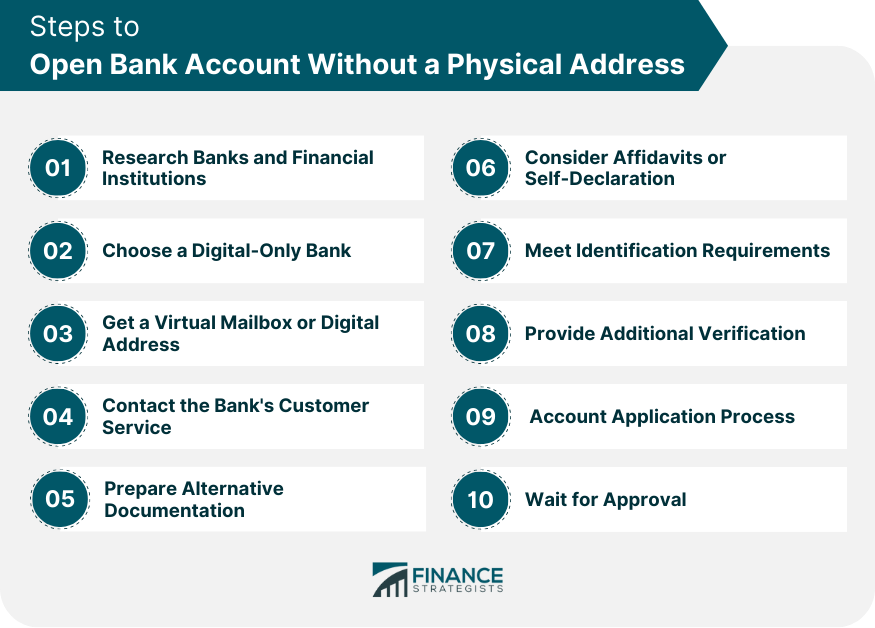

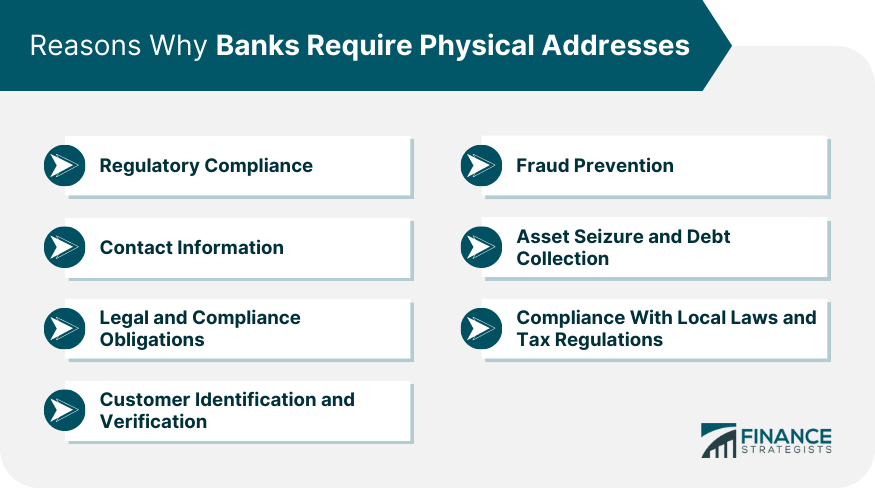

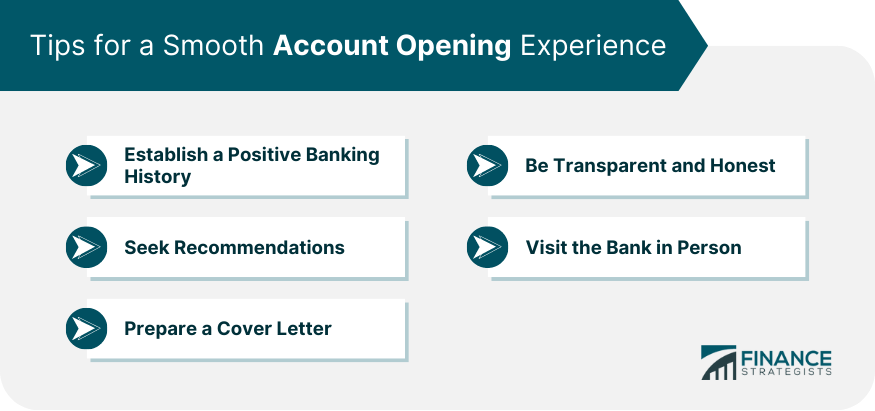

In many cases, it is possible to open a bank account without a physical address, though the process may vary depending on the bank's regulations. Banks typically require a physical address for mailing purposes, verification, and to comply with anti-money laundering regulations. However, various alternatives and solutions can be explored to open an account without a traditional physical address, such as accepting virtual mailbox addresses or other forms of documentation to prove residency. Online banks, in particular, maybe more accommodating to customers without a physical address. It is essential to conduct thorough research, communicate with different banks, and gather the necessary alternative documents to increase the chances of successfully opening a bank account without a traditional physical address. Opening a bank account without a physical address can be challenging, but with the right approach, it is possible. Here are the steps to help you navigate the process: Begin by conducting thorough research to identify banks and financial institutions known for their flexibility in accepting alternative proof of address. Look for online banks, credit unions, or community banks that have a reputation for accommodating customers with unique circumstances. Opt for a digital-only bank as they tend to have more lenient address verification procedures. Digital banks operate entirely online, and their account opening processes may be more accessible to individuals without a physical address. Sign up for a virtual mailbox service or a digital address provider. These services offer unique physical addresses that you can use for banking purposes. Some banks may recognize virtual addresses as valid proof of residence. Reach out to the customer service department of the bank you wish to open an account with. Inquire specifically about their policies for account opening without a physical address. They can provide valuable information and guide you through the process. Assemble alternative documents that can demonstrate your residential address. These may include utility bills (water, electricity, gas), rental agreements, property tax documents, or government-issued identification with your current address. Verify with the bank which documents they accept as valid proof of address. Inquire if the bank allows customers to sign an affidavit or self-declaration form to confirm their residential address. If this option is available, ensure you follow the bank's specific guidelines for submitting such documents. Ensure you have all the necessary identification documents required for account opening. Commonly accepted identification documents include a valid passport, driver's license, national ID card, or other government-issued ID. Be prepared to offer additional verification if requested by the bank. They may ask for references, financial statements, employment verification, or other documents to establish your identity and financial stability. During this phase, the bank's verification team meticulously checks the application and supporting documents to ensure compliance with regulatory requirements and internal policies. Wait for the bank to review and approve your account opening request. The approval timeline may vary depending on the bank's processes. Banks require physical addresses for several important reasons: • Regulatory Compliance: Banks are subject to strict regulatory requirements, including Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Collecting physical addresses helps banks verify the identity of their customers and comply with these regulations to prevent fraudulent activities, money laundering, and other illicit financial transactions. • Contact Information: Physical addresses allow banks to send account statements, important notices, and other communications related to the account. It also ensures that the bank can reach the customer in case of any account-related issues or concerns. • Legal and Compliance Obligations: Banks have legal obligations to maintain accurate records of their customers. Physical addresses are a vital part of this record-keeping process and help establish a verifiable customer profile. • Customer Identification and Verification: A physical address is one of the primary pieces of information used to identify and verify a customer's identity. It provides an additional