Transfer on Death (TOD) accounts are a type of beneficiary designation that allows the owner of an asset to transfer that asset to a designated beneficiary upon the owner's death. TOD accounts are becoming increasingly popular as a way to simplify the transfer of assets after death and avoid the costs and delays associated with probate. To set up a TOD account, the owner of an asset, such as a bank account, brokerage account, or real estate, must complete a beneficiary designation form provided by the financial institution holding the asset. The beneficiary designation form will typically ask for the designated beneficiary's name, address, and Social Security number. Once the form is completed, it must be submitted to the financial institution, and the beneficiary designation will become effective upon the owner's death. One of the benefits of TOD accounts is that they are relatively easy to set up. Compared to a traditional will or trust, the requirements for setting up a TOD account are minimal. However, it is important to note that not all assets can be transferred through a TOD account. For example, assets held in a living trust or retirement account cannot be transferred through a TOD account. There are several benefits to using a TOD account as part of an estate plan. Probate is the legal process that takes place after a person's death to transfer their assets to their heirs or beneficiaries. Probate can be time-consuming and expensive, and it can take months or even years to complete. By using a TOD account, the asset can be transferred directly to the designated beneficiary without going through probate. Probate is a public process, which means that the details of a person's assets and beneficiaries become part of the public record. Using a TOD account, the transfer of assets can be kept private between the owner and the designated beneficiary. The asset owner retains full control over the asset during their lifetime. It can change the beneficiary designation or close the account at any time. Additionally, because TOD accounts are not subject to probate, the transfer of assets can be completed quickly. This can be important when the beneficiary needs immediate access to the funds. TOD accounts can be cost-effective compared to other estate planning options. Traditional estate planning methods, such as wills and trusts, can be expensive to set up and maintain. In contrast, setting up a TOD account is typically free, and no ongoing costs are associated with maintaining the account. While TOD accounts offer several benefits, they also have limitations and risks. One of the primary limitations of TOD accounts is that not all assets can be transferred through them. For example, assets held in a living trust or retirement account cannot be transferred through a TOD account. Additionally, some financial institutions may not offer TOD accounts for certain types of assets. Another risk associated with TOD accounts is joint ownership. If the owner of an asset adds a risk joint owner to a TOD account, the joint owner will have rights to the asset after the owner's death. This can lead to potential legal challenges if the joint owner has a dispute with the designated beneficiary or if the joint owner predeceases the asset owner. It is also essential to remember that TOD accounts provide a different level of control and security than traditional estate planning tools such as wills and trusts. While the asset owner can change the beneficiary designation at any time, they cannot impose conditions on the asset transfer, such as requiring the beneficiary to use the funds for a specific purpose. Finally, TOD accounts can create complications if the asset owner has multiple beneficiaries. If the owner designates multiple beneficiaries for a single asset, the beneficiaries may have to share the asset or negotiate a buyout. This can lead to potential conflicts and legal challenges. If you are the designated beneficiary of a TOD account, there are several steps you will need to take to claim the assets after the owner's death. First, you will need to provide proof of the owner's death, such as a death certificate, to the financial institution holding the asset. Once the financial institution has received proof of death, it will transfer the asset to the designated beneficiary. It should be noted that inheriting assets through a TOD account can have tax implications. Depending on the asset type and the estate size, the beneficiary may be subject to federal and state estate taxes. Additionally, if the asset has appreciated in value since the owner's death, the beneficiary may be subject to capital gains taxes when they sell the asset. TOD accounts can be a useful tool for simplifying the transfer of assets after death and avoiding the costs and delays associated with probate. They offer several benefits, including the avoidance of probate, the privacy of asset transfer, flexibility in asset management, and cost savings compared to other estate planning options. However, it is important to be aware of the limitations and risks associated with TOD accounts, including limitations on the types of assets that can be transferred, potential legal challenges associated with joint ownership, and the lack of control and protection compared to traditional estate planning methods. As with any estate planning decision, it is important to seek professional advice from an estate planning attorney before setting up a TOD account to ensure that it is the right option for your specific situation. They can help you navigate the complexities of estate planning and ensure that your assets are transferred to your beneficiaries efficiently and securely.What Are TOD Accounts?

Setting up a TOD Account

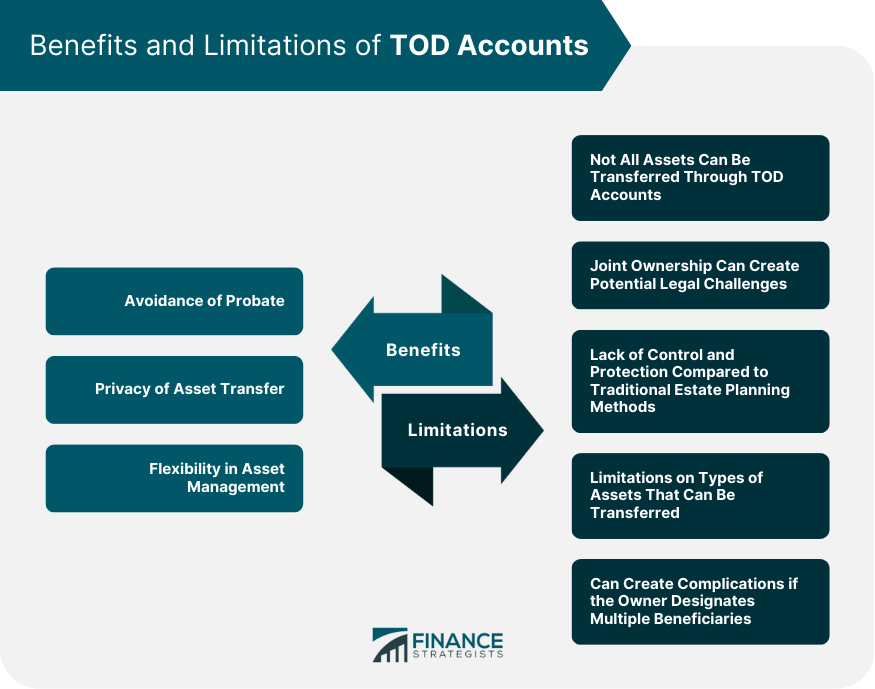

Benefits of TOD Accounts

Avoidance of Probate

Privacy of Asset Transfer

Flexibility in Asset Management

Cost-Effectiveness

Limitations and Risks of TOD Accounts

Inheriting Assets Through a TOD Account

Conclusion

TOD Accounts FAQs

Not all assets can be transferred through a TOD account. Assets such as bank accounts, brokerage accounts, and real estate can typically be transferred through a TOD account. However, assets held in a living trust or retirement account cannot be transferred through a TOD account.

TOD accounts offer several benefits, including the avoidance of probate, the privacy of asset transfer, flexibility in asset management, and cost savings compared to traditional estate planning methods.

Yes, there are risks associated with TOD accounts. These include limitations on the types of assets that can be transferred, potential legal challenges associated with joint ownership, and the need for more control and protection compared to traditional estate planning methods.

To inherit assets through a TOD account, the designated beneficiary must provide proof of the owner's death, such as a death certificate, to the asset's financial institution. Once proof of death is received, the financial institution will transfer the asset to the designated beneficiary.

It is highly recommended to seek professional advice from a financial advisor or estate planning attorney before setting up a TOD account. They can help you determine if a TOD account is the right option for your specific situation and ensure that your assets are transferred to your beneficiaries efficiently and securely.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.