Opening a kid's bank account is instrumental in setting a foundation for financial literacy, teaching the significance of saving and money management at a young age. It offers a practical platform for understanding basic banking operations, from deposits to withdrawals, balance inquiries, and interest calculations. By having their own account, children learn firsthand about the value of money, its growth through interest, and the importance of financial responsibility. It encourages the habit of saving, letting kids see how even small, regular deposits can grow over time. A bank account can also foster a sense of independence and confidence in financial matters. It makes abstract concepts like interest and savings tangible and comprehensible. Moreover, this early exposure to banking systems can better equip them for more complex financial decisions in the future. Overall, a kid's bank account is a vital tool in nurturing financial awareness and discipline from an early age. There are generally two primary account types for children: savings and checking. For younger children, a savings account is ideal as it teaches them the fundamentals of saving. As they grow older and require more financial freedom, you might consider transitioning them to a checking account. Both types offer unique advantages that cater to different stages of a child’s financial journey. Not all financial institutions are created equal. Some banks and credit unions offer accounts specially designed for kids, featuring no fees and interactive online platforms. Before settling on a bank, make sure to shop around and find one that aligns with your child's needs. Furthermore, consider the proximity of physical branches for those teachable moments in banking. Different banks have varied age criteria for opening a child's account. While some institutions permit accounts for children as young as three, others might have a higher age cutoff. Ensure you’re aware of these stipulations. Being familiar with these nuances ensures a smoother process when opening the account. Some accounts come with monthly maintenance fees, while others might charge for ATM withdrawals or other transactions. Opt for accounts with minimal or no fees to ensure your child gets the most out of their savings. Always read the fine print to prevent any unexpected charges in the future. Preparation is key. Before heading to the bank, gather all necessary documents: Child's birth certificate or passport Child's Social Security number or Tax ID Proof of address Parent or guardian's identification and Social Security number. Ensuring all documents are in order streamlines the account opening process and avoids unnecessary delays Higher interest rates can motivate your child to save more. An account with competitive rates can help grow their savings, offering a tangible lesson on the power of compound interest. Seeing their money grow can be an excellent incentive for continued saving. In today's digital age, having online access is crucial. Banks with interactive platforms can make managing money more engaging for your child, offering tools, games, and educational content. Moreover, familiarizing them with digital banking prepares them for the tech-driven financial landscape of the future. Some banks provide resources like tutorials, quizzes, and interactive lessons. These can instill sound financial habits from a young age. Leveraging these tools can provide a holistic financial education beyond just saving and spending. Limitations on withdrawals can be a double-edged sword. While they can teach patience and long-term saving, they might also be restrictive if your child needs access to their funds. It’s essential to balance this by discussing the value of patience and the reasons behind such restrictions. Joint accounts grant both the child and the parent/guardian access. This shared access means you can monitor transactions, making sure your child is on the right financial path. This dual-access also presents opportunities for joint financial projects and teaching moments. A custodial account is controlled by the adult until the child reaches a certain age, typically 18 or 21. While this means the child has limited access, it can be beneficial as it shields them from potential financial missteps. Still, it's crucial to maintain open communication about the funds and their eventual control. Custodial accounts can have tax benefits, but they might also impact financial aid eligibility when your child goes to college. It’s essential to consult with a tax advisor or financial planner to fully understand the implications. Taking this step ensures you're maximizing benefits while minimizing potential pitfalls. Sit down with your child regularly to go over their bank statements. This routine can help them understand the flow of money, spot any irregularities, and set future financial goals. It's an active way to introduce them to the concept of budgeting and tracking expenses. Establish the pillars of financial literacy. Encourage saving by setting aside a portion of their allowance or gift money. Discuss wise spending habits, and if they’re of age, consider ways they can start earning, such as chores or part-time jobs. These foundational lessons will serve them well throughout their life. Whether it’s a new toy, a video game, or a special treat, setting financial targets can be motivating. Help your child chart their progress and celebrate when they achieve their goals. Each accomplishment can boost their confidence and understanding of money. Keep a vigilant eye on the account to detect any unauthorized transactions. Early detection can prevent potential losses. Open dialogue about any suspicious activities they observe can further protect their funds. Enable alerts for transactions, balance updates, and any other significant account activities. This way, both you and your child stay in the loop. Being proactive with these alerts can also be an opportunity to teach your child about financial vigilance. With the rise of online scams, it's essential to educate your child about online safety, recognizing phishing emails, and the importance of strong, unique passwords. Equipping them with this knowledge now can guard them against online financial threats in adulthood. Transitioning from a child’s account to a teen account often comes with additional features like a debit card. Navigate this change by discussing the responsibilities that come with it. This transition can be an exciting time, marking their step towards more financial independence. A debit card can be both exciting and daunting for a teen. Establish ground rules, teach them about ATM safety, and monitor their spending habits. This tangible representation of their funds can be a powerful tool in teaching the value of money. As your child approaches adulthood, introduce the concept of credit scores. Explain its importance, factors that influence it, and how good financial habits now can positively impact their future. Early education on credit can set them on a path to strong financial health later in life. Equipped with the right account and knowledge, your child is well on their way to a future of sound financial decisions. The establishment of a kid's bank account can be a powerful instrument for instilling financial literacy and discipline in children from an early age. Understanding the intricacies of banking, from account types to fee structures, is essential in navigating this process. Equally important are the safety measures and continual education necessary for a comprehensive understanding of the financial landscape. As children transition into teen banking, a whole new level of responsibilities, including understanding debit cards and credit scores, comes into play. The active participation of parents in their child's financial journey can not only foster healthy money habits but also promote a sense of independence and financial confidence in the young mind. Encourage your child to take their first step into the financial world by opening a bank account today.Importance of Opening a Kid’s Bank Account

