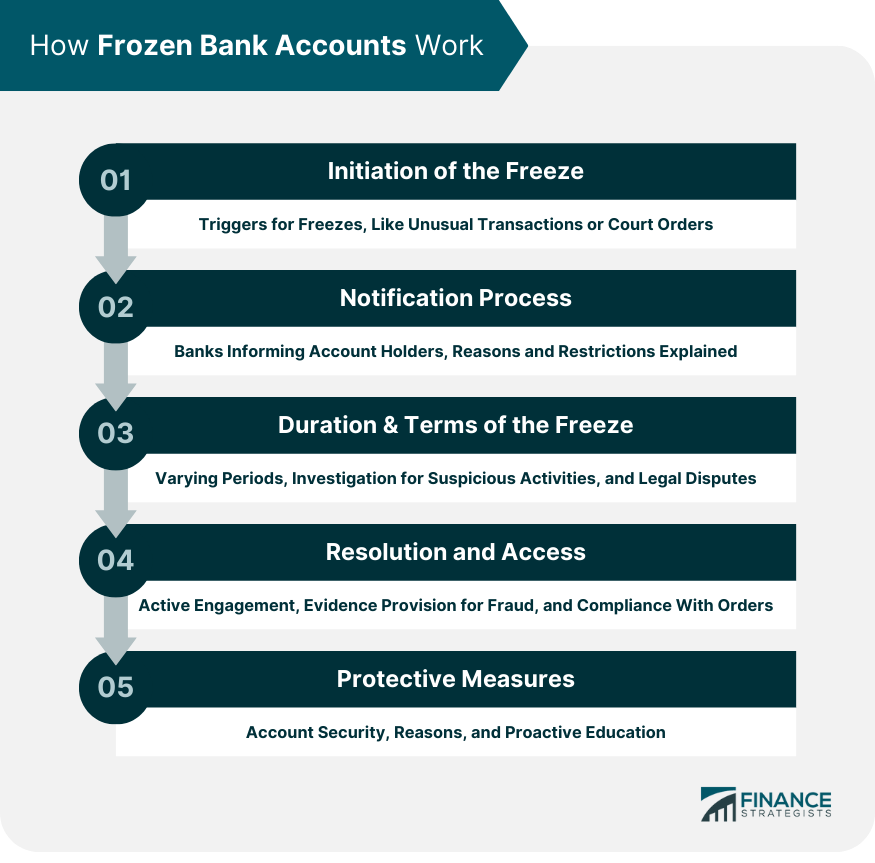

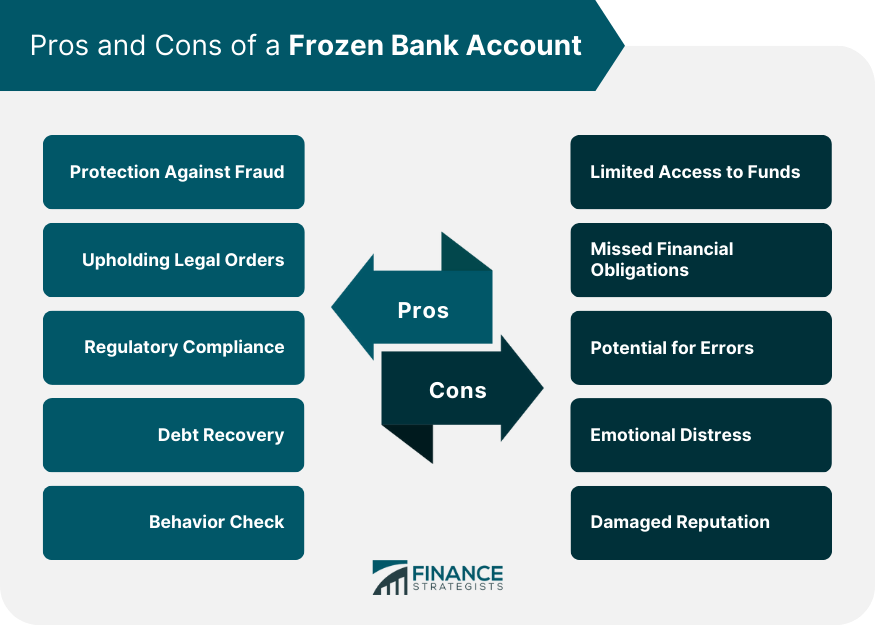

A frozen bank account is a financial state in which an account holder cannot access or perform any monetary transactions from their bank account. The assets or balance in the account remain untouched, but the account holder cannot utilize them until specific conditions or requirements are met. The account can be frozen for various reasons, ranging from suspicions of fraudulent activity to legal requirements or court orders. The purpose and importance of freezing a bank account lie in safeguarding the interests of both the account holder and other entities. For example, if there's an indication of suspicious or unauthorized activity, freezing the account can prevent potential financial loss and give time for an investigation. Alternatively, if there's a legal dispute or a court order, such as one involving debt collection or divorce proceedings, the account might be frozen to ensure the rightful claimant can access the funds once the matter is resolved. Frozen bank accounts operate within a framework established by banking regulations, institutional policies, and legal mandates. Here's a detailed breakdown of how they work: When a bank or financial institution deems it necessary to freeze an account, it is usually based on specific triggers. These could include a high volume of unusual transactions within a short period, activities that hint at money laundering or fraud, non-compliance with mandatory 'Know Your Customer' (KYC) protocols, or a direct court order linked to ongoing legal disputes. Upon initiating the freeze, the bank is typically obliged to inform the account holder. This communication, often sent via mail or electronic means, explains the reason for the action. It also provides essential details on the nature of the restriction, whether it's a partial freeze (restricting certain types of transactions) or a full freeze (halting all account activities). The period an account remains frozen can differ based on the underlying cause. If the freeze is due to suspicious activities that require verification, the bank initiates an internal investigation. This could last anywhere from a few days to several weeks, depending on the complexity of the situation. For legal disputes or court orders, the freeze may persist until the legal issues are resolved, which could span months or even longer. During this time, interest on the existing funds (if applicable) will continue to accrue, ensuring that the account holder doesn't bear undue financial burden. To restore access to their account, the account holder is usually required to engage actively with the bank. If the freeze was due to discrepancies in personal information, the account holder might need to update or verify their details. In cases of potential fraud, providing evidence of legitimate transactions or activities can help. For legal-induced freezes, resolution might involve paying off debts, reaching settlements, or complying with court directives. Ensuring consistent and open communication with the bank can often hasten the unfreezing process. Additionally, preparing a checklist based on the reason for the freeze can streamline the resolution process. It's crucial for account holders to understand that banks don't freeze accounts arbitrarily. Institutions have a duty to ensure the financial system's integrity, protect individual assets, and comply with legal orders. As such, to prevent freezes, account holders should regularly update personal information, monitor their transaction patterns, and stay informed about bank policies related to account security and freezes. Educating oneself on common reasons banks freeze accounts can also act as a preemptive measure. Regular interactions with bank representatives, especially in understanding account terms and conditions, can provide added layers of protection. Bank accounts can be frozen for a myriad of reasons, often rooted in ensuring financial security and adhering to regulatory mandates. Common triggers include: Suspicious Activity: Rapid, large, or irregular transactions that deviate from an account holder's typical behavior might be flagged as potential fraud or money laundering. Overdrafts: Repeated overdrafts or a prolonged negative balance can prompt banks to freeze an account to prevent further debt accumulation. Unverified Account Details: If banks cannot verify the authenticity of the account holder's details, especially during routine KYC checks, they might impose a freeze until verification is completed. Legal Directives: Court orders related to divorce settlements, child support, debt collections, or other