Probate is the legal process that validates a deceased person's will and ensures its proper execution. It involves the court's supervision of the administration and distribution of the deceased's estate. During probate, the court confirms the appointment of the executor named in the will or appoints an administrator if there is no will. The executor or administrator is responsible for managing the estate's assets, paying off debts and taxes, and distributing the remaining assets to the beneficiaries according to the terms of the will or applicable laws. Failing to apply for probate in a timely manner can lead to various complications and legal issues, such as delays in settling the deceased's affairs, potential mismanagement of assets, disputes among beneficiaries, and even legal consequences for the executor. The timing of when an executor has to apply for probate depends on various factors. Generally, an executor needs to apply for probate if the value of the deceased person's assets exceeds a certain threshold specified by the jurisdiction. This threshold varies by region and can be based on the total value of the estate or specific types of assets. The need for probate also depends on the nature of the assets. Assets that are jointly owned, have designated beneficiaries (such as life insurance policies or retirement accounts), or held in a trust may bypass probate and transfer directly to the intended recipients. If the deceased person left a valid will, the executor usually needs to apply for probate to have the will legally recognized. The probate process ensures that the executor has the authority to carry out the instructions outlined in the will. Executors should consult local laws and regulations to determine the specific requirements for probate in their jurisdiction. These requirements may include filing deadlines, documentation, and any additional steps that must be followed. It is highly recommended for executors to seek legal advice from an attorney specializing in probate law. A lawyer can provide guidance on the specific requirements and timelines for probate in the relevant jurisdiction. The executor, also known as the personal representative, is the individual appointed by the deceased person to oversee the administration of their estate during the probate process. The executor holds a position of trust and has important responsibilities, which include: The executor takes the necessary steps to initiate the probate proceedings by filing the required documents with the appropriate court. This includes submitting the will, if one exists, and any other necessary paperwork. One of the primary duties of the executor is to identify and locate all the assets of the deceased. This may involve locating bank accounts, investments, real estate properties, business interests, and personal belongings. The executor is responsible for safeguarding and managing these assets throughout the probate process. The executor must determine the debts and obligations of the estate and ensure they are paid using the estate's funds. This includes settling outstanding bills, loans, taxes, and any other financial obligations. By diligently addressing these matters, the executor protects the estate from potential legal issues and ensures a fair distribution of remaining assets. Once all debts, taxes, and expenses have been settled, the executor is responsible for distributing the remaining assets to the beneficiaries. This task requires identifying the rightful beneficiaries as specified in the will or following the laws of intestacy if there is no will. The executor ensures that the assets are distributed in accordance with the deceased's wishes or applicable legal requirements. Failure to apply for probate results in the executor not gaining the necessary legal authority to manage the estate. This authority is crucial for the executor to fulfill their responsibilities, such as gathering and managing assets, paying debts and taxes, and distributing the estate to the beneficiaries. Without the legal authority obtained through probate, the executor may encounter numerous obstacles. They will not have the power to access the deceased's financial accounts, sell or transfer assets, or make important decisions regarding the estate. Neglecting to apply for probate can lead to substantial setbacks in resolving the affairs of the deceased. Applying for probate is the crucial first step in the legal process of administering the estate. It involves validating the will, confirming the executor's authority, and providing a framework for the distribution of assets. Without the probate process, the executor lacks the legal authority to handle various aspects of estate settlement. They may encounter difficulties in accessing bank accounts, selling property, or transferring assets to beneficiaries. Additionally, creditors may not receive timely payment, leading to potential legal complications. The executor plays a crucial role in identifying, valuing, and safeguarding the assets of the deceased. Failure to apply for probate could potentially lead to improper handling of assets within the estate. They are responsible for managing these assets in accordance with the deceased's wishes as outlined in the will or applicable laws. Without an active executor, the assets of the estate may be left unattended or vulnerable to mismanagement. This could include assets such as real estate, financial accounts, investments, business interests, or personal property. Failure to properly manage these assets can result in financial losses, diminishing the value of the estate and impacting the beneficiaries' inheritance. When probate isn't applied for by an executor, it can spark confusion and disputes among beneficiaries about the management and allocation of the estate. Disputes may arise concerning asset allocation, valuation, or the interpretation of the deceased's intentions, potentially leading to legal conflicts and further delays in settling the estate. Addressing the failure of an executor to apply for probate is crucial to ensure the proper administration of the estate and the protection of beneficiaries' interests. It is essential to take prompt action to rectify the situation, either by appointing a substitute executor or seeking court intervention if necessary. By doing so, the immediate implications mentioned above can be mitigated, and the estate administration process can proceed more effectively. Probate is a legal process, overseen by a court, that validates a will and ensures proper execution. The executor's role involves initiating probate, managing assets, settling debts and taxes, and distributing assets to beneficiaries. If the executor delays or fails to start probate, problems can arise including legal issues, asset mismanagement, delays, and beneficiary conflicts. This failure compromises the executor's authority to manage the estate, causing difficulties with account access, decision-making, and debt payment. Poor asset management can devalue assets, and disputes among beneficiaries can lead to legal issues and further delays. Quick action, such as appointing a new executor or seeking court assistance, is crucial to mitigate these problems, ensuring proper estate administration and safeguarding beneficiaries' interests.Definition of Probate

