Student bank accounts are essential for helping college students manage their money wisely. They go beyond just being convenient, as they teach students how to be responsible with their finances. Through online banking, mobile apps, and budgeting tools, students learn important money skills that will help them in the future. After graduating from college, student bank accounts go through significant changes. This prompts graduates to think about their banking options and come up with new strategies to manage their money. The transition from a student account to a regular account is a big step toward financial independence. By understanding the changes that occur, exploring new account options, and investing in financial education, graduates can confidently shape their financial future. As graduates bid adieu to their academic years and welcome the new phase of adulthood, their student accounts are automatically converted into regular accounts by the bank. This transition involves several steps that impact the account's features and functionality, shaping the banking experience for the future. The first step in the transition process is the automatic conversion of the student bank account into a regular account. Financial institutions typically initiate this conversion shortly after the graduation date, reflecting the change in the account holder's status from a student to a young professional. With the account conversion comes updated terms and conditions, which may differ from the favorable features and benefits that characterize the student account. Graduates should carefully review the new terms to understand any modifications in fees, interest rates, and overdraft facilities. Some changes may include the introduction of monthly maintenance fees or adjustments to overdraft limits, and it is crucial for graduates to be aware of these alterations. Graduates should take the time to assess the implications of these changes on their financial management. For some, the prospect of new fees or reduced interest rates may cause apprehension, while others may welcome the opportunity to explore a broader range of banking products and services tailored to their evolving needs. Understanding the implications will enable graduates to make informed decisions about their banking preferences. Many financial institutions offer a grace period after graduation, during which certain benefits of the student account may still apply. This grace period serves as a buffer, allowing graduates to adjust to their new banking reality without immediately facing all the changes associated with the regular account status. Graduates should familiarize themselves with the duration and specific benefits provided during this grace period to maximize its advantages. The transition also presents an opportune moment for graduates to assess whether their current bank and account align with their evolving financial needs and aspirations. Graduates may consider factors such as the bank's branch accessibility, mobile app usability, customer service, and product offerings to ensure they have the right banking partner to support their financial journey. As graduates navigate the transition, they can explore other account options tailored explicitly for young professionals or recent graduates. Many banks offer specialized post-graduate accounts with exclusive benefits, such as higher interest rates, additional rewards, or discounts on various services. By exploring these options, graduates can find an account that best suits their current financial requirements and long-term goals. With graduation behind them, graduates may find themselves facing new financial goals and responsibilities. This transition is an excellent time to revisit their financial objectives and reassess their saving and spending strategies. By setting clear financial goals, graduates can effectively prioritize their financial decisions and work towards building a solid foundation for their future. Throughout this transition, graduates should continue to prioritize financial literacy and seek opportunities to enhance their knowledge of personal finance. Engaging with educational resources and financial planning tools offered by the bank can empower graduates to make informed choices and develop a strong sense of financial competence. As recent graduates embark on their journey into the professional world, they are presented with a range of new account options tailored explicitly to meet their evolving financial needs. These specialized post-graduate accounts offer a variety of features and benefits designed to empower graduates with financial flexibility and strategic advantages. These are specifically crafted for graduates transitioning from college to the workforce. Young professional accounts often offer a host of perks, such as higher interest rates on savings, fee waivers on certain transactions, and personalized financial guidance from banking professionals. Additionally, they may come with mobile banking apps equipped with innovative budgeting tools and financial planning resources, empowering graduates to manage their money with ease and confidence. Graduates' premium accounts are a step above traditional