Formal probate is a court-supervised process where the validity of a deceased person's will is determined and their assets are distributed. It's often used when the deceased's estate is complex, there are legal disputes, or when there is ambiguity within the will. During formal probate, an executor (named in the will) or an administrator (if there's no will or named executor) gathers the deceased's assets, pays any outstanding debts or taxes, and distributes the remaining assets to the named beneficiaries in accordance with the will or state law. This process provides a legal structure ensuring that the wishes of the deceased are honored, the estate's debts are paid, and the rightful heirs receive their inheritances. The complexity may arise from a multitude of factors, such as the variety and number of assets, the sheer magnitude of wealth involved, or the existence of complicated business interests. For example, if the decedent had vast and varied assets, including stocks, real estate, ownership in several businesses, or intellectual property rights, the estate becomes complex. Further, estates with assets in different jurisdictions, such as properties spread across various states or even countries, add another layer of complexity. In such cases, the management and distribution of these assets require formal probate to ensure that all assets are accounted for and distributed lawfully and equitably. These disagreements might stem from multiple aspects such as the validity of the will, interpretation of the will's provisions, or disagreements on the allocation of assets. Formal probate provides a regulated, judicially supervised forum where these disagreements can be aired, and resolutions can be sought. The court's intervention ensures fairness, equity, and adherence to the rule of law, thereby protecting the rights and interests of all parties involved. Insolvency, a state where the debts of the decedent exceed the value of their estate, also necessitates formal probate. The formal probate process allows for a systematic approach to handle the decedent's debts. In these situations, the probate court prioritizes and determines which creditors get paid from the estate's assets. Furthermore, the court ensures that the executor or personal representative follows the legal rules for insolvent estates, preventing any preferential treatment of certain creditors over others. Thus, the formal probate process ensures that the insolvent estate's debt handling is just, equitable, and lawful. Will contestations may arise due to suspicions of fraud, undue influence, or the mental incapacity of the decedent at the time of making the will. During formal probate, the court is equipped to handle such contestations, scrutinizing the evidence, and determining the validity of the will. In some cases, a comprehensive investigation may be needed to ascertain the veracity of claims. In this context, formal probate provides a regulated, structured process to ensure the legitimacy of the will and the protection of all parties' rights. From the outset, the executor's responsibilities involve initiating the probate process by filing the decedent's will with the appropriate probate court. Once the court approves the executor, they will receive "letters testamentary," legal documents granting them the authority to manage the estate's affairs. The executor is responsible for locating and protecting the decedent's assets, which involves a detailed inventory of all properties, valuables, financial accounts, and debts owed to the estate. Additionally, the executor settles the decedent's debts and taxes. They must notify creditors, evaluate claims, and pay valid debts. This might involve selling some of the estate's assets. The executor is also responsible for filing the decedent's final income tax returns and paying any estate taxes. Finally, the executor distributes the remaining assets to the beneficiaries as specified in the will. This distribution process must also be documented and reported to the court. The executor's role is complex and requires significant time, effort, and attention to detail. The probate court oversees the formal probate process. It confirms the validity of the will, grants the executor the authority to administer the estate, and ensures that the process adheres to legal protocols. The court's involvement provides a layer of protection to all parties involved. It protects the rights of the beneficiaries and creditors, ensuring that the executor administers the estate faithfully and that valid claims are paid. In cases where disputes arise, such as contesting the will's validity or disagreements among beneficiaries, the court steps in to mediate and make necessary rulings. In the absence of a will, the court determines the distribution of assets according to the state's intestacy laws. Beneficiaries or heirs are those who stand to receive assets from the decedent's estate. Beneficiaries are named in the will, while heirs are those who would inherit under state law if there were no will. Although beneficiaries and heirs are usually passive participants in the probate process, they