layer of authentication in conjunction with other identification documents like passports, driver's licenses, or national IDs. • Fraud Prevention: Collecting physical addresses helps banks prevent fraud and unauthorized account access. It allows the bank to verify the customer's residency and prevent individuals from using false addresses to create fraudulent accounts. • Asset Seizure and Debt Collection: In the unfortunate event of a default on loans or other financial obligations, banks need accurate address information to initiate legal actions, pursue debt collection, or repossess assets if necessary. • Compliance With Local Laws and Tax Regulations: Banks must comply with local laws and tax regulations that may require the collection of physical address information for tax reporting and compliance purposes. Non-traditional accounts that individuals can consider opening if they do not have a physical address include: Non-traditional accounts may include prepaid debit cards, which are not linked to a traditional checking or savings account. Prepaid cards can be a convenient alternative for making purchases and managing funds without the need for a physical address. These are designed for individuals who are in the process of establishing or re-establishing their financial stability. These accounts may have certain restrictions but provide essential banking services to support the individual's financial journey. Some banks offer accounts specifically for non-residents or individuals without a permanent physical address in a particular country. These accounts may cater to expatriates, students, or travelers who need banking services in a foreign country. Non-traditional accounts may include basic checking accounts with simplified features and fewer requirements. These accounts are accessible to a broader range of customers, including those without a physical address. Explore international banking options that cater to global customers, providing solutions for those without a fixed address. Opening a bank account without a physical address can present unique challenges, but with proper preparation and understanding, you can still have a smooth account opening experience. Here are some tips to help you navigate the process successfully: • Establish a Positive Banking History: If you have an existing relationship with a bank or financial institution, consider reaching out to them first. Having a positive banking history with a reputable institution may increase your chances of opening an account without a physical address. • Seek Recommendations: Ask friends or family members if they have faced similar challenges and successfully opened an account without a physical address. Their experiences and recommendations may guide you to the right bank or provide insights into the process. • Prepare a Cover Letter: Include a cover letter with your account application explaining your unique situation and providing context for the lack of a physical address. A well-written cover letter can help bank representatives understand your circumstances better. • Be Transparent and Honest: Always be truthful in providing information to the bank. Transparency and honesty are essential in building trust with the bank and ensuring a smooth account opening process. • Visit the Bank in Person: If you are near a bank branch, consider visiting in person to discuss your situation with a banking representative. Face-to-face interactions may help convey your situation more effectively. Opening a bank account without a physical address is indeed possible, though the process may vary depending on the bank's policies and regulations. To have a smooth account opening experience, it is crucial to conduct thorough research and communicate with banks known for their flexibility in accepting alternative proofs of address. Consider digital-only banks or those offering specialized non-traditional accounts for individuals facing unique circumstances. Gather alternative address documentation, such as virtual mailbox services, utility bills, or rental agreements, to support your application. Additionally, being transparent, honest, and well-prepared throughout the process can enhance your chances of successfully opening an account without a physical address. By exploring these options and following the tips provided, individuals can navigate the account opening process with greater confidence and financial inclusion.Can You Open a Bank Account Without a Physical Address?

