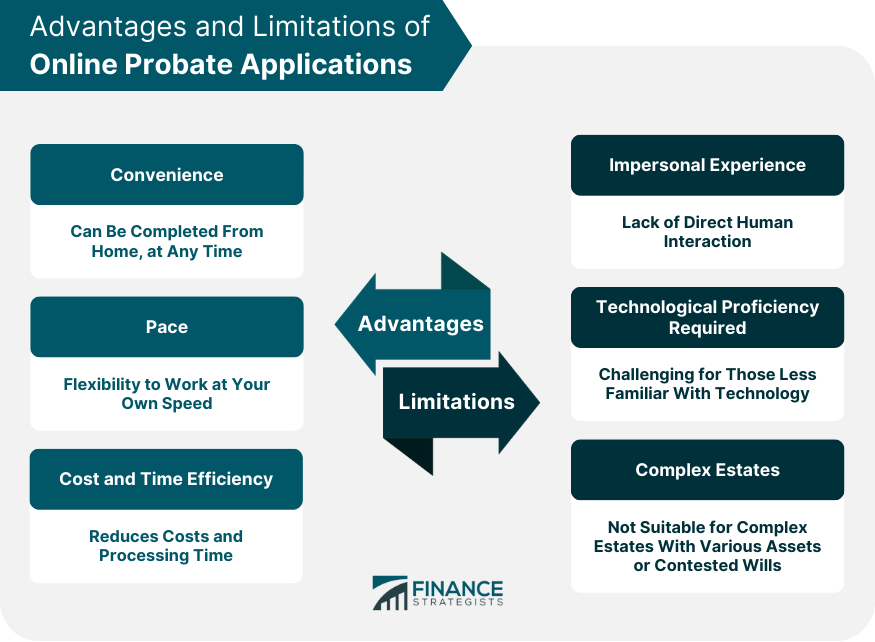

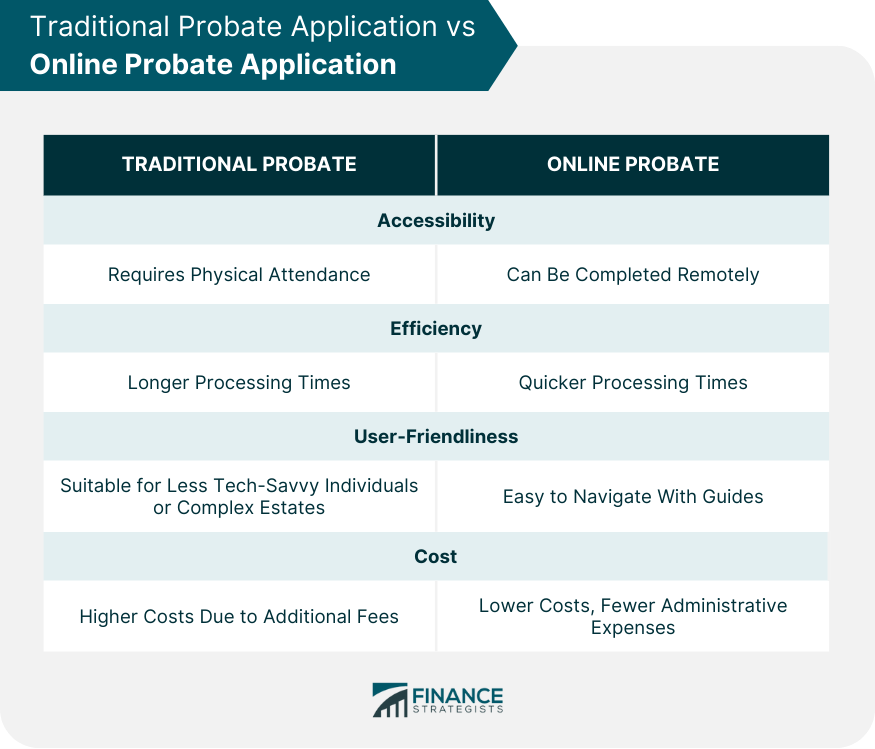

Eligibility for online probate application varies depending on your location and the specifics of the estate. However, there are common requirements that apply in most cases. The applicant should be a named executor in the will or the next of kin if there is no will. The estate should not be insolvent, meaning that its assets exceed its liabilities. The will should not be in dispute. The online probate application process is most useful when the estate is straightforward. If the deceased's financial affairs are not complex, and no disputes are anticipated among the beneficiaries, applying for probate online can save a great deal of time and effort. On the other hand, if the estate involves complicated assets or potential disputes, seeking legal advice and possibly avoiding the online process could be more prudent. The first step is to gather the necessary documents. These usually include the original will, death certificate, and any documents related to the deceased's assets and liabilities. You'll also need identification documents for the executor or next of kin applying for probate. Next, you will need to value the estate. This involves calculating the value of all the deceased's assets (such as property, bank accounts, and investments) and liabilities (like mortgages, loans, and bills). This can be a complex process and may require the assistance of a professional valuer. Typically, the first step in submitting the application is to create an account on the probate service website. This will often involve providing your details and setting up a username and password. The application form will usually ask for details about the deceased, the executor, the value of the estate, and information about the beneficiaries. It's crucial to provide accurate information and double-check everything before submission. Upon completing the application form, a fee typically needs to be paid. The amount of this fee can vary depending on the value of the estate and the specific probate service being used. Once the fees are settled, you can proceed with the submission of the application After the application has been submitted and the fees paid, all that remains is to wait for the decision. The length of this waiting period can vary greatly depending on the complexity of the estate and the workload of the probate court. Convenience: One of the key advantages of online probate applications is the convenience they offer. You can complete the application from the comfort of your own home, at any time of day, eliminating the need for physical trips to court. Pace: The online application process allows you to work at your own pace. This flexibility can make the process less stressful, as you have the freedom to take breaks, reflect, and gather information as needed. Cost and Time Efficiency: Online probate applications often reduce costs and processing time. Without the need for physical document delivery and by cutting down on administrative work, the process becomes more efficient. Impersonal Experience: The digital nature of the service can often feel impersonal. Without direct human interaction, some individuals may find the process isolating and even intimidating. Technological Proficiency Required: Online applications can be challenging for those who are less familiar or comfortable with technology. It might involve learning new systems, which can add a layer of complexity to an already challenging time. Complex Estates: Complex estates that include various types of assets, foreign assets, or contested wills may require a more personalized and nuanced approach that can often be better managed through traditional application routes. Navigating the online probate application process can be a challenge, especially for those unfamiliar with it. Here are some tips to make the process smoother. Mistakes in the probate application can lead to delays or even rejection. One common mistake is undervaluing the estate. Make sure to account for all assets and liabilities accurately. Another common mistake is not fully understanding the will, leading to incorrect interpretation and application. If the will's wording is complex, consider seeking professional advice. Finally, be sure to check and double-check all details entered into the application form to avoid errors. There are numerous tools and resources available to assist with online probate