A probate caveat is a legal mechanism used to stop the probate process temporarily. It acts as a red flag, indicating that there is a dispute concerning the will or the appointment of the personal representative of the estate. The word 'caveat' itself means 'let him beware' in Latin, which effectively describes the function of a probate caveat – to cause the court and involved parties to proceed with caution. The purpose of a probate caveat is to protect the rights of interested parties when there is a question or dispute regarding the deceased's estate. A caveat can be filed by anyone with a legitimate interest in the estate, such as an heir, a creditor, or anyone named (or not named) in the will. It is generally used to ensure that the probate process does not proceed until the dispute is resolved. It refers to the individual who files the caveat. This person typically has a legitimate interest in the estate and believes that there's a valid reason to halt the probate process, such as the suspicion of fraud or the belief that the will is invalid. The executor, also known as the personal representative, is responsible for managing the probate process. If a caveat is filed, the executor must respond to the issues raised. This often involves providing evidence that the will is valid and that they are capable and suitable to act as the executor. The probate court oversees the probate process and handles any disputes that arise. If a probate caveat is filed, the court will adjudicate the matter, often necessitating a hearing or trial where evidence is presented, and a resolution is sought. This typically happens when an interested party believes that the deceased was manipulated or coerced into altering their will. To prove this, the caveator must usually present evidence that the deceased was vulnerable to influence and that the alleged influencer had the opportunity and motive to exploit this vulnerability. Disputes can occur when there are multiple versions of a will, the will was not properly executed (for instance, it lacks necessary signatures), or there is doubt about the mental capacity of the testator when the will was created. An interested party may believe that the executor is not acting in the best interest of the estate, perhaps due to a conflict of interest, lack of ability, or unethical actions. In such cases, the court may need to decide whether to remove the executor or provide additional oversight. The timing of filing a probate caveat is crucial. Ideally, it should be filed as soon as concerns arise about the validity of a will or the behavior of an executor. This is because a caveat prevents the issuing of a grant of probate, but it cannot overturn a grant that has already been issued. The caveat must be lodged with the probate court that is handling the deceased's estate. Filing a probate caveat involves submitting a formal document to the probate court. The document must state the identity of the person lodging the caveat (the caveator) and the reasons for doing so. Some jurisdictions may require a fee to file a caveat. The complexity and contentious nature of the matters involved generally make it advisable to have legal representation when filing a probate caveat. Filing a probate caveat effectively halts the probate process until the dispute is resolved. This can have significant implications for the distribution of the deceased's estate, often delaying beneficiaries from receiving their inheritances. If a caveat is found to be baseless or maliciously filed, the caveator may be liable for costs and could face legal penalties. Until the issues raised in the caveat are resolved, the estate cannot be administered and assets cannot be distributed to the beneficiaries. This can cause financial hardship and prolong the emotional distress associated with the death of a loved one. If the parties involved cannot reach an agreement independently, the case may go to trial, which can be a lengthy and expensive process. Legal disputes can also exacerbate personal conflicts among family members and other interested parties, adding to the stress and complexity of the situation. Once the issues raised by a probate caveat are resolved, either through negotiation or court judgement, the caveat is removed, and the probate process can continue. Depending on the outcome, this may involve proceeding with the original will, validating a new will, or appointing a new executor. Mediation involves a neutral third party, known as a mediator, who does not make decisions but rather facilitates conversation and assists the disputing parties in reaching a mutually agreeable solution. Mediation provides a faster resolution than court litigation, thus minimizing the disruption to the probate process. It also tends to be more cost-effective, as it avoids many of the legal fees associated with a trial. In addition, the process of mediation is less formal and adversarial than court proceedings, which can help to preserve familial relationships that might otherwise be strained by a legal battle. It is also confidential, allowing privacy as opposed to the public nature of litigation. Renunciation is a legal act where an individual voluntarily declines to accept an inheritance. This can be an entire estate or a specific part of it. An individual might renounce an inheritance if they believe it will lead to a financial burden, such as inheriting property that requires significant maintenance costs or has a mortgage attached. It can also be a method of avoiding a protracted legal dispute. The stress, time, and financial cost of litigation can be considerable, and some individuals might find that renouncing their claim is the most beneficial choice in the long run. Outside of the more structured mediation process, disputing parties might opt for a less formal out-of-court settlement. This involves direct negotiations between the parties, often with the aid of their respective legal counsel. This approach might be especially useful in cases where the conflict revolves around specific assets that could be divided or shared in a manner agreeable to all parties. This method has the potential for preserving relationships, saving time and money, and providing a customized resolution that may not be possible in a court ruling. A no-contest clause, also known as an "in terrorem" clause, is a provision in a will that essentially disinherits anyone who challenges the terms of the will in court and loses. However, this only works as a preventive measure, not a solution once a conflict has arisen. Also, the enforceability of no-contest clauses varies by jurisdiction, so legal advice should be sought when considering this option. A probate caveat serves as a vital legal mechanism to temporarily halt the probate process when disputes or uncertainties arise regarding the deceased's estate. It acts as a cautionary flag, protecting the rights of interested parties and ensuring a fair resolution. The caveator, executor, and probate court are the key actors involved in this process, with the caveator filing the caveat, the executor responding to the issues raised, and the probate court overseeing the proceedings. Filing a probate caveat can have significant consequences, leading to delays in estate administration, potential legal disputes, and prolonged emotional distress. However, alternative approaches such as mediation, renouncing a claim, or pursuing out-of-court settlements can offer faster and more cost-effective solutions. These alternatives prioritize open communication, preservation of relationships, and customized resolutions, reducing the strain on all parties involved. While a no-contest clause in a will may discourage challenges, its enforceability varies, emphasizing the importance of seeking legal advice before considering this option.What Is a Probate Caveat?