How to Open Bank Account Without a Physical Address

Step 1: Research Banks and Financial Institutions

Step 2: Choose a Digital-Only Bank

Step 3: Get a Virtual Mailbox or Digital Address

Step 4: Contact the Bank's Customer Service

Step 5: Prepare Alternative Documentation

Step 6: Consider Affidavits or Self-Declaration

Step 7: Meet Identification Requirements

Step 8: Provide Additional Verification

Step 9: Account Application Process

Step 10: Wait for Approval

Why Do Banks Require Physical Addresses

Alternatives to Standard Banking

Prepaid Debit Cards

Transitional Accounts

Non-residential Accounts

Basic Checking Accounts

International Banking Options

Tips for a Smooth Account Opening Experience

Conclusion

How to Open Bank Account Without a Physical Address FAQs

Yes, it is possible to open a bank account without a physical address. Some banks offer alternative solutions for address verification, such as virtual mailboxes or digital addresses.

You will typically need alternative proofs of address, such as utility bills, rental agreements, or government-issued identification with your current address. Check with the bank to confirm their accepted documents.

Yes, digital-only banks often have more lenient address verification procedures, making them a viable option for individuals without traditional residential addresses.

Yes, some banks may accept virtual mailbox addresses as valid proof of residence. It's essential to verify with the bank if they recognize virtual addresses.

Yes, some banks offer non-traditional accounts designed for individuals facing unique circumstances, such as prepaid debit cards or accounts for non-residents. These accounts may have different requirements and features.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.