applications. Most online probate services offer comprehensive guides that explain the process in detail. Online probate calculators can help estimate the value of an estate, and online forums and blogs can offer advice and shared experiences. While the online probate process is designed to be user-friendly, there are situations when seeking professional advice is recommended. These include when the will is complex or disputed, when the estate is insolvent or includes foreign assets, or when there are doubts about the validity of the will. Understanding the differences between the traditional and online probate application processes can help you make the most suitable choice for your situation. One of the major advantages of online probate applications is that they can be completed at any time and from any location. In contrast, traditional applications often require physical attendance at a probate office or court. While the time frame for both processes depends on the complexity of the estate, the digital nature of online applications often allows for quicker processing times. Traditional applications may be subject to longer waiting periods due to paperwork and manual processes. For those comfortable with using technology, online applications are typically easier to navigate. The platform often includes guides and instructions, making the process straightforward. Conversely, traditional applications may be more suited to those less familiar with online systems or those with complex estates that require more personalized handling. Online probate applications often come with lower costs due to the elimination of certain administrative expenses. Traditional applications may involve higher costs due to extra fees, such as for postal services or travel. Online probate applications offer a convenient and accessible method of navigating the legal processes following a death. From understanding eligibility and the application process to knowing when to seek legal advice, this guide provides comprehensive insights into the online probate process. For those considering an online probate application, remember that every estate is unique. It's important to take into consideration the complexity of the estate and the requirements of the probate process. And while this process may seem overwhelming, tools, resources, and professional guidance can make it more manageable. Finally, whether you're navigating the probate process now or planning for the future, consider consulting with an estate planning lawyer. Legal professionals can provide valuable advice tailored to your specific situation and help ensure a smooth process.Understanding the Online Probate Application Process

Eligibility for Online Probate Application

When to Use Online Probate Application

Step-By-Step Guide to Online Probate Application

Step 1: Gathering Necessary Documents

Step 2: Valuing the Estate

Step 3: Creating an Online Account

Step 4: Completing the Application Form

Step 5: Paying the Probate Fees and Submitting the Application

Step 6: Waiting for the Probate Decision

Advantages of Online Probate Applications

Limitations of Online Probate Applications

Tips and Advice for a Successful Online Probate Application

Common Mistakes to Avoid

Helpful Tools and Resources

When to Seek Legal Advice

Traditional Probate Application vs Online Probate Application

Accessibility

Efficiency

User-Friendliness

Cost

The Bottom Line

Online Probate Application FAQs

An online probate application is a digital process that allows you to apply for the legal authority to manage a deceased person's estate, which involves settling debts and distributing assets.

Typically, a named executor in the will or the next of kin can use the online probate application system. However, eligibility can vary depending on the specifics of the estate and local regulations.

The advantages of an online probate application include convenience, accessibility, efficiency, and often lower costs compared to traditional probate applications.

You'll typically need the original will, the death certificate, documents related to the deceased's assets and liabilities, and identification documents for the executor or next of kin.

If you encounter difficulties with the online probate application, consider seeking professional advice. Legal professionals, such as estate planning lawyers, can provide invaluable guidance during the process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.