A person's "Next of Kin" is their closest living blood relative. The purpose of determining a person's next of kin is to figure out the appropriate and legal line of inheritance for their estate. In some cases, the next of kin may also have certain responsibilities during or right after their relative's life. For example, they may need to make medical decisions or prepare funeral arrangements. The process of identifying the next of kin involves adhering to specific legal procedures and may require the submission of relevant documentation to establish the familial relationship. Intestate succession laws vary by jurisdiction, and each jurisdiction has its own rules governing the distribution of assets among next of kin. Generally speaking, legally determining a person's next of kin is not as important if the deceased leaves behind a will or if they have a living spouse. In the case that the deceased has a will, it becomes the primary legal outline mandating the distribution of their estate. If the deceased has a living spouse but no will, then by law in most US states, the estate is inherited in full by the spouse. These laws essentially determine who the deceased's next of kin is, and consequently, who will inherit the assets. Different jurisdictions have varied laws, but commonly, spouses, children, and parents are prioritized. In the absence of these primary relations, extended family members like siblings, nieces, nephews, or even cousins could be considered. It underscores the importance of having a will, as intestate succession might not always reflect the deceased's actual wishes. In situations where the relationship between the deceased and the next of kin needs validation, kinship affidavits come to the rescue. These are sworn statements, often provided by other relatives or family friends, attesting to the relationship's legitimacy. Such affidavits become particularly crucial in cases where the family tree is complicated or when there are disputes among family members regarding the legitimacy of the next of kin. They serve as an essential tool in ensuring assets are rightfully claimed and managed. If there are disputes regarding the determination of the next of kin, or if there's ambiguity in a will, the probate court steps in. These proceedings aim to ensure that assets are distributed according to legal standards and the deceased's wishes. The court may need to validate claims, assess the authenticity of documents, or even arbitrate disputes among potential heirs. While ideally, matters are settled amicably among family members, the probate court provides a structured environment to handle more complex situations. In cases where an individual dies without leaving a will, the next of kin becomes the primary heir, often inheriting assets by default. The precise distribution can depend on the laws of the respective country or state, but in most cases, spouses, children, or parents stand first in line. Estate planning, on the other hand, offers individuals the ability to dictate how their assets will be distributed upon their death. Here, the next of kin can be identified as primary beneficiaries, ensuring they receive the intended portion of the estate, be it properties, money, or other assets. Should a person pass away, their next of kin might need to liquidate assets to clear off debts or distribute the remaining assets among other family members. Moreover, in certain cases, debts can be inherited. This means that if the deceased had outstanding loans or liabilities, the next of kin might be legally required to settle those debts using the inherited assets, creating a complex interplay of responsibilities and rights. Financial institutions, by default, restrict access to a person's accounts and investments upon their death. As a result, the next of kin often finds themselves navigating intricate bureaucratic processes to gain access. This can involve producing death certificates, legal documents, or even court orders. Once access is granted, the next of kin has the responsibility to manage or distribute these funds. In cases where investments are involved, decisions about holding, selling, or reinvesting become paramount, often requiring a deep understanding of the financial world or seeking expert advice. Beyond financial matters, the next of kin is often entrusted with making critical decisions, especially during emergencies. This can range from medical decisions, like approving surgeries when the individual is unconscious, to deciding on funeral arrangements post-death. Being a next of kin is not a mere title; it carries weight and responsibility. It's a role that demands sensitivity, decisiveness, and, at times, the ability to make challenging choices, putting the individual's best interest at the forefront. Beneficiary designations go beyond just wills. Insurance policies, retirement accounts, and certain financial instruments allow owners to designate beneficiaries. In many instances, the next of kin automatically becomes the beneficiary unless otherwise specified. Being a beneficiary comes with its own set of responsibilities. It means understanding the intricacies of the policies or accounts, ensuring timely claim settlements, and managing the proceeds responsibly. With rights come responsibilities. The next of kin might be obligated to pay off the deceased's debts, manage tax implications, or even address legal claims against the estate. These obligations can be overwhelming, but they are a part and parcel of the role, underscoring the need for clear communication and effective legal counsel. Familial disputes, sadly, are not uncommon post the passing of a loved one. The distribution of assets, decision-making responsibilities, or simply the emotional toll can give rise to conflicts. For the next of kin, navigating these disputes while grieving can be especially challenging. While some conflicts can be resolved through dialogue and understanding, others might require legal interventions. In either case, the next of kin often finds themselves at the epicenter, tasked with balancing personal emotions with broader family dynamics. Modern family structures are evolving. Blended families, multiple marriages, and varied familial relationships can make the determination of the next of kin convoluted. In such scenarios, legal definitions might clash with personal sentiments, leading to potential disagreements and confusions. The complexity underscores the importance of proactive estate planning and open communication. It allows for the clear determination of roles, responsibilities, and rights, ensuring smoother transitions during times of crisis. Being a next of kin is not just about inheriting assets. It's also about navigating the labyrinth of legal and tax implications. Different jurisdictions have varied tax structures concerning inheritance. Without proper guidance, the next of kin might find themselves facing hefty tax bills or legal penalties. Moreover, international inheritance, where assets are spread across countries, introduces another layer of complexity. Understanding local laws, managing currency conversions, and ensuring compliance becomes vital, making the role of the next of kin even more challenging. In lieu of a will or a living spouse, the line of inheritance starts with the offspring of the deceased, moving from their children to their grandchildren and so on. In the absence of any offspring, the line of inheritance moves upward to the parents of the deceased. If their parents are not capable of receiving the inheritance, then so-called collateral heirs, meaning siblings, nieces, and nephews, have the right to the deceased's estate. "Next of Kin" refers to an individual's closest living blood relative and is vital in determining the legal line of inheritance for their estate. The process involves adhering to legal procedures and providing relevant documentation to establish familial relationships. Responsibilities of the next of kin may include making medical decisions and handling funeral arrangements. Intestate succession laws prioritize spouses, children, and parents as primary beneficiaries. Kinship affidavits validate relationships in complex cases. Probate court proceedings resolve disputes and ensure asset distribution according to the deceased's wishes. Challenges may arise from family conflicts, complex family structures, and legal or tax implications. Effective estate planning, clear communication, and seeking expert advice can help the next of kin navigate these responsibilities and ensure a smoother transition during challenging times.Next of Kin Definition