legal disputes can mandate the freezing of assets until the matter is resolved. Unpaid Liabilities: If an account holder owes money to the bank or another creditor and fails to settle it, the bank might freeze the account as a means of recovery. Regulatory Compliance: Regulatory bodies might order account freezes if they suspect illegal activities like tax evasion, embezzlement, or other financial crimes. Bank Errors or Technical Glitches: Occasionally, software glitches or human errors within the banking system can inadvertently trigger an account freeze, although these are usually resolved promptly. Cross-Border Concerns: International transactions, especially to or from countries under economic sanctions or with high risks of financial crimes, might result in a temporary freeze for additional scrutiny. Protection Against Fraud: Freezing an account can prevent unauthorized transactions, shielding account holders from potential financial loss. Upholding Legal Orders: It ensures that funds remain intact when there's a court order or a legal dispute, safeguarding the interests of rightful claimants. Regulatory Compliance: Freezing can be a measure to ensure that account holders and banks adhere to regulatory norms, like KYC procedures. Debt Recovery: Creditors can use this mechanism to ensure that debts are paid, which can potentially protect the financial system from potential defaults. Behavior Check: A freeze can act as a deterrent, reminding account holders to be cautious and encouraging them to adhere to good banking practices. Limited Access to Funds: Account holders cannot access their money, leading to potential financial distress, especially if there are no alternative sources of funds. Missed Financial Obligations: With a frozen account, there's a risk of missing out on payments like bills, mortgages, or loans, which can result in penalties or a reduced credit score. Potential for Errors: Sometimes, accounts are frozen due to bank errors or oversights, which can be inconvenient and time-consuming to resolve. Emotional Distress: The sudden inability to access one's funds can cause stress, uncertainty, and feelings of vulnerability. Damaged Reputation: If the account is frozen due to suspicions of illegal activities (even if later proven unfounded), it might harm the account holder's reputation or standing with the bank or in the community. A frozen bank account serves as a protective measure with multifaceted implications. It stands as a safeguard against fraudulent activities and unauthorized transactions, shielding individuals from financial losses. Moreover, it upholds legal orders and regulatory compliance, ensuring the preservation of funds for rightful claimants and upholding the integrity of the financial system. This mechanism aids in debt recovery and prompts account holders to adhere to responsible financial practices. However, this comes with its share of drawbacks. Limited access to funds can lead to financial strain and missed obligations, potentially impacting credit scores and reputation. The process can be marred by errors and emotional distress, underscoring the need for careful consideration and proactive engagement with banks. Understanding the underlying reasons and implications of frozen accounts empowers individuals to navigate these situations effectively, fostering a more secure financial landscape for all parties involved.What Is a Frozen Bank Account?

How Frozen Bank Accounts Work

Initiation of the Freeze

Notification Process

Duration & Terms of the Freeze

Resolution and Access

Protective Measures

Common Reasons for Freezing a Bank Account

Pros of a Frozen Bank Account

Cons of a Frozen Bank Account

Conclusion

Frozen Bank Account FAQs

A frozen bank account is when an account holder is unable to access or perform transactions with their account due to specific conditions or legal orders.

Banks freeze accounts for reasons like suspicious activities, legal disputes, court orders, unpaid liabilities, or regulatory compliance concerns.

The duration varies. For suspicious activities, it might be a few days to weeks for investigation. Legal disputes can extend freezes for months or until issues are resolved.

Resolution involves actively engaging with the bank. Update information, provide evidence for fraud claims, or comply with court directives, depending on the reason for the freeze.

Pros include protection against fraud, adherence to legal orders, and regulatory compliance. However, cons involve limited access to funds, missed financial obligations, potential errors, emotional distress, and reputational damage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.