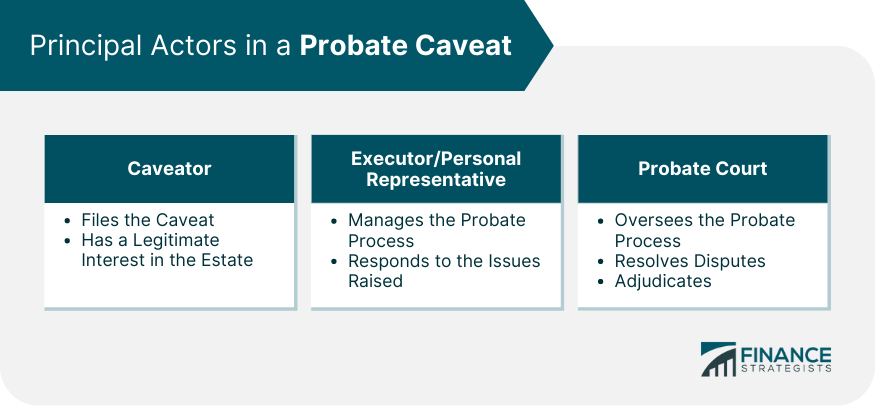

Principal Actors in a Probate Caveat

Caveator

Executor or Personal Representative

Probate Court

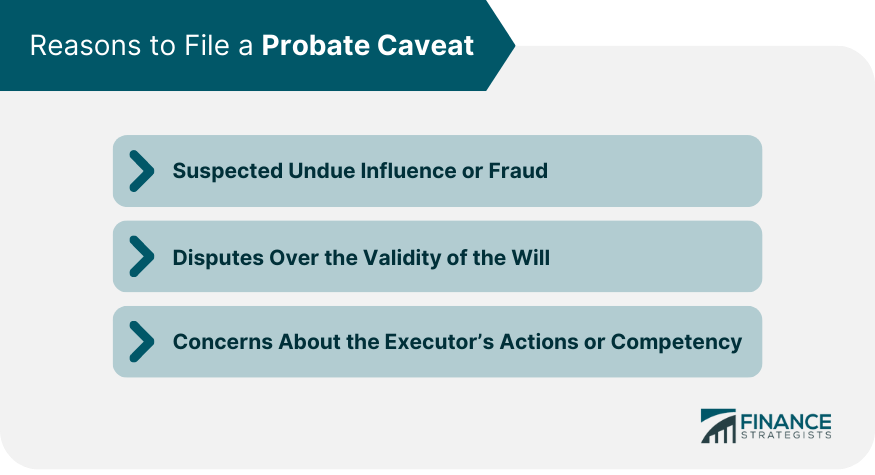

Reasons to File a Probate Caveat

Suspected Undue Influence or Fraud

Disputes Over the Validity of the Will

Concerns About the Executor’s Actions or Competency

Process of Filing a Probate Caveat

When to File

How to File

Legal Consequences of Filing

Impact of Probate Caveats

Delay in Probate Administration

Legal Disputes and Litigation

Resolution of Caveats and Reinstatement of the Probate Process

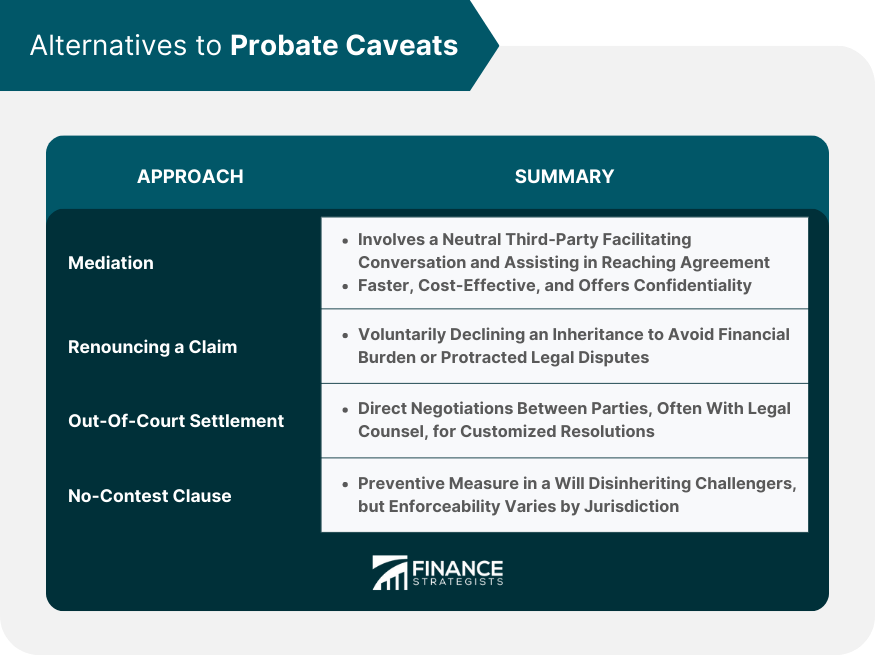

Alternatives to Probate Caveats

Mediation

Renouncing a Claim

Out-Of-Court Settlement

No-Contest Clause

Final Thoughts

What Is a Probate Caveat? FAQs

Any individual with a legitimate interest in the estate, such as an heir, creditor, or someone named (or not named) in the will, can file a probate caveat.

Once a probate caveat is filed, it temporarily stops the probate process. The court will then adjudicate the matter, often requiring a hearing or trial to resolve the dispute.

A probate caveat can be filed if there are suspicions of undue influence or fraud, disputes over the validity of the will, or concerns about the actions or competency of the executor.

The duration of the delay caused by a probate caveat varies depending on the complexity of the dispute and the court's caseload. It can range from several months to potentially a year or more.

Yes, a probate caveat can be withdrawn or removed if the issues raised are resolved through negotiation, court judgment, or other means. Once the caveat is removed, the probate process can resume accordingly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.