Business bank accounts offer numerous advantages over personal accounts, especially for entrepreneurs and business owners. Business bank accounts provide a legal distinction between personal and business funds. This separation can prove critical, particularly if your business is a Limited Liability Company (LLC) or a corporation. It can protect personal assets from business liabilities and vice versa. Switching to a business bank account lends credibility to your enterprise. Clients and vendors typically find it more professional to make payments to a business account rather than a personal one. It also provides an opportunity to build a credit history under your business's name, which can be beneficial for future business loans or credit applications. With a separate business account, tracking business income and expenses becomes much more manageable. It can simplify bookkeeping and make tax preparation less complicated since all transactions related to your business are in one place. Before making the switch, there are several considerations to bear in mind. Understanding your banking needs is crucial. Consider the size of your business, the volume of transactions, the need for physical branch access, and the kind of banking services you require, like merchant services or business loans. Once you know what you need, begin researching potential banks. Look at factors such as fees, services, interest rates, and customer reviews. Consider whether a local, national, or online bank best suits your business model. Most banks charge a variety of fees, including monthly service charges, ATM fees, and transaction fees. Look for a bank that offers the services you need at the most affordable rates. Reading customer reviews can also give you an insight into the bank's customer service and reliability. The bank's reputation in the industry is also worth considering. Look at how they handle customer service and their online banking capabilities. In today's digital age, having a robust and user-friendly online banking platform is crucial. Before applying for a business account, ensure you have all the necessary documents ready. These may include: These are basic documents like your business's registration certificate, location proof, etc. If your business is an LLC or corporation, you will need an EIN. For sole proprietors, a social security number will suffice. These can include any local or state licenses your business requires. For partnerships, LLCs, or corporations, you may need to provide documentation showing ownership structure. Switching from a personal to a business account involves a few key steps. The first step in the transition is opening a new business bank account. This involves filling out an application form, either online or in person, and making an initial deposit. Ensure you understand the terms and conditions of the account before signing anything. The next step is to transition your business finances. This involves redirecting all business income to the new account and changing any automatic payments or direct debits from your personal account to the business account. If you decide to close your personal account, ensure you've transferred all funds and obligations to the new business account. It's essential to check for any pending transactions or automatic payments before closure. After successfully opening your business account, it's critical to verify that all transitions have been made correctly. Check all automatic payments and deposits to ensure they're functioning correctly. Familiarize yourself with the bank's online portal and any new banking tools or services your business account offers. After switching to a business account, it's essential to stay on top of things. Regularly reviews your account statements to ensure there are no errors or fraudulent activities. Understanding and maintaining the required minimum balance is also important to avoid additional fees. Leverage the benefits your business account offers. Whether it's online banking, business loans, or merchant services, these tools can help streamline your business operations and promote growth. With a separate business account, your taxes become simpler to manage. However, it's important to understand the tax obligations and benefits related to your business account. Consult a tax professional if you're unsure. As your business grows and changes, so too might your banking needs. Review your banking relationship periodically to ensure it's still serving your business well. Transitioning from a personal to a business bank account is a pivotal move for entrepreneurs and businesses. A business account provides legal protections, enhances professionalism, and simplifies financial management and tax preparation. Before switching, it's crucial to assess business needs, compare banks, understand their fees, services, interest rates, and customer reviews, and prepare the necessary documentation. The transition process involves opening a new business account, moving finances from a personal to a business account, and confirming the setup. After switching, maintaining the account, utilizing the provided services, understanding tax obligations, and periodically reviewing the banking relationship is important. By separating personal and business finances, businesses can streamline operations, boost their professional image, and safeguard personal assets against business liabilities. Therefore, a business bank account is an indispensable tool for growing and establishing businesses.Why Switch From a Personal to a Business Bank Account?

Legal Protections Offered by Business Accounts

Enhancing Professionalism in Financial Dealings

Simplifying Business Finance Management and Tax Preparation

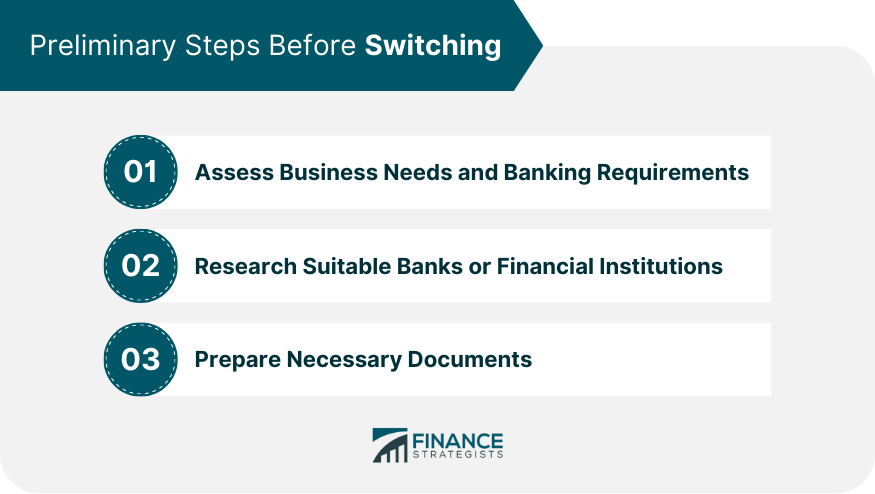

Preliminary Steps Before Switching

Assess Business Needs and Banking Requirements

Research Suitable Banks or Financial Institutions

Compare Fees, Services, Interest Rates, and Customer Reviews

Consider the Bank's Reputation, Customer Service, and Online Banking Capabilities