retain certain rights. They have the right to be notified of the probate proceedings and to receive a copy of the inventory of the decedent's estate. They can also request accountings, which detail how the executor has managed the estate. If beneficiaries or heirs have concerns about the executor's actions or the validity of the will, they have the right to raise these issues with the court. In extreme cases, they can petition the court to remove an executor they believe is not fulfilling their duties properly. This petition is a formal request for the court to open probate for the estate and approve the appointment of an executor or personal representative. It's typically prepared and submitted by the proposed executor, usually with the assistance of a probate attorney. The petition must include vital information such as the decedent's details, the nominated executor's details, and the names of the potential heirs or beneficiaries. This includes heirs, beneficiaries, and potential creditors. Notice to heirs and beneficiaries is crucial as it informs them of the commencement of the probate process and provides them an opportunity to object if they have any issues. Creditors are also notified because they have a right to submit claims against the estate for debts the decedent owed at the time of death. In most jurisdictions, creditors have a limited time to submit their claims, typically ranging from a few months to a year. This includes cataloging all of the decedent's assets and liabilities at the time of death. Assets can be both tangible (houses, cars, jewelry) and intangible (stocks, bonds, bank accounts). The executor must also evaluate these assets, sometimes requiring professional appraisers' help, especially for unique or high-value items. Understanding the total value of the estate is crucial as it aids in settling the decedent's debts and distributing the remaining assets to beneficiaries. The executor reviews all claims submitted by creditors and determines their validity. Approved claims are paid from the estate's assets, often requiring the sale of certain assets to generate the necessary funds. In addition, the executor is responsible for filing the decedent's final income tax return and paying any outstanding income taxes. If the estate's value exceeds a certain threshold, the executor may also need to file an estate tax return and pay any estate taxes due. Once all debts, taxes, and expenses have been paid, the executor can distribute the remaining assets to the beneficiaries as dictated by the will or according to the state's intestacy laws. The executor must maintain detailed records of all distributions and provide a final account to the court showing how the estate's assets were managed and disbursed. Once the court approves this final account, the executor's responsibilities are typically complete, and the probate process can be officially closed. This rigorous oversight ensures that the entire process is conducted in accordance with the law, adhering to the exact specifications laid out in the decedent's will or the stipulations of intestacy laws in the absence of a will. This supervision helps to prevent the misappropriation of estate assets, ensuring the deceased's assets are distributed as per their wishes. It's a mechanism that reinforces the integrity of the process, potentially deterring fraudulent activity or misuse of power by the executor. As part of their fiduciary duties, executors are required to document the estate’s assets comprehensively and accurately, providing an inventory to the court. Furthermore, they must account for how these assets are distributed amongst the beneficiaries or heirs. This transparency does more than keep interested parties informed; it actively discourages contentious disputes over asset distribution that might arise from confusion or misunderstanding. Upon the decedent's death, creditors are notified and given a window within which they must file their claims against the estate. The executor pays valid claims from the estate's assets during the probate process. This step is particularly advantageous because, once probate concludes, the estate is typically shielded from further claims by those creditors. It provides a level of finality and certainty, assuring beneficiaries that their inherited assets will not be unexpectedly claimed to settle the decedent's debts post-probate. The court's involvement in these transfers aids in removing ambiguities about property ownership. It provides an undeniable chain of title, minimizing the risk of future property disputes. This clarity is particularly important for beneficiaries intending to sell the property in the future. Clear titles are more appealing to potential buyers and make the selling process significantly smoother. While the exact duration can vary, the process often takes several months to years to conclude. This extended period is due to a combination of various factors such as the complexity of the estate, the efficiency of the executor, the probate court's caseload, and the presence of any legal disputes. Moreover, this drawn-out process can take a toll on the