accounts, designed to cater to the unique needs of recent graduates. They may include enhanced features like cashback rewards on purchases, exclusive access to financial workshops or seminars, and priority customer service. These accounts aim to offer a higher level of personalization and support, providing graduates with the tools they need to navigate their financial journey with assurance. Some banks offer tailored account bundles, allowing graduates to choose from a selection of financial products and services that align with their individual preferences and goals. These bundles might include options for savings accounts, investment accounts, and credit cards, all bundled together with added perks and discounts. Graduates can customize their bundles based on their specific financial objectives, thereby creating a personalized banking experience. Recognizing the burden of student loans on recent graduates, certain financial institutions offer specialized accounts with unique features aimed at easing the loan repayment process. These accounts may offer incentives such as direct deposit bonuses applied to loan payments or reduced interest rates for borrowers with these accounts. Graduates can benefit from such features, making the journey toward becoming debt-free more manageable. Some graduates may find value in exploring community-based banking options. Local credit unions or community banks often prioritize personalized service and community support, fostering a sense of connection and trust. These institutions may offer competitive rates and a more intimate banking experience, making graduates feel valued as customers and community members. After graduation, managing finances becomes a paramount responsibility for recent graduates as they transition into the professional world. Navigating this new phase of financial independence requires careful planning, responsible money management, and a keen understanding of personal financial goals. • Budgeting: Graduates should assess their income, including salaries, allowances, and sources of revenue, and then allocate funds for essential expenses such as rent, groceries, transportation, and loan payments. Establishing a budget helps graduates track their spending, avoid overspending, and stay on track with their financial goals. • Repayment Strategies for Student Loans: Whether through a standard repayment plan, income-driven plan, or consolidation, adopting a suitable repayment strategy can help graduates manage their debt responsibly. • Building an Emergency Fund: Graduates should aim to save three to six months' worth of living expenses in a separate savings account to safeguard against unforeseen events such as medical emergencies or unexpected job loss. • Tackling Credit Card Debt: If graduates have accumulated credit card debt during college, now is the time to prioritize paying it off. Credit card interest rates can be high, making it essential to allocate extra funds towards eliminating this debt. Avoiding unnecessary credit card spending and making timely payments can prevent further financial strain. • Contributing to Retirement Accounts: Graduates should consider contributing to employer-sponsored retirement accounts like 401(k)s or Individual Retirement Accounts (IRAs). Early contributions can leverage the power of compound interest and set graduates on a path to a secure retirement. • Monitoring Credit Score: A good credit score is essential for accessing favorable financial opportunities in the future, such as low-interest rates on loans or credit cards. Graduates should regularly monitor their credit scores and report to identify any discrepancies or potential improvements. • Evaluating Financial Goals Regularly: Life after graduation can be dynamic; graduates should periodically review their financial goals and adjust their budget and savings strategies accordingly. • Seeking Financial Guidance: For graduates navigating complex financial decisions, seeking professional financial guidance can be immensely beneficial. Financial advisors can offer personalized advice, helping graduates make informed choices about investments, retirement planning, and other long-term financial objectives. Student bank accounts play a pivotal role in helping college students manage their finances responsibly, offering valuable tools and resources for financial literacy. As graduates transition from student to regular accounts, they face changes in terms and conditions, prompting them to reconsider their banking options and strategies. By understanding the implications of these changes and exploring new account options tailored to young professionals, graduates can confidently shape their financial future. Additionally, managing finances post-graduation involves budgeting for real-world expenses, addressing student loan repayment strategies, building emergency funds, and monitoring credit scores. Regular evaluation of financial goals and seeking professional financial guidance are also essential steps in achieving long-term financial success. With thoughtful planning and financial education, recent graduates can navigate the transition to financial independence with confidence.What Is a Student Bank Account?