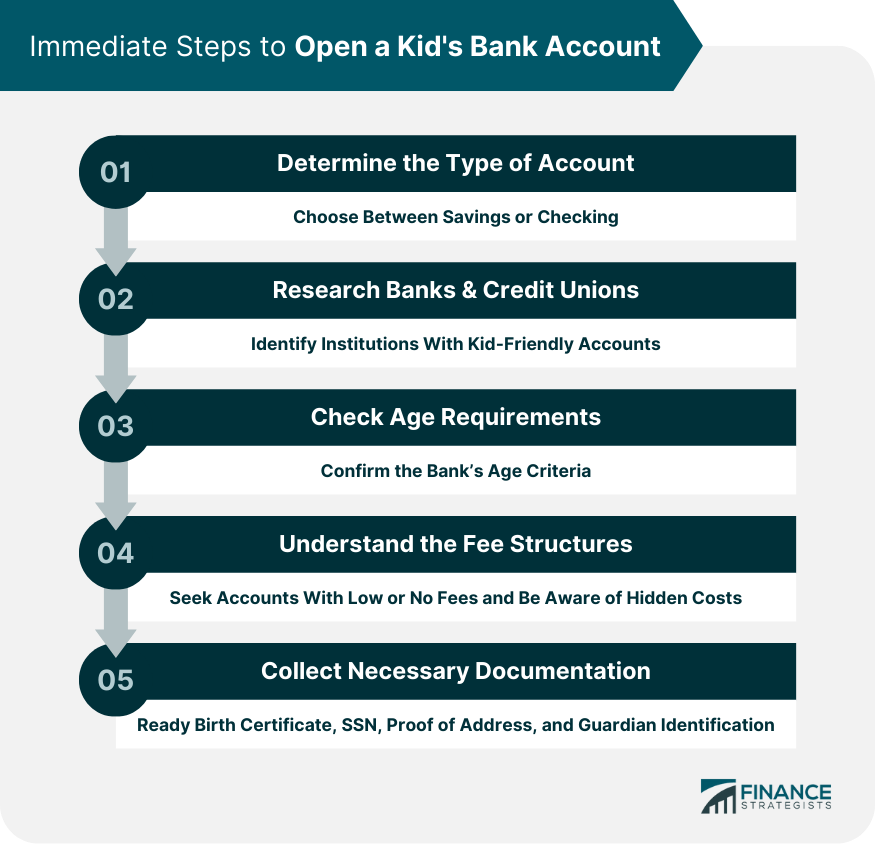

Immediate Steps to Open a Kid's Bank Account

Determine the Type of Account

Research Banks and Credit Unions

Check Age Requirements

Understand the Fee Structures

Collect Necessary Documentation

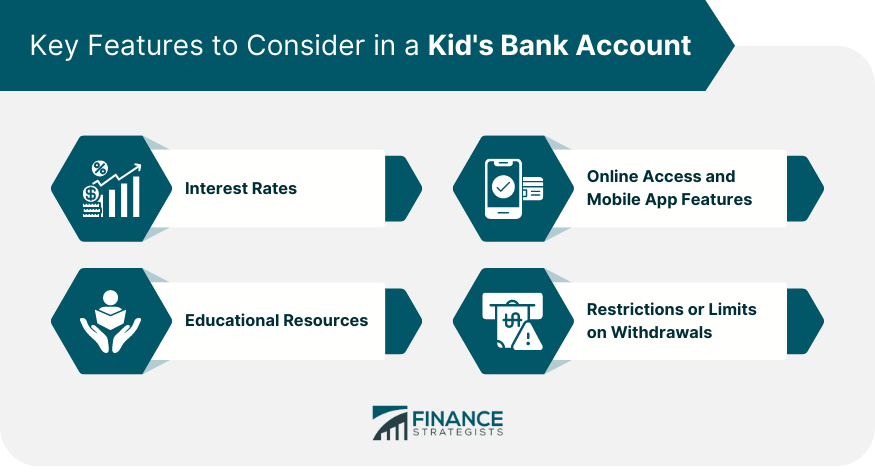

Key Features to Consider in a Kid's Bank Account

Interest Rates

Online Access and Mobile App Features

Educational Resources

Restrictions or Limits on Withdrawals

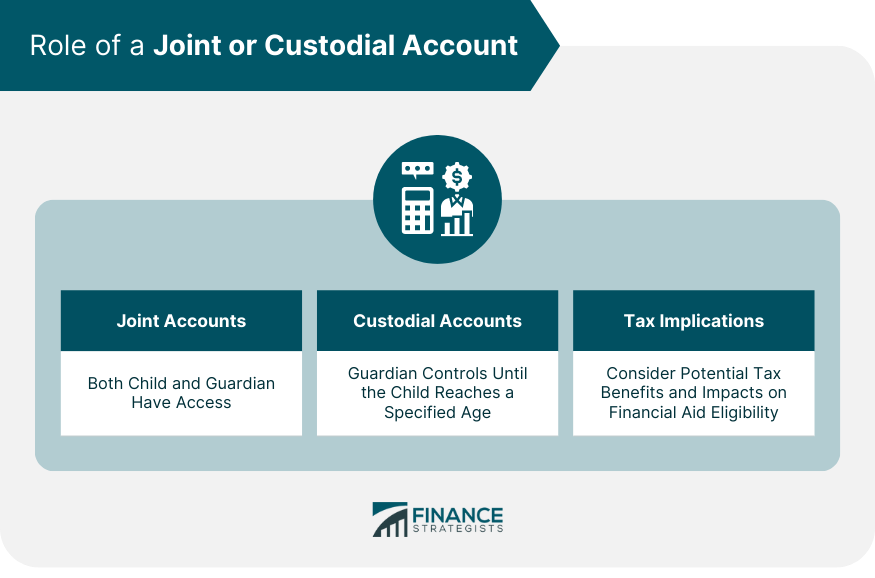

Role of a Joint or Custodial Account

How Joint Accounts Work

Benefits and Limitations of a Custodial Account

Tax Implications