beneficiaries awaiting their inheritance. The delay can create financial hardships for those who may be relying on the inheritance for immediate financial needs. The associated costs include, but are not limited to, court fees, personal representative or executor fees, attorney's fees, appraisal costs, and accounting fees. Further, these costs are paid from the estate's assets, thereby reducing the net value of the estate that is ultimately distributed to the beneficiaries. For smaller estates, the cost of probate can significantly erode the value of the assets, sometimes even leading to an insolvency scenario where the estate's liabilities exceed its assets. Probate proceedings are public, meaning the details of the deceased's estate, including the value of their assets and debts, are accessible to the general public. In addition, the identities of the beneficiaries or heirs and the specifics of their inheritance are also made public. This lack of privacy can be especially problematic for individuals who highly value their privacy or are concerned about the potential for fraudulent schemes targeting the estate or beneficiaries. Coupled with the emotional toll of losing a loved one, the administrative and legal burdens that an executor must shoulder can be overwhelming. This is especially true for complex estates or those involving contentious disputes among heirs or beneficiaries. Consequently, the executor may experience substantial stress, which can potentially affect their health and personal life. A trust is a legal entity that holds assets for the benefit of another. Two primary types of trusts can be used: revocable and irrevocable. A revocable trust, also known as a living trust, is created during the lifetime of the trustor, who can change or terminate the trust at any time. Assets placed in a revocable trust can bypass probate, thus allowing for an immediate transfer to the beneficiaries upon the trustor's death. An irrevocable trust, once created, generally cannot be altered or terminated without the beneficiaries' consent. This kind of trust not only avoids probate but also can provide additional benefits, such as protection from creditors and estate tax reductions. However, setting up a trust can be complex and may require professional assistance. Despite these challenges, many find the benefits of bypassing probate make trusts a worthwhile investment. These designations allow the direct transfer of specific assets to named beneficiaries upon the asset owner's death, bypassing probate entirely. Transfer-On-Death designations are typically used for financial assets such as stocks, bonds, and brokerage accounts. Some states also allow TOD designations for real estate and vehicles. On the other hand, Payable-On-Death designations are generally used for bank accounts and retirement accounts. Upon the account owner's death, the named beneficiary can claim the money directly from the financial institution without going through probate. While TOD and POD designations can be effective probate-avoidance tools, they must be used thoughtfully. Any changes in beneficiaries need to be documented properly, and these designations should align with the overall estate plan to avoid unintended consequences. This form of ownership means that upon the death of one owner, the property automatically passes to the surviving owner(s), bypassing probate. Joint ownership is commonly used by married couples for homes, bank accounts, and other significant assets. It can also be used by business partners or any group of people who collectively own a piece of property. However, joint ownership may not be appropriate in all situations. For instance, if the joint owners are not spouses, the transfer of property upon one owner's death might trigger a taxable event. Furthermore, the surviving owner(s) may face potential creditor claims against the deceased owner's portion of the property. Therefore, it's essential to consider these factors and possibly consult a legal or financial advisor before establishing joint ownership. Formal probate is a crucial legal process that provides a structured and regulated framework for handling complex estates, disputes among heirs or beneficiaries, insolvency cases, and contested wills. It ensures that the wishes of the deceased are respected, debts are settled, and assets are distributed equitably. The key actors in the formal probate process, including the executor, probate court, and beneficiaries, play essential roles in upholding the integrity of the estate and protecting the rights of all parties involved. Benefits of formal probate include court supervision, transparency in asset distribution, definitive settlement of claims, and clear title in real estate transfers. However, formal probate also has drawbacks, such as being time-consuming, costly, and lacking privacy, which can impose a burden on the executor. To avoid the formal probate process, individuals can explore alternative strategies like trusts, transfer-on-death and payable-on-death designations, or joint ownership, which offer more efficient asset transfer mechanisms. Definition of Formal Probate