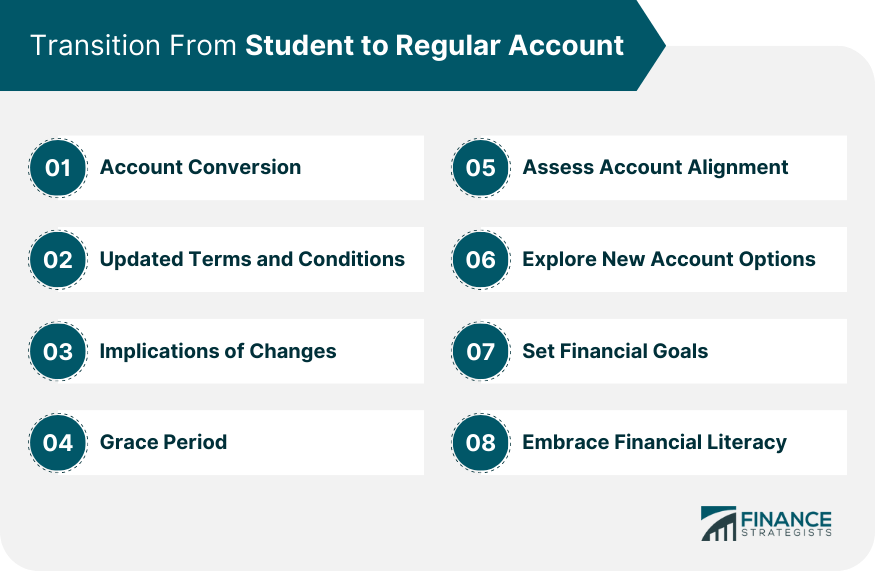

Transition From Student to Regular Account

Step 1: Account Conversion

Step 2: Updated Terms and Conditions

Step 3: Implications of Changes

Step 4: Grace Period

Step 5: Assessing Account Alignment

Step 6: Exploring New Account Options

Step 7: Setting Financial Goals

Step 8: Embracing Financial Literacy

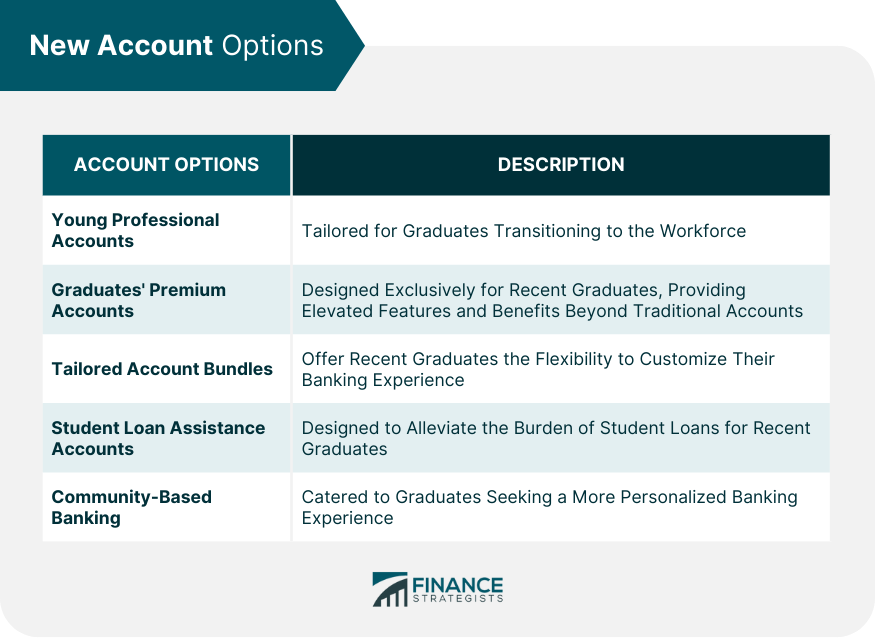

New Account Options

Option 1: Young Professional Accounts

Option 2: Graduates' Premium Accounts

Option 3: Tailored Account Bundles

Option 4: Student Loan Assistance Accounts

Option 5: Community-Based Banking

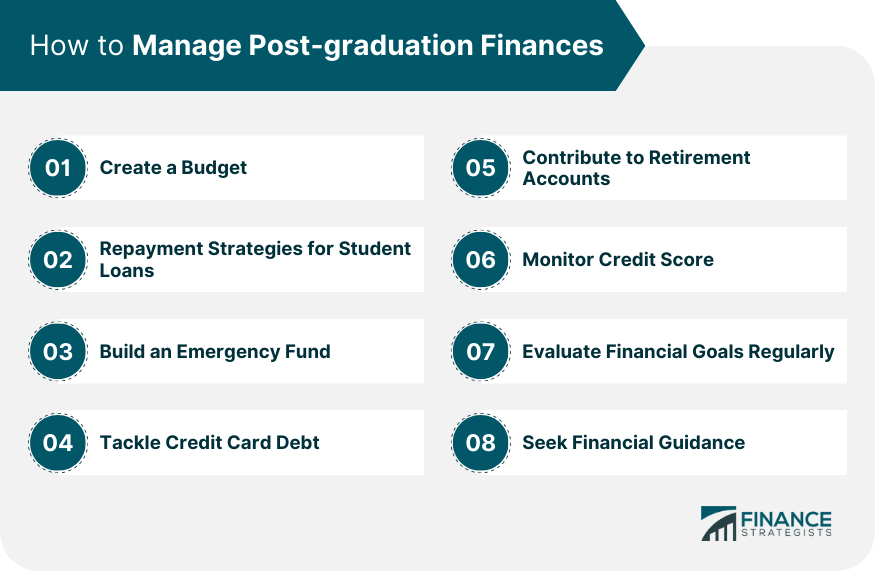

Managing Post-graduation Finances

Conclusion

What Happens to a Student Bank Account Upon Graduation? FAQs

Upon graduation, a student bank account typically undergoes a transition and is converted into a regular account by the bank.

Yes, the features of your student bank account may change. Updated terms and conditions may include adjustments in fees, interest rates, and overdraft facilities.

In most cases, you do not need to close your student bank account. It will automatically convert into a regular account, allowing you to continue using the same account number and services.

Some banks offer a grace period after graduation, during which certain benefits of the student account may still apply. However, it is essential to familiarize yourself with the specific terms and duration of the grace period.

Yes, it's a good idea to explore new account options tailored for recent graduates. Banks may offer specialized post-graduate accounts with unique benefits, such as higher interest rates and personalized financial guidance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.