A jumbo certificate of deposit (CD) is a type of time deposit offered by financial institutions that requires a larger minimum deposit compared to regular CDs. Jumbo CDs are typically designed for high-net-worth individuals or institutional investors who want to earn higher interest rates on their savings. Jumbo CDs play a significant role in the banking industry as they provide an avenue for financial institutions to attract and retain high-value customers. These CDs allow banks to access larger amounts of capital, which they can then use for lending and other financial activities. For investors, jumbo CDs offer an opportunity to earn competitive returns on their substantial savings while benefiting from the security and stability provided by FDIC insurance. A key characteristic of jumbo CDs is their higher minimum deposit requirement, which typically exceeds the threshold for regular CDs. The minimum deposit for jumbo CDs can vary depending on the financial institution, but it is generally set at a significantly higher amount, often ranging from $100,000 to several million dollars. Jumbo CDs generally offer higher interest rates compared to regular CDs. Financial institutions provide these higher rates to attract and incentivize larger deposits from high-net-worth individuals and institutional investors. The increased interest rates on jumbo CDs can result in more substantial returns on investment over the fixed term of the CD. Like other types of CDs, jumbo CDs have fixed terms and maturity dates. The term refers to the length of time the funds must remain in the CD before reaching maturity. Common terms for jumbo CDs range from three months to several years, and the investor cannot withdraw the funds before the maturity date without incurring penalties. One of the primary advantages of jumbo CDs is the potential for higher returns on investment compared to other savings vehicles. The higher interest rates offered by jumbo CDs enable investors to earn more interest over the fixed term of the CD, increasing their overall returns. Jumbo CDs are considered relatively low-risk investments due to their fixed interest rates and FDIC insurance coverage. The fixed interest rate ensures a predictable return on investment, while FDIC insurance provides protection for the deposit amount (up to the maximum coverage limit) in case the financial institution fails. Investors who have a significant amount of liquid assets can use jumbo CDs to diversify their investment portfolio. By allocating funds to jumbo CDs, they can balance their portfolio with a low-risk asset that provides a stable income stream. Investors considering jumbo CDs should be aware of the potential liquidity limitations. Since jumbo CDs have fixed terms, the funds are locked in until maturity. Withdrawing the funds before the maturity date may result in penalties or loss of interest. Financial institutions often impose penalties for early withdrawal from jumbo CDs. These penalties are typically a percentage of the withdrawn amount or a specified number of months' worth of interest. It's essential for investors to carefully evaluate their financial needs and liquidity requirements before committing to a jumbo CD. Investors should ensure that the financial institution offering the jumbo CD is FDIC-insured. FDIC insurance protects the deposit amount up to the maximum coverage limit per depositor, per institution. Verifying the institution's FDIC membership provides an added layer of security for investors. Individual jumbo CDs are accounts held by a single person, allowing them to deposit a substantial amount of money and earn higher interest rates based on the deposit size. Individual jumbo CDs provide a convenient option for high-net-worth individuals looking to maximize their savings and earn competitive returns. Joint jumbo CDs are accounts that allow two or more individuals, such as spouses or business partners, to open a CD together. Joint accounts provide the opportunity for multiple investors to pool their funds and benefit from the higher interest rates offered by jumbo CDs. This can be advantageous for individuals who want to combine their resources and maximize their returns. Trust jumbo CDs are specifically designed for trusts, which are legal arrangements that hold assets on behalf of beneficiaries. Trust accounts offer the added benefit of asset protection and estate planning. By utilizing jumbo CDs within a trust structure, individuals can preserve and grow wealth while ensuring the financial security of future generations. The laddering strategy involves dividing the jumbo CD investment across multiple CDs with staggered maturity dates. By spreading the investment over different terms, investors can take advantage of higher interest rates on longer-term CDs while maintaining regular access to a portion of their funds as each CD reaches maturity. This strategy provides a balance between liquidity and earning potential. With the income strategy, investors prioritize generating regular income from their jumbo CD investments. Instead of reinvesting the interest, they opt to receive periodic interest payments, providing a steady stream of income. This strategy can be suitable for investors seeking a reliable income source from their savings. Investors pursuing a growth strategy with jumbo CDs aim to maximize their returns over a more extended period. They select longer-term CDs with higher interest rates, allowing their investment to grow substantially over time. This strategy requires a longer-term commitment and a willingness to forgo immediate access to the funds. When opening a jumbo CD account, it is crucial to research and compare different financial institutions to find the best terms, interest rates, and customer service. Consider factors such as the institution's reputation, stability, and the specific terms and conditions associated with their jumbo CD offerings. Financial institutions often have specific eligibility requirements for opening a jumbo CD account, including minimum deposit thresholds and additional documentation. Ensure that you meet the institution's criteria and gather the necessary information before initiating the account-opening process. To open a jumbo CD account, you will need to complete an application with the chosen financial institution. The application process typically involves providing personal and financial information, including your identification, social security number, and details about the funds you intend to deposit. Follow the institution's instructions for submitting the application and funding your jumbo CD account. A jumbo certificate of deposit (CD) is a type of time deposit that requires a larger minimum deposit and offers higher interest rates than regular CDs. Jumbo CDs have a higher minimum deposit requirement, offer higher interest rates, and have fixed terms and maturity dates. Jumbo CDs provide higher returns, lower risk, and potential diversification in investment portfolios. However, investors should consider liquidity concerns, early withdrawal penalties, and FDIC insurance coverage. Jumbo CDs can be a valuable tool for individuals and institutions looking to earn competitive returns on their savings. By understanding the features, advantages, and considerations of jumbo CDs, investors can make informed decisions that align with their financial goals and risk tolerance.What Is a Jumbo CD?

