the estate or its beneficiaries, the executor could be held personally liable. This can also apply if the executor fails to pay the deceased's taxes or debts in a timely manner, resulting in penalties or interest charges. Beneficiaries, creditors, or other interested parties may initiate legal action against the executor for not fulfilling their responsibilities, including the failure to apply for probate. Such legal disputes can add stress, costs, and further delay to the administration of the estate. If an executor consistently fails to act or performs their duties inadequately, the court may choose to remove and replace them. This often requires a petition from an interested party and proof of the executor's negligence or incompetence. Inaction can also reduce the confidence of the beneficiaries and other stakeholders in the executor. This can strain relationships and create conflict, making the estate administration process even more difficult. Failure to apply for probate can result in asset mismanagement, delays in settling affairs, legal liabilities for the executor, and disputes among beneficiaries. The lack of legal authority hampers asset handling and decision-making. Delayed settlement affects creditors and beneficiaries. Mismanagement can lead to financial losses and disputes over asset distribution. Options include appointing a substitute executor or petitioning the court for a new one. Court intervention may involve appointing an administrator and distributing assets according to intestacy laws. The executor's inaction can result in breach of fiduciary duty, impacting beneficiaries' rights and inheritance. Delays increase costs and prolong the probate process. Estate planning and careful executor selection are crucial for a smooth probate process. Seeking professional advice ensures proper administration and protection of beneficiaries' interests.Not Apply for Probate?

Delayed or Halted Estate Administration

Legal Challenges

Personal Liability

Replacement of Executor

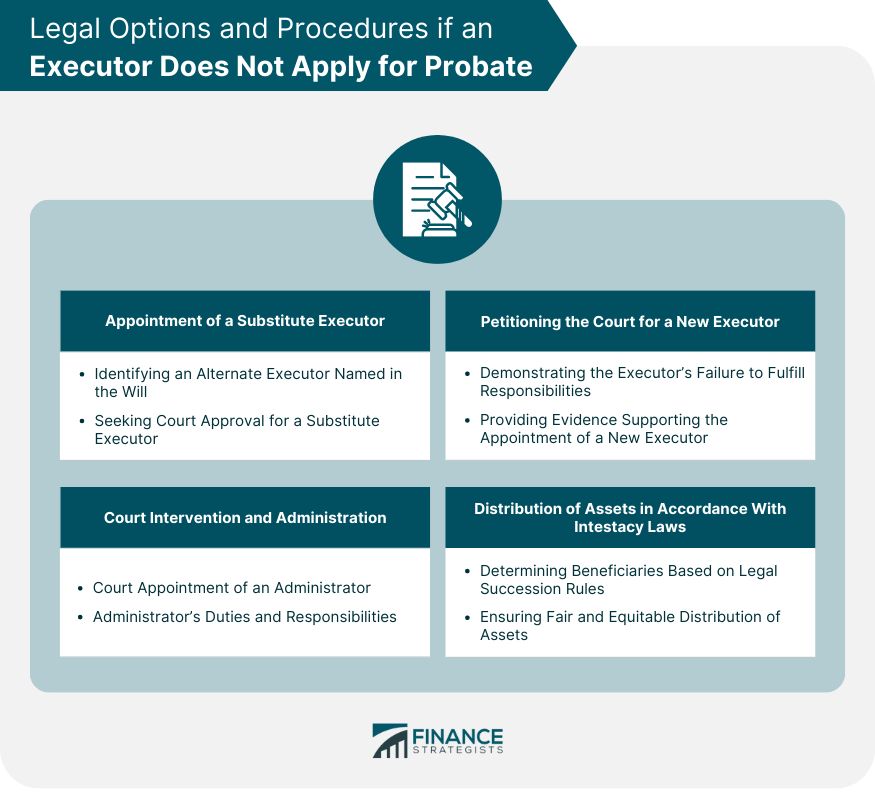

Legal Options and Procedures if an Executor Does Not Apply for Probate

Appointment of a Substitute Executor

Identifying an Alternate Executor Named in the Will

Seeking Court Approval for a Substitute Executor

Petitioning the Court for a New Executor

Demonstrating the Executor’s Failure to Fulfill Responsibilities

Providing Evidence Supporting the Appointment of a New Executor

Court Intervention and Administration

Court Appointment of an Administrator

Selection of a Qualified Individual to Manage the Estate

Administrator’s Duties and Responsibilities

Distribution of Assets in Accordance With Intestacy Laws

Determining Beneficiaries Based on Legal Succession Rules

Ensuring Fair and Equitable Distribution of Assets

Consequences of an Executor's Inaction

Delay in Estate Administration

Financial and Legal Repercussions

Legal Challenges and Disputes

Removal of Executor

Reduced Confidence in Executor

Conclusion

What Happens if an Executor Does Not Apply for Probate? FAQs

If an executor does not apply for probate, the estate cannot be properly administered or distributed according to the deceased's wishes. It can result in significant delays and complications in settling the estate.

Yes, if the appointed executor does not apply for probate, another interested party, such as a beneficiary or a creditor, can petition the court to appoint a new executor or administrator to handle the estate's administration.

If an executor neglects their duties, they may be held liable for breach of fiduciary duty. This can result in legal consequences and potential financial penalties. It is essential for executors to act responsibly and fulfill their obligations.

If the executor's inaction leads to disagreements or disputes among beneficiaries, it may further complicate the probate process and strain relationships. In such cases, beneficiaries may need to seek legal intervention to protect their rights and ensure a fair resolution.

The executor's inaction can significantly delay the distribution of assets to beneficiaries. Without proper administration and probate proceedings, beneficiaries may not receive their inheritance in a timely manner, causing financial hardship and frustration. It is crucial for executors to act promptly and fulfill their duties to ensure a smooth asset distribution process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.