How to Determine Next of Kin

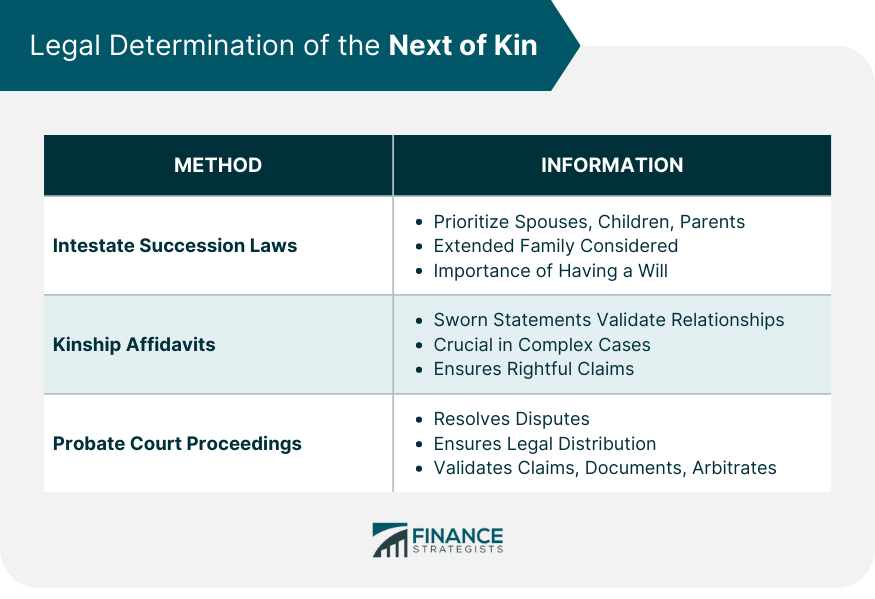

Intestate Succession Laws

Kinship Affidavits

Probate Court Proceedings

Role of Next of Kin in Financial Matters

Inheritance and Estate Planning

Manage Assets and Debts

Access Bank Accounts and Investments

Responsibilities and Rights of Next of Kin

Decision-Making

Beneficiary Designations

Legal and Financial Obligations

Challenges for Next of Kin

Conflicts Within the Family

Complex Family Structures

Legal and Tax Implications

Next of Kin Example

Conclusion

Next of Kin FAQs

A person’s “Next of Kin” is their closest living blood relative.

The purpose of determining a person’s next of kin is to figure out the appropriate and legal line of inheritance for their estate.

Generally speaking, legally determining a person’s next of kin is not as important if the deceased leaves behind a will or if they have a living spouse.

In lieu of a will or a living spouse, the line of inheritance starts with the offspring of the deceased, moving from their children to their grandchildren and so on.

In the case that the deceased has a will, it becomes the primary legal outline mandating the distribution of their estate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.