Protecting your bank account from creditors is vital for financial security. Creditors, following a legal judgment, can gain access to your account, freezing or garnishing your funds, causing significant disruption to your life. This could jeopardize your ability to pay bills, meet basic needs, or make planned investments. Financial vulnerability is not just about immediate monetary loss but also about the psychological stress it inflicts, destabilizing your mental well-being. It's crucial to understand your rights and legal protections, such as specific types of accounts or amount thresholds that may be exempted. Also, financial planning and debt management strategies, including timely payment of debts and setting up emergency funds, can help safeguard your account. Knowing the law is half the battle. Both federal and state laws often have provisions that protect certain amounts or types of bank account funds from creditors. For instance, some states protect a portion of the account holder's wages, while others might exempt specific savings. Dive into your state’s regulations and familiarize yourself with these exemptions; they can be your first line of defense. Ensure that you're updated on these laws, as they can change based on legislative sessions and court rulings. An Asset Protection Trust offers a haven for your assets, placing them beyond the reach of future creditors. It's crucial to set these up with transparency and without any intent to defraud creditors. Remember, there's a thin line between legal protection and evasion; always stay on the right side of the law. Also, ensure that the trust is structured in a jurisdiction known for strong asset protection laws. Surprisingly, a joint account can offer some protection. Depending on the jurisdiction, many joint accounts come with a "right of survivorship." This means that upon the death of one account holder, the funds automatically pass to the other, without becoming part of the deceased’s estate (and thus shielded from their creditors). However, be cautious about the implications for taxation and accessibility when you co-own an account. If you foresee a potential lawsuit or creditor action, it's essential not to commingle funds. For instance, if you have a personal account and a business account, never mix funds between the two. This clear demarcation makes it harder for creditors to claim assets. Moreover, consistently labeling accounts and documenting transactions can prevent misunderstandings. This often-overlooked shield can be a lifesaver. Liability insurance can cover potential claims, ensuring your bank account remains untouched. For professionals like doctors or architects, malpractice and professional liability insurance can be particularly pertinent. These insurance types also serve as a reflection of your commitment to your profession and clients. Many people don't realize that retirement accounts, such as 401(k)s and IRAs, often carry significant protections against creditors. By channeling more funds into these accounts, you not only secure your retirement but also protect your wealth. Plus, contributing consistently can yield compounding benefits, amplifying your financial growth. Creating a business entity, like an LLC (Limited Liability Company) or corporation, can be a great way to shield personal assets. These structures ensure that personal finances remain separate from business liabilities, providing an added layer of defense. Moreover, they can provide tax benefits and facilitate easier business operations. While it sounds devious, transferring assets legally can put them out of creditors' reach. This doesn’t mean hasty transfers when you see trouble looming; that can be flagged as fraudulent. However, legal mechanisms, like gifting assets or establishing family limited partnerships, can reposition assets strategically. Such decisions should be aligned with your broader estate and financial planning goals. An overdraft can make your account vulnerable. Always be on top of your account balance, and be wary of liens, which can give creditors a legal claim to your funds. Setting up account alerts can act as an early warning system for potential issues. In today’s digital age, it's not uncommon for unauthorized activities to creep into bank statements. Regularly checking ensures you nip any suspicious activity in the bud, and it also helps you keep a finger on the pulse of your financial health. In addition to reviewing for unauthorized transactions, look for fees or charges that might be eroding your balance. Cyber threats are real, and a compromised bank account can open doors for creditors. When choosing a bank, prioritize those with a reputation for strong digital security measures. This commitment to security is not just about technology but also entails training bank personnel to recognize and mitigate threats. Before trouble starts knocking, consult with a legal expert. Being proactive can save countless headaches down the line. Early consultation provides a buffer, allowing you to make more informed decisions before pressing issues arise. All lawyers are not created equal. For asset protection, you need a specialist, someone who understands the nuances and can guide you effectively. Look for those with proven track records, and don't shy away from seeking client testimonials. The financial landscape is dynamic, and yesterday’s strategies might not work today. Regular check-ins with your lawyer ensure that your protective measures evolve with the times. This regular touchpoint can also keep you apprised of new legal developments that might affect your assets. Forewarned is forearmed. By knowing what pitfalls to sidestep, you're already ahead of the game. Attempting to move assets deceitfully to escape creditors is a massive no-no. Such transfers can be reversed, and you might find yourself in hotter water legally. It's crucial to approach asset transfers with clear intent and proper documentation. While it's comforting to believe that all your assets are safe, this isn't always the case. Always validate your assumptions, especially when the stakes are high. Regularly consulting experts can dispel myths and reaffirm your protective measures. The world doesn't stand still, and neither should your asset protection strategies. Periodic reviews ensure you remain ahead, always protected, always secure. Adaptability, in this arena, is more than a virtue—it's a necessity. Safeguarding your bank account from creditors is a multifaceted process, encompassing a deep understanding of legal exemptions, strategic use of financial tools like Asset Protection Trusts (APTs) and retirement accounts, and maintaining operational caution. Regular monitoring of account activities and updates in the legal landscape can significantly strengthen your defensive shield. Implementing long-term strategies such as liability insurance, establishing a business entity, and legal asset transfers can also ensure your assets are well-protected. Avoid common mistakes such as fraudulent transfers and complacency, and continually reevaluate your protective measures. Engage the services of a skilled asset protection lawyer to guide you through this intricate process. Take control of your financial future today and prioritize bank account protection as a crucial aspect of your financial planning.Importance of Protecting Your Bank Account From Creditors