Teaching Financial Responsibility

Reviewing Account Statements

Concepts of Saving, Spending, and Earning

Setting Financial Goals

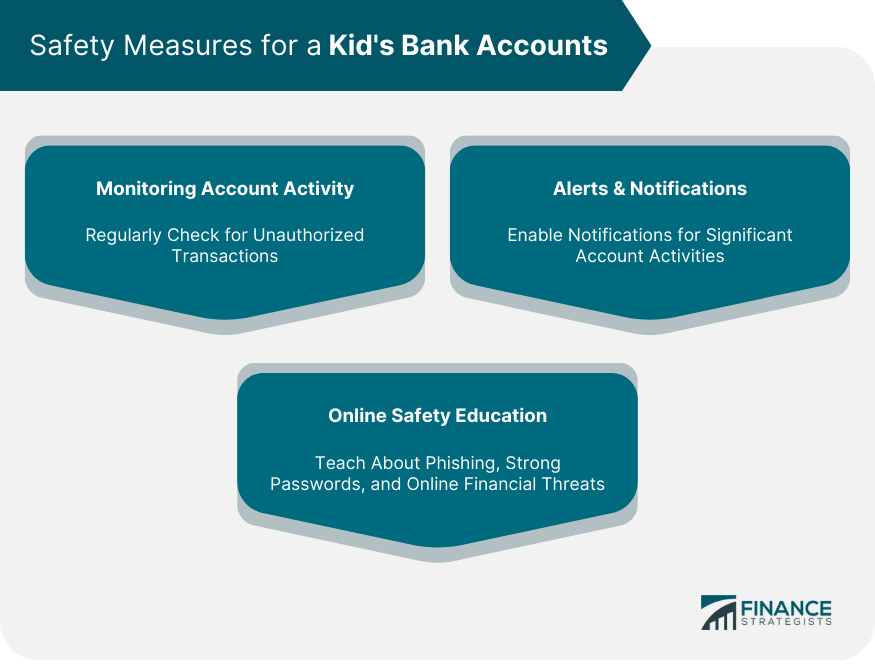

Safety Measures for a Kid's Bank Accounts

Monitoring Account Activity

Alerts and Notifications

Online Safety Education

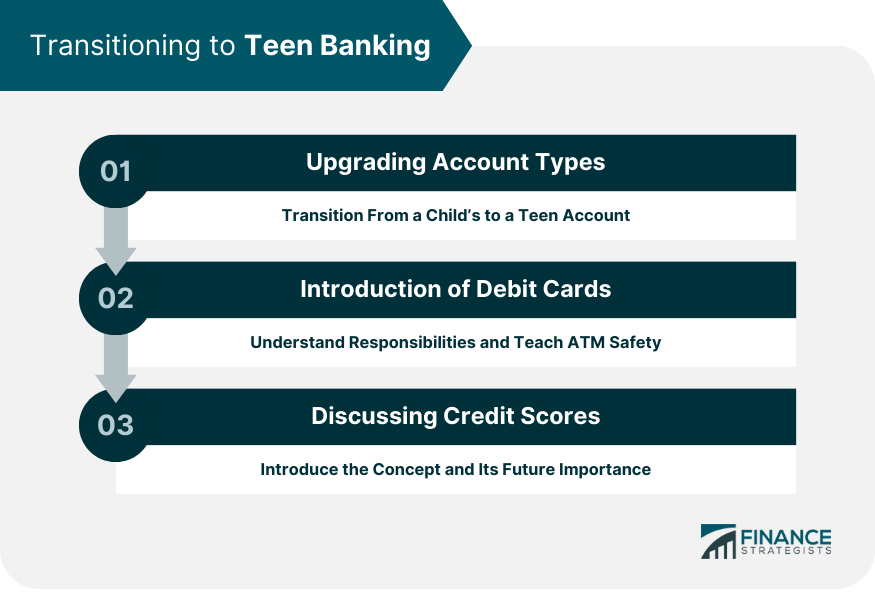

Transitioning to Teen Banking

Upgrading Account Types

Introduction of Debit Cards

Discussing Credit Scores

Bottom Line

How to Open a Kid's Bank Account FAQs

Begin by determining the account type, researching suitable banks, checking age requirements, understanding fees, and collecting necessary documentation.

Look for competitive interest rates, online access, educational resources, and withdrawal restrictions tailored for children.

Joint accounts grant both child and guardian access, while custodial accounts are controlled by the guardian until the child reaches a specified age.

Regularly review account statements with them, instill concepts of saving, spending, and earning, and set financial goals together.

As they approach their teenage years, consider upgrading their account type, introducing them to debit cards, and discussing credit scores.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.