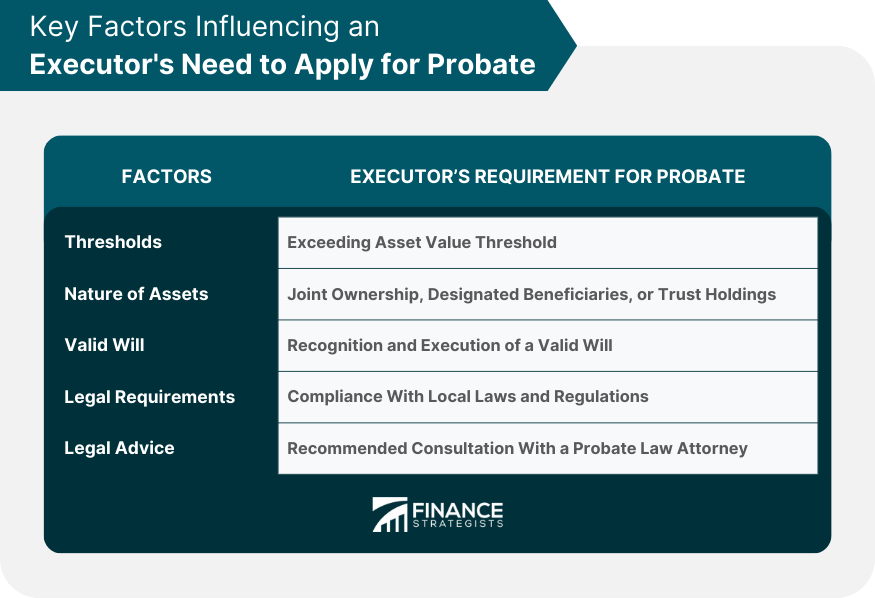

When Does an Executor Have to Apply for Probate?

Thresholds

Nature of Assets

Valid Will

Legal Requirements

Legal Advice

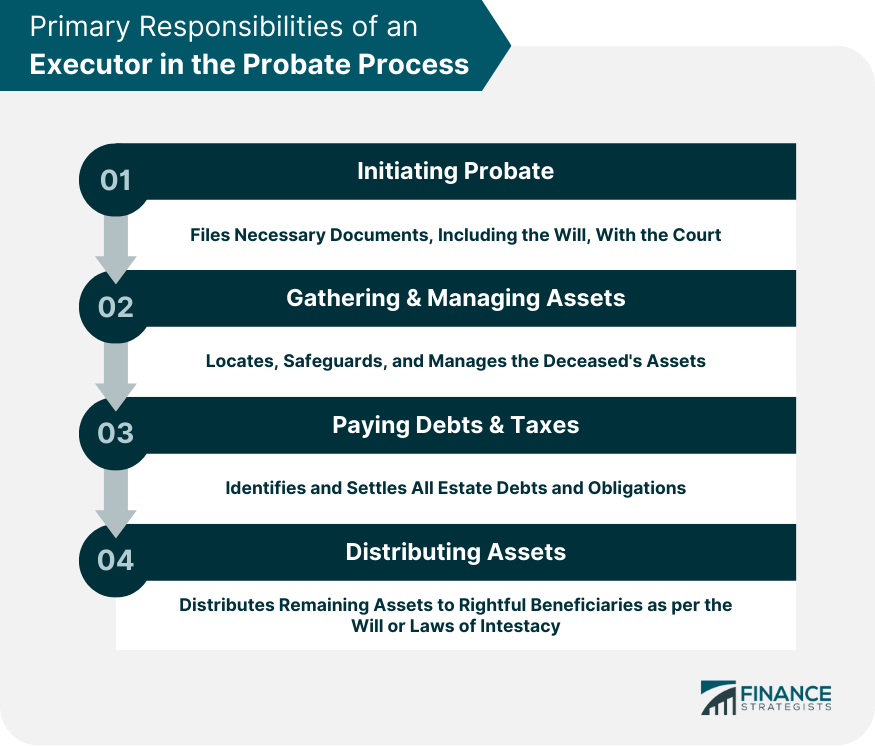

Executor's Role in the Probate Process

Initiating the Probate Process

Gathering and Managing Assets

Paying Debts and Taxes

Distributing Assets to Beneficiaries

Immediate Implications of Failing to Apply for Probate

Lack of Legal Authority to Administer the Estate

Delay in Settling the Deceased’s Affairs

Potential Mismanagement of Assets

Increased Risk of Disputes Among Beneficiaries

Conclusion

When Does an Executor Have to Apply for Probate? FAQs

An executor typically has to apply for probate when the deceased person's assets are subject to probate and exceed certain value thresholds, or when the nature of the assets requires court validation for transfer of ownership.

Factors such as estate value thresholds, types of assets, and the presence or absence of a valid will determine whether an executor needs to apply for probate.

Yes, in certain cases where the estate is small or meets specific criteria, jurisdictions may offer simplified probate procedures or small estate alternatives that eliminate the need for full probate.

Yes, if the original executor is unable or unwilling to apply for probate, they can appoint an alternate executor named in the will to handle the probate process.

Failing to apply for probate can result in a lack of legal authority to administer the estate, delays in settling the deceased's affairs, potential mismanagement of assets, and increased risk of disputes among beneficiaries.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.