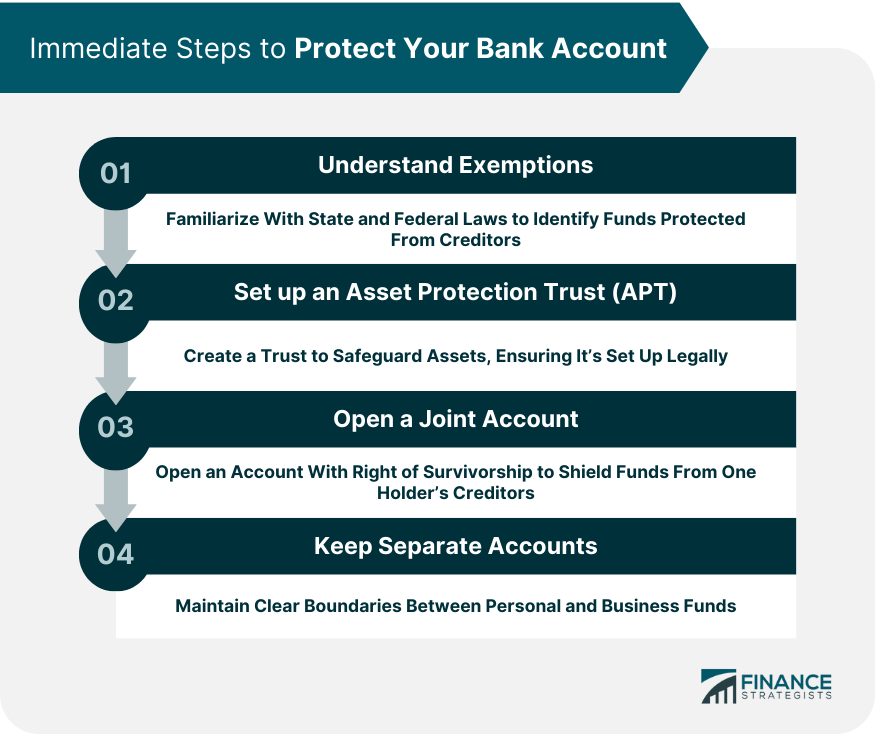

Immediate Steps to Protect Your Bank Account

Understand Exemptions

Set up an Asset Protection Trust (APT)

Open a Joint Account

Keep Separate Accounts

Long-Term Strategies for Financial Security

Set Up Liability Insurance

Invest in Retirement Accounts

Establish a Business Entity

Transfer Assets

How to Bank With Caution

Stay Informed on Overdrafts and Liens

Regularly Review Account Statements

Opt for Banks With Robust Digital Security

Legal Practices in Bank Account Protection

Seek Legal Advice Early

Find a Lawyer With Experience in Asset Protection

Regularly Update and Review Protective Measures

Common Mistakes to Avoid When Protecting a Bank Account From Creditors

Fraudulent Transfers

Assuming All Assets Are Protected

Not Continually Re-Evaluating Protection Measures

Bottom Line

Strategies on How to Protect Your Bank Account From Creditors FAQs

By familiarizing yourself with federal and state laws, you can identify specific funds in bank accounts that are exempt from creditors.

Investing in liability insurance, retirement accounts, and establishing business entities like LLCs can offer long-term protection.

Regularly reviewing statements detects unauthorized activities and keeps you informed about your financial health, preventing vulnerabilities.

Legal experts can guide on asset protection, inform about legal developments, and help avoid common pitfalls.

Avoid fraudulent transfers, assumptions that all assets are safe, and not regularly re-evaluating your protection measures.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.