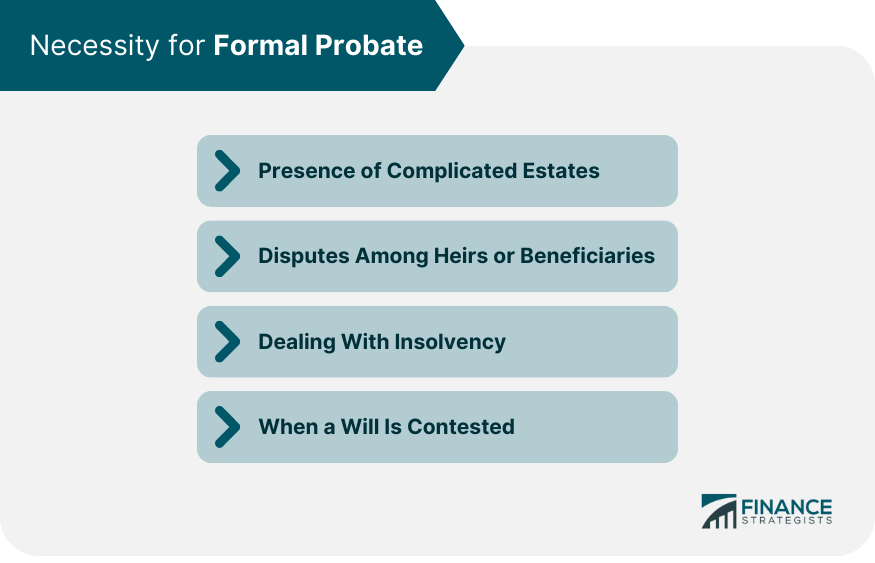

Necessity for Formal Probate

Presence of Complicated Estates

Disputes Among Heirs or Beneficiaries

Dealing With Insolvency

When a Will Is Contested

Key Actors in the Formal Probate Process

Executor or Personal Representative

Probate Court

Beneficiaries or Heirs

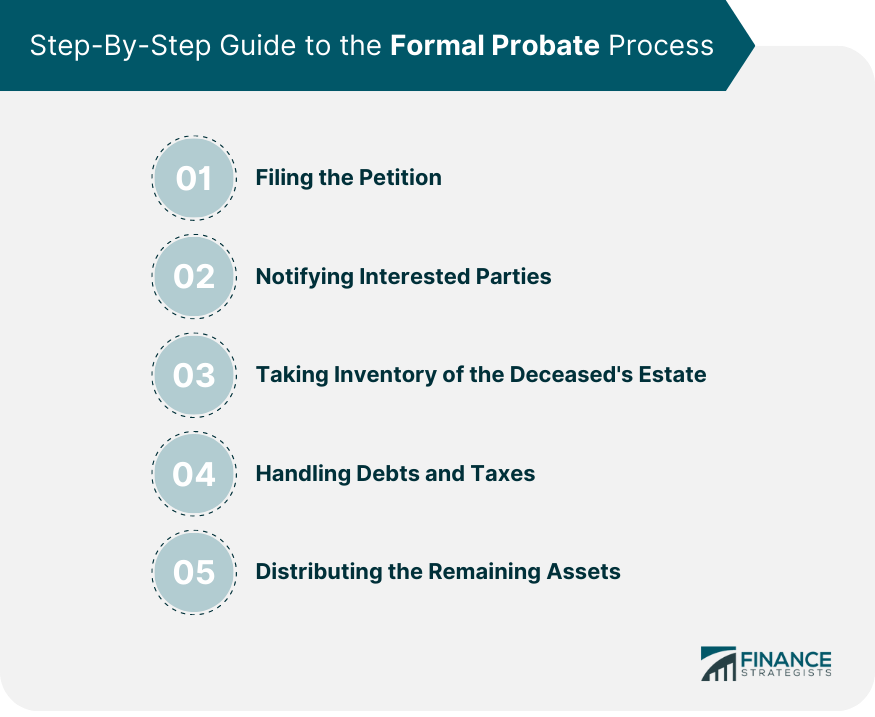

Step-By-Step Guide to the Formal Probate Process

Filing the Petition

Notifying Interested Parties

Taking Inventory of the Deceased's Estate

Handling Debts and Taxes

Distributing the Remaining Assets

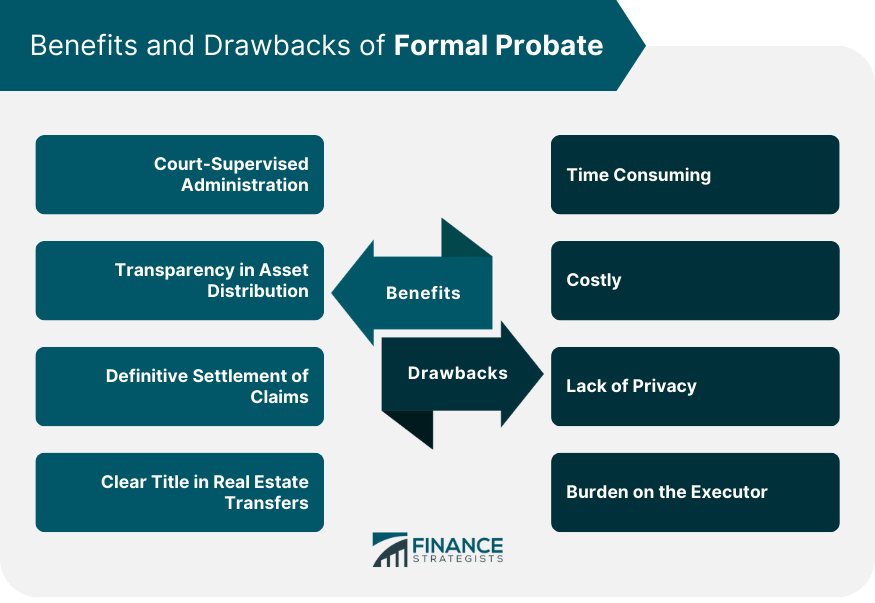

Benefits of Formal Probate

Court-Supervised Administration

Transparency in Asset Distribution

Definitive Settlement of Claims

Clear Title in Real Estate Transfers

Drawbacks of Formal Probate

Time-Consuming

Costly

Lack of Privacy

Burden on the Executor

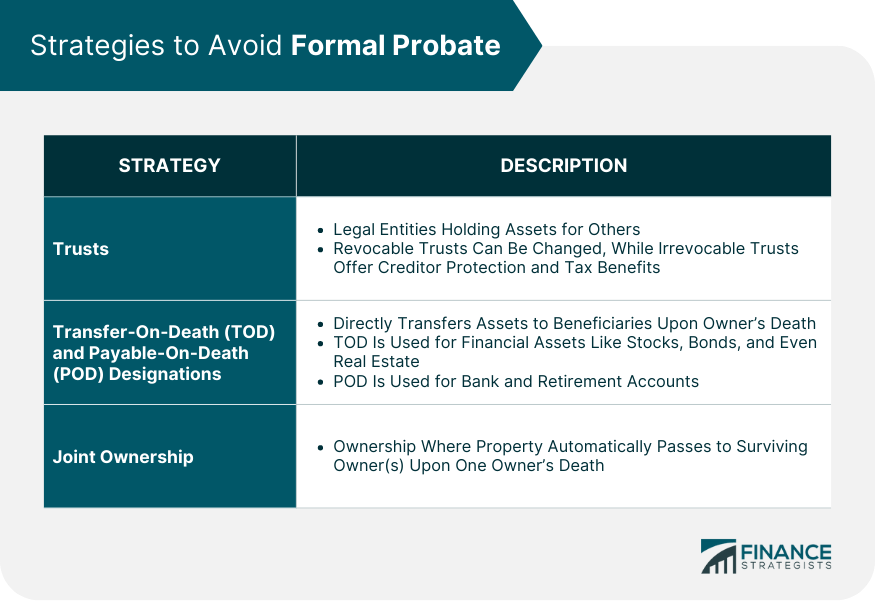

Strategies to Avoid Formal Probate

Trusts

Transfer-On-Death and Payable-On-Death Designations

Joint Ownership

Final Thoughts

What Is a Formal Probate? FAQs

Formal probate is a court-supervised process that determines the validity of a deceased person's will and oversees the distribution of their assets. It is typically used when the estate is complex, there are disputes among heirs or beneficiaries, or when there are questions regarding the will's provisions.

Formal probate is necessary in cases where the estate is complex, such as when there are numerous and diverse assets, business interests, or assets in different jurisdictions. It is also required when there are disputes among heirs or beneficiaries, issues of insolvency, or contested wills.

The key participants in the formal probate process include the executor or personal representative, who is responsible for administering the estate, the probate court, which oversees the process and resolves disputes, and the beneficiaries or heirs who stand to receive assets from the estate.

Formal probate provides court supervision, ensuring that the process is conducted in accordance with the law and the wishes of the deceased. It promotes transparency in asset distribution, settles claims definitively, and establishes clear title in real estate transfers, reducing the risk of future disputes.

Yes, there are alternatives to formal probate. One common alternative is setting up a trust, which allows assets to be transferred outside of probate. Transfer-on-death and payable-on-death designations can also be used for specific assets, bypassing probate. Joint ownership is another option for certain types of assets. It is advisable to consult with a legal professional to determine the most suitable alternative for individual circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.