Characteristics of Jumbo CDs

Minimum Deposit Requirement

Higher Interest Rates

Fixed Term and Maturity Date

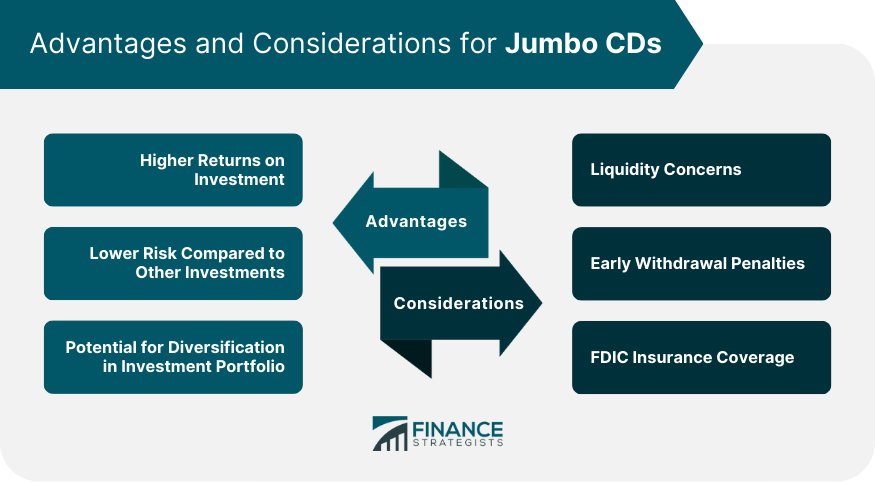

Advantages of Jumbo CDs

Higher Returns on Investment

Lower Risk Compared to Other Investments

Potential for Diversification in Investment Portfolio

Considerations for Jumbo CD Investors

Liquidity Concerns

Early Withdrawal Penalties

FDIC Insurance Coverage

Types of Jumbo CD Accounts

Individual Jumbo CDs

Joint Jumbo CDs

Trust Jumbo CDs

Jumbo CD Strategies

Laddering Strategy

Income Strategy

Growth Strategy

How to Open a Jumbo CD Account

Researching and Comparing Financial Institutions

Meeting Eligibility Requirements

Completing the Application Process

Conclusion

Jumbo CD FAQs

The minimum deposit requirement for a jumbo CD varies depending on the financial institution. It typically ranges from $100,000 to several million dollars. It's essential to check with the specific institution offering the jumbo CD to determine their minimum deposit requirement.

While jumbo CDs are designed to be held until maturity, some financial institutions may allow early withdrawals. However, withdrawing funds before the maturity date often incurs penalties, such as a reduction in interest earned or a specified fee. It's crucial to review the terms and conditions of the jumbo CD before making any early withdrawal decisions.

Yes, jumbo CDs are typically FDIC insured, as long as the financial institution offering the CD is a member of the Federal Deposit Insurance Corporation (FDIC). FDIC insurance provides protection for deposits up to the maximum coverage limit per depositor, per institution.

When a jumbo CD reaches its maturity date, you have several options. You can choose to renew the CD for another term, withdraw the funds, or explore other investment opportunities. If you do not take any action, some financial institutions may automatically renew the CD for another term, but at the prevailing interest rate.

Jumbo CDs are generally considered safe investments due to their fixed interest rates and FDIC insurance coverage. However, it's essential to evaluate your own financial goals, risk tolerance, and liquidity needs before investing in jumbo CDs or any other financial instrument. Diversifying your investment portfolio and seeking advice from a financial professional can help ensure you make informed investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.