Prepare Necessary Documents

Business Identification Documents

Employer Identification Number (EIN) Or Social Security Number (SSN) If Sole Proprietor

Business Licensing Documents

Ownership Agreements

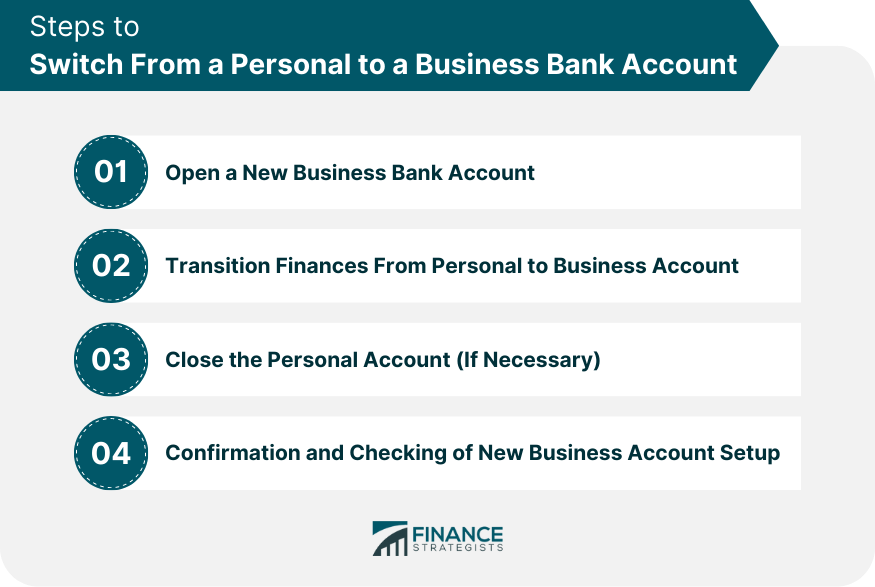

Steps to Switch From a Personal to a Business Bank Account

Open a New Business Bank Account

Transition Finances From Personal to Business Account

Close the Personal Account (If Necessary)

Confirmation and Checking of New Business Account Setup

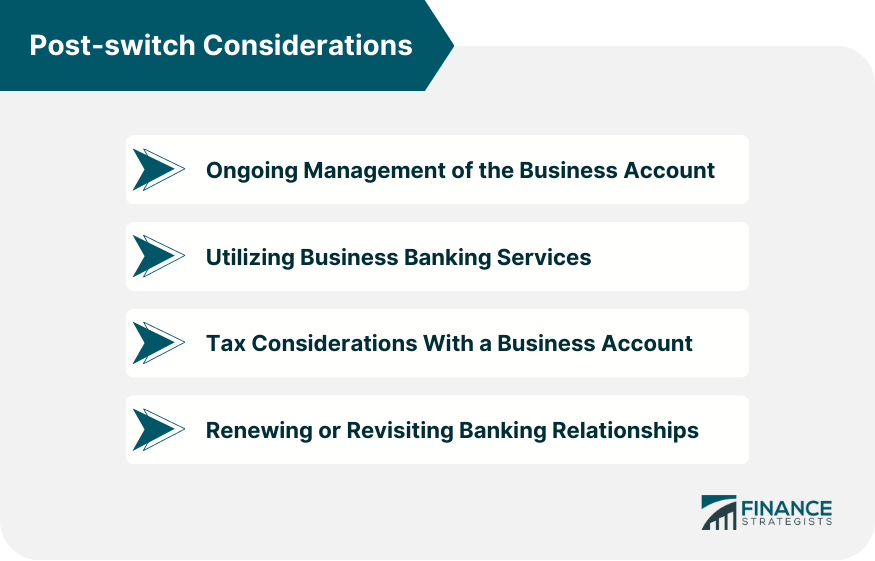

Post-switch Considerations

Ongoing Management of the Business Account

Utilizing Business Banking Services

Tax Considerations With a Business Account

Renewing or Revisiting Banking Relationships

Bottom Line

How to Switch From Personal to Business Bank Account FAQs

Separating your personal and business bank accounts helps maintain clear financial boundaries, simplifying tax preparation and financial management. It also enhances your professional image and provides legal protection by separating personal assets from business liabilities.

To choose the right bank for your business account, consider factors such as the volume of transactions, your business size, access to physical branches, and specific banking services you need. Compare fees, interest rates, customer reviews, and the bank's reputation and online banking capabilities.

The documents required may vary between banks, but generally, you will need business identification documents, your Employer Identification Number (EIN) or Social Security Number (SSN) if a sole proprietor, business licensing documents, and ownership agreements or operating agreements for partnerships, corporations, or LLCs.

After opening your business bank account, you should redirect all business income to this account and switch any automatic payments or direct debits. If you decide to close your personal account, ensure all obligations linked to it have been addressed.

Post-switch considerations include regular account management, understanding and maintaining minimum balance requirements, and leveraging business banking services like online and mobile banking, business loans, and merchant services. It's also crucial to understand the tax obligations and benefits associated with your business account. Regularly reviewing and revising your banking relationship as your business grows or